U.S. Hot Stocks: Hot Stocks to Watch

April 12 2016 - 9:41AM

Dow Jones News

Among the companies with shares expected to trade actively in

Tuesday's session are Fastenal Co. (FAST), Legg Mason Inc. (LM) and

Perry Ellis International Inc. (PERY).

Fastenal Co. reported is profit edged 1.1% lower in the first

quarter of the year as its core fastener business weakened. Shares

fell 3.56% to $45.27 in premarket trading.

Trian Fund Management LP will sell its shares in Legg Mason

Inc., ending its years-long involvement with the money manager

which included helping to force a chief executive change. Legg

Mason shares rose 1.68% to $32.10 premarket.

Perry Ellis International Inc. said it narrowed its loss in the

fourth quarter, as the company Tuesday backed its outlook for the

year amid expanding margins. Shares were flat at $17.84

premarket.

Outerwall Inc. (OUTR), the operator of Redbox movie rental

kiosks, agreed to nominate three new directors to its board as part

of an agreement reached with its second-largest shareholder,

activist investor Engaged Capital LLC.

Alcoa Inc. (AA) on Monday reported a 92% drop in first-quarter

profit, hurt by weak aluminum prices, and said it could cut as many

as 2,000 jobs. The metals maker's results underscore the company's

motive in spinning off its more profitable aerospace and

automotive-focused business in the second half of this year.

Debit-card issuer Green Dot Corp. (GDOT), under pressure from

activist investor Harvest Capital Strategies, has added three

independent directors to its board.

Juniper Networks Inc.'s (JNPR) results for the March quarter

will miss financial targets, the company said Monday, blaming

weaker demand and the timing of customers' adopting its

products.

Marathon Oil Corp. (MRO) will sell its Wyoming upstream and

midstream assets for $870 million, as big energy producers continue

to reshape their portfolios during a severe and extended pricing

downturn.

Salesforce.com Inc. (CRM) said the value of Chief Executive Marc

Benioff's compensation was $33.4 million for the year ended Jan.

31, down from $39.9 million in the previous year. The

customer-relationship software company said it made "significant"

compensation changes, reflecting shareholder feedback, including a

shift from an option-based long-term equity plan to a greater focus

on performance-based restricted stock units.

Write to Maria Armental at maria.armental@wsj.com and Chris Wack

at chris.wack@wsj.com

(END) Dow Jones Newswires

April 12, 2016 09:26 ET (13:26 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

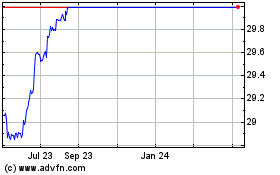

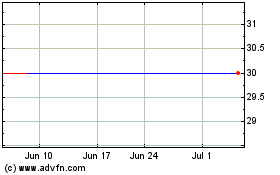

Arconic (NYSE:ARNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arconic (NYSE:ARNC)

Historical Stock Chart

From Apr 2023 to Apr 2024