Global Stocks Edge Lower as Investors Await Fed Minutes

October 08 2015 - 11:43AM

Dow Jones News

By Dan Strumpf And Chiara Albanese

U.S. stocks eased Thursday as investors await further clues

about the timing of a potential interest-rate increase and the

start to the third-quarter earnings season.

The Dow Jones Industrial Average slipped 14 points, or 0.1%, to

16898 in midmorning trading. The S&P 500 lost 0.3%, while the

Nasdaq Composite Index declined 0.7%.

The Federal Reserve is due to release notes this afternoon from

the most recent policy meeting, which could offer clues on the

timing of forthcoming interest-rate increases.

And, the third-quarter earnings season unofficially kicks off

Thursday with a report from aluminum giant Alcoa Inc., due after

the closing bell. Investors are bracing for another weak quarter as

U.S. multinationals remained hobbled by slumping commodity prices

and a strong U.S. dollar.

"There's a lot of uncertainty among professional investors as to

whether companies are going to make or miss" earnings targets, said

Brett Mock, managing director at brokerage firm JonesTrading.

"Earnings are a big tossup."

Earnings among companies in the S&P 500 are expected to

decline 5.4% in the third quarter, according to analysts surveyed

by FactSet.

U.S. stocks have rallied in recent sessions after last week's

disappointing employment data for September pushed back investors'

expectations over the timing rate increases. The Dow is up more

than 7% since its late-August slump.

In Europe, stocks were slightly higher. The Stoxx Europe 600

index climbed 0.2%. The

"Markets are taking a breather after a nice rebound," said

Jeroen Blokland, portfolio manager at Dutch asset manager Robeco,

which oversees EUR273 billion ($307 billion) in assets.

The yield on the 10-year Treasury note rose to 2.068% as prices

fell.

The release of the minutes from the Fed's September meeting is

expected to offer investors more insight over the central bank's

thinking. Low interest rates have boosted global stocks for the

last six years.

"Fed minutes will be under fierce scrutiny tonight," Mr.

Blokland said.

While the minutes will offer new information on the discussion

going on at the central bank level, "it is hard to forecast a

change in the Fed stance without an improvement in economic data,"

said Sean Shepley, head of macro strategy at Credit Suisse in

London, referring to a weaker than expected U.S. employment report

last week.

Elsewhere, the Bank of England kept its benchmark interest rate

unchanged at 0.5% Thursday, a decision which was largely expected

by analysts and investors.

"[The Bank of England has] no urgency to hike rates," said

Michael Saunders, economist at Citigroup. He expects the central

bank to keep rates unchanged for the next 12 months, with the first

increase in rates in late-2016.

Earlier in the day Hong Kong's Hang Seng Index lost 1%. Japan's

Nikkei Stock Average was also down 1%, pulling back from a winning

streak that has boosted Japanese shares to their highest level in

almost a month.

China's Shanghai Composite Index rose 3% Thursday, as it caught

up with a rally in global equities after a week-long holiday.

In currencies markets, the dollar fell slightly against the yen

to trade around Yen119.87. The euro was up 0.3% against the dollar

at $1.1271.

U.S.-traded crude futures gained 1.2% to $48.37 a barrel. Gold

prices fell 0.4% at $1144.50 an ounce.

Write to Dan Strumpf at daniel.strumpf@wsj.com and Chiara

Albanese at chiara.albanese@wsj.com

(END) Dow Jones Newswires

October 08, 2015 11:28 ET (15:28 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

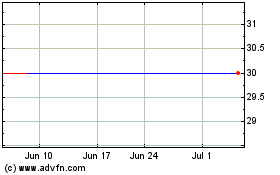

Arconic (NYSE:ARNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

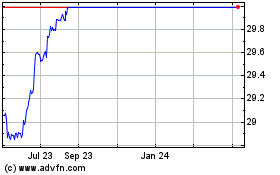

Arconic (NYSE:ARNC)

Historical Stock Chart

From Apr 2023 to Apr 2024