TIDMZTF

RNS Number : 9167F

Zotefoams PLC

02 August 2016

Tuesday 2 August 2016

Zotefoams plc

Interim Report for the Six Months Ended 30 June 2016

Zotefoams plc ("Zotefoams", or "the Group" or "the Company"), a

world leader in cellular material technology, today announces its

interim results for the six months ended 30 June 2016.

Highlights

-- Group revenue increased by 2% to GBP27.07m (2015: GBP26.49m)

-- Operating profit pre-exceptional items increased by 5%

-- Adjusted profit before tax(1) in line with prior year

-- Group focus on development and investment

-- Positive sales momentum going into second half of 2016

o AZOTE(R) polyolefin foam orders strengthening after soft June

and July

o ZOTEK(R) technical foam sales plus orders currently in excess

of 2015 sales

o MuCell Extrusion, record open order book including a "one-off"

extrusion line order from Japan

-- Significant operational improvements in Croydon, UK facility

delivering improved service and reduced labour requirements, with

an exceptional item due to associated restructuring costs

-- Dow Chemical announced promotion of MuCell(R) extrusion

technology in South America to mitigate the carbon footprint of the

2016 Rio Olympic Games

-- Interim dividend increased by 3% to 1.85 pence

Financial highlights

Six months Six months Change

ended ended

30 June 30 June

2016 2015

GBPm GBPm %

Group Revenue 27.07 26.49 2

Gross Profit 8.14 7.94 3

Operating Profit pre

exceptional item 3.33 3.17 5

Operating Profit post

exceptional item 3.07 3.17 (3)

Adjusted profit before

tax1 3.21 3.19 1

Profit before tax pre

exceptional item 3.03 3.02 0

Profit before tax 2.77 3.02 (8)

Basic eps (p) 5.18 5.50 (6)

Basic eps (p) pre exceptional

item 5.78 5.50 5

Interim dividend (p) 1.85 1.80 3

(1) Before amortisation of acquired intangible assets and

exceptional items

Commenting on the results, Steve Good, Chairman said:

"We enter the second half of the year with a good order book, a

strong product portfolio, growth expectations in all business units

and the benefits of the weaker Sterling. Whilst today we reported

record revenue for the first half of the year, growth was muted by

customer inventory adjustments and sales phasing. In addition,

profits were broadly flat, but this was due to increased

expenditure in selling, development and technical resource to

support long-term growth opportunities.

Therefore, whilst recognising the significant uncertainty

resulting from the macro-economic backdrop, the Board remains

confident in the prospects for the business."

Enquiries:

Zotefoams plc Tel Today: 0203-727-1000

David Stirling, Group Thereafter: 0208-664-1600

CEO

Gary McGrath, Finance

Director

FTI Consulting 0203-727-1000

Victoria Foster Mitchell/Simon

Conway

About Zotefoams plc

Zotefoams plc (LSE - ZTF) is a world leader in cellular material

technology. Using a unique manufacturing process with

environmentally friendly nitrogen expansion, Zotefoams produces

lightweight foams in Croydon, UK and Kentucky, USA for diverse

markets worldwide. Zotefoams also owns and licenses patented

MuCell(R) microcellular foam technology from a base in

Massachusetts, USA to customers worldwide and sells T-FIT(R)

advanced insulation systems.

www.zotefoams.com

Results overview

In the first six months of 2016 Group revenue increased by 2% to

GBP27.07m (2015: GBP26.49m), delivering a record figure for the

first six months aided by a weaker GBP against our main trading

currencies. However, growth was impacted by customer inventory

adjustments and sales phasing, primarily in our HPP Business Unit,

where we see a much stronger second half developing. An efficiency

improvement programme at our Croydon, UK factory has increased

effective capacity and will reduce operating costs in the future,

resulting in an exceptional cost of GBP0.3m during the period. We

also increased operational expenditure to accelerate development of

the Zotefoams Group, with a new venture in Oklahoma, USA and

Kunshan, PRC, and a large number of new products and applications

approaching commercialisation. These investments, in the short

term, dampened the benefit of currency gains. Gross profit

increased by 3% and profit before tax pre-exceptional item

increased to GBP3.03m (2015: GBP3.02m), while adjusted profit

before tax remained consistent with prior year. Basic earnings per

share were 5.18p after exceptional items (2015: 5.50p). The

Directors have decided to increase the interim dividend by 3% to

1.85p per share (2015: 1.80p), reflecting the Board's continued

confidence in the Group's future.

Currency review

As a predominantly UK-based exporter, Zotefoams has

approximately 80% of sales denominated in US Dollars and Euros.

With most costs incurred in Sterling, other than our main raw

materials which are denominated in Euros and some staff and

operational costs which are in US Dollars, movements in foreign

exchange rates can have a significant impact on our results. The

average Euro rate was 1.28:GBP1 for the first six months of 2016

(equivalent 2015 rate 1.38:GBP1) and the average US Dollar rate was

1.42:GBP1 (equivalent 2015 rate 1.53:GBP1). The period end closing

exchange rates, and in particular the movement between the period

opening and closing rates, generated a non-cash translational gain

of GBP0.51m in the period (2015: loss of GBP0.44m), the benefit of

which is credited against administration expenses.

Financial and operational review

Polyolefin Foams

Overall sales volumes were at similar levels to 2015. We

estimate underlying growth of 4% offset by a reduction in inventory

held by our direct customers. UK sales volumes increased by 9% with

a strong start to the year being maintained until a poor June 2016

with obvious lower confidence in the market, which continued into

July 2016, but has reverted with a more robust August 2016 order

book. In continental Europe, where we saw the most marked reduction

in customer inventory levels, sales volumes were down by 5%, but

again we believe the underlying demand was positive. In Asia, where

Japan is the dominant market, sales volumes declined by almost 25%,

again with some destocking exacerbating the impact of a relatively

weak Japanese Yen, which has made imports more expensive for the

past few years. Sales increased by 12% in North America, with the

benefit of a stronger USD and added value from Zotefoams Midwest in

a market where volume increased by 9%.

Group revenue from Azote(R) Polyolefin Foams increased by 3% to

GBP22.79m (2015: GBP22.09m), although at constant currency it would

have been GBP21.30m.

The Euro-denominated cost for one tonne of our main raw

material, low density polyethylene ('LDPE'), was approximately 12%

higher than in H1:2015. We also suffered from a force majeure event

from our main polymer supplier for a significant period. Although

this material is multi-sourced, such a supply disruption does incur

meaningful additional costs, which fell wholly within the first

half of this year. Overall this added approximately GBP0.4m to our

polyolefin foams cost base in the period.

Operating profit in polyolefin foams, before exceptional items,

declined by 7% to GBP3.81m (2015: GBP4.08m), mainly due to

increased material costs and additional expenditure related to our

investment in Kentucky, USA, which is due to begin operation in

2017, and in Oklahoma USA, which began operation in March 2016.

High-Performance Products ('HPP')

HPP sales of GBP3.17m were slightly below the previous year

(2015: GBP3.39m). Customer orders are, typically, strongly

second-half weighted and therefore the performance in the first six

months understates the underlying growth in this Business Unit. As

fixed costs have been increased to support our sales opportunities,

the phasing of sales also impacts our reported Business Unit profit

margin disproportionately in the period, with segment operating

profit pre-exceptional Item of GBP0.30m (2015: GBP0.67m).

We are very pleased with the progress of a large number of

opportunities within our HPP business generally. ZOTEK(R) F foams,

where the main market is in aviation, is the largest segment and

continues to offer medium-term growth consistent with our past

experience, although 2016 is likely to show more muted growth in

aviation, with our customers managing inventory lower in the

downstream supply chain. Markets such as composites, automotive and

sports are using ZOTEK(R) Nylon foams in small initial quantities,

which we believe could offer excellent potential in the future and

we have secured the first orders for what we expect to be a

significant business in our ZOTEK(R) PEBA foams within the sport

and leisure sector.

In the period, one disappointing aspect within our HPP Business

Unit has been the difficulty experienced in setting up the

manufacturing site for our T-FIT(R) insulation products. In 2015,

we announced a joint venture in China for the manufacture of this

product range and expected this to be operational by October 2015.

Unforeseen operational difficulties forced the joint venture

company to find another factory location and re-apply for a

business license in China. We now expect the business to be

operational during Q3:2016. This delay has impacted management

time, while the additional overhead costs, in China and in

Thailand, have been underutilised. However, we remain fully

committed to T-FIT(R) insulation with a high level of current

quotes into clean-room insulation and, with very promising trials

of nylon-based insulation tube for process industries and a

modified PVDF foam for food and dairy, we intend to launch further

products within this range which target a much larger potential

market.

In addition to supporting and developing the product offering

within HPP, Zotefoams' technical department continues to enhance

our unique technology. Traditionally, Zotefoams has manufactured

rectangular sheets of foam with extrusion of a solid sheet being

the primary step. While this has many advantages, there are markets

where this cuboid shape results in large material yield loss as

complex shapes are cut from the foam, often needing high levels of

machine time and labour input. We have recently successfully

trialled the manufacture of complex 3-dimensional foam shapes,

which can be manufactured using an initial step of injection

moulding or 3D printing technology. This is an exciting development

for some large volume applications and we are currently working to

commercialise this promising new technology.

MuCell Extrusion LLC ('MEL')

MEL licenses microcellular foam technology and sells related

machinery. Sales increased by 10% to GBP1.11m (2015: GBP1.01m) with

an increase of 11 lines installed at licensees (2015: 12 lines in

H1) bringing the total installed base to 99 lines, of which we

estimate approximately half are currently in use by the

licensee.

In the period, The Dow Chemical Company ("Dow") announced they

are promoting MuCell(R) extrusion technology in South America to

mitigate the carbon footprint of the 2016 Rio Olympic Games. As a

direct result of this initiative, MuCell(R) extrusion technology

for foamed film will be used by four major packaging companies in

the region.

In addition, MEL secured its largest individual order, where we

will deliver an entire extrusion line with MuCell(R) technology to

a customer in Japan for use in consumer packaging. This order is in

excess of GBP1m and contributed significantly to our record order

intake in the period.

Enquiry levels and the installed equipment base at MEL continue

to increase and during the second half of 2016 we plan to hire

additional technical and engineering staff to meet the demand for

customer support. Finally, the development of our technology

continues to be a priority and we have filed additional patent

applications in blow moulding, which we believe will significantly

enhance our product offering almost immediately.

MEL reported an operating loss before exceptional item and

amortisation costs of GBP0.24m (2015: loss GBP0.22m).

Distribution and Administration

Costs of distribution and administration are either incurred

directly or allocated to each business unit according to management

estimates. The main elements of administrative expenses are

technical development, finance and administration, and information

systems as well as the cost (or benefit) of foreign exchange hedges

maturing in the period and non-cash foreign exchange translation

expenses. Administrative costs excluding the impact of foreign

exchange hedges and translation were GBP3.23m (2015: GBP2.49m),

with the main increase resulting from additional expenditure on raw

materials and product development, new business start-ups, finance

and systems.

Tax and Cash Flow

Zotefoams' estimated effective tax rate for the period was 19%

(2015: 20.5%), which is slightly below the UK corporation tax rate

for the period of 20%. Cash generated from operations was GBP4.93m

(2015: GBP4.99m). Capital expenditure was GBP8.00m, GBP6.22m higher

than depreciation and amortisation, and primarily related to group

capacity expansion via the Kentucky, USA, manufacturing facility,

which, together with tax and dividend payments, increased net debt

(cash less bank overdrafts and other bank borrowings) by GBP5.64m

from GBP1.59m at 31 December 2015 to GBP7.23m.

Pensions

The April 2014 triennial actuarial valuation, on a Statutory

Funding Objective basis, calculated a deficit for the Pension

Scheme of GBP2.50m. As a result of this, the Company has agreed

with the Trustees to make contributions to the Scheme of GBP41,000

per month until April 2020 to eliminate this deficit and, in

addition, pay the ongoing Scheme expenses of GBP14,000 per

month.

Following declining bond yields and the immediate aftermath of

the UK's decision to exit the European Union, the Company has

obtained guidance from the actuaries as at 30 June 2016. Based on

guidance received, the Company has increased the pension deficit by

GBP2.4m to reflect current market conditions. The position will

further be reviewed at year end and a full actuarial valuation is

scheduled for April 2017.

Capital Expenditure

Zotefoams is investing significantly to support future growth.

Our largest project is extending our existing facility in Kentucky,

USA. Initially we committed to installing sufficient extruders and

a single high-pressure autoclave to deliver approximately 20%

additional global capacity for block foams. As previously

announced, we have experienced unforeseen delays in delivery of the

autoclave since this initial decision was made. The Board has

therefore taken a decision to invest in a second high-pressure

autoclave, which will allow us the certainty of additional core

capacity at relatively short notice. Overall the project is now

expected to be $30m, of which $4.5m is an extension to existing

buildings and infrastructure. The project is proceeding to

previously announced timescales and is anticipated to be

operational, with the first autoclave commissioned, in H1:2017. We

continue to invest in our Croydon, UK facility increasing

production capacity and capability, mainly in speciality extrusion,

and two further low-pressure autoclaves for expansion of HPP

products.

Planned capital investment in China, where our Kunshan ZOTEK

King Lai joint venture is located, is not expected to be

significant to the Group.

Employees and Talent Management

Talent management is becoming increasingly important as

Zotefoams grows and evolves. The opportunities we have, in new

products, markets and geographies, require that we identify and

develop the right people to define and deliver to our potential.

Over the past six months we have recruited substantially to meet

the needs of our business and, as at 30 June 2016, headcount was

352, with approximately 11% of employees recruited within the past

12 months.

On behalf of the Board, we would like to thank all of our

employees for their continued contribution to Zotefoams in the

period.

Dividend

Reflecting the Board's continued confidence in the Group's

future, the Directors have increased the interim dividend by 3% to

1.85 pence per share (2015: 1.80 pence). The dividend will be paid

on 13 October 2016 to shareholders on the Company's register at the

close of business on 16 September 2016.

Principal Risks and Uncertainties

Zotefoams' business and share price may be affected by a number

of risks, not all of which are within our control. The process

Zotefoams has in place for identifying, assessing and managing

risks is set out in the Company statement of Principal Risks and

Uncertainties on pages 22 to 25 of the 2015 Annual Report and

Accounts. The specific principal risks (which could impact

Zotefoams' sales, profits and reputation) and relevant mitigating

factors, as currently identified by Zotefoams' risk management

process, have not changed significantly since the publication of

the last Annual Report and detailed explanations of these can be

found in the 2015 Annual Report. Broadly, these risks include

operational disruption, supply chain disruption, technological

change and competitor activity, pension liabilities, foreign

exchange, macro-economic factors, financing, commercial and

people.

Current Trading and Prospects

In our Azote(R) Polyolefin foams business, where customers are

predominantly based in the UK and continental Europe, the softening

of orders experienced in June 2016 has continued into July 2016,

whereas demand for August 2016 looks strong by comparison to

previous years. The recent devaluation of Sterling against both the

USD and Euro is positive for the business, as approximately 80% of

our revenues are denominated in these currencies, however most raw

materials are bought in Euros and our US operational costs are in

USD, therefore giving a partial natural hedge. The trading impact

of Sterling devaluation will benefit us a little for the remainder

of this year, with a more significant positive impact during 2017

when our financial hedges at higher rates have expired. We expect

the costs of LDPE for the remainder of the year to be at a similar

level to the first six months. In our HPP business, orders plus

invoiced sales for ZOTEK(R) technical foams currently exceed 2015

sales. In T-Fit(R) insulation products, where the order book is

typically shorter, we anticipate growth in the second half of the

year from a strong pipeline of bids. In MEL we have a record order

book by value and a significant number of quotations out to

potential customers, but the number of machines currently on order

is below the record levels seen at this time last year.

Outlook

We enter the second half of the year with a good order book, a

strong product portfolio, growth expectations in all business units

and the benefits of the weaker Sterling. Whilst recognising the

significant uncertainty resulting from the macro-economic backdrop,

the Board remains confident in the prospects for the business.

S P Good D B Stirling

Chairman Group CEO

1 August 2016 1 August 2016

ZOTEK(R), Azote(R) and T-FIT(R) are registered trademarks of

Zotefoams plc. MuCell(R) is a registered trademark of Trexel

Inc.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The directors confirm that these condensed consolidated interim

statements have has been prepared in accordance with International

Accounting Standard 34, 'Interim Financial Reporting' as adopted by

the European Union and that the interim management report includes

a fair review of the information required by DTR 4.2.7 and DTR

4.2.8, namely:

-- an indication of important events that have occurred during

the first six months and their impact on the condensed set of

financial statements, and a description of the principal risks and

uncertainties for the remaining six months of the financial year;

and

-- material related-party transactions in the first six months and any material changes in the related-party transactions described in the last annual report.

The directors of Zotefoams plc are listed in the Zotefoams plc

Annual Report for 31 December 2015, with the exception of the

following changes in the period: Mr N G Howard retired on 31 March

2016 and Mr C G Hurst retired on 16 May 2016. A list of current

directors is maintained on the Zotefoams plc website:

www.zotefoams.com

The maintenance and integrity of the Zotefoams plc website is

the responsibility of the directors; the work carried out by the

auditors does not involve consideration of these matters and,

accordingly, the auditors accept no responsibility for any changes

that may have occurred to the financial statements since they were

initially presented on the website.

Legislation in the United Kingdom governing the preparation and

dissemination of financial statements may differ from legislation

in other jurisdictions.

By order of the Board:

S P Good G C McGrath

Chairman Finance Director

1 August 2016 1 August 2016

CONDENSED CONSOLIDATED INTERIM INCOME STATEMENT FOR THE SIX

MONTHSED 30 JUNE 2016

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2015

2016 2015

(unaudited) (unaudited) (audited)

Note GBP'000 GBP'000 GBP'000

Group revenue 6 27,069 26,489 53,869

Cost of sales (18,931) (18,545) (38,863)

--------------------------- ----- -------------------- -------------------- --------------------

Gross profit 8,138 7,944 15,006

Distribution

costs (2,089) (1,832) (3,886)

Administrative

expenses pre-exceptional

item (2,716) (2,939) (4,795)

Exceptional

item 14 (262) - -

Total administrative

expenses (2,978) (2,939) (4,795)

Operating profit 3,071 3,173 6,325

--------------------------- ----- -------------------- -------------------- --------------------

Operating profit

pre exceptional

item 6 3,333 3,173 6,325

--------------------------- ----- -------------------- -------------------- --------------------

Finance income - 2 2

Finance costs (288) (153) (306)

Share of loss

from Joint Venture (17) (5) (11)

Profit before

Income tax 2,766 3,017 6,010

Income tax expense 7 (522) (618) (1,213)

--------------------------- ----- -------------------- -------------------- --------------------

Profit for the

period 2,244 2,399 4,797

--------------------------- ----- -------------------- -------------------- --------------------

Attributable

to:

Equity holders

of the Parent 2,266 2,399 4,824

Non controlling

interest (22) - (27)

2,244 2,399 4,797

--------------------------- ----- -------------------- -------------------- --------------------

Earnings per

share:

Basic (p) 9 5.18 5.50 11.10

Diluted (p) 9 5.11 5.40 10.90

The notes below form part of these financial statements.

CONDENSED CONSOLIDATED INTERIM STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 JUNE 2016

Six months Six months Year

--------------------------------------------

ended ended ended

-------------------------------------------

30-Jun 30-Jun 31-Dec

2016 2015 2015

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

------------------------------------------- --------------- --------------- ---------------

Profit for the period 2,244 2,399 4,797

-------------------------------------------- --------------- --------------- ---------------

Other comprehensive income/(expense)

Items that will not be reclassified

to profit or loss

Actuarial (losses)/gains on defined

benefit schemes (2,534) - 443

Tax relating to items that will

not be reclassified 481 - (84)

-------------------------------------------- --------------- ---------------

Total items that will not be reclassified

to profit or loss (2,053) - 359

-------------------------------------------- --------------- --------------- ---------------

Items that may be re-classified

subsequently to profit or loss

Effective portion of changes in

fair value of cash flow hedges

net of recycling (915) 604 (46)

Foreign exchange translation

gains/(losses) on investment

in foreign subsidiaries and

joint ventures 2,171 (190) 814

Tax relating to items that may

be reclassified 174 (121) 6

-------------------------------------------- --------------- --------------- ---------------

Total items that may be classified

subsequently to profit or loss 1,430 293 774

-------------------------------------------- --------------- --------------- ---------------

Other comprehensive (expense)/income

for the period, net of tax (623) 293 1,133

-------------------------------------------- ---------------

Total comprehensive income for

the period 1,621 2,692 5,930

-------------------------------------------- --------------- --------------- ---------------

Attributable to:

Equity holders of the parent 1,643 2,692 5,952

Non-controlling interest (22) - (22)

Total comprehensive income for

the period 1,621 2,692 5,930

-------------------------------------------- --------------- --------------- ---------------

The notes below form part of these financial statements.

CONDENSED CONSOLIDATED INTERIM STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2016

30-Jun 30-Jun 31-Dec

----------------------------------

2016 2015 2015

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

ASSETS

---------------------------------- --------------- ------------ -------------

Non-current assets

Property, plant and equipment 41,983 29,781 35,372

Intangible assets 7,219 6,791 6,868

Investments in joint venture 163 338 163

Deferred income tax assets 669 458 574

---------------------------------- --------------- ------------ -------------

Total non-current assets 50,034 37,368 42,977

---------------------------------- --------------- ------------ -------------

Current assets

Inventories 10,898 8,487 9,862

Trade and other receivables 15,605 14,428 17,219

Derivative financial instruments - 456 -

Cash and cash equivalents

(excluding bank overdrafts) 2,578 4,020 6,148

---------------------------------- --------------- ------------ -------------

Total current assets 29,081 27,391 33,229

---------------------------------- --------------- ------------ -------------

Total assets 79,115 64,759 76,206

---------------------------------- --------------- ------------ -------------

LIABILITIES

Current liabilities

Trade and other payables (8,482) (6,876) (10,250)

Current income tax liabilities (447) (481) (726)

Interest-bearing loans and

borrowings (1,146) (726) (1,102)

Derivative financial instruments (1,110) - (195)

Bank overdraft (2,900) (313) (879)

Total current liabilities (14,085) (8,396) (13,152)

---------------------------------- --------------- ------------ -------------

Non-current liabilities

Interest-bearing loans and

borrowings (5,765) (1,125) (5,758)

Deferred income tax liabilities (499) (857) (938)

Retirement benefit obligations (7,621) (5,912) (5,238)

Total non-current liabilities (13,885) (7,894) (11,934)

---------------------------------- --------------- ------------ -------------

Total liabilities (27,970) (16,290) (25,086)

---------------------------------- --------------- ------------ -------------

Total net assets 51,145 48,469 51,120

---------------------------------- --------------- ------------ -------------

Equity

Issued share capital 2,221 2,191 2,221

Own shares held (31) (9) (38)

Share premium 24,340 24,340 24,340

Capital redemption reserve 15 15 15

Translation reserve 3,807 637 1,636

Non-controlling interest 116 - 138

Hedging reserve (936) 334 (195)

Retained earnings 21,613 20,961 23,003

---------------------------------- --------------- ------------ -------------

Total equity attributable

to the equity holders of the

Parent 51,145 48,469 51,120

---------------------------------- --------------- ------------ -------------

The notes below form part of these financial statements.

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CASH FLOWS FOR THE

SIX MONTHSED 30 JUNE 2016

Six months Six months Year

--------------------------------------

ended ended ended

--------------------------------------

30-Jun 30-Jun 31-Dec

2016 2015 2015

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

-------------------------------------- ------------ ------------ -----------

Cash flows from operating

activities:

Profit for the period 2,244 2,399 4,797

Adjustments for:

Depreciation, amortisation

and impairment 1,780 1,733 3,476

Finance income - (2) (2)

Finance costs 288 153 306

Loss from joint venture 17 5 11

Equity-settled share-based

payments 75 136 223

Taxation 521 618 1,213

-------------------------------------- ------------ ------------ -----------

Cashflow from operating activities

before changes in working

capital and provisions 4,925 5,042 10,024

Decrease/(increase) in trade

and other receivables 2,175 (1,045) (3,546)

(Increase)/decrease in inventories (801) 765 (471)

(Decrease)/increase in trade

and other payables (1,039) 560 3,065

Employee benefit contributions (330) (330) (660)

-------------------------------------- ------------ ------------ -----------

Cash generated from operations 4,930 4,992 8,412

Interest paid (109) (45) (97)

Tax paid (715) (365) (782)

-------------------------------------- ------------ ------------ -----------

Net cash from operating activities 4,106 4,582 7,533

-------------------------------------- ------------ ------------ -----------

Interest received - 2 2

Investment in joint ventures - (169) -

Acquisition of intangible

assets (69) (300) (422)

Acquisition of property,

plant and equipment (7,934) (2,898) (8,683)

-------------------------------------- ------------ ------------ -----------

Net cash used in investing

activities (8,003) (3,365) (9,103)

-------------------------------------- ------------ ------------ -----------

Issue of share capital to

employees 30 10 126

Repurchase of own shares - (4) (127)

Repayment of borrowings (457) (383) (741)

Proceeds from borrowings - - 5,356

Investment in subsidiary

by non-controlling interest - - 160

Dividends paid (1,664) (1,615) (2,400)

-------------------------------------- ------------ ------------ -----------

Net cash (used)/generated

in financing activities (2,091) (1,992) 2,374

-------------------------------------- ------------ ------------ -----------

Net (decrease)/increase in

cash and cash equivalents (5,988) (775) 804

Cash and cash equivalents

at 1 January 5,269 4,628 4,628

Effect of exchange rate fluctuations

on cash held 397 (146) (163)

-------------------------------------- ------------ ------------ -----------

Cash and cash equivalents

at the end of period (322) 3,707 5,269

-------------------------------------- ------------ ------------ -----------

Cash and cash equivalents comprise cash at bank, short-term

highly liquid investments with a maturity date of less than three

months and bank overdrafts.

The notes below form part of these financial statements.

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2016

Share Own Share Capital Translation Hedging Non-controlling Retained Total

capital shares premium redemption reserve reserve interest earnings equity

held reserve

----------------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- -------- -------- -------- ----------- ------------ -------- ---------------- --------- --------

Balance at

1 January

2016 2,221 (38) 24,340 15 1,636 (195) 138 23,003 51,120

---------------- -------- -------- -------- ----------- ------------ -------- ---------------- --------- --------

Foreign

exchange

translation

profit on

investment

in foreign

subsidiaries

and joint

ventures - - - - 2,171 - - - 2,171

Effective

portion of

changes in

fair value

of cash flow

hedges net

of recycling - - - - - (915) - - (915)

Tax relating

to effective

portion of

changes in

fair value

of cash flow

hedges net

of recycling - - - - - 174 - - 174

Actuarial

losses on

defined

benefit

scheme - - - - - - - (2,534) (2,534)

Tax relating

to actuarial

losses on

defined

benefit

scheme - - - - - - - 481 481

Profit for

the period - - - - - - (22) 2,266 2,244

Total

comprehensive

income/(loss)

for the period - - - - 2,171 (741) (22) 213 1,621

---------------- -------- -------- -------- ----------- ------------ -------- ---------------- --------- --------

Transactions

with owners

of the Parent

Shares issued

to employees - 7 - - - - - 23 30

Equity-settled

share-based

payment

transactions

net of tax - - - - - - - 38 38

Dividends

paid - - - - - - - (1,664) (1,664)

---------------- -------- -------- -------- ----------- ------------ -------- ---------------- --------- --------

Total

transactions

with owners

of the Parent - 7 - - - - - (1,603) (1,596)

---------------- -------- -------- -------- ----------- ------------ -------- ---------------- --------- --------

Balance at

30 June 2016

(unaudited) 2,221 (31) 24,340 15 3,807 (936) 116 21,613 51,145

---------------- -------- -------- -------- ----------- ------------ -------- ---------------- --------- --------

During the six months period ended 30 June 2016, 82,239 shares

vested and were issued from the Zotefoams Employee Benefit Trust

('EBT') following the exercise of these options.

The notes below form part of these financial statements.

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2015

Share Own Share Capital Translation Hedging Retained Total

capital shares premium redemption reserve reserve earnings equity

held reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------------------- --------- -------- --------- ------------ ------------ --------- ---------- --------

Balance at

1 January 2015 2,191 (17) 24,340 15 827 (149) 20,027 47,234

----------------------- --------- -------- --------- ------------ ------------ --------- ---------- --------

Foreign exchange

translation

loss on investment

in foreign

subsidiaries

and joint ventures - - - - (190) - - (190)

Effective portion

of changes

in fair value

of cash flow

hedges net

of recycling - - - - - 604 - 604

Tax relating

to effective

portion of

changes in

fair value

of cash flow

hedges net

of recycling - - - - - (121) - (121)

Profit for

the period - - - - - - 2,399 2,399

----------------------- --------- -------- --------- ------------ ------------ --------- ---------- --------

Total comprehensive

(loss)/income

for the period - - - - (190) 483 2,399 2,692

----------------------- --------- -------- --------- ------------ ------------ --------- ---------- --------

Transactions

with owners

of the Parent

Shares issued

to employees - 10 - - - - - 10

Shares acquired - (2) - - - - (2) (4)

Equity-settled

share-based

payment transactions

net of tax - - - - - - 152 152

Dividends paid - - - - - - (1,615) (1,615)

----------------------- --------- -------- --------- ------------ ------------ --------- ---------- --------

Total transactions

with owners

of the Parent - 8 - - - - (1,465) (1,457)

----------------------- --------- -------- --------- ------------ ------------ --------- ---------- --------

Balance at

30 June 2015

(unaudited) 2,191 (9) 24,340 15 637 334 20,961 48,469

----------------------- --------- -------- --------- ------------ ------------ --------- ---------- --------

The notes below form part of these financial statements.

NOTES TO THE INTERIM FINANCIAL STATEMENTS FOR THE SIX MONTHSED

30 JUNE 2016

1. GENERAL INFORMATION

The Company is a public limited liability company incorporated

and domiciled in the UK. The address of the registered office is

675 Mitcham Road, Croydon, CR9 3AL. The Group is principally

engaged in manufacturing and selling cellular materials and,

through MuCell Extrusion LLC ('MEL'), licensing microcellular foam

technology and supplying related equipment. The Group has

manufacturing sites in the UK and the USA and sells into worldwide

markets. The Company is listed on the London Stock Exchange and is

registered in England and Wales with Company Number 2714645.

2. BASIS OF PREPARATION

This condensed set of consolidated interim financial statements

has been prepared in accordance with IAS 34 Interim Financial

Reporting as adopted by the EU.

As required by the Disclosure and Transparency Rules of the

Financial Conduct Authority, the condensed set of consolidated

interim financial statements has been prepared applying the

accounting policies and presentation that were applied in the

preparation of the Group's published consolidated financial

statements for the year ended 31 December 2015. Those consolidated

financial statements were prepared in accordance with IFRSs as

adopted by the EU.

This condensed set of consolidated interim financial statements

has been reviewed, but not audited, and was approved for issue on 1

August 2016. This condensed set of consolidated interim financial

statements does not comprise statutory accounts within the meaning

of Section 434 of the Companies Act 2006. Statutory accounts for

the year ended 31 December 2015 were approved by the Board of

Directors on 14 March 2016 and delivered to the Registrar of

Companies. The independent audit on those accounts was unqualified,

did not contain an emphasis of matter paragraph and did not contain

any statement under Section 498 of the Companies Act 2006.

Pension

Pension obligations have increased by GBP2.4m in the period to

GBP7.62m, from GBP5.24m at December 2015. This is due to yields

decreasing following the referendum result, announcing that the UK

would leave the European Union. The discount factor used to

calculate the future pension obligations has therefore decreased,

resulting in a larger net present value of the pension deficit at

30 June 2016. The income statement charge is based on the set of

assumptions laid out in the consolidated financial statements for

the year ended 31 December 2015.

Forward-looking statements

Certain statements in this condensed set of consolidated interim

financial statements are forward-looking. Although the Group

believes that the expectations reflected in these forward-looking

statements are reasonable, we can give no assurance that these

expectations will prove to be correct. Because these statements

involve risks and uncertainties, actual results may differ

materially from those expressed or implied by these forward-looking

statements.

We undertake no obligation to update any forward-looking

statements whether as a result of new information, future events or

otherwise.

Going concern

After making enquiries, the directors have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future. The Group

therefore continues to adopt the going concern basis of accounting

in preparing its condensed consolidated interim financial

statements.

3. ACCOUNTING POLICIES

The accounting policies adopted are consistent with those of the

Group's published consolidated financial statements for the year

ended 31 December 2015, as described in those consolidated

financial statements with the exception of tax which is accrued

based on an estimated tax rate that would be applicable to

estimated annual earnings.

Exceptional items

Exceptional items are items which due to their size, incidence

and non-recurring nature have been classified separately in order

to draw them to the attention of the reader of the financial

statements and, in management's judgement, to show more accurately

the underlying profits of the Group. Such items are included within

the consolidated interim income statement caption to which they

relate, and are separately disclosed either in the notes to the

consolidated interim financial statements or on the face of the

consolidated interim income statement.

4. CYCLICAL NATURE OF BUSINESS

Recently, the seasonality of Zotefoams' business has been

largely eliminated, with most variability derived from order timing

from HPP and MEL, and customer inventory management according to

their specific business needs. There remains an underlying cyclical

nature of our markets, over the longer macroeconomic business

cycle, as Zotefoams sells into a wide variety of business segments,

many of which are themselves cyclical.

5. ESTIMATES

The preparation of condensed consolidated interim financial

statements requires management to make judgements, estimates and

assumptions that affect the application of accounting policies and

the reported amounts of assets, liabilities, income and expenses.

The estimates and associated assumptions are based on historical

experience and various other factors that are believed to be

reasonable under the circumstances, the results of which form the

basis for making the judgements about carrying values of assets and

liabilities that are not readily available from other sources.

Actual results may differ from these estimates.

In preparing these condensed consolidated interim financial

statements, the significant judgements made by management in

applying the Group's accounting policies and the key sources of

estimation uncertainty were the same as those that applied to the

consolidated financial statements as at and for the year ended 31

December 2015.

6. SEGMENT REPORTING

The Group manufactures and sells high-performance foams and

licenses related technology for specialist markets worldwide.

Zotefoams' activities are categorised as follows:

-- Polyolefins: these foams are made from olefinic homopolymer

and copolymer resin. The most common resin used is low density

polyethylene ('LDPE').

-- High-Performance Products (HPP): these foams exhibit

high-performance on certain key properties, such as improved

chemical, flammability or temperature performance, due to the

resins on which they are based. Turnover in the segment is

currently derived mainly from our ZOTEK(R) F foams and T-FIT(R)

insulation, both made from PVDF fluoropolymer. Other commercially

launched products are foams made from polyamide (nylon) and

polyether block amide ('PEBA').

-- MEL: licenses microcellular foam technology and sells related machinery.

Due to our unique manufacturing technology Zotefoams can produce

polyolefin foams with superior performance to other manufacturers.

Our strategy is to use the capabilities of our technology to

produce foams from other materials in addition to polyolefins.

There were no significant transactions within the period between

reportable segments.

Polyolefins HPP MEL Consolidated

Six months ended GBP'000 GBP'000 GBP'000 GBP'000

30 June 2016 (unaudited)

Group revenue 22,789 3,174 1,106 27,069

Segment profit/(loss)

before amortisation 3,832 300 (241) 3,891

Amortisation of

acquired intangible

assets (24) - (162) (186)

--------------------------- ------------ -------- -------- -------------

Segment profit/(loss) 3,808 300 (403) 3,705

Foreign exchange

gains - - - 510

Unallocated central

costs - - - (882)

--------------------------- ------------ -------- -------- -------------

Operating profit

pre exceptional

item 3,333

--------------------------- ------------ -------- -------- -------------

Polyolefins HPP MEL Consolidated

Six months ended GBP'000 GBP'000 GBP'000 GBP'000

30 June 2015 (unaudited)

Group revenue 22,087 3,394 1,008 26,489

Segment profit/(loss)

before amortisation 4,102 670 (221) 4,551

Amortisation of

acquired intangible

assets (24) - (153) (177)

--------------------------- ------------ -------- -------- -------------

Segment profit/(loss) 4,078 670 (374) 4,374

Foreign exchange

losses - - - (444)

Unallocated central

costs - - - (757)

--------------------------- ------------ -------- -------- -------------

Operating profit

pre exceptional

item 3,173

--------------------------- ------------ -------- -------- -------------

7. INCOME TAX EXPENSE

Six months Six months

--------------------

ended ended

--------------------

30 June 30 June

2016 2015

GBP'000 GBP'000

-------------------- ----------- -----------

Current tax:

UK corporation tax 433 454

Foreign tax 3 7

-------------------- ----------- -----------

436 461

Deferred tax 86 157

-------------------- ----------- -----------

522 618

-------------------- ----------- -----------

The Group's consolidated effective tax rate for the six months

ended 30 June 2016 was 19% (2015: 20.5%).

Tax is accrued based on an estimated tax rate applicable to

estimated annual earnings.

8. DIVIDS

Six months Six months

ended ended

30 June 30 June

2016 2015

GBP'000 GBP'000

----------------------------------- ----------- -----------

Final dividend for the year ended

31 December 2015 of 3.80p

(2014: 3.70p) per share 1,664 1,615

----------------------------------- ----------- -----------

The final dividend for the year ended 31 December 2015 was paid

on 25 May 2016. The interim dividend of 1.85p (2015: 1.80p) per

share, amounting to GBP0.8m (2015: GBP0.79m) has not been

recognised as a liability in this interim financial information. It

will be recognised in shareholders' equity in the year to 31

December 2016.

9. EARNINGS PER SHARE

The calculation of the basic and diluted earnings per share is

based on the following data:

Six months Six months

---------------------------------------------

ended ended

---------------------------------------------

30-Jun 30-Jun

2016 2015

GBP'000 GBP'000

--------------------------------------------- ----------- -----------

Earnings

Earnings for the purpose of basic

earnings per share pre-exceptional

items being net profit attributable

to equity holders of the parent

pre-exceptional items 2,528 2,399

Earnings for the purposes of

diluted earnings per share pre-exceptional

items 2,528 2,399

Earnings for the purpose of basic

earnings per share being net

profit attributable to equity

holders of the parent 2,266 2,399

Earnings for the purposes of

diluted earnings per share 2,266 2,399

--------------------------------------------- ----------- -----------

Number of shares Number Number

--------------------------------------------- ----------- -----------

Weighted average number of ordinary

shares for the purposes of basic

earnings per share 43,715,063 43,549,103

Effect of dilutive potential

ordinary shares:

-----------

Share options and Long-Term Incentive

Plans 603,994 598,840

--------------------------------------------- ----------- -----------

Weighted average number of ordinary

shares for the purposes of diluted

earnings per share 44,319,057 44,147,943

--------------------------------------------- ----------- -----------

10. FINANCIAL INSTRUMENTS AND FINANCIAL RISK MANAGEMENT

The Group's activities expose it to a variety of financial risks

including credit risk, interest rate risk, liquidity risk and

foreign currency risk.

The condensed interim financial statements do not include all

financial risk management information and disclosures required in

the annual financial statements; they should be read in conjunction

with the Group's annual financial statements as at 31 December

2015. There have been no changes in any risk management policies

since the year end.

Fair value estimation

The table below analyses financial instruments carried at fair

value, by valuation method. The different levels have been defined

as follows:

-- Quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1).

-- Inputs other than quoted prices included within Level 1 that

are observable for the asset or liability, either directly (that

is, as prices) or indirectly (that is, derived from prices) (Level

2).

-- Inputs for the asset or liability that are not based on

observable market data (that is, unobservable inputs) (Level

3).

The following table presents the Group's financial instruments

that are measured at fair value at 30 June 2016.

Level Level Level Total

1 2 3

GBP'000 GBP'000 GBP'000 GBP'000

Assets

Forward exchange - - - -

contracts

Total assets - - - -

------------------- --------- -------- -------- --------

Liabilities

Forward exchange

contracts - (1,110) - (1,110)

Total liabilities - (1,110) - (1,110)

------------------- --------- -------- -------- --------

The following table presents the Group's financial instruments

that are measured at fair value at 30 June 2015.

Level Level Level Total

1 2 3

GBP'000 GBP'000 GBP'000 GBP'000

Assets

Forward exchange

contracts - 456 - 456

Total assets - 456 - 456

------------------- --------- -------- -------- --------

Liabilities

Forward exchange - - - -

contracts

Total liabilities - - - -

------------------- --------- -------- -------- --------

The forward exchange contracts have been fair valued using

forward exchange rates that are quoted in an active market.

Group's valuation process

The Group's finance department performs the valuation of forward

exchange contracts required for financial reporting purposes. This

is reported to the Audit Committee.

The results of the valuation processes are included in the

Group's monthly reporting to the directors which include all

members of the Audit Committee.

Fair value of financial assets and liabilities measured at

amortised cost

The fair value of borrowings is as follows:

30 June 2016 30 June 2015

GBP'000 GBP'000

Current 1,146 726

Non-current 5,765 1,125

Total 6,911 1,851

------------- ------------- -------------

The fair value of the following financial assets and liabilities

approximate to their carrying amount:

-- Trade and other receivables

-- Other current financial assets

-- Cash and cash equivalents

-- Trade and other payables

-- Other current liabilities

11. RELATED PARTY TRANSACTIONS

There were no material related party transactions requiring

disclosure for the periods ended 30 June 2016 and 30 June 2015.

12. BORROWINGS

On 1 March 2016 the Group and Company reduced its overdraft

facility from GBP4.9m to GBP2.0m and took out a 4 year

multi-currency revolving credit facility ('RCF') for GBP8m secured

on the property and book debts of the Company. This facility has

financial covenants on net debt/EBITDA and EBIT/gross financing

costs ratios. The group also took out an $8m mortgage in the prior

year, which is being repaid over 10 years.

13. CAPITAL COMMITMENTS

Capital expenditure commitment of GBP9.5m has been contracted

for at the end of the reporting period but not yet incurred, and is

in respect of Property, Plant and Equipment.

14. EXCEPTIONAL ITEMS

Items that are material either because of their size or their

nature, or that are non-recurring are considered as exceptional

items and are presented within the line items to which they best

relate. During the period, the exceptional item related to

redundancy costs totalling GBP262k, as a result of the efficiency

improvement programme, which have been included in the income

statement as an operating exceptional cost.

15. EVENTS OCCURING AFTER THE REPORTING PERIOD

An interim dividend of 1.85p per share (2015: 1.80p per share)

was proposed by the board of directors on 1 August 2016. It is

payable on 13 October 2016 to shareholders who are on the register

at 16 September 2016. This interim dividend has not been recognised

as a liability in this interim financial information. It will be

recognised in shareholders' equity in the year to 31 December

2016.

INDEPENDENT REVIEW REPORT TO ZOTEFOAMS PLC

Report on the Interim Results

Our conclusion

We have reviewed Zotefoams plc's Interim Results (the "interim

financial statements") in the Interim Report for the 6 month period

ended 30 June 2016. Based on our review, nothing has come to our

attention that causes us to believe that the interim financial

statements are not prepared, in all material respects, in

accordance with International Accounting Standard 34, 'Interim

Financial Reporting', as adopted by the European Union and the

Disclosure Rules and Transparency Rules of the United Kingdom's

Financial Conduct Authority.

What we have reviewed

The interim financial statements comprise:

-- the condensed consolidated statement of financial position as at 30 June 2016;

-- the condensed consolidated income statement and condensed

consolidated statement of comprehensive income for the period then

ended;

-- the condensed consolidated statement of cash flows for the period then ended;

-- the condensed consolidated statement of changes in equity for the period then ended; and

-- the explanatory notes to the interim financial statements.

The interim financial statements included in the Interim Report

have been prepared in accordance with International Accounting

Standard 34, 'Interim Financial Reporting', as adopted by the

European Union and the Disclosure Rules and Transparency Rules of

the United Kingdom's Financial Conduct Authority.

As disclosed in note 2 to the interim financial statements, the

financial reporting framework that has been applied in the

preparation of the full annual financial statements of the Group is

applicable law and International Financial Reporting Standards

(IFRSs) as adopted by the European Union.

Responsibilities for the interim financial statements and the

review

Our responsibilities and those of the directors

The Interim Report, including the interim financial statements,

is the responsibility of, and has been approved by, the directors.

The directors are responsible for preparing the Interim Report in

accordance with the Disclosure Rules and Transparency Rules of the

United Kingdom's Financial Conduct Authority.

Our responsibility is to express a conclusion on the interim

financial statements in the Interim Report based on our review.

This report, including the conclusion, has been prepared for and

only for the company for the purpose of complying with the

Disclosure Rules and Transparency Rules of the United Kingdom's

Financial Conduct Authority and for no other purpose. We do not, in

giving this conclusion, accept or assume responsibility for any

other purpose or to any other person to whom this report is shown

or into whose hands it may come save where expressly agreed by our

prior consent in writing.

What a review of interim financial statements involves

financial information consists of making enquiries, primarily of

persons responsible for financial and accounting matters, and

applying analytical and other review procedures.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK and

Ireland) and, consequently, does not enable us to obtain assurance

that we would become aware of all significant matters that might be

identified in an audit. Accordingly, we do not express an audit

opinion.

We have read the other information contained in the Interim

Report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the interim financial statements.

PricewaterhouseCoopers LLP

Chartered Accountants

Gatwick

1 August 2016

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UGUQGRUPQPGG

(END) Dow Jones Newswires

August 02, 2016 02:01 ET (06:01 GMT)

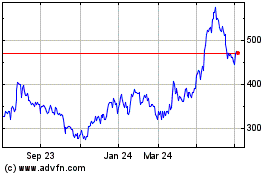

Zotefoams (LSE:ZTF)

Historical Stock Chart

From Mar 2024 to Apr 2024

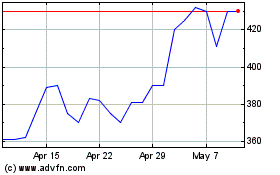

Zotefoams (LSE:ZTF)

Historical Stock Chart

From Apr 2023 to Apr 2024