Yum Authorizes $4.2 Billion Stock Buyback Through Year's End

May 20 2016 - 3:23PM

Dow Jones News

By Maria Armental

Yum Brands Inc. authorized buying back up to $4.2 billion of its

stock by year's end as part of its pledge of returning $6.2 billion

to shareholders ahead of the planned separation of its China

business.

On Wednesday, Yum said it would offer $4.6 billion in new debt

to shore up its finances ahead of the separation.

The China business, once at the center of Yum's growth plans but

whose results had faltered amid food-safety scares and stiffer

competition, has rebounded over the past year, posting three

consecutive quarterly increases in sales at stores open for at

least a year, a key industry metric.

The Louisville, Ky., company said Friday it had bought back 27.6

million shares, or about $2 billion of stock, from October through

May 19. The company has a market value of roughly $32.6 billion,

according to FactSet.

Shares, down 15% over the past 12 months, were up slightly in

afternoon trading at $80.21.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

May 20, 2016 15:08 ET (19:08 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

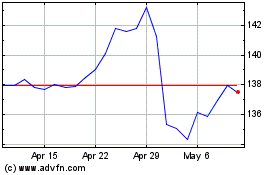

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Mar 2024 to Apr 2024

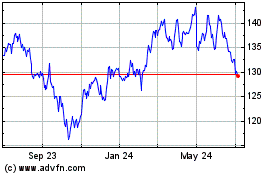

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Apr 2023 to Apr 2024