Yen Rises After BoJ Kuroda Comments

September 26 2016 - 2:00AM

RTTF2

The Japanese yen strengthened against other major currencies in

the early European session on Monday, after a speech by Bank of

Japan Governor Haruhiko Kuroda saying that the bank is willing to

use every possible tool, if necessary, to achieve its price

stability objective.

Speaking to the business leaders in Osaka, the BoJ Governor

Kuroda said that there is no better opportunity than now to

completely get out of deflation. Just talking about a limit to

monetary policy does not help at all, said Kuroda.

The BoJ last week modified its policy framework, giving thrust

to the yield curve as it still struggles to achieve the inflation

target.

Meanwhile, market attention turned from central bank meetings to

U.S. politics ahead of tonight's crucial debate between Hillary

Clinton and Donald Trump. The first of the three presidential

debates can have a significant effect on presidential election

polling.

A Washington Post-ABC News poll has Democratic presidential

nominee Hillary leading Republican candidate Trump by 2 points on

the eve of the debate.

In other economic news, data from the Cabinet Office showed that

the leading index for Japan fell to 100.0 in July from 100.6 in

June, which was revised down from 100.7.

The coincident index that reflects the current economic

activity, rose slightly to 112.1 in July from 112.0 in the previous

month. The preliminary reading for the month was 112.8.

In the Asian trading today, the yen held steady against its

major rivals.

In the European trading, the yen rose to nearly a 1-1/2-month

high of 129.88 against the pound, a 5-week high of 72.69 against

the NZ dollar and a 5-day high of 76.20 against the Canadian

dollar, from early lows of 131.23, 73.21 and 76.79, respectively.

If the yen extends its uptrend, it is likely to find resistance

around 128.00 against the pound, 71.00 against the kiwi and 75.00

against the loonie.

Against the U.S. dollar, the Swiss franc and the Australian

dollar, the yen advanced to 4-day highs of 100.51, 103.66 and 76.45

from early lows of 101.08, 104.27 and 76.98, respectively. The yen

may test resistance near 99.00 against the greenback, 101.00

against the franc and 75.00 against the aussie.

The yen edged up to 112.90 against the euro, from an early low

of 113.51. On the upside, 111.00 is seen as the next resistance

level for the yen.

Looking ahead, U.S. new home sales data for August is slated for

release in the New York session.

At 8:30 am ET, European Central Bank's member of the supervisory

board, Ignazio Angeloni, speaks at a conference "Strengths and

Weaknesses of European Banking" organized by Brevan Howard Centre

and Imperial College Business School, in London.

At 9:00 am ET, European Central Bank President Mario Draghi will

testify before the Committee on Economic and Monetary Affairs of

European Parliament, in Brussels.

At 9:30 am ET, Minneapolis Fed President Neel Kashkari

participates in a fireside chat moderated by Harry Melander,

president of the Minnesota Building and Construction Trades Council

and board member of the Federal Reserve Bank of Minneapolis, in

Minneapolis, U.S.

Fifteen minutes later, European Central Bank Vice President

Vitor Constancio is expected to speak at a conference, in

Frankfurt.

At 11:45 am ET, Federal Reserve Governor Daniel Tarullo will

deliver a speech titled "Next Steps in the Evolution of Stress

Testing" at the Yale School of Management Leaders Forum, in New

Haven.

At 12:00 pm ET, Austrian National Bank Governor and ECB

Governing Council member Ewald Nowotny is expected to speak on the

future of banks, in Vienna.

At 1:30 pm ET, Federal Reserve Bank of Dallas President Robert

Kaplan will participate in moderated Q&A before the Independent

Bankers Association of Texas Annual Convention in Dan Antonio.

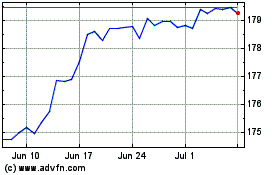

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Mar 2024 to Apr 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Apr 2023 to Apr 2024