Yen Extends Rally As G-7 Clashes, European Shares Slide

May 23 2016 - 1:11AM

RTTF2

The Japanese yen continued to be higher against its major

opponents in early European trading on Monday, amid risk aversion

on weak commodity prices, and as the G-7 meeting ended with

disagreement between U.S. and Japan over intervention to stem the

yen's rise.

Japan and the United States were at logger-heads over currency

policy at the G7 finance leaders' meeting in Japan over the

weekend, with U.S. Treasury Secretary Jack Lew reiterating his view

that the yen's movement hasn't been overly volatile and Tokyo has

no reason to intervene in the forex market.

Reacting to Lew's comments, Japanese Finance Minister Taro Aso

said he was telling his US counterpart that recent "one-sided,

abrupt, and speculative moves" in forex trading are

undesirable.

Further underpinning the yen was data showing larger than

expected Japan trade surplus in April.

Data from the Ministry of Finance showed that Japan recorded a

merchandise trade surplus of 823.474 billion yen in April

That topped forecasts for a surplus of 521.4 billion yen

following the 754.2 billion yen surplus in March.

Exports were down 10.1 percent on year, missing forecasts for a

fall of 9.9 percent following the 6.8 percent drop in the previous

month.

The currency has been trading in a positive territory in the

previous session.

The yen climbed to 5-day highs of 109.41 against the greenback

and 158.50 versus the pound, from last week's closing values of

110.10 and 159.65, respectively. The next possible resistance

levels for the yen may be found around 108.00 against the greenback

and 156.00 against the pound.

The yen appreciated to 110.50 against the Swiss franc, its

strongest since May 9. On the upside, 108.00 is likely seen as the

next resistance level for the yen. The pair ended Friday's trading

at 111.19.

The yen hit a weekly high of 122.75 against the euro, off its

previous low of 123.64. Continuation of the yen's uptrend may see

it finding resistance around the 122.00 mark. At Friday's close,

the pair was valued at 123.55.

Flash survey results from Markit showed that the Eurozone

private sector growth weakened to a 16-month low in May.

The flash composite output index fell unexpectedly to 52.9 in

May, 16-month low, from 53 in April. It was forecast to rise to

53.2.

The yen firmed to a 4-day high of 79.03 against the aussie,

while approaching a 2-week high of 83.31 against the loonie. The

yen is seen finding resistance around 76.00 against the aussie and

82.00 against the loonie.

The yen rebounded to 74.30 against the kiwi, from a low of 74.72

hit at 11:45 pm ET. The yen is likely to test resistance around the

73.00 region.

Looking ahead, at 6:15 am ET, Federal Reserve Bank of St. Louis

President James Bullard speaks about the US economy and monetary

policy at the Official Monetary and Financial Institution Forum in

Beijing.

San Francisco Fed President John Williams speaks about monetary

policy in New York at 8:00 am ET.

Markit's U.S. flash manufacturing PMI for May is to be released

at 9:45 am ET.

At 10:00 am ET, Eurozone flash consumer sentiment index for May

is due.

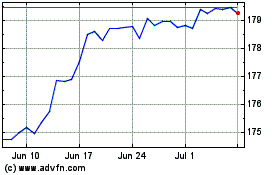

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Mar 2024 to Apr 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Apr 2023 to Apr 2024