Yen Extends Fall Amid Risk Appetite

July 20 2016 - 10:22PM

RTTF2

The Japanese yen continued to be weak against the other major

currencies in the Asian session on Thursday amid risk appetite,

with the positive cues from Wall Street on upbeat corporate

earnings results and expectations of more stimulus by global

central banks lifting investor sentiment.

Expectations that the Bank of Japan will expand its monetary

easing at its policy meeting next week also boosted investor

sentiment.

Investors are also awaiting the outcome of the European Central

Bank's first monetary policy meeting following Britain's vote to

leave the European Union, later today. The ECB is expected to leave

policy unchanged, but may offer signals that additional stimulus is

coming if the economy weakens in response to Brexit.

Crude oil for September delivery are currently up $0.15 to

$45.90 a barrel. The crude oil price rose as official data showed

that U.S. inventories continued to fall.

Commercial crude oil stockpiles in the U.S. fell by 2.3 million

barrels in the week to July 15, the Energy Information

Administration reported. The rebound in oil prices was capped by

speculation that global supplies will rise in the second half of

the year.

Wednesday, the yen fell 0.13 percent against the euro, 0.29

percent against the pound, 0.45 percent against the U.S. dollar and

0.23 percent against the franc.

In the Asian trading, the yen fell to near 1-month lows of

118.39 against the euro, 108.94 against the Swiss franc and 107.49

against the U.S. dollar, from yesterday's closing quotes of 117.71,

108.21 and 106.86, respectively. If the yen extends its downtrend,

it is likely to find support around 124.00 against the euro, 113.00

against the franc and 111.00 against the greenback.

Against the pound and the Canadian dollar, the yen dropped to

6-day lows of 142.39 and 82.28 from yesterday's closing quotes of

141.07 and 81.83, respectively. On the downside, 141.07 against the

pound and 81.83 against the loonie are seen as the next support

levels for the yen.

The yen slipped to a 2-day low of 80.40 against the Australian

dollar, from yesterday's closing value of 79.85. The yen may test

support near the 83.00 region.

Looking ahead, U.K. retail sales data and public sector finance

data, both for June, are slated for release at 4:30 am ET.

The European Central Bank will announce its interest rate

decision at 7:45 am ET. Economists expect the bank to retain its

key refi rate at 0.00 percent.

Following the announcement, President Mario Draghi will hold the

customary post-meeting press conference.

In the New York session, Canada wholesale sales data for May,

U.S. weekly jobless claims for the week ended July 16, U.S. FHFA

house price index for May, U.S. existing home sales data for June,

leading indicator for June and Philadelphia Fed manufacturing index

for July are set to be published.

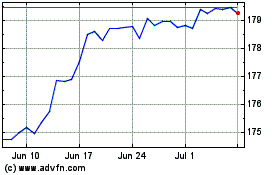

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Mar 2024 to Apr 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Apr 2023 to Apr 2024