Yen Declines On Risk Appetite

March 30 2015 - 7:00AM

RTTF2

The Japanese yen drifted lower against its major rivals in

European deals on Monday, as sentiment lifted up on hopes that

Chinese authorities would pursue more monetary easing to bolster

economic growth.

People's Bank of China Governor Zhou Xiaochuan signaled over the

weekend that China has ample room to ease policy if inflation

continues to fall. His comments spurred hopes for immediate action

by Beijing to boost the economy amid growing deflationary

risks.

Investors continued to monitor developments in Greece, where its

government is continuing talks with creditors to reach a reform

agreement before it runs out of money. Athens is set to present a

list of economic reform proposals to international creditors today

after Tsipras's earlier reform plans met resistance from EU

leaders.

Data from the Ministry of Economy, Trade and Industry showed

that Japan's industrial output fell 3.4 percent on month in

February. The contraction was for the first time in three

months.

The headline figure missed forecasts for a decline of 1.9

percent following the 3.7 percent increase in January.

The yen showed mixed trading in the Asian session. While the yen

was steady against the franc and the greenback, it advanced against

the euro and the pound.

The yen hit 5-day lows of 119.80 against the greenback and

177.95 against the pound, off early high of 119.10 and a 4-day high

of 176.67, respectively. The next possible support for the yen is

seen around 120.00 against the greenback and 179.00 against the

pound.

The yen slipped to 94.93 against the loonie, 130.15 against the

euro and 124.30 against the franc, reversing from early highs of

94.40, 129.29 and 123.46, respectively. If the yen continues

decline, it is likely to support around 96.00 against the loonie,

131.00 against the euro and 125.00 against the franc.

The yen that climbed to a 10-day high of 89.70 against the kiwi

in early deals edged down to 90.22. Next likely support for the yen

may be located around against the 92.5 mark.

Looking ahead, preliminary German consumer price index for

March, Canada industrial product price and raw materials price

index - both for February and U.S. personal income and spending

data and pending home sales data for February are slated for

release in the New York session.

At 9:00 am ET, European Union's financial affairs chief Pierre

Moscovici is expected to speak to the EU parliament committee in

Brussels.

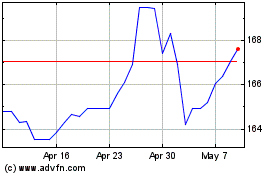

Euro vs Yen (FX:EURJPY)

Forex Chart

From Mar 2024 to Apr 2024

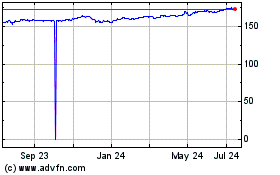

Euro vs Yen (FX:EURJPY)

Forex Chart

From Apr 2023 to Apr 2024