Yen Advances As Sentiment Sours On Political Problems In Yemen

March 26 2015 - 4:41AM

RTTF2

The Japanese yen climbed against its major counterparts in late

Asian deals on Thursday, as demand for safe-haven assets improved

after Saudi Arabia began air strikes in Yemen against Houthi

fighters, who are trying to intensify their grip on the port city

of Aden.

Adel al-Jubeir, the Saudi ambassador, said the attack "in

response to request from the legitimate Yemen government" and the

operation is "designed to protect the people of Yemen and its

legitimate government from a takeover by the Houthis".

Reports said that Saudi has deployed 100 fighter jets, 150,000

soldiers and other navy units. Planes from Egypt, Morocco, Jordan,

Sudan, Kuwait, the United Arab Emirates, Qatar and Bahrain are also

joining the attack.

The military campaign after rebel forces seized parts of Aden,

the country's second largest city, and a nearby air base. Yemeni

President Abed Rabbo Mansour Hadi reportedly abandoned the country,

leaving on a boat from the southern port of Aden.

Soft U.S. economic data released overnight also dented

sentiment. U.S. jobless claims and services PMI reports are due

today, which may give more insights about the economy.

The yen drifted higher to 118.53 against the U.S. dollar for the

first time since February 20. The next possible resistance for the

yen may be located around the 118.00 zone.

The yen advanced to a 3-day high of 130.16 against the euro,

while approaching 176.47 against the pound, a new 7-week high. If

the yen extends rise, it may find resistance around 128.00 against

the euro and 175.00 against the pound.

The yen appreciated to a 2-day high of 123.63 versus the pound,

6-day highs of 95.06 against the loonie, 89.94 against the NZ

dollar and 92.78 against the aussie. On the upside, the yen may

find resistance around 173.00 against the pound, 94.00 against the

loonie, 87.5 against the kiwi and 90.00 against the aussie.

Looking ahead, Swiss KOF Spring economic forecast and Eurozone

M3 money supply and U.K. retail sales- both for February are due to

be released shortly.

At 4:35 am ET, U.S. Federal Reserve Bank of St. Louis President

James Bullard is expected to give OMFIF Public Lecture on the

economy and monetary policy in Frankfurt.

In the New York session, U.S. weekly jobless claims for the week

ended March 21 and Markit's U.S. PMI reports for March are slated

for release.

At 9:00 am ET, U.S. Federal Reserve Bank of Atlanta President

Dennis Lockhart will deliver a speech about the economic outlook

and monetary policy at the Engage International Investment

Education Symposium, in Detroit.

Subsequently, European Central Bank president Mario Draghi will

address the Italian parliament's finance and EU policy committees

in Rome at 9:15 am ET. After 15 minutes, Bank of Canada Governor

Stephen Poloz is expected to speak at the Canada-UK Chamber of

Commerce, in London.

At 1:30 pm ET, Bank of England Governor Mark Carney will hold a

press conference about his role as Chair of the Financial Stability

Board, in Frankfurt.

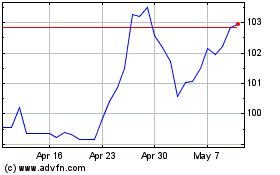

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Mar 2024 to Apr 2024

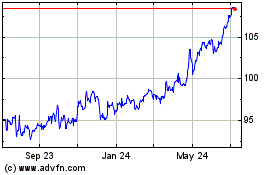

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Apr 2023 to Apr 2024