Yen Advances Amid Reports On BoJ Hesitation Over Further Easing

July 21 2016 - 2:28AM

RTTF2

The Japanese yen climbed against its major counterparts in early

European trading on Thursday, reversing early losses, amid media

reports that the Bank of Japan may hold off implementing additional

easing measures at its meeting next week.

Some BoJ officials are of the opinion that delay in attaining

the BoJ's inflationary goal wouldn't warrant immediate easing, as a

tighter labor market eventually boost wages and feed into consumer

prices, Reuters news agency reported.

Although the BoJ is likely to downgrade its assessment that

underlying trend inflation is "improving steadily next week,

there's no consensus among the policy makers on whether that

warrants prompt action, it reported.

Caution ahead of the European Central Bank's monetary policy

decision, due shortly, also boosted the safe-haven currency.

The central bank is widely expected to leave its monetary policy

unchanged, but investors are watching for signs of future easing in

the post-Brexit era.

In economic front, data from the Ministry of Economy, Trade and

Industry showed that Japan's all industry activity dropped for the

first time in three months in May.

The all industry activity index slid 1 percent month-on-month in

May, reversing a 0.8 percent rise in April. This was the first

increase in three months but slightly slower than the expected drop

of 1.1 percent.

The yen was weaker in the previous session, weighed by hopes for

more easing by the Bank of Japan at its policy meeting next

week.

Bouncing off from an early 6-day low of 142.39 against the

pound, the yen edged up to 139.08. If the yen gains further, it may

find resistance around the 136.00 zone.

Data from the Office for National Statistics showed that British

retail sales declined more than expected in June.

Retail sales volume including auto fuel fell 0.9 percent

month-on-month in June, offsetting a 0.9 percent rise in May. This

was the biggest fall seen so far this year and larger than the

expected fall of 0.6 percent.

The yen advanced to a 3-day high of 105.54 against the

greenback, following a decline to near 1-1/2-month low of 107.49 in

the previous session. The next possible resistance for the yen may

be found around the 104.00 area.

The Japanese currency spiked up to 6-day highs of 116.19 against

the euro and 106.84 against the franc, off its early near 4-week

lows of 118.46 and 108.94, respectively. On the upside, the yen may

find resistance around 113.00 against the euro and 104.00 against

the franc.

The yen strengthened to a 10-day high of 73.76 versus the kiwi,

weekly high of 79.05 against the aussie and a 6-day high of 80.76

against the loonie, reversing from an early low of 75.07, 2-day low

of 80.46 and a 6-day low of 82.28, respectively. The yen is seen

finding resistance around 72.00 against the kiwi, 76.00 against the

aussie and 77.5 against the loonie.

Looking ahead, the European Central Bank will announce its

interest rate decision at 7:45 am ET. Economists expect the bank to

retain its key refi rate at 0.00 percent.

Following the announcement, President Mario Draghi will hold the

customary post-meeting press conference.

In the New York session, Canada wholesale sales data for May,

U.S. weekly jobless claims for the week ended July 16, U.S. FHFA

house price index for May, U.S. existing home sales data for June,

leading indicator for June and Philadelphia Fed manufacturing index

for July are set to be published.

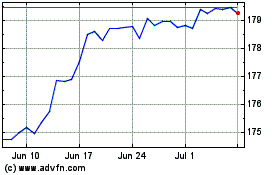

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Mar 2024 to Apr 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Apr 2023 to Apr 2024