XOMA Reports Second Quarter 2017 Financial Results

August 08 2017 - 4:30PM

Executing new corporate strategy leveraging

extensive portfolio of partnered programsEarned $10 million

milestone payment from a pharmaceutical partnerReduced combined

R&D and G&A expenses 56% year-over-yearCurrent cash balance

sufficient to fund operations through August 2018

XOMA Corporation (Nasdaq:XOMA), a pioneer in the discovery and

development of therapeutic antibodies, today announced its second

quarter 2017 financial results and recent business

highlights.

“We made significant progress executing our new strategy to

create long-term value for shareholders in the second quarter,”

stated Jim Neal, Chief Executive Officer of XOMA. “In addition to

earning a $10 million milestone payment from one of our

pharmaceutical partners, we continued to pursue out-licensing

opportunities for our unpartnered programs and to produce valuable

clinical evidence in support of those assets. We also focused on

decreasing our cost infrastructure as we set the stage for a future

positive cash flow environment. With our extensive portfolio of

partner-funded programs, lean cost structure and strengthened

balance sheet, we are positioning ourselves to deliver profitable

growth in the years ahead.”

Recent Business Highlights

XOMA made important progress positioning the Company for

long-term growth and improving its financial health, including:

- Executing a new strategy that leverages XOMA’s extensive

portfolio of partnered programs and licensed technologies that has

the potential to generate substantial future milestone and royalty

proceeds for the Company.

- Earning a $10 million milestone payment in May 2017 that was

received in July 2017, reflecting the clinical advancement of an

asset the Company licensed to one of its pharmaceutical partners.

Similar to this program, XOMA has more than 20 additional clinical

and preclinical programs that are fully funded by partners across

the biotech and pharmaceutical landscape and that are expected to

add to the growth in milestone payments and royalty revenue streams

over time.

- Pursuing strategic partner discussions with multiple companies

regarding out-licensing certain of XOMA’s unpartnered programs.

Recent developments in certain antibody target-related clinical

trials have led to an increase in the interest in some of XOMA’s

portfolio assets.

- Continuing implementation of the Company’s previously announced

aggressive cost reductions by decreasing headcount to fewer than 20

employees as of June 30, 2017.

- Establishing a tentative agreement with Servier to extend

payment terms on the Company’s €12.0 million debt arrangement.

Financial Results

XOMA recorded total revenues of $10.9 million for the second

quarter of 2017, compared to $0.4 million for the second quarter of

2016. The increase in revenues for the second quarter of 2017 was

due primarily to a $10 million milestone payment earned under the

Company’s license agreement with one of its pharmaceutical

partners. This milestone payment was received in July

2017.

Research and development (R&D) expenses were $2.9 million

for the second quarter of 2017, compared to $13.7 million for the

second quarter of 2016. The decrease in R&D expenses for the

second quarter of 2017 was due primarily to a $3.8 million

reduction in salaries and related expenses, a $3.6 million decrease

in external manufacturing activities, a $1.6 million reduction in

clinical trial costs, and a $1.0 million decrease in the allocation

of facilities and information technology costs. The significant

reduction in R&D spending year-over-year is a result of the

execution of the Company’s new corporate strategy of leveraging its

extensive portfolio of partnered programs and licensed

technologies.

General and administrative (G&A) expenses were $5.2 million

for the second quarter of 2017, compared to $4.8 million for the

second quarter of 2016. G&A expenses for the three months ended

June 30, 2017, included increases of $1.0 million in the allocation

of facilities and information technology costs due to a greater

proportion of general and administrative personnel after the

Company’s restructuring activities, $0.3 million in legal,

accounting and tax services and $0.2 million in consulting

services, partially offset by a $0.8 million decrease in salaries

and other personnel costs related to the reduction in headcount

from its restructuring activities. G&A salaries and related

expenses included $1.6 million of non-cash stock compensation

expense.

Restructuring charges were $1.5 million for the second quarter

of 2017. These charges related primarily to severance, other

termination benefits and outplacement services associated with the

Company’s restructuring activities in 2016 and the first half of

2017.

Net income for the second quarter of 2017 was $0.3 million,

compared to net loss of $15.2 million for the second quarter of

2016. The Company recorded non-cash charges of $0.9 million for

unrealized foreign exchange losses primarily related to the

Company’s €12.0 million loan from Servier in the second quarter of

2017.

On June 30, 2017, XOMA had cash and cash equivalents of $12.5

million and $10 million included in accounts receivable from a

milestone earned in May 2017 from one of its licensees, which was

received in July 2017. The Company ended December 31, 2016, with

cash and cash equivalents of $25.7 million. The Company’s current

cash and cash equivalents are expected to be sufficient to fund its

operations through August 2018.

About XOMA Corporation

XOMA has an extensive portfolio of products, programs, and

technologies that are the subject of licenses the Company has in

place with other biotech and pharmaceutical companies. Many

of these licenses are the result of the Company's pioneering

efforts in the discovery and development of antibody therapeutics.

There are more than 20 such programs that are fully funded by

partners and could produce milestone payments and royalty payments

in the future. For more information, visit www.xoma.com.

Forward-Looking Statements

Certain statements contained in this press release are

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934, including statements regarding: the potential of

XOMA’s portfolio of partnered programs and licensed technologies

generating substantial milestone and royalty proceeds over time;

the significant unmet therapeutic need for certain rare medical

conditions associated with hyperinsulinism; XOMA’s intent to

license X213 and X358; and statements that otherwise relate to

future periods. These statements are based on assumptions that may

not prove accurate, and actual results could differ materially from

those anticipated due to certain risks inherent in the

biotechnology industry and for companies engaged in the development

of new products in a regulated market. Potential risks to XOMA

meeting these expectations are described in more detail in XOMA's

most recent filing on Form 10-K and in other SEC filings. Consider

such risks carefully when considering XOMA's prospects. Any

forward-looking statement in this press release represents XOMA's

views only as of the date of this press release and should not be

relied upon as representing its views as of any subsequent date.

XOMA disclaims any obligation to update any forward-looking

statement, except as required by applicable law.

| XOMA CORPORATION |

|

| CONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME (LOSS) |

|

| (unaudited) |

|

| (in thousands, except per share

amounts) |

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| License

and collaborative fees |

|

$ |

10,775 |

|

|

$ |

275 |

|

|

$ |

10,925 |

|

|

$ |

2,766 |

|

| Contract

and other |

|

|

115 |

|

|

|

168 |

|

|

|

225 |

|

|

|

1,639 |

|

| Total

revenues |

|

|

10,890 |

|

|

|

443 |

|

|

|

11,150 |

|

|

|

4,405 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research

and development |

|

|

2,916 |

|

|

|

13,703 |

|

|

|

6,908 |

|

|

|

27,313 |

|

| General

and administrative |

|

|

5,203 |

|

|

|

4,779 |

|

|

|

10,370 |

|

|

|

9,084 |

|

|

Restructuring |

|

|

1,460 |

|

|

|

(21 |

) |

|

|

3,480 |

|

|

|

15 |

|

| Total

operating expenses |

|

|

9,579 |

|

|

|

18,461 |

|

|

|

20,758 |

|

|

|

36,412 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income

(loss) from operations |

|

|

1,311 |

|

|

|

(18,018 |

) |

|

|

(9,608 |

) |

|

|

(32,007 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest

expense |

|

|

(297 |

) |

|

|

(1,007 |

) |

|

|

(906 |

) |

|

|

(2,009 |

) |

| Other

income (expense), net |

|

|

(729 |

) |

|

|

602 |

|

|

|

600 |

|

|

|

296 |

|

|

Revaluation of contingent warrant liabilities |

|

|

— |

|

|

|

3,263 |

|

|

|

— |

|

|

|

10,195 |

|

| Loss on

extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

(515 |

) |

|

|

— |

|

| Net

income (loss) |

|

$ |

285 |

|

|

$ |

(15,160 |

) |

|

$ |

(10,429 |

) |

|

$ |

(23,525 |

) |

| Basic and diluted net

income (loss) available to common stockholders |

|

$ |

172 |

|

|

$ |

(15,160 |

) |

|

$ |

(16,032 |

) |

|

$ |

(23,525 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic net income (loss)

per share available to common stockholders |

|

$ |

0.02 |

|

|

$ |

(2.52 |

) |

|

$ |

(2.21 |

) |

|

$ |

(3.92 |

) |

| Diluted net income

(loss) per share available to common stockholders |

|

$ |

0.02 |

|

|

$ |

(2.52 |

) |

|

$ |

(2.21 |

) |

|

$ |

(3.92 |

) |

| Weighted average shares

used in computing basic net income (loss) per share available to

common stockholders |

|

|

7,588 |

|

|

|

6,022 |

|

|

|

7,240 |

|

|

|

6,000 |

|

| Weighted average shares

used in computing diluted net income (loss) per share available to

common stockholders |

|

|

7,643 |

|

|

|

6,022 |

|

|

|

7,240 |

|

|

|

6,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive

income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income (loss) |

|

$ |

285 |

|

|

$ |

(15,160 |

) |

|

$ |

(10,429 |

) |

|

$ |

(23,525 |

) |

| Net

unrealized loss on marketable securities |

|

|

— |

|

|

|

(12 |

) |

|

|

— |

|

|

|

(54 |

) |

| Total

comprehensive income (loss) |

|

$ |

285 |

|

|

$ |

(15,172 |

) |

|

$ |

(10,429 |

) |

|

$ |

(23,579 |

) |

| XOMA CORPORATION |

|

| CONDENSED CONSOLIDATED BALANCE

SHEETS |

|

| (in thousands, except share and per share

amounts) |

|

| |

|

|

|

|

June 30, |

|

|

December 31, |

|

|

|

|

2017 |

|

|

2016 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

12,465 |

|

|

$ |

25,742 |

|

| Trade and

other receivables, net |

|

|

10,631 |

|

|

|

566 |

|

| Prepaid

expenses and other current assets |

|

|

334 |

|

|

|

852 |

|

| Total

current assets |

|

|

23,430 |

|

|

|

27,160 |

|

| Property and equipment,

net |

|

|

234 |

|

|

|

1,036 |

|

| Other assets |

|

|

481 |

|

|

|

481 |

|

| Total

assets |

|

$ |

24,145 |

|

|

$ |

28,677 |

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’

DEFICIT |

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

|

| Accounts

payable |

|

$ |

3,512 |

|

|

$ |

5,689 |

|

| Accrued

and other liabilities |

|

|

2,062 |

|

|

|

4,215 |

|

| Accrued

restructuring costs |

|

|

1,020 |

|

|

|

3,594 |

|

| Deferred

revenue – current |

|

|

1,425 |

|

|

|

899 |

|

| Interest

bearing obligations – current |

|

|

13,539 |

|

|

|

17,855 |

|

| Accrued

interest on interest bearing obligations – current |

|

|

125 |

|

|

|

254 |

|

| Total

current liabilities |

|

|

21,683 |

|

|

|

32,506 |

|

| Deferred revenue –

non-current |

|

|

17,255 |

|

|

|

18,000 |

|

| Interest bearing

obligations – non-current |

|

|

14,322 |

|

|

|

25,312 |

|

| Other liabilities –

non-current |

|

|

— |

|

|

|

69 |

|

| Total

liabilities |

|

|

53,260 |

|

|

|

75,887 |

|

| |

|

|

|

|

|

|

|

|

| Stockholders’

deficit: |

|

|

|

|

|

|

|

|

| Preferred

stock, $0.05 par value, 1,000,000 shares authorized, 5,003 and |

|

|

|

|

|

|

|

|

| 0 shares

issued and outstanding as of June 30, 2017 and December 31, |

|

|

|

|

|

|

|

|

| 2016,

respectively |

|

|

— |

|

|

|

— |

|

| Common

stock, $0.0075 par value, 277,333,332 shares authorized, |

|

|

|

|

|

|

|

|

| 7,593,230

and 6,114,145 shares issued and outstanding at June 30, 2017 |

|

|

|

|

|

|

|

|

| and

December 31, 2016, respectively |

|

|

57 |

|

|

|

46 |

|

|

Additional paid-in capital |

|

|

1,174,912 |

|

|

|

1,146,357 |

|

|

Accumulated deficit |

|

|

(1,204,084 |

) |

|

|

(1,193,613 |

) |

| Total

stockholders’ deficit |

|

|

(29,115 |

) |

|

|

(47,210 |

) |

| Total

liabilities and stockholders’ deficit |

|

$ |

24,145 |

|

|

$ |

28,677 |

|

Investor contact:

Luke Heagle

Pure Communications

+1 910-726-1372

lheagle@purecommunications.com

Media contact:

Colin Sanford

Pure Communications

+1 415-946-1094

csanford@purecommunications.com

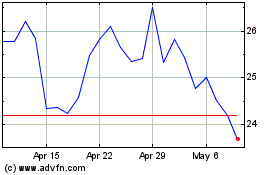

XOMA (NASDAQ:XOMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

XOMA (NASDAQ:XOMA)

Historical Stock Chart

From Apr 2023 to Apr 2024