XOMA Posts Wider Q1 Loss - Analyst Blog

May 09 2014 - 4:00PM

Zacks

XOMA Corporation’s

(XOMA) shares declined 18.5% after the company reported

wider-than-expected loss per share in the first quarter of 2014 and

slower-than-expected patient enrolment in two phase III studies

being conducted with gevokizumab.

The company posted a loss of 23

cents per share, wider than the Zacks Consensus Estimate of a loss

of 19 cents per share and the year-ago loss of 15 cents per

share.

Total revenues for the reported

quarter were $3.4 million, down 63.9% from the year-ago quarter.

Revenues were lower than the year-ago quarter primarily due to a

milestone payment from Servier. Revenues were well below the Zacks

Consensus Estimate of $9 million.

The Quarter in

Detail

R&D expenses for the quarter

increased 29.5% to $21.5 million. The surge was driven by increased

costs related to pipeline development, including gevokizumab and

higher stock-based compensation expense.

XOMA is working on commencing a

phase III study on gevokizumab for inflammatory pyoderma

gangrenosum (PG). XOMA intends to submit the phase III study

protocols for gevokizumab to the U.S. Food and Drug Administration

(FDA) within the next few weeks. A response from the FDA should be

out by Aug 2014. Gevokizumab received orphan drug status in the

U.S. for the treatment of PG.

Meanwhile, partner Servier is

enrolling patients in the phase III EYEGUARD program on

gevokizumab. EYEGUARD-A is being conducted to evaluate gevokizumab

for the treatment of non-infectious uveitis (NIU), EYEGUARD-B is

evaluating gevokizumab’s ability to prevent disease flares in

patients with Behçet's uveitis and EYEGUARD-C is being conducted to

evaluate gevokizumab for the prevention of disease flares in NIU

patients who are controlled with steroids. Gevokizumab has orphan

drug status for NIU and Behçet's uveitis. However, patient

enrolment for EYEGUARD-A and EYEGUARD-C is going slower than

expected.

Selling, general and administrative

expenses increased 27.4% to $5.3 million.

2014 Guidance

Maintained

XOMA continues to expect cash usage

for operating activities in the range of $55.0 million − $60.0

million in 2014. This includes license and contract-related

revenues that the company expects to receive this year.

XOMA currently carries a Zacks Rank

#3 (Hold). Some better-ranked stocks in the health care sector

include Alexion Pharmaceuticals, Inc. (ALXN),

ANI Pharmaceuticals, Inc. (ANIP) and

Gilead Sciences Inc. (GILD). All these stocks

carry a Zacks Rank #1 (Strong Buy).

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

ALEXION PHARMA (ALXN): Free Stock Analysis Report

ANI PHARMACEUT (ANIP): Free Stock Analysis Report

GILEAD SCIENCES (GILD): Free Stock Analysis Report

XOMA CORP (XOMA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

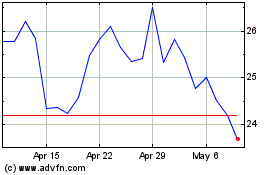

XOMA (NASDAQ:XOMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

XOMA (NASDAQ:XOMA)

Historical Stock Chart

From Apr 2023 to Apr 2024