Wynn Resorts, Limited (Nasdaq: WYNN) today reported financial

results for the third quarter ended September 30, 2017.

Net revenues were $1.61 billion for the third quarter of 2017,

an increase of 45.3%, or $502.5 million, from $1.11 billion for the

same period of 2016. The increase was the result of an increase of

$390.7 million from Wynn Palace, which opened in the third quarter

of 2016, and increases of $79.3 million and $32.5 million from Wynn

Macau and our Las Vegas Operations, respectively.

On a U.S. generally accepted accounting principles ("GAAP")

basis, net income attributable to Wynn Resorts, Limited was $79.8

million, or $0.78 per diluted share, for the third quarter of 2017,

compared to a net loss attributable to Wynn Resorts, Limited of

$17.4 million, or $0.17 per diluted share, for the same period of

2016. The increase in net income attributable to Wynn Resorts,

Limited was primarily the result of a full quarter of income from

Wynn Palace and increased operating income from Wynn Macau and Wynn

Las Vegas, partially offset by a loss on extinguishment of debt, an

increase in net income attributable to noncontrolling interests and

an increase in property charges and other. Property charges and

other during the third quarter of 2017 included $19.1 million of

estimated costs primarily related to property damage caused by a

typhoon that impacted Macau during the quarter. Adjusted net income

attributable to Wynn Resorts, Limited (1) was $155.8 million, or

$1.52 per diluted share, for the third quarter of 2017, compared to

$75.5 million, or $0.74 per diluted share, for the same period of

2016.

Adjusted Property EBITDA (2) was $473.0 million for the third

quarter of 2017, an increase of 54.8%, or $167.5 million, from

$305.4 million for the same period of 2016, the result of increases

of $112.7 million, $32.2 million and $22.6 million from Wynn

Palace, Wynn Macau and our Las Vegas Operations, respectively.

Wynn Resorts, Limited also announced today that the Company has

approved a cash dividend of $0.50 per share, payable on November

28, 2017 to stockholders of record as of November 16, 2017.

Wynn Macau

Net revenues from Wynn Macau were $597.4 million for the third

quarter of 2017, a 15.3% increase from $518.1 million for the same

period of 2016. Adjusted Property EBITDA from Wynn Macau was $183.2

million for the third quarter of 2017, a 21.3% increase from $151.0

million for the same period of 2016.

Casino revenues from Wynn Macau were $567.7 million for the

third quarter of 2017, a 16.2% increase from $488.3 million for the

same period of 2016. Table games turnover in VIP operations was

$13.37 billion, a 22.2% increase from $10.94 billion for the third

quarter of 2016. VIP table games win as a percentage of turnover

(calculated before commissions) was 3.37%, above the expected range

of 2.7% to 3.0% and the 3.34% experienced in the third quarter of

2016. Table drop in mass market operations was $1.07 billion, a

3.2% decrease from $1.11 billion for the third quarter of 2016.

Table games win in mass market operations was $216.4 million, a

5.5% increase from $205.2 million for the third quarter of 2016.

Table games win percentage in mass market operations was 20.2%,

compared to 18.6% experienced in the third quarter of 2016. Slot

machine handle was $864.6 million, a 26.9% increase from $681.6

million for the third quarter of 2016, while slot machine win

increased 21.1% to $35.5 million.

Non-casino revenues before promotional allowances from Wynn

Macau were $62.2 million for the third quarter of 2017, a 2.3%

decrease from $63.7 million for the same period of 2016. Room

revenues decreased 7.9%, to $24.1 million for the third quarter of

2017, from $26.2 million for the same period of 2016. Average daily

rate ("ADR") was $246, an 8.9% decrease from $270 for the third

quarter of 2016. Occupancy increased to 97.3% for the third quarter

of 2017, from 95.1% for the same period of 2016. Revenue per

available room ("REVPAR") was $240, a 6.6% decrease from $257 for

the third quarter of 2016.

Wynn Palace

The reported financial results for the third quarter of 2016

include 40 days of operations of Wynn Palace, which opened on

August 22, 2016.

Net revenues from Wynn Palace were $555.3 million for the third

quarter of 2017, compared to $164.6 million for the same period of

2016. Adjusted Property EBITDA from Wynn Palace was $138.2 million

for the third quarter of 2017, compared to $25.5 million for the

same period of 2016.

Casino revenues from Wynn Palace were $514.5 million for the

third quarter of 2017, compared to $146.7 million for the same

period of 2016. Table games turnover in VIP operations was $13.69

billion, compared to $4.15 billion for the third quarter of 2016.

VIP table games win as a percentage of turnover was 2.99%, within

the expected range of 2.7% to 3.0% and above the 2.90% experienced

in the third quarter of 2016. Table drop in mass market operations

was $866.6 million, compared to $275.9 million for the third

quarter of 2016. Table games win in mass market operations was

$194.3 million, compared to $51.5 million for the third quarter of

2016. Table games win percentage in mass market operations was

22.4%, compared to 18.7% experienced in the third quarter of 2016.

Slot machine handle was $817.5 million, compared to $204.5 million

for the third quarter of 2016, while slot machine win increased

from $12.6 million to $42.0 million in the third quarter of

2017.

Non-casino revenues before promotional allowances from Wynn

Palace were $79.4 million for the third quarter of 2017, compared

to $33.9 million for the same period of 2016. Room revenues were

$32.9 million for the third quarter of 2017, compared to $14.2

million for the same period of 2016. ADR was $219, a 23.7% decrease

from $287 for the third quarter of 2016. Occupancy increased to

96.1% for the third quarter of 2017, from 70.8% for the same period

of 2016. REVPAR was $211, a 3.9% increase from $203 for the third

quarter of 2016.

Las Vegas Operations

Net revenues from our Las Vegas Operations were $459.6 million

for the third quarter of 2017, a 7.6% increase from $427.1 million

for the same period of 2016. Adjusted Property EBITDA from our Las

Vegas Operations was $151.5 million, a 17.6% increase from $128.9

million for the third quarter of 2016.

Casino revenues from our Las Vegas Operations were $174.4

million for the third quarter of 2017, a 13.9% increase from $153.2

million for the same period of 2016. Table games drop was $496.2

million, a 2.7% increase from $483.4 million for the third quarter

of 2016. Table games win was $132.2 million, a 10.8% increase from

$119.4 million for the third quarter of 2016. Table games win

percentage was 26.6%, above the property’s expected range of 21% to

25% and the 24.7% experienced in the third quarter of 2016. Slot

machine handle was $819.5 million, a 0.1% increase from $818.7

million for the third quarter of 2016, while slot machine win

increased 13.6% to $59.6 million.

Non-casino revenues before promotional allowances from our Las

Vegas Operations were $329.8 million for the third quarter of 2017,

a 4.3% increase from $316.3 million for the same period of 2016.

Room revenues increased 5.3%, to $118.1 million for the third

quarter of 2017, from $112.2 million for the same period of 2016.

ADR was $299, a 3.8% increase from $288 for the third quarter of

2016. Occupancy increased to 91.4% for the third quarter of 2017,

from the 90.0% experienced in the same period of 2016. REVPAR was

$273, a 5.4% increase from $259 for the third quarter of 2016. Food

and beverage revenues increased 6.6%, to $154.8 million for the

third quarter of 2017, compared to the same period of 2016.

Entertainment, retail and other revenues decreased 3.3%, to $57.0

million for the third quarter of 2017, compared to the same period

of 2016.

Wynn Boston Harbor Project in Massachusetts

The Company is currently constructing Wynn Boston Harbor, an

integrated resort in Everett, Massachusetts, located adjacent to

Boston along the Mystic River. The resort will contain a hotel, a

waterfront boardwalk, meeting and convention space, casino space, a

spa, retail offerings and food and beverage outlets. The total

project budget, including gaming license fees, construction costs,

capitalized interest, pre-opening expenses and land costs, is

estimated to be approximately $2.4 billion. As of

September 30, 2017, we have incurred $935.6 million in total

project costs. We expect to open Wynn Boston Harbor in

mid-2019.

Balance Sheet

During the quarter, Wynn Macau, Limited completed a cash tender

offer for $946.4 million principal amount of the $1.35 billion 5

1/4% Senior Notes due 2021 (the “2021 Notes”) and on October 20,

2017 redeemed the remaining untendered $403.6 million principal

amount. In connection with these transactions, Wynn Macau, Limited

issued $600 million 4 7/8% Senior Notes due 2024 and $750 million 5

1/2% Senior Notes due 2027, and used the net proceeds to cover the

majority of the cost of extinguishing the 2021 Notes. As a result

of these transactions, the Company recorded a $20.8 million loss on

extinguishment of debt during the third quarter of 2017.

Our cash and cash equivalents, restricted cash and investment

securities at September 30, 2017 were $3.26 billion and

included $403.6 million that was used to redeem the remaining

principal amount of the untendered 2021 Notes on October 20,

2017.

Total debt outstanding at the end of the quarter was $10.18

billion, including $4.15 billion of Macau related debt, $3.16

billion of Wynn Las Vegas debt and $2.87 billion at the parent

company and other. Our Macau related debt at the end of the quarter

includes the $403.6 million principal amount of untendered 2021

Notes that was redeemed on October 20, 2017.

Conference Call and Other Information

The Company will hold a conference call to discuss its results,

including the results of Wynn Las Vegas, LLC, on October 26,

2017 at 1:30 p.m. PT (4:30 p.m. ET). Interested parties are invited

to join the call by accessing a live audio webcast at

http://www.wynnresorts.com.

On November 8, 2017, the Company will make Wynn Las Vegas, LLC

financial information for the quarter ended September 30, 2017

available to noteholders, prospective investors, broker-dealers and

securities analysts. Please contact our investor relations office

at 702-770-7555 or at investorrelations@wynnresorts.com, to obtain

access to such financial information.

Forward-looking Statements

This release contains forward-looking statements regarding

operating trends and future results of operations. Such

forward-looking statements are subject to a number of risks and

uncertainties that could cause actual results to differ materially

from those we express in these forward-looking statements,

including, but not limited to, our dependence on Stephen A. Wynn,

general global political and economic conditions, adverse tourism

trends, dependence on a limited number of resorts, competition in

the casino/hotel and resort industries, uncertainties over the

development and success of new gaming and resort properties,

construction risks, extensive regulation of our business, pending

or future legal proceedings, cybersecurity risk and our leverage

and debt service. Additional information concerning potential

factors that could affect the Company’s financial results is

included in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2016 and the Company’s other periodic reports

filed with the Securities and Exchange Commission. The Company is

under no obligation to (and expressly disclaims any such obligation

to) update or revise its forward-looking statements as a result of

new information, future events or otherwise.

Non-GAAP Financial Measures

(1) “Adjusted net income attributable to Wynn Resorts, Limited”

is net income (loss) attributable to Wynn Resorts, Limited before

pre-opening expenses, property charges and other, change in

interest rate swap fair value, change in Redemption Note fair

value, loss on extinguishment of debt, foreign currency

remeasurement gain (loss), net of noncontrolling interests and

taxes calculated using the specific tax treatment applicable to the

adjustments based on their respective jurisdictions. Adjusted net

income attributable to Wynn Resorts, Limited and adjusted net

income attributable to Wynn Resorts, Limited per diluted share are

presented as supplemental disclosures to financial measures in

accordance with GAAP because management believes that these

non-GAAP financial measures are widely used to measure the

performance, and as a principal basis for valuation, of gaming

companies. These measures are used by management and/or evaluated

by some investors, in addition to income and earnings per share

computed in accordance with GAAP, as an additional basis for

assessing period-to-period results of our business. Adjusted net

income attributable to Wynn Resorts, Limited and adjusted net

income attributable to Wynn Resorts, Limited per diluted share may

be different from the calculation methods used by other companies

and, therefore, comparability may be limited.

(2) “Adjusted Property EBITDA” is net income (loss) before

interest, taxes, depreciation and amortization, pre-opening

expenses, property charges and other, management and license fees,

corporate expenses and other (including intercompany golf course

and water rights leases), stock-based compensation, loss on

extinguishment of debt, change in interest rate swap fair value,

change in Redemption Note fair value and other non-operating income

and expenses, and includes equity in income from unconsolidated

affiliates. Adjusted Property EBITDA is presented exclusively as a

supplemental disclosure because management believes that it is

widely used to measure the performance, and as a basis for

valuation, of gaming companies. Management uses Adjusted Property

EBITDA as a measure of the operating performance of its segments

and to compare the operating performance of its properties with

those of its competitors, as well as a basis for determining

certain incentive compensation. The Company also presents Adjusted

Property EBITDA because it is used by some investors as a way to

measure a company’s ability to incur and service debt, make capital

expenditures and meet working capital requirements. Gaming

companies have historically reported EBITDA as a supplement to

GAAP. In order to view the operations of their casinos on a more

stand-alone basis, gaming companies, including Wynn Resorts,

Limited, have historically excluded from their EBITDA calculations

pre-opening expenses, property charges, corporate expenses and

stock-based compensation, that do not relate to the management of

specific casino properties. However, Adjusted Property EBITDA

should not be considered as an alternative to operating income as

an indicator of the Company’s performance, as an alternative to

cash flows from operating activities as a measure of liquidity, or

as an alternative to any other measure determined in accordance

with GAAP. Unlike net income, Adjusted Property EBITDA does not

include depreciation or interest expense and therefore does not

reflect current or future capital expenditures or the cost of

capital. The Company has significant uses of cash flows, including

capital expenditures, interest payments, debt principal repayments,

taxes and other non-recurring charges, which are not reflected in

Adjusted Property EBITDA. Also, Wynn Resorts’ calculation of

Adjusted Property EBITDA may be different from the calculation

methods used by other companies and, therefore, comparability may

be limited.

The Company has included schedules in the tables that accompany

this release that reconcile (i) net income (loss) attributable

to Wynn Resorts, Limited to adjusted net income attributable to

Wynn Resorts, Limited, (ii) operating income (loss) to

Adjusted Property EBITDA, and (iii) net income (loss) attributable

to Wynn Resorts, Limited to Adjusted Property EBITDA.

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except per share

data)

(unaudited)

Three Months Ended September 30, Nine Months Ended

September 30, 2017 2016

2017 2016 Operating revenues:

Casino $ 1,256,602 $ 788,219 $ 3,574,059 $ 2,263,608 Rooms 175,108

152,608 531,558 431,047 Food and beverage 190,854 167,997 537,807

469,072 Entertainment, retail and other 105,500 93,230

310,636 257,256 Gross revenues 1,728,064

1,202,054 4,954,060 3,420,983 Less: promotional allowances (115,733

) (92,232 ) (336,788 ) (255,119 ) Net revenues 1,612,331

1,109,822 4,617,272 3,165,864 Operating

expenses: Casino 799,978 505,620 2,303,435 1,428,532 Rooms 44,070

40,188 134,394 115,937 Food and beverage 113,452 109,333 323,840

294,480 Entertainment, retail and other 44,159 40,153 129,986

116,126 General and administrative 178,506 144,206 502,637 381,156

(Benefit) provision for doubtful accounts 1,656 (2,368 ) (4,593 )

816 Pre-opening 6,908 70,778 19,445 150,496 Depreciation and

amortization 137,982 106,467 415,488 264,187 Property charges and

other 28,293 18,514 38,494 31,366 Total

operating expenses 1,355,004 1,032,891 3,863,126

2,783,096 Operating income 257,327 76,931

754,146 382,768 Other income (expense):

Interest income 8,447 3,678 21,998 9,940 Interest expense, net of

amounts capitalized (95,874 ) (79,669 ) (291,875 ) (193,698 )

Change in interest rate swap fair value (2 ) 1,168 (1,056 ) (1,693

) Change in Redemption Note fair value (41,718 ) (22,218 ) (69,982

) (19,239 ) Loss on extinguishment of debt (20,774 ) — (43,061 ) —

Equity in income from unconsolidated affiliates — — — 16 Other

(1,894 ) 899 (19,840 ) (1,046 ) Other income (expense), net

(151,815 ) (96,142 ) (403,816 ) (205,720 ) Income (loss) before

income taxes 105,512 (19,211 ) 350,330 177,048 Benefit (provision)

for income taxes 457 (120 ) (5,040 ) (1,145 ) Net income

(loss) 105,969 (19,331 ) 345,290 175,903 Less: net (income) loss

attributable to noncontrolling interests (26,202 ) 1,894

(89,791 ) (47,728 ) Net income (loss) attributable to Wynn Resorts,

Limited $ 79,767 $ (17,437 ) $ 255,499 $ 128,175

Basic and diluted income (loss) per common share: Net income

(loss) attributable to Wynn Resorts, Limited: Basic $ 0.78 $ (0.17

) $ 2.51 $ 1.26 Diluted $ 0.78 $ (0.17 ) $ 2.49 $ 1.26 Weighted

average common shares outstanding: Basic 102,173 101,439 101,960

101,423 Diluted 102,794 101,439 102,460 101,835 Dividends declared

per common share: $ 0.50 $ 0.50 $ 1.50 $ 1.50

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

RECONCILIATION OF NET INCOME (LOSS)

ATTRIBUTABLE TO WYNN RESORTS, LIMITED

TO ADJUSTED NET INCOME ATTRIBUTABLE TO

WYNN RESORTS, LIMITED

(in thousands, except per share

data)

(unaudited)

Three Months Ended September 30, Nine Months Ended

September 30, 2017 2016

2017 2016 Net income (loss)

attributable to Wynn Resorts, Limited $ 79,767 $ (17,437 ) $

255,499 $ 128,175 Pre-opening expenses 6,908 70,778 19,445 150,496

Property charges and other 28,293 18,514 38,494 31,366 Change in

interest rate swap fair value 2 (1,168 ) 1,056 1,693 Change in

Redemption Note fair value 41,718 22,218 69,982 19,239 Loss on

extinguishment of debt 20,774 — 43,061 — Foreign currency

remeasurement (gain) loss 1,894 (899 ) 19,840 1,046 Income tax

impact on adjustments (9,983 ) 1,681 (11,753 ) 1,598 Noncontrolling

interests impact on adjustments (13,556 ) (18,153 ) (19,483 )

(38,472 ) Adjusted net income attributable to Wynn Resorts, Limited

$ 155,817 $ 75,534 $ 416,141 $ 295,141

Adjusted net income attributable to Wynn Resorts, Limited per

diluted share $ 1.52 $ 0.74 $ 4.06 $ 2.90

Weighted average common shares outstanding - diluted

102,794 101,917 102,460 101,835

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

RECONCILIATION OF OPERATING INCOME

(LOSS) TO ADJUSTED PROPERTY EBITDA

(in thousands)

(unaudited)

Three Months Ended September 30, 2017

Operating

income

(loss)

Pre-opening

expenses

Depreciation

and

amortization

Property

charges and

other

Management

and license

fees

Corporate

expense

and other

Stock-based

compensation

Adjusted

Property

EBITDA

Macau Operations: Wynn Macau $ 124,566 $ — $ 24,734 $ 6,396 $

23,099 $ 2,384 $ 2,040 $ 183,219 Wynn Palace 28,432 — 65,062 19,493

21,769 2,198 1,274 138,228 Other Macau (6,551 ) — 1,115

157 — 5,111 168 — Total Macau

Operations 146,447 — 90,911 26,046 44,868 9,693 3,482 321,447 Las

Vegas Operations 76,785 237 44,549 2,247 22,513 4,740 438 151,509

Corporate and Other 34,095 6,671 2,522 —

(67,381 ) 17,510 6,583 — Total $ 257,327

$ 6,908 $ 137,982 $ 28,293 $ — $

31,943 $ 10,503 $ 472,956

Three

Months Ended September 30, 2016

Operating

income

(loss)

Pre-opening

expenses

Depreciation

and

amortization

Property

charges and

other

Management

and license

fees

Corporate

expense

and other

Stock-based

compensation

Adjusted

Property

EBITDA

Macau Operations: Wynn Macau $ 99,461 $ — $ 24,687 $ 1,758 $ 20,018

$ 2,751 $ 2,334 $ 151,009 Wynn Palace (79,226 ) 65,548 31,561 8

6,554 847 255 25,547 Other Macau (4,884 ) — 902 —

— 5,186 (1,204 ) — Total Macau Operations

15,351 65,548 57,150 1,766 26,572 8,784 1,385 176,556 Las Vegas

Operations 46,960 64 46,403 16,748 13,441 4,634 629 128,879

Corporate and Other 14,620 5,166 2,914 —

(40,013 ) 11,279 6,034 — Total $ 76,931

$ 70,778 $ 106,467 $ 18,514 $ — $

24,697 $ 8,048 $ 305,435

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

RECONCILIATION OF OPERATING INCOME

(LOSS) TO ADJUSTED PROPERTY EBITDA

(in thousands)

(unaudited)

Nine Months Ended September 30, 2017

Operating

income

(loss)

Pre-opening

expenses

Depreciation

and

amortization

Property

charges and

other

Management

and license

fees

Corporate

expense

and other

Stock-based

compensation

Adjusted

Property

EBITDA

Macau Operations: Wynn Macau $ 406,418 $ — $ 74,043 $ 7,932 $

72,727 $ 7,586 $ 6,017 $ 574,723 Wynn Palace 56,443 — 193,749

20,253 56,520 6,744 3,778 337,487 Other Macau (12,515 ) —

3,376 163 — 8,480 496 — Total

Macau Operations 450,346 — 271,168 28,348 129,247 22,810 10,291

912,210 Las Vegas Operations 205,119 748 136,561 9,657 47,246

17,583 1,382 418,296 Corporate and Other 98,681 18,697

7,759 489 (176,493 ) 33,250 17,617

— Total $ 754,146 $ 19,445 $ 415,488 $

38,494 $ — $ 73,643 $ 29,290 $

1,330,506

Nine Months Ended September 30, 2016

Operating

income

(loss)

Pre-opening

expenses

Depreciation

and

amortization

Property

charges and

other

Management

and license

fees

Corporate

expense

and other

Stock-based

compensation

Adjusted

Property

EBITDA

Macau Operations: Wynn Macau $ 369,490 $ — $ 74,530 $ 4,206 $

67,154 $ 9,196 $ 8,067 $ 532,643 Wynn Palace (154,602 ) 131,144

41,162 187 6,554 847 255 25,547 Other Macau (14,022 ) —

2,379 — — 10,667 976 — Total

Macau Operations 200,866 131,144 118,071 4,393 73,708 20,710 9,298

558,190 Las Vegas Operations 138,333 2,199 137,349 26,989 38,963

14,324 2,036 360,193 Corporate and Other 43,569 17,153

8,767 — (112,671 ) 25,660 17,522

— Total $ 382,768 $ 150,496 $ 264,187 $ 31,382

$ — $ 60,694 $ 28,856 $ 918,383

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

RECONCILIATION OF NET INCOME (LOSS)

ATTRIBUTABLE TO WYNN RESORTS, LIMITED TO ADJUSTED PROPERTY

EBITDA

(in thousands)

(unaudited)

Three Months Ended September 30, Nine Months Ended

September 30, 2017 2016

2017 2016 Net income (loss)

attributable to Wynn Resorts, Limited $ 79,767 $ (17,437 ) $

255,499 $ 128,175 Net income (loss) attributable to noncontrolling

interests 26,202 (1,894 ) 89,791 47,728 Pre-opening expenses 6,908

70,778 19,445 150,496 Depreciation and amortization 137,982 106,467

415,488 264,187 Property charges and other 28,293 18,514 38,494

31,366 Corporate expense and other 31,943 24,697 73,643 60,694

Stock-based compensation 10,503 8,048 29,290 28,856 Interest income

(8,447 ) (3,678 ) (21,998 ) (9,940 ) Interest expense, net of

amounts capitalized 95,874 79,669 291,875 193,698 Change in

interest rate swap fair value 2 (1,168 ) 1,056 1,693 Change in

Redemption Note fair value 41,718 22,218 69,982 19,239 Loss on

extinguishment of debt 20,774 — 43,061 — Other expenses 1,894 (899

) 19,840 1,046 (Benefit) provision for income taxes (457 ) 120

5,040 1,145 Adjusted Property EBITDA $ 472,956

$ 305,435 $ 1,330,506 $ 918,383

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

SUPPLEMENTAL DATA SCHEDULE

(dollars in thousands, except for win

per unit per day, ADR and REVPAR)

(unaudited)

Three Months Ended September 30, Nine Months Ended

September 30, 2017 2016

2017 2016 Macau

Operations: Wynn Macau: VIP: Average number of table games 96

142 93 171 VIP turnover $ 13,373,060 $ 10,941,100 $ 42,680,904 $

36,252,239 VIP table games win $ 451,136 $ 365,047 $ 1,456,139 $

1,214,675 VIP table games win as a % of turnover 3.37 % 3.34 % 3.41

% 3.35 % Table games win per unit per day (1) $ 51,324 $ 28,003 $

57,095 $ 25,871 Mass market: Average number of table games 206 201

205 228 Table drop (2) $ 1,070,119 $ 1,105,938 $ 3,274,733 $

3,489,272 Table games win $ 216,439 $ 205,179 $ 650,911 $ 687,876

Table games win % 20.2 % 18.6 % 19.9 % 19.7 % Table games win per

unit per day (1) $ 11,408 $ 11,089 $ 11,637 $ 11,008 Average number

of slot machines 918 804 907 787 Slot machine handle $ 864,553 $

681,552 $ 2,589,125 $ 2,584,342 Slot machine win $ 35,522 $ 29,327

$ 113,607 $ 113,098 Slot machine win per unit per day (3) $ 421 $

396 $ 459 $ 524 Room statistics: Occupancy 97.3 % 95.1 % 96.9 %

93.8 % ADR (4) $ 246 $ 270 $ 256 $ 304 REVPAR (5) $ 240 $ 257 $ 248

$ 286 Wynn Palace (6): VIP: Average number of table games

106 72 101 72 VIP turnover $ 13,694,250 $ 4,150,448 $ 36,340,603 $

4,150,448 VIP table games win $ 409,648 $ 120,455 $ 997,031 $

120,455 VIP table games win as a % of turnover 2.99 % 2.90 % 2.74 %

2.90 % Table games win per unit per day (1) $ 42,015 $ 42,117 $

36,290 $ 42,117 Mass market: Average number of table games 201 274

205 274 Table drop (2) $ 866,637 $ 275,898 $ 2,365,661 $ 275,898

Table games win $ 194,294 $ 51,525 $ 530,668 $ 51,525 Table games

win % 22.4 % 18.7 % 22.4 % 18.7 % Table games win per unit per day

(1) $ 10,491 $ 4,702 $ 9,507 $ 4,702 Average number of slot

machines 1,100 1,132 1,041 1,132 Slot machine handle $ 817,543 $

204,515 $ 2,132,973 $ 204,515 Slot machine win $ 41,965 $ 12,610 $

110,712 $ 12,610 Slot machine win per unit per day (3) $ 415 $ 279

$ 390 $ 279 Room statistics: Occupancy 96.1 % 70.8 % 96.0 % 70.8 %

ADR (4) $ 219 $ 287 $ 237 $ 287 REVPAR (5) $ 211 $ 203 $ 227 $ 203

WYNN RESORTS, LIMITED AND

SUBSIDIARIES

SUPPLEMENTAL DATA SCHEDULE

(dollars in thousands, except for win

per unit per day, ADR and REVPAR)

(unaudited)

(continued)

Three Months Ended September 30, Nine Months Ended

September 30, 2017 2016

2017 2016 Las Vegas

Operations: Average number of table games 237 234 236 236 Table

drop (2) $ 496,233 $ 483,382 $ 1,374,167 $ 1,385,963 Table games

win $ 132,227 $ 119,388 $ 364,374 $ 340,572 Table games win % 26.6

% 24.7 % 26.5 % 24.6 % Table games win per unit per day (1) $ 6,065

$ 5,552 $ 5,657 $ 5,264 Average number of slot machines 1,849 1,890

1,864 1,888 Slot machine handle $ 819,462 $ 818,719 $ 2,350,162 $

2,286,559 Slot machine win $ 59,605 $ 52,460 $ 162,340 $ 150,786

Slot machine win per unit per day (3) $ 350 $ 302 $ 319 $ 291 Room

statistics: Occupancy 91.4 % 90.0 % 88.5 % 85.7 % ADR (4) $ 299 $

288 $ 305 $ 298 REVPAR (5) $ 273 $ 259 $ 270 $ 255 (1) Table

games win per unit per day is shown before discounts and

commissions, as applicable. (2) In Macau, table drop is the amount

of cash that is deposited in a gaming table’s drop box plus cash

chips purchased at the casino cage. In Las Vegas, table drop is the

amount of cash and net markers issued that are deposited in a

gaming table’s drop box. (3) Slot machine win per unit per day is

calculated as gross slot machine win minus progressive accruals and

free play. (4) ADR is average daily rate and is calculated by

dividing total room revenues including the retail value of

promotional allowances (less service charges, if any) by total

rooms occupied including complimentary rooms. (5) REVPAR is revenue

per available room and is calculated by dividing total room

revenues including the retail value of promotional allowances (less

service charges, if any) by total rooms available. (6) Wynn Palace

opened on August 22, 2016.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171026006564/en/

Wynn Resorts, LimitedRobert Amerine,

702-770-7555investorrelations@wynnresorts.com

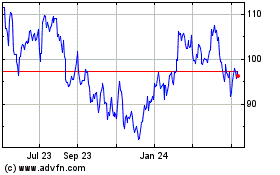

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Apr 2023 to Apr 2024