Worthington Reports Fourth Quarter and Fiscal Year Results

Record Earnings per Share of $2.11 for Fiscal 2014

COLUMBUS, OH--(Marketwired - Jun 26, 2014) - Worthington

Industries, Inc. (NYSE: WOR) today reported net sales of $891.0

million and net earnings of $33.2 million, or $0.47 per diluted

share, for its fiscal 2014 fourth quarter ended May 31,

2014.

Net earnings in the quarter include impairment and restructuring

charges that reduced earnings by $23.7 million, or $0.21 per share

after tax. The most significant charge was a $19.0 million

impairment of Worthington Nitin Cylinders, a 60% owned joint

venture in India. Worthington's portion of this charge was

$11.4 million after eliminating our partner's $7.6 million share in

the non-controlling interest line. In addition, earnings

benefitted from a $4.9 million pre-tax gain in SG&A as we

settled a legal dispute with a supplier involved in the 2012 recall

of cylinders, and we recorded $2.7 million of miscellaneous income

for insurance proceeds related to property damaged in a fire at our

Austria cylinder plant. The after tax benefit of these two

items was $0.07 per share.

In the fourth quarter of the prior year, the Company reported

net sales of $704.1 million and net earnings of $33.5 million, or

$0.46 per diluted share. Included in the prior quarter were

several impairment and other charges totaling $10.8 million pretax,

which reduced earnings per diluted share by $0.14.

For the fiscal year ended May 31, 2014, the Company reported net

earnings of $151.3 million, or $2.11 per diluted share. Net sales

were up 20%, or $514.2 million, from the prior year due to the

consolidation of the Company's laser-welded blanks joint venture

(TWB), higher volumes in Steel Processing, and recent acquisitions

in Pressure Cylinders. Current year net earnings were adversely

affected by impairment and other non-recurring items which resulted

in a net charge of $36.0 million, pretax, or $0.22 per diluted

share. In the prior year, earnings included $13.0 million of

pre-tax impairment and restructuring charges, or $0.17 per diluted

share.

Financial highlights for the current and comparative periods are

as follows:

| |

| (U.S. dollars in millions, except per share

data) |

| |

|

|

|

4Q 2014 |

|

3Q 2014 |

|

4Q 2013 |

|

12M2014 |

|

12M2013 |

| Net

sales |

|

$ |

891.0 |

|

$ |

773.2 |

|

$ |

704.1 |

|

$ |

3,126.4 |

|

$ |

2,612.2 |

|

Operating income |

|

|

32.3 |

|

|

45.3 |

|

|

33.5 |

|

|

135.8 |

|

|

129.1 |

|

Equity income |

|

|

22.2 |

|

|

21.2 |

|

|

21.0 |

|

|

91.5 |

|

|

94.6 |

| Net

earnings |

|

|

33.2 |

|

|

40.6 |

|

|

33.5 |

|

|

151.3 |

|

|

136.4 |

|

Earnings per share |

|

$ |

0.47 |

|

$ |

0.57 |

|

$ |

0.46 |

|

$ |

2.11 |

|

$ |

1.91 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

"We had a great fiscal 2014 with the highest annual earnings per

share in our Company's history," said John McConnell, Chairman and

CEO. "The fourth quarter results showed improvement over the

prior year period with Steel Processing leading the way. Our

transformation efforts continue to help that business deliver

strong results as it nears the peak volumes we saw prior to the

downturn." McConnell added, "Pressure Cylinders had good

retail and industrial sales but experienced a negative short-term

impact from the severe winter weather conditions in the energy

business. Transformation is underway with some early success in our

Engineered Cabs business while it operates in a flat market

environment. All in all, we are pleased with the year

over-year-results and our ability to keep our commitment to

shareholders through our stock buy-back and the increase in our

dividend. I want to congratulate our employees for their hard

work and dedication to improving all aspects of our

businesses."

Consolidated Quarterly Results

Net sales for the fourth quarter ended May 31, 2014 were $891.0

million, up 27% from the comparable quarter in the prior year, when

net sales were $704.1 million. The increase resulted from higher

overall volumes, aided by acquisitions.

Gross margin for the current quarter was $130.8 million,

compared to $111.1 million in the prior year quarter. The $19.7

million increase was the result of higher overall

volumes.

Operating income for the current quarter was $32.3 million, a

decrease of $1.2 million from the prior year quarter, as the

improvement in gross margin was more than offset by higher

impairment charges and a $4.2 million increase in SG&A

expense. The increase in SG&A expense was driven by the

impact of acquisitions and higher profit sharing and bonus expense

partially offset by the $4.9 million net gain related to the

settlement of the legal dispute described above. Impairment

charges in the current quarter included $19.0 million related to

Worthington Nitin Cylinders, $2.5 million related to the Company's

stainless steel business, Precision Specialty Metals, and $1.4

million related to the Company's aluminum high-pressure cylinder

business in New Albany, Mississippi.

Interest expense was $8.0 million for the current quarter,

compared to $6.2 million in the comparable period in the prior

year. The increase was due to the impact of higher average

debt levels and higher average interest rates resulting from an

increase in the usage of long-term debt versus short-term

debt.

Equity in net income from unconsolidated joint ventures

increased $1.2 million over the prior year quarter to $22.2 million

on sales of $371.4 million. Excluding the removal of TWB from

equity income, due to its consolidation, and a $4.8 million charge

for the write-off of our China metal framing JV in the prior year,

equity income was essentially flat compared to the prior year

quarter. However, income from ClarkDietrich decreased $2.0

million on lower volumes related to severe weather

conditions. This decrease was offset by increases in WAVE and

Serviacero. All joint ventures posted positive results led by

WAVE, Serviacero and ArtiFlex, which contributed $16.3 million,

$2.5 million, and $1.5 million of equity income, respectively.

Income tax expense was $18.4 million in the current quarter

compared to $16.7 million in the comparable quarter in the prior

year. The current quarter tax expense reflected an effective

rate of 35.7% compared to 33.3% for the prior year

quarter.

Balance Sheet

At quarter end, total debt was $666.3 million, up $224.5 million

from February 28, 2014, due to the April 15, 2014, issuance of

$250.0 million aggregate principal amount of senior notes due

2026. A portion of the net proceeds were used to repay

borrowings then outstanding under both the Company's $425.0 million

revolving credit facility and its $100.0 million trade accounts

receivable securitization facility. The Company had $190

million of cash at quarter end, $100 million of which will be used

to repay $100 million of current notes due in December 2014.

Quarterly Segment Results

Steel Processing's net sales of $563.5 million were up 48%, or

$183.9 million, from the prior year quarter primarily from the

consolidation of TWB and increased sales in the automotive,

agriculture and construction markets. Operating income

increased by $13.3 million to $33.3 million due primarily to the

increase in volume and the addition of TWB. The overall

increase in operating income was partially offset by the $2.5

million impairment charge related to Precision Specialty

Metals.

Pressure Cylinders' net sales of $264.2 million were up 5%, or

$11.9 million, from the comparable prior year quarter driven by

recent acquisitions and higher average selling prices in retail

products. Operating income was $6.0 million, a decrease of

$10.4 million from the prior year quarter, as the favorable impact

of recent acquisitions was more than offset by the impairment

charges.

Engineered Cabs' net sales declined $2.4 million in the current

quarter to $52.7 million as lower average selling prices, due to

product mix, more than offset the impact of higher overall

volumes. Operating loss in the current quarter increased $3.0

million to $4.2 million on lower net sales and higher manufacturing

and SG&A expense.

The "Other" category includes the Construction Services and

Energy Innovations operating segments, as well as non-allocated

corporate expenses. Operations in the "Other" category

reported net sales of $10.6 million, a decrease of $6.4 million

from the prior year quarter, mostly due to the Construction

Services business. The "Other" category reported an operating

loss of $2.8 million driven by losses within Construction

Services. The Mid-Rise business within construction services

was shut down as of May 31, 2014.

Recent Business Developments

- On March 27, 2014, the Company acquired the tank manufacturing

division of Steffes Corporation for cash consideration of $28.9

million. Steffes manufactures oilfield storage tanks for

customers drilling in the Bakken shale and Williston Basin region

from its manufacturing facility in Dickinson, ND.

- On April 15, 2014, the Company completed the public offering of

$250.0 million aggregate principal amount of senior notes due

2026. The notes bear interest at an annual rate of 4.55%.

- During the quarter, the Company repurchased a total of

1,000,000 common shares for $37.1 million at an average price of

$37.14.

- On June 25, 2014, the board of directors declared a quarterly

dividend of $0.18 per share payable on September 29, 2014 to

shareholders of record on September 12, 2014.

- On June 25, 2014, the Board of Directors authorized the

repurchase of an additional 10.0 million shares. This is in

addition to the 1.7 million shares remaining under the 2011

authorization.

Highlights for Fiscal 2014

- On July 31, 2013, the Company acquired an additional 10%

interest in the laser welded blanks joint venture, TWB, increasing

the ownership to a 55% controlling interest. TWB's results have

been consolidated within Steel Processing since that date, with the

minority member's portion of earnings eliminated within earnings

attributable to non-controlling interest.

- During the second quarter of fiscal 2014, a re-branding

initiative was launched to brand substantially all of the

businesses under the Worthington Industries name. In

connection with the branding strategy, the Company discontinued the

use of non-Worthington trade names except for retail brand names

including BernzOmatic® and Balloon Time® and those related to our

joint ventures.

- An agreement was finalized in October 2013 with Nisshin Steel

Co., Ltd. and Marubeni-Itochu Steel Inc. to form Zhejiang Nisshin

Worthington Precision Specialty Steel Co., Ltd. The joint

venture will construct a plant in Zhejiang Province in the People's

Republic of China that will produce cold rolled strip steel

primarily for the automotive industry. Worthington will own a

10% interest in the joint venture with the option to increase its

ownership interest to 34%.

- The Company entered into an agreement in November 2013 to sell

the operating assets related to our steel high pressure and

acetylene cylinders business in North America.

- On December 10, 2013, the Company announced the closure of its

Baltimore steel facility. With the consolidation of the steel

industry, many of the mills that previously supplied the Baltimore

facility have closed, negatively impacting the supply chain

there. The Company has concluded that it can more efficiently

service its customers in the Mid-Atlantic Region from other

Worthington facilities and processing partners. The facility is no

longer operating as of May 31, 2014.

- Worthington acquired a 75% interest in Worthington Aritas, one

of Europe's leading LNG (liquefied natural gas) and cryogenic

technology companies in January, 2014 for cash consideration of

$35.6 million. The remaining 25% stake was retained by the prior

owners.

- During fiscal 2014, the Company repurchased a total of

3,380,500 common shares for $128.2 million at an average price of

$37.93.

Outlook

"We anticipate continued year-over-year growth in fiscal 2015 as

we pursue our strategy and our commitment to delivering consistent

earnings growth," McConnell said. "Automotive should remain

strong and we are seeing some signs of positive growth in the

construction markets. We also expect good results from key

Pressure Cylinders markets in retail, industrial, alternative fuels

and energy products. We will continue to drive improvements

throughout our businesses and we will pursue acquisitions which

enhance existing businesses, providing new products and higher

growth markets."

Conference Call

Worthington will review fourth quarter and full-year results

during its quarterly conference call on June 26, 2014, at 10:30

a.m., Eastern Daylight Saving Time. Details regarding the

conference call can be found on the Company web site at

www.WorthingtonIndustries.com.

Corporate Profile

Worthington Industries is a leading diversified metals

manufacturing company with 2014 fiscal year sales of $3.1 billion.

The Columbus, Ohio based company is North America's premier

value-added steel processor and a leader in manufactured metal

products, such as propane, oxygen, refrigerant and industrial

cylinders, hand torches, camping cylinders, scuba tanks, compressed

natural gas storage cylinders, helium balloon kits and exploration,

recovery and production tanks for global energy markets;

custom-engineered open and enclosed cabs and operator stations for

heavy mobile equipment; laser welded blanks; steel pallets and

racks; and through joint ventures, suspension grid systems for

concealed and lay-in panel ceilings, current and past model

automotive service stampings and light gauge steel framing for

commercial and residential construction. Worthington employs

approximately 10,000 people and operates 80 facilities in 10

countries.

Founded in 1955, the Company operates under a long-standing

corporate philosophy rooted in the golden rule. Earning money for

its shareholders is the first corporate goal. This philosophy

serves as an unwavering commitment to the customer, supplier, and

shareholder, and it serves as the Company's foundation for one of

the strongest employee-employer partnerships in American

industry.

Safe Harbor Statement

The Company wishes to take advantage of the Safe Harbor

provisions included in the Private Securities Litigation Reform Act

of 1995 (the "Act"). Statements by the Company relating to outlook,

strategy or business plans; future or expected growth,

performance, sales, volumes, cash flows, earnings, balance sheet

strengths, debt, financial condition or other financial measures;

projected profitability potential, capacity, and working capital

needs; or demand trends for the Company or its markets; additions

to product lines and opportunities to participate in new markets;

pricing trends for raw materials and finished goods and the impact

of pricing changes; anticipated capital expenditures and asset

sales; anticipated improvements and efficiencies in costs,

operations, sales, inventory management, sourcing and the supply

chain and the results thereof; the ability to make acquisitions and

the projected timing, results, benefits, costs, charges and

expenditures related to acquisitions, newly-created joint ventures,

headcount reductions and facility dispositions, shutdowns and

consolidations; the alignment of operations with demand; the

ability to operate profitably and generate cash in down markets;

the ability to maintain margins and capture and maintain market

share and to develop or take advantage of future opportunities, new

products and new markets; expectations for Company and customer

inventories, jobs and orders; expectations for the economy and

markets or improvements therein; expected benefits from

transformation plans, cost reduction efforts and other new

initiatives; expectations for increasing volatility or improving

and sustaining earnings, earnings potential, margins or shareholder

value; effects of judicial rulings and other non-historical matters

constitute "forward-looking statements" within the meaning of the

Act. Because they are based on beliefs, estimates and assumptions,

forward-looking statements are inherently subject to risks and

uncertainties that could cause actual results to differ materially

from those projected. Any number of factors could affect actual

results, including, without limitation, the effect of national,

regional and worldwide economic conditions generally and within

major product markets, including a prolonged or substantial

economic downturn; the outcome of negotiations surrounding the

United States debt and budget, which may be adverse due to its

impact on tax increases, governmental spending, and customer

confidence and spending, and the overall economy; the effect of

conditions in national and worldwide financial markets; product

demand and pricing; changes in product mix, product substitution

and market acceptance of the Company's products; fluctuations in

the pricing, quality or availability of raw materials (particularly

steel), supplies, transportation, utilities and other items

required by operations; effects of facility closures and the

consolidation of operations; the effect of financial difficulties,

consolidation and other changes within the steel, automotive,

construction and other industries in which the Company

participates; failure to maintain appropriate levels of

inventories; financial difficulties (including bankruptcy filings)

of original equipment manufacturers, end-users and customers,

suppliers, joint venture partners and others with whom the Company

does business; the ability to realize targeted expense reductions

from headcount reductions, facility closures and other cost

reduction efforts; the ability to realize other cost savings and

operational, sales and sourcing improvements and efficiencies, and

other expected benefits from transformation initiatives, on a

timely basis; the overall success of, and the ability to integrate

newly-acquired businesses and joint ventures, maintain and develop

their customers, and achieve synergies and other expected benefits

and cost savings therefrom; capacity levels and efficiencies,

within facilities, within major product markets and within the

industry as a whole; the effect of disruption in the business of

suppliers, customers, facilities and shipping operations due to

adverse weather, casualty events, equipment breakdowns, acts of war

or terrorist activities or other causes; changes in customer

demand, inventories, spending patterns, product choices, and

supplier choices; risks associated with doing business

internationally, including economic, political and social

instability, foreign currency exposure and the acceptance of our

products in these markets; the ability to improve and maintain

processes and business practices to keep pace with the economic,

competitive and technological environment; the outcome of adverse

claims experience with respect to workers' compensation, product

recalls or product liability, casualty events or other matters;

deviation of actual results from estimates and/or assumptions used

by the Company in the application of its significant accounting

policies; level of imports and import prices in the Company's

markets; the impact of judicial rulings and governmental

regulations, both in the United States and abroad, including those

adopted by the United States Securities and Exchange Commission and

other governmental agencies as contemplated by the Dodd-Frank Wall

Street Reform and Consumer Protection Act of 2010; the effect of

changes to healthcare laws in the United States which may increase

our healthcare and other costs and negatively impact our operations

and financial results; and other risks described from time to time

in the Company's filings with the United States Securities and

Exchange Commission, including those described in "Part I - Item

1A. - Risk Factors" of our Annual Report on Form 10-K for the

fiscal year ended May 31, 2013.

| |

|

| WORTHINGTON INDUSTRIES, INC. |

|

| CONSOLIDATED STATEMENTS OF EARNINGS |

|

| (In thousands, except per share amounts) |

|

| |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

May 31, |

|

|

May 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| Net sales |

|

$ |

891,005 |

|

|

$ |

704,060 |

|

|

$ |

3,126,426 |

|

|

$ |

2,612,244 |

|

| Cost of goods sold |

|

|

760,169 |

|

|

|

592,950 |

|

|

|

2,633,907 |

|

|

|

2,215,601 |

|

| |

Gross

margin |

|

|

130,836 |

|

|

|

111,110 |

|

|

|

492,519 |

|

|

|

396,643 |

|

| Selling, general and administrative expense |

|

|

74,781 |

|

|

|

70,580 |

|

|

|

300,396 |

|

|

|

258,324 |

|

| Impairment of long-lived assets |

|

|

22,871 |

|

|

|

4,968 |

|

|

|

58,246 |

|

|

|

6,488 |

|

| Restructuring and other expense (income) |

|

|

869 |

|

|

|

1,482 |

|

|

|

(2,912 |

) |

|

|

3,293 |

|

| Joint venture transactions |

|

|

(12 |

) |

|

|

584 |

|

|

|

1,036 |

|

|

|

(604 |

) |

| |

Operating income |

|

|

32,327 |

|

|

|

33,496 |

|

|

|

135,753 |

|

|

|

129,142 |

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Miscellaneous income |

|

|

3,066 |

|

|

|

388 |

|

|

|

16,963 |

|

|

|

1,452 |

|

| |

Interest expense |

|

|

(7,977 |

) |

|

|

(6,167 |

) |

|

|

(26,671 |

) |

|

|

(23,918 |

) |

| |

Equity in net income of unconsolidated affiliates |

|

|

22,233 |

|

|

|

21,044 |

|

|

|

91,456 |

|

|

|

94,624 |

|

| |

Earnings before income taxes |

|

|

49,649 |

|

|

|

48,761 |

|

|

|

217,501 |

|

|

|

201,300 |

|

| Income tax expense |

|

|

18,401 |

|

|

|

16,744 |

|

|

|

57,349 |

|

|

|

64,465 |

|

| Net earnings |

|

|

31,248 |

|

|

|

32,017 |

|

|

|

160,152 |

|

|

|

136,835 |

|

| Net earnings (loss) attributable to noncontrolling

interest |

|

|

(1,915 |

) |

|

|

(1,506 |

) |

|

|

8,852 |

|

|

|

393 |

|

| Net earnings attributable to controlling interest |

|

$ |

33,163 |

|

|

$ |

33,523 |

|

|

$ |

151,300 |

|

|

$ |

136,442 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average common shares outstanding |

|

|

67,980 |

|

|

|

70,201 |

|

|

|

68,944 |

|

|

|

69,301 |

|

| Earnings per share attributable to controlling

interest |

|

$ |

0.49 |

|

|

$ |

0.48 |

|

|

$ |

2.19 |

|

|

$ |

1.97 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average common shares outstanding |

|

|

70,441 |

|

|

|

72,999 |

|

|

|

71,664 |

|

|

|

71,314 |

|

| Earnings per share attributable to controlling

interest |

|

$ |

0.47 |

|

|

$ |

0.46 |

|

|

$ |

2.11 |

|

|

$ |

1.91 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common shares outstanding at end of period |

|

|

67,408 |

|

|

|

69,752 |

|

|

|

67,408 |

|

|

|

69,752 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash dividends declared per share |

|

$ |

0.15 |

|

|

$ |

- |

|

|

$ |

0.60 |

|

|

$ |

0.52 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| WORTHINGTON INDUSTRIES, INC. |

| CONSOLIDATED BALANCE SHEETS |

| (In thousands) |

| |

| |

|

|

|

|

| |

|

May 31, |

|

May 31, |

| |

|

2014 |

|

2013 |

| Assets |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

| |

Cash and cash equivalents |

|

$ |

190,079 |

|

$ |

51,385 |

| |

Receivables, less allowances of $3,043 and $3,408 at

May 31, 2014 and May 31, 2013, respectively |

|

|

493,127 |

|

|

394,327 |

| |

Inventories: |

|

|

|

|

|

|

| |

|

Raw materials |

|

|

213,173 |

|

|

175,093 |

| |

|

Work in process |

|

|

105,872 |

|

|

103,861 |

| |

|

Finished products |

|

|

90,957 |

|

|

77,814 |

| |

|

|

Total

inventories |

|

|

410,002 |

|

|

356,768 |

| |

Income taxes receivable |

|

|

5,438 |

|

|

724 |

| |

Assets held for sale |

|

|

32,235 |

|

|

3,040 |

| |

Deferred income taxes |

|

|

24,272 |

|

|

21,928 |

| |

Prepaid expenses and other current assets |

|

|

43,769 |

|

|

38,711 |

| |

|

Total current assets |

|

|

1,198,922 |

|

|

866,883 |

| |

|

|

|

|

|

|

| Investments in unconsolidated affiliates |

|

|

179,113 |

|

|

246,125 |

| Goodwill |

|

|

251,093 |

|

|

213,858 |

| Other intangible assets, net of accumulated

amortization of $35,506 and $26,669 at May 31, 2014 and May 31,

2013, respectively |

|

|

145,993 |

|

|

147,144 |

| Other assets |

|

|

22,399 |

|

|

17,417 |

| Property, plant & equipment: |

|

|

|

|

|

|

| |

Land |

|

|

15,260 |

|

|

26,253 |

| |

Buildings and improvements |

|

|

213,848 |

|

|

205,017 |

| |

Machinery and equipment |

|

|

848,889 |

|

|

798,467 |

| |

Construction in progress |

|

|

32,135 |

|

|

22,899 |

| |

|

Property, plant & equipment at cost |

|

|

1,110,132 |

|

|

1,052,636 |

| |

|

Less: accumulated depreciation |

|

|

611,271 |

|

|

593,206 |

| Property, plant and equipment, net |

|

|

498,861 |

|

|

459,430 |

| Total assets |

|

$ |

2,296,381 |

|

$ |

1,950,857 |

| |

|

|

|

|

|

|

| Liabilities and equity |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

| |

Accounts payable |

|

$ |

333,744 |

|

$ |

222,696 |

| |

Short-term borrowings |

|

|

10,362 |

|

|

113,728 |

| |

Accrued compensation, contributions to employee benefit

plans |

|

|

|

|

|

|

| |

and related taxes |

|

|

78,514 |

|

|

68,043 |

| |

Dividends payable |

|

|

11,044 |

|

|

551 |

| |

Other accrued items |

|

|

49,873 |

|

|

36,536 |

| |

Income taxes payable |

|

|

4,953 |

|

|

6,268 |

| |

Current maturities of long-term debt |

|

|

101,173 |

|

|

1,092 |

| |

|

Total current liabilities |

|

|

589,663 |

|

|

448,914 |

| |

|

|

|

|

|

|

| Other liabilities |

|

|

76,426 |

|

|

70,882 |

| Distributions in excess of investment in unconsolidated

affiliate |

|

|

59,287 |

|

|

63,187 |

| Long-term debt |

|

|

554,790 |

|

|

406,236 |

| Deferred income taxes |

|

|

71,333 |

|

|

89,401 |

| |

|

Total liabilities |

|

|

1,351,499 |

|

|

1,078,620 |

| |

|

|

|

|

|

|

| Shareholders' equity - controlling interest |

|

|

850,812 |

|

|

830,822 |

| Noncontrolling interest |

|

|

94,070 |

|

|

41,415 |

| |

|

Total equity |

|

|

944,882 |

|

|

872,237 |

| Total liabilities and equity |

|

$ |

2,296,381 |

|

$ |

1,950,857 |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| WORTHINGTON INDUSTRIES, INC. |

|

| CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

| (In thousands) |

|

| |

|

| |

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

May 31, |

|

|

May 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| Operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings |

|

$ |

31,248 |

|

|

$ |

32,017 |

|

|

$ |

160,152 |

|

|

$ |

136,835 |

|

| Adjustments to reconcile net earnings to net cash

provided by operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Depreciation and amortization |

|

|

19,967 |

|

|

|

18,333 |

|

|

|

79,730 |

|

|

|

66,469 |

|

| |

Impairment of long-lived assets |

|

|

22,871 |

|

|

|

4,968 |

|

|

|

58,246 |

|

|

|

6,488 |

|

| |

Provision for deferred income taxes |

|

|

(5,660 |

) |

|

|

(8,052 |

) |

|

|

(25,916 |

) |

|

|

1,798 |

|

| |

Bad

debt expense |

|

|

462 |

|

|

|

208 |

|

|

|

32 |

|

|

|

783 |

|

| |

Equity in net income of unconsolidated affiliates, net of

distributions |

|

|

(6,960 |

) |

|

|

8,308 |

|

|

|

(15,333 |

) |

|

|

(10,948 |

) |

| |

Net

gain (loss) on sale of assets |

|

|

(352 |

) |

|

|

1,343 |

|

|

|

(11,212 |

) |

|

|

1,121 |

|

| |

Stock-based compensation |

|

|

8,810 |

|

|

|

2,684 |

|

|

|

22,017 |

|

|

|

13,270 |

|

| |

Excess tax benefits - stock-based compensation |

|

|

(1,586 |

) |

|

|

(1,728 |

) |

|

|

(8,880 |

) |

|

|

(5,183 |

) |

| |

Gain

on previously held equity interest in TWB |

|

|

- |

|

|

|

- |

|

|

|

(11,000 |

) |

|

|

- |

|

| Changes in assets and liabilities, net of impact of

acquisitions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Receivables |

|

|

(34,207 |

) |

|

|

(8,277 |

) |

|

|

(49,206 |

) |

|

|

18,801 |

|

| |

Inventories |

|

|

21,573 |

|

|

|

34,372 |

|

|

|

(38,010 |

) |

|

|

77,115 |

|

| |

Prepaid expenses and other current assets |

|

|

(7,057 |

) |

|

|

(763 |

) |

|

|

(2,921 |

) |

|

|

871 |

|

| |

Other

assets |

|

|

(5,091 |

) |

|

|

1,501 |

|

|

|

(5,278 |

) |

|

|

4,636 |

|

| |

Accounts payable and accrued expenses |

|

|

(38,503 |

) |

|

|

(12,612 |

) |

|

|

69,682 |

|

|

|

(47,483 |

) |

| |

Other

liabilities |

|

|

2,924 |

|

|

|

4,992 |

|

|

|

6,943 |

|

|

|

8,404 |

|

| Net cash provided by operating activities |

|

|

8,439 |

|

|

|

77,294 |

|

|

|

229,046 |

|

|

|

272,977 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Investment in property, plant and equipment |

|

|

(19,181 |

) |

|

|

(10,186 |

) |

|

|

(71,338 |

) |

|

|

(44,588 |

) |

| |

Acquisitions, net of cash acquired |

|

|

(29,151 |

) |

|

|

(113,115 |

) |

|

|

(11,517 |

) |

|

|

(175,225 |

) |

| |

Distributions from unconsolidated affiliates |

|

|

- |

|

|

|

863 |

|

|

|

9,223 |

|

|

|

863 |

|

| |

Proceeds from sale of assets and insurance |

|

|

3,125 |

|

|

|

747 |

|

|

|

27,438 |

|

|

|

16,974 |

|

| Net cash used by investing activities |

|

|

(45,207 |

) |

|

|

(121,691 |

) |

|

|

(46,194 |

) |

|

|

(201,976 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net

proceeds from (repayments of) short-term borrowings |

|

|

(24,994 |

) |

|

|

83,140 |

|

|

|

(103,618 |

) |

|

|

(168,446 |

) |

| |

Proceeds from long-term debt |

|

|

247,566 |

|

|

|

- |

|

|

|

247,566 |

|

|

|

150,000 |

|

| |

Principal payments on long-term debt |

|

|

(364 |

) |

|

|

(310 |

) |

|

|

(1,219 |

) |

|

|

(1,480 |

) |

| |

Proceeds from (payments for) issuance of common shares |

|

|

(628 |

) |

|

|

4,954 |

|

|

|

4,618 |

|

|

|

37,914 |

|

| |

Excess tax benefits - stock-based compensation |

|

|

1,586 |

|

|

|

1,728 |

|

|

|

8,880 |

|

|

|

5,183 |

|

| |

Payments to noncontrolling interest |

|

|

(1,819 |

) |

|

|

(672 |

) |

|

|

(40,969 |

) |

|

|

(9,254 |

) |

| |

Repurchase of common shares |

|

|

(37,140 |

) |

|

|

(30,417 |

) |

|

|

(128,218 |

) |

|

|

(30,417 |

) |

| |

Dividends paid |

|

|

(10,246 |

) |

|

|

- |

|

|

|

(31,198 |

) |

|

|

(44,144 |

) |

| Net cash provided (used) by financing activities |

|

|

173,961 |

|

|

|

58,423 |

|

|

|

(44,158 |

) |

|

|

(60,644 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Increase in cash and cash equivalents |

|

|

137,193 |

|

|

|

14,026 |

|

|

|

138,694 |

|

|

|

10,357 |

|

| Cash and cash equivalents at beginning of period |

|

|

52,886 |

|

|

|

37,359 |

|

|

|

51,385 |

|

|

|

41,028 |

|

| Cash and cash equivalents at end of period |

|

$ |

190,079 |

|

|

$ |

51,385 |

|

|

$ |

190,079 |

|

|

$ |

51,385 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

| WORTHINGTON INDUSTRIES, INC. |

|

| SUPPLEMENTAL DATA |

|

| (In thousands) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| This supplemental information is provided to assist in

the analysis of the results of operations. |

|

| |

|

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

May 31, |

|

|

May 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| Volume: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Steel Processing (tons) |

|

|

949 |

|

|

|

703 |

|

|

|

3,282 |

|

|

|

2,659 |

|

| |

Pressure Cylinders (units) |

|

|

22,908 |

|

|

|

23,363 |

|

|

|

84,564 |

|

|

|

82,189 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Steel Processing |

|

$ |

563,515 |

|

|

$ |

379,632 |

|

|

$ |

1,936,073 |

|

|

$ |

1,462,630 |

|

| |

Pressure Cylinders |

|

|

264,184 |

|

|

|

252,328 |

|

|

|

928,396 |

|

|

|

859,264 |

|

| |

Engineered Cabs |

|

|

52,714 |

|

|

|

55,075 |

|

|

|

200,528 |

|

|

|

226,002 |

|

| |

Other |

|

|

10,592 |

|

|

|

17,025 |

|

|

|

61,429 |

|

|

|

64,348 |

|

| |

|

Total

net sales |

|

$ |

891,005 |

|

|

$ |

704,060 |

|

|

$ |

3,126,426 |

|

|

$ |

2,612,244 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Material cost: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Steel Processing |

|

$ |

412,183 |

|

|

$ |

267,913 |

|

|

$ |

1,392,009 |

|

|

$ |

1,044,802 |

|

| |

Pressure Cylinders |

|

|

124,442 |

|

|

|

123,854 |

|

|

|

426,856 |

|

|

|

409,101 |

|

| |

Engineered Cabs |

|

|

24,639 |

|

|

|

26,912 |

|

|

|

90,854 |

|

|

|

112,769 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and administrative expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Steel Processing |

|

$ |

33,755 |

|

|

$ |

29,483 |

|

|

$ |

129,669 |

|

|

$ |

110,094 |

|

| |

Pressure Cylinders |

|

|

30,000 |

|

|

|

31,366 |

|

|

|

125,984 |

|

|

|

106,947 |

|

| |

Engineered Cabs |

|

|

7,995 |

|

|

|

6,878 |

|

|

|

30,620 |

|

|

|

27,448 |

|

| |

Other |

|

|

3,031 |

|

|

|

2,853 |

|

|

|

14,123 |

|

|

|

13,835 |

|

| |

|

Total

selling, general and administrative expense |

|

$ |

74,781 |

|

|

$ |

70,580 |

|

|

$ |

300,396 |

|

|

$ |

258,324 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Steel Processing |

|

$ |

33,312 |

|

|

$ |

19,990 |

|

|

$ |

119,025 |

|

|

$ |

68,156 |

|

| |

Pressure Cylinders |

|

|

5,997 |

|

|

|

16,402 |

|

|

|

55,004 |

|

|

|

66,367 |

|

| |

Engineered Cabs |

|

|

(4,232 |

) |

|

|

(1,209 |

) |

|

|

(26,516 |

) |

|

|

4,158 |

|

| |

Other |

|

|

(2,750 |

) |

|

|

(1,687 |

) |

|

|

(11,760 |

) |

|

|

(9,539 |

) |

| |

|

Total

operating income |

|

$ |

32,327 |

|

|

$ |

33,496 |

|

|

$ |

135,753 |

|

|

$ |

129,142 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| The following provides detail of impairment of

long-lived assets, restructuring and other expense (income), and

joint venture transactions included in operating income by segment

presented above. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

May 31, |

|

|

May 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| Impairment of long-lived assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Steel Processing |

|

$ |

2,500 |

|

|

$ |

- |

|

|

$ |

7,141 |

|

|

$ |

- |

|

| |

Pressure Cylinders |

|

|

20,371 |

|

|

|

4,968 |

|

|

|

32,005 |

|

|

|

6,488 |

|

| |

Engineered Cabs |

|

|

- |

|

|

|

- |

|

|

|

19,100 |

|

|

|

- |

|

| |

Other |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

|

Total

impairment of long-lived assets |

|

$ |

22,871 |

|

|

$ |

4,968 |

|

|

$ |

58,246 |

|

|

$ |

6,488 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Restructuring and other expense (income): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Steel Processing |

|

$ |

- |

|

|

$ |

- |

|

|

$ |

(3,382 |

) |

|

$ |

- |

|

| |

Pressure Cylinders |

|

|

289 |

|

|

|

2,482 |

|

|

|

(745 |

) |

|

|

2,665 |

|

| |

Engineered Cabs |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

Other |

|

|

580 |

|

|

|

(1,000 |

) |

|

|

1,215 |

|

|

|

628 |

|

| |

|

Total

restructuring and other expense (income) |

|

$ |

869 |

|

|

$ |

1,482 |

|

|

$ |

(2,912 |

) |

|

$ |

3,293 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Joint venture transactions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Steel Processing |

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

| |

Pressure Cylinders |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

Engineered Cabs |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

Other |

|

|

(12 |

) |

|

|

584 |

|

|

|

1,036 |

|

|

|

(604 |

) |

| |

|

Total

joint venture transactions |

|

$ |

(12 |

) |

|

$ |

584 |

|

|

$ |

1,036 |

|

|

$ |

(604 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONTACTS: Cathy M. Lyttle VP, Corporate Communications and

Investor Relations Phone: (614) 438-3077 E-mail: Email Contact

Sonya L. Higginbotham Director, Corporate Communications Phone:

(614) 438-7391 E-mail: Email Contact 200 Old Wilson Bridge Rd.

Columbus, Ohio 43085 WorthingtonIndustries.com

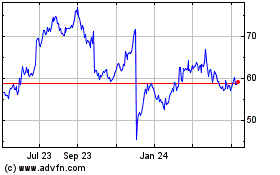

Worthington Enterprises (NYSE:WOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Worthington Enterprises (NYSE:WOR)

Historical Stock Chart

From Apr 2023 to Apr 2024