Worthington Industries to Acquire STAKO

September 30 2011 - 8:17AM

Business Wire

Worthington Industries, Inc. (NYSE:WOR) announced today that its

Pressure Cylinders segment has purchased the assets of STAKO, a

leading European producer of automotive liquefied propane gas (LPG)

tanks, located in Slupsk, Poland.

STAKO manufactures toroidal and cylindrical LPG tanks for

storage of liquid gas propane-butane mixture for engines in

passenger cars and commercial and delivery vehicles. The company

has also initiated production of compress natural gas (CNG)

composite and steel tanks used mainly for storage of compressed

methane used to fuel automotive vehicles and buses. Other composite

tanks are used for storage of compressed air for medicine,

aeronautics breathing air for fire fighters, scuba diving and

paintball. STAKO currently has 470 employees. Sales for the last 12

months were approximately $25 million USD.

“This acquisition expands our alternative fuels product offering

and gives us the broadest offering of alternative fuel tanks for

the automotive OEM and aftermarkets,” said Worthington Industries

Chairman and CEO John McConnell.

“STAKO is one of the world’s leading manufacturer of LPG auto

tanks and strengthens our manufacturing presence for the growing

global alternative fuels markets,” said Andy Billman, President,

Worthington Cylinders.

With the addition of these assets, Worthington Cylinders now

offers the broadest line of alternative fuel cylinders for storage

of high pressure CNG and LPG: Type I steel, Type II hoop-wrapped

steel, and Type III aluminum-lined/ composite reinforced. The

Company also has Type IV resin-lined/composite reinforced

technology that it intends to further develop for the automotive

industry. SCI, a recent Pressure Cylinders acquisition and a leader

in composite technology for the automotive industry, will be

working with STAKO to further develop this market.

About Worthington CylindersWorthington Cylinders is the

world’s leading global manufacturer of pressure cylinders,

delivering products and value-added services to its customers

designed to exceed their expectations in quality, service and

value. Worthington Cylinders offers the most complete line of

pressure cylinders in the industry, including storage of liquefied

petroleum, refrigerant, oxygen and industrial gases. Balloon Time®

and Worthington Pro Grade® products are available at retailers

nationwide and provide consumers products for grilling, party

planning, outdoor leisure activities and home repair.

About Worthington IndustriesWorthington Industries is a

leading diversified metals manufacturing company with 2011 fiscal

year sales of approximately $2.4 billion. The Columbus, Ohio based

company is North America’s premier value-added steel processor; a

leader in manufactured pressure cylinders, such as propane, oxygen

and helium tanks, hand-held torches, refrigerant and industrial

tanks, camping cylinders, compressed natural gas storage cylinders

and scuba tanks; framing systems and stairs for mid-rise buildings;

steel pallets and racks; and through joint ventures, suspension

grid systems for concealed and lay-in panel ceilings, laser welded

blanks; light gauge steel framing for commercial and residential

construction; and current and past model automotive service

stampings. Worthington, including its joint ventures employs

approximately 8,500 people and operates 74 facilities in 12

countries.

Safe Harbor StatementThe Company wishes to take advantage

of the Safe Harbor provisions included in the Private Securities

Litigation Reform Act of 1995 (the “Act”). Statements by the

Company relating to the expected benefits of the acquisition

including the expectations for accretiveness, synergies and growth;

expected growth of the pressure cylinder business; increases to

product lines; opportunities to participate in certain markets; and

other non-historical matters constitute “forward looking

statements” within the meaning of the Act. Because they are based

on beliefs, estimates and assumptions, forward-looking statements

are inherently subject to risks and uncertainties that could cause

actual results to differ materially from those projected. Any

number of factors could affect actual results, including, without

limitation, the possibility that costs or difficulties related to

the integration of the business acquired are greater than expected;

the ability to maintain relationships with customers of the

acquired business; product demand and pricing, changes in product

mix and market acceptance of products; fluctuations in pricing,

quality or availability of raw materials, supplies, utilities and

other items required by operations; the ability to realize price

increases, cost savings and operational efficiencies on a timely

basis; capacity levels and efficiencies within facilities, within

major markets and within the industry as a whole; financial

difficulties of customers, suppliers, joint venture partners and

others with whom the Company does business; the effect of national,

regional and worldwide economic conditions generally and within

major product markets, including a prolonged or substantial

economic downturn; the effect of adverse weather on facilities and

shipping operations; changes in customer spending patterns and

supplier choices; acts of war and terrorist activities; the ability

to improve processes and business practices to keep pace with the

economic, competitive and technological environment; deviation of

actual results from estimates and/or assumptions used by the

Company; the level of import and import prices in the company’s

markets; the impact of governmental regulations, both in the United

States and abroad; and other risks described from time to time in

filings with the United States Securities and Exchange

Commission.

Worthington Enterprises (NYSE:WOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

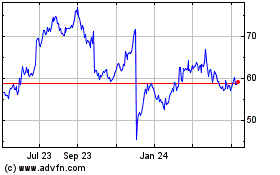

Worthington Enterprises (NYSE:WOR)

Historical Stock Chart

From Apr 2023 to Apr 2024