WiseTech IPO Set to Be One of Australia's Biggest Technology Listings

March 17 2016 - 11:40PM

Dow Jones News

MELBOURNE, Australia—WiseTech Global Ltd., a software company

launched out of a Sydney basement in the 1990s, has laid out plans

for one of Australia's biggest ever technology listings.

The company said Friday it had lodged a prospectus with the

country's securities regulator for an initial public offering that

could see it list with a market value of more than 1 billion

Australian dollars (US$764.8 million), after raising A$100

million-A$220 million.

The Australian Securities Exchange has attracted a number of

technology listings among a flurry of IPOs in recent years, albeit

mainly of smaller companies. The government under Prime Minister

Malcolm Turnbull is pushing the development of the country's tech

industry as the economy grapples with a slump in investment and

jobs in mining and energy.

Chief Executive Richard White, who founded the company at his

home in 1994 with little more than his credit card to fund

development, defended his decision to remain in Australia and opt

for a local listing.

Sydney-based software firm Atlassian Corp. raised about US$430

million and garnered a more than US$4 billion valuation listing on

Nasdaq in December, and Atlassian co-CEO Mike Cannon-Brookes this

week told a business conference that Australia lacked sophisticated

tech investors and an ASX listing would have meant a lower

valuation for the company.

"Along the way, people have told me that being Australian, it

wouldn't work," Mr. White said. "It isn't about which stock

exchange you list on, it's about the people."

An ASX listing, he said, would provide WiseTech with sufficient

funds to continue growing and give it a base for further

acquisitions but more importantly would lift the company's profile

among global clients, many of which are themselves listed.

"We are not in a mad rush to raise capital," he told reporters.

"We'll get more than enough cash out of Australian investors."

The largest tech listing in Australia to date has been that of

MYOB Group Ltd. The accounting software firm raised about US$668

million last year, giving it a postdeal market value of US$1.71

billion, according to data from Dealogic.

Dublin-based health-care software provider Oneview Healthcare

PLC made its debut on the ASX on Thursday, with its shares rising

2.5% above the offer price in an IPO that raised A$62.4 million to

help fund the rollout of its product. Also this week, Redbubble, an

online marketplace for stationary and other printed items, said it

had raised A$12 million ahead of a June IPO aimed at bringing in a

further A$50 million to fund growth.

However, cryptocurrency "miner" Bitcoin Group Ltd. earlier this

month pulled plans to float, blaming a call by the exchange to

prove it will have enough capital to run its operations.

WiseTech provides customizable freight-forwarding and customs

software, and recently signed a 4½ -year contract with DHL Global

Forwarding GmbH that it estimated would deliver revenue of up to

A$60 million.

The retail offer is set to open March 29, and early trading is

scheduled for April 11. According to the prospectus, WiseTech plans

to issue up to 75 million shares priced at between A$2.58 and

A$4.12 each. Based on that, it expects a market value for the

company of between A$762.9 million and A$1.19 billion.

In April, the company raised A$80 million from investors

including Fidelity Worldwide Investment and Sydney-based boutique

investment manager Smallco, to accelerate its growth ahead of the

IPO.

Mr. White, who will retain a stake of about 50% in his company

after listing, said the company had been profitable for the last

decade. In the year through mid-2015, it had a profit of A$10

million on revenue of A$70 million, according to the

prospectus.

Blackpeak Capital Pty. Ltd. is acting as financial adviser to

WiseTech for the IPO, and Credit Suisse (Australia) Ltd. and Morgan

Stanley Australia Securities Ltd. are joint lead managers.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

March 17, 2016 23:25 ET (03:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

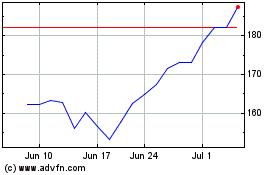

Atlassian (NASDAQ:TEAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

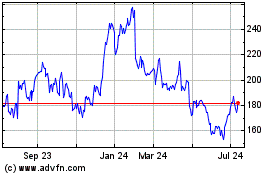

Atlassian (NASDAQ:TEAM)

Historical Stock Chart

From Apr 2023 to Apr 2024