Gross Revenues grew 10% YoY

IT Services Revenue grew in line with

guidance

Wipro Limited (NYSE:WIT) today announced financial

results under International Financial Reporting Standards (IFRS)

for its first quarter ended June 30, 2015.

Highlights of the Results for the

Quarter ended June 30, 2015:

- Gross Revenues were Rs. 122.4 billion

($1.9 billion1), an increase of 10% YoY.

- Net Income2 was Rs. 21.9 billion ($344

million1), an increase of 4% YoY.

- IT Services Segment Revenue was

$1,794.1 million, a sequential increase of 1.1%

- Non-GAAP constant currency IT Services

Segment Revenue in dollar terms grew 0.2% sequentially and grew

8.1% YoY

- IT Services Segment Revenue in Rupee

terms was Rs. 115.8 billion ($1.8 billion1), an increase of 10%

YoY.

- IT Services Segment Results was Rs.

24.3 billion ($382 million1), an increase of 1% YoY.

- IT Services Segment Margins was 21.0%

for the quarter.

Performance for the quarter ended June

30, 2015

T K Kurien, Member of the Board & Chief Executive Officer

of Wipro, said, “On the Run side, deals are getting

increasingly competitive and we are focused on increasing the

levels of automation, while on the Change side, new stakeholders

are influencing buying decisions in the Digital space. On the Run

side, we continued to win deals which deploy Wipro HOLMESTM, our

Artificial Intelligence platform to drive down costs for our

customers. On the Change side, we have announced the acquisition of

Designit, one of the largest independent global strategic design

firms. Designit’s design capabilities in synergy with Wipro’s scale

in technology services will position Wipro uniquely in Digital, as

an integrated design & technology player.”

Jatin Dalal, Chief Financial Officer of Wipro, said, “We

continued to drive productivity and improve operating levers even

as we invested for growth in people, process and IP. In the

quarter, we maintained strong cash flow generation while operating

margins were, on predictable lines, modestly lower due to employee

compensation measures.”

Outlook for the Quarter ending

September 30, 2015

We expect Revenues from our IT Services business to be in the

range of $1,821 million to $1,857 million*.

* Guidance is based on the following exchange rates: GBP/USD at

1.56, Euro/USD at 1.13, AUD/USD at 0.78, USD/INR at 63.86 and

USD/CAD at 1.22

IT Services

The IT Services segment had a headcount of 161,789 as of June

30, 2015. We added 36 new customers during the quarter.

Wipro continued its momentum in winning Large Deals globally as

described below:

Wipro has been selected by one of the largest upstream oil and

gas companies in Oman as its IT Partner to implement an ‘Integrated

IT Services Contract’. The five-year engagement aims to improve

operational efficiency across the organisation by integrating

managed services for help desk, applications and telecom.

Wipro won a multi-year total outsourcing deal spanning

Applications, Infrastructure and Business Process Services in a

pay-per-use model from one of the largest construction companies

with operations around the world. This engagement will transform

the customer’s technology estate to drive simplification,

scalability, agility and cost optimisation.

Wipro won an IT outsourcing deal from a global leader in

marketing services for Small and Medium Businesses (SMBs). Wipro

will provide applications and infrastructure services to the

customer’s business units in the US, UK and Spain. The deal

includes tools for automation and innovation, all of which are

being offered in an Opex-based commercial model.

Corporation Bank has chosen Wipro to transform its existing core

banking solution. This is a technology transformation initiative

covering core transaction processing, channels across Internet and

Mobile Banking, Risk Based Internal Audit and Enterprise

Performance Management Applications. This project aims at providing

Corporation Bank and its customers with an enhanced uptime and

better response.

Wipro Ventures

During this fiscal year, Wipro made an investment in Talena, an

early-stage company building innovative Big Data Availability

Management Solutions.

Wipro also made an investment in Vicarious, an early-stage

company developing the next-generation of Artificial Intelligence

algorithms and solutions.

Digital highlights

Wipro Digital, the digital business unit of Wipro Limited, on

July 9, 2015, announced its intention to acquire Designit, an

award-winning global strategic design firm specializing in

designing transformative product-service experiences. This

investment marks a further stage in Wipro's move to evolve the

digital offerings it takes to market, combining its reputation and

heritage in deep engineering and transformative technology with

human centered-design methods.

Wipro has been awarded a strategic Application Development and

Management contract by Allied Irish Bank, a leading bank in Ireland

offering a full range of personal and corporate banking services.

Wipro will manage and transform their Digital and Online Channels,

Data and Enterprise support services & Applications estate over

a period of 5 years.

This win builds on recent successes by Wipro Digital, including

selection by a North American bank to redesign and implement a

transformational B2B payment portal as well as working with the

Lawn Tennis Association of the UK as their official Digital

Technology Services Partner.

Awards and accolades

Wipro was been ranked among the top service providers in the

'2015 Nordic IT Outsourcing Study', an annual study on IT

outsourcing and IT service provider performance in the Nordic

region, conducted by Whitelane Research and PA Consulting Group.

Wipro received an overall customer satisfaction score of 80% from

its customers in Sweden, which was significantly higher than the

average score (72%) for other service providers.

Wipro has been rated as a 'High Performer' by leading global

analyst firm HfS Research, in the Population Health and Care

Management (PHM) Business Services for U.S. Healthcare Providers

and Payers, April 2015 Blueprint report.

Everest Group 2015 Workplace PEAK Matrix positions Wipro in the

Leaders’ quadrant based on overall market success and delivery

capabilities. Everest Group also positioned Wipro in the Leaders’

category based on overall market success and delivery capabilities

in its 2015 PEAK Matrix for Banking AO (Application Outsourcing).

Additionally, Wipro has been placed in the Leaders’ quadrant by

Everest Group in its 2015 PEAK Matrix for Mortgage BPO.

IT Products

- Our IT Products Segment delivered

Revenue of Rs. 8.2 billion ($128 million1) for the quarter ended

June 30, 2015, an increase of 7% YoY.

- IT Products Segment Results for the

quarter ended June 30, 2015 was Rs. 139 million ($2 million1).

Please refer the table on page 6 for reconciliation between IFRS

IT Services Revenue and IT Services Revenue on a non-GAAP constant

currency basis.

About Non-GAAP financial measures

This press release contains non-GAAP financial measures within

the meaning of Regulation G and Item 10(e) of Regulation S-K. Such

non-GAAP financial measures are measures of our historical or

future performance, financial position or cash flows that are

adjusted to exclude or include amounts that are excluded or

included, as the case may be, from the most directly comparable

financial measure calculated and presented in accordance with

IFRS.

The table on page 6 provides IT Services Revenue on a constant

currency basis, which is a non-GAAP financial measure that is

calculated by translating IT Services Revenue from the current

reporting period into U.S. dollars based on the currency conversion

rate in effect for the prior reporting period. We refer to growth

rates in constant currency so that business results may be viewed

without the impact of fluctuations in foreign currency exchange

rates, thereby facilitating period-to-period comparisons of our

business performance.

This non-GAAP financial measure is not based on any

comprehensive set of accounting rules or principles and should not

be considered a substitute for, or superior to, the most directly

comparable financial measure calculated in accordance with IFRS,

and may be different from non-GAAP measures used by other

companies. In addition to this non-GAAP measure, the financial

statements prepared in accordance with IFRS and the reconciliation

of these non-GAAP financial measures with the most directly

comparable IFRS financial measure should be carefully

evaluated.

Results for the quarter ended June 30, 2015, prepared under

IFRS, along with individual business segment reports, are available

in the Investors section of our website

www.wipro.com.

Quarterly Conference Call

We will hold an earnings conference call today at 07:15 p.m.

Indian Standard Time (09:45 a.m. US Eastern Time) to discuss our

performance for the quarter. An audio recording of the management

discussions and the question and answer session will be available

online and will be accessible in the Investor Relations section of

our website at www.wipro.com.

About Wipro Limited (NYSE: WIT)

Wipro Limited (NYSE:WIT) is a leading Information Technology,

Consulting and Business Process Services company that delivers

solutions to enable its clients do business better. Wipro delivers

winning business outcomes through its deep industry experience and

a 360 degree view of "Business through Technology" - helping

clients create successful and adaptive businesses. A company

recognized globally for its comprehensive portfolio of services, a

practitioner's approach to delivering innovation, and an

organization wide commitment to sustainability, Wipro has a

workforce of over 150,000, serving clients in 175+ cities across 6

continents.

For more information, please visit www.wipro.com

Forward-looking statements

The forward-looking statements contained herein

represent Wipro’s beliefs regarding future events, many of which

are by their nature, inherently uncertain and outside Wipro’s

control. Such statements include, but are not limited to,

statements regarding Wipro’s growth prospects, its future financial

operating results, and its plans, expectations and intentions.

Wipro cautions readers that the forward-looking statements

contained herein are subject to risks and uncertainties that could

cause actual results to differ materially from the results

anticipated by such statements. Such risks and uncertainties

include, but are not limited to, risks and uncertainties regarding

fluctuations in our earnings, revenue and profits, our ability to

generate and manage growth, intense competition in IT services, our

ability to maintain our cost advantage, wage increases in India,

our ability to attract and retain highly skilled professionals,

time and cost overruns on fixed-price, fixed-time frame contracts,

client concentration, restrictions on immigration, our ability to

manage our international operations, reduced demand for technology

in our key focus areas, disruptions in telecommunication networks,

our ability to successfully complete and integrate potential

acquisitions, liability for damages on our service contracts, the

success of the companies in which we make strategic investments,

withdrawal of fiscal governmental incentives, political

instability, war, legal restrictions on raising capital or

acquiring companies outside India, unauthorized use of our

intellectual property, and general economic conditions affecting

our business and industry. Additional risks that could affect our

future operating results are more fully described in our filings

with the United States Securities and Exchange Commission,

including, but not limited to, Annual Reports on Form 20-F. These

filings are available at www.sec.gov. We may, from time to time,

make additional written and oral forward-looking statements,

including statements contained in the company’s filings with the

Securities and Exchange Commission and our reports to shareholders.

We do not undertake to update any forward-looking statement that

may be made from time to time by us or on our behalf.

Wipro limited and subsidiaries CONDENSED CONSOLIDATED

INTERIM STATEMENT OF FINANCIAL POSITION (Rupees in millions, except

share and per share data, unless otherwise stated)

As of March 31,

As of June 30, 2015 2015

2015

Conveniencetranslation into

USdollar in millions(unaudited) -

Referfootnote 1 on Page 1

ASSETS

Goodwill 68,078 69,240 1,089 Intangible assets 7,931 7,983 126

Property, plant and equipment 54,206 55,738 877 Derivative assets

736 271 4 Available for sale investments 3,867 4,013 63 Non-current

tax assets 11,409 11,551 182 Deferred tax assets 2,945 3,636 57

Other non-current assets 14,369 14,179 223

Total non-current

assets 163,541 166,611 2,621 Inventories 4,849 4,736 74

Trade receivables 91,531 91,740 1,443 Other current assets 73,359

69,487 1,093 Unbilled revenues 42,338 46,259 727 Available for sale

investments 53,908 110,585 1,739 Current tax assets 6,490 6,949 109

Derivative assets 5,077 3,250 51 Cash and cash equivalents 158,940

132,937 2,091

Total current assets 436,492 465,943 7,327

TOTAL ASSETS 600,033 632,554 9,948

EQUITY

Share capital 4,937 4,938 78 Share premium 14,031 14,120 222

Retained earnings 372,248 394,177 6,199 Share based payment reserve

1,312 1,688 27 Other components of equity 15,454 14,485 228 Equity

attributable to the equity holders of the Company 407,982 429,408

6,754 Non-controlling interest 1,646 1,827 29

Total equity

409,628 431,235 6,783

LIABILITIES

Long - term loans and borrowings 12,707 12,702 200 Deferred tax

liabilities 3,240 3,186 50 Derivative liabilities 71 41 1

Non-current tax liabilities 6,695 6,269 99 Other non-current

liabilities 3,658 5,441 86 Provisions 5 12 -

Total non-current

liabilities 26,376 27,651 436 Loans and borrowings and

bank overdrafts 66,206 69,082 1,085 Trade payables and accrued

expenses 58,745 63,962 1,006 Unearned revenues 16,549 16,829 265

Current tax liabilities 8,036 8,932 140 Derivative liabilities 753

1,261 20 Other current liabilities 12,223 12,238 192 Provisions

1,517 1,364 21

Total current liabilities 164,029 173,668

2,729

TOTAL LIABILITIES 190,405 201,319 3,165

TOTAL EQUITY AND LIABILITIES 600,033 632,554 9,948

Wipro limited and subsidiaries CONDENSED CONSOLIDATED

INTERIM STATEMENTS OF INCOME (Rupees in millions, except share and

per share data, unless otherwise stated)

Three Months ended June 30, 2014 2015

2015

Conveniencetranslation into

USdollar in millions(unaudited) -

Referfootnote 1 on Page 1

Gross revenues 111,358 122,376 1,923 Cost of revenues

(74,941 ) (84,787 ) (1,333 )

Gross profit 36,417

37,589 590 Selling and marketing expenses

(7,557 ) (8,044 ) (126 ) General and administrative expenses (6,187

) (6,853 ) (108 ) Foreign exchange gains/(losses), net 1,098 1,330

21

Results from operating activities 23,771

24,022 377 Finance expenses (888 ) (1,286 )

(20 ) Finance and other income 4,239 5,242 82

Profit before

tax 27,122 27,978 439 Income tax expense

(5,942 ) (5,945 ) (93 )

Profit for the period 21,180

22,033 346 Attributable

to: Equity holders of the company 21,032 21,877 344 Non-controlling

interest 148 156 2

Profit for the

period 21,180 22,033 346

Earnings per equity share: Attributable to equity share

holders of the company Basic 8.57 8.91 0.14 Diluted 8.54 8.89

0.14 Weighted average number of equity shares used in

computing earnings per equity share Basic 2,455,543,231

2,455,804,709 2,455,804,709 Diluted 2,462,939,809 2,460,584,039

2,460,584,039

Additional Information Segment

Revenue IT Services Business Units BFSI 28,065 31,020

489 HLS 11,290 12,988 204 RCTG 14,727 17,380 273 ENU 16,822 17,577

276 MFG 19,110 21,524 338 GMT 15,069 15,284 240

IT SERVICES TOTAL 105,083 115,773 1,820 IT PRODUCTS

7,660 8,174 128 RECONCILING ITEMS (287 ) (241 ) (4 ) TOTAL 112,456

123,706 1,944

Segment Result

IT Services Business Units BFSI 6,624 7,013 111 HLS 2,131

2,759 43 RCTG 3,188 3,140 49 ENU 4,553 3,812 60 MFG 4,368 4,327 69

GMT 3,762 2,698 42 OTHERS - - UNALLOCATED (623 ) 530 8

TOTAL IT SERVICES 24,003 24,279 382 IT PRODUCTS 165

139 2 RECONCILING ITEMS (397 ) (396 ) (6 ) TOTAL 23,771

24,022 378 FINANCE EXPENSE (888 ) (1,286 ) (20 )

FINANCE AND OTHER INCOME 4,239 5,242 82 PROFIT

BEFORE TAX 27,122 27,978 440 INCOME TAX EXPENSE (5,942 ) (5,945 )

(94 )

PROFIT FOR THE PERIOD 21,180

22,033 346 Segment result represents

operating profits of the segments and dividend income and gains or

losses (net) relating to strategic investments, which are presented

within “Finance and other income” in the statement of Income. The

Company is organized by the following operating segments; IT

Services and IT Products.

The IT Services segment primarily consists

of IT Service offerings to our customers organized by industry

verticals as follows: Banking, Financial Services and Insurance

(BFSI), Healthcare and Life Sciences (HLS), Retail, Consumer,

Transport and Government (RCTG), Energy, Natural Resources and

Utilities (ENU), Manufacturing (MFG), Global Media and Telecom

(GMT). Starting with quarter ended September 30, 2014, it also

includes Others which comprises dividend income and gains or losses

(net) relating to strategic investments, which are presented within

“Finance and other income” in the statement of Income. Key service

offering to customers includes software application development and

maintenance, research and development services for hardware and

software design, business application services, analytics,

consulting, infrastructure outsourcing services and business

process services.

In the IT Products segment, the Company is

a value added reseller of desktops, servers, notebooks, storage

products, networking solutions and packaged software for leading

international brands. In certain total outsourcing contracts of the

IT Services segment, the Company delivers hardware products,

software licenses and other related deliverables.

Reconciliation of Non-GAAP Constant Currency IT Services

Revenue to IT Services Revenue as per IFRS ($MN)

Three Months ended June 30,2015 IT Services Revenue as per

IFRS $ 1,794 IT Services

Revenue as per IFRS $ 1,794 Effect of Foreign

currency exchange movement $ (16 ) Effect of Foreign

currency exchange movement $ 87 Non-GAAP Constant Currency IT

Services Revenue based on previous quarter exchange rates $ 1,778

Non-GAAP Constant Currency IT Services Revenue based on previous

year exchange rates $ 1,881

1. For the convenience of the reader, the amounts in Indian

Rupees in this release have been translated into United States

Dollars at the noon buying rate in New York City on June 30, 2015,

for cable transfers in Indian rupees, as certified by the Federal

Reserve Board of New York, which was US $1= Rs. 63.59. However, the

realized exchange rate in our IT Services business segment for the

quarter ended June 30, 2015 was US$1= Rs. 64.53

2. Refers to ‘Profit for the period attributable to equity

holders of the company’

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150723005862/en/

Wipro LimitedContact for Investor RelationsAravind V S,

+91-80-2505 6186aravind.viswanathan@wipro.comorAbhishek Kumar Jain,

+1 978 826 4700abhishekkumar.jain@wipro.comorContact for Media

& PressVipin Nair,

+91-80-3991-6154vipin.nair1@wipro.com

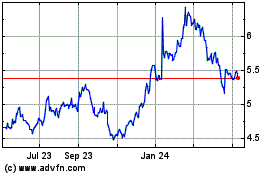

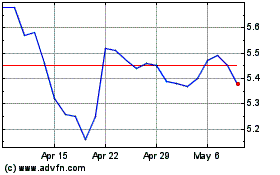

Wipro (NYSE:WIT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Wipro (NYSE:WIT)

Historical Stock Chart

From Apr 2023 to Apr 2024