By Laurie Burkitt

BEIJING--The China economic slowdown that has rattled global

markets is also shaking the fortunes of multinationals that do

business here.

Those that fed China's traditional boom industries of

infrastructure, energy and steel--like Anglo-Australian miner BHP

Billiton Ltd. and French energy-equipment maker Schneider Electric

SE--are suffering precipitous falls in revenue there after years

when their profits were boosted by the country's 10%-plus economic

growth. Many also face heavy write-downs as investment plans

predicated on surging China demand look increasingly unrealistic as

the country's growth slows.

In contrast, companies like iPhone maker Apple Inc. and luggage

maker Samsonite International SA that cater to China's consumers

are faring much better as retail demand overall remains strong.

"We're spending as much as we always do," said Zhen Lin, a

27-year-old magazine editor on maternity leave, emerging from a

Beijing supermarket with a cart half full of groceries. Ms. Lin

said she eats out several times a week and isn't holding back on

her spending. Among the purchases she is planning: a new computer

this year and a new car some time in the next two.

The shifting fortunes of international companies in the world's

second-largest economy come after two decades when China has not

only been the world's factory floor, but an El Dorado for foreign

companies of all stripes.

Major luxury and retail brands as well as car makers piled in,

becoming as prevalent on the streets of Shanghai as they are in New

York or London. China became the world's largest car market--a

critical venue for companies like General Motors Co. and Volkswagen

AG. Sales of luxury goods in China jumped 30% to 266 billion yuan

($41.4 billion) in 2011, and by 2012, Chinese shoppers made a

quarter of all global luxury purchases. Giorgio Armani SpA had

around 300 stores in China then, just shy of Wal-Mart Stores Inc.'s

380.

Major oil companies like BP PLC and Royal Dutch Shell PLC

invested in projects in China, and hundreds of other industrial

companies boosted output around the world to meet China's demand.

China still consumes nearly half the world's copper and has become

the world's second-largest oil importer. It also consumes 45% of

global steel, but some analysts reckon its demand may have already

peaked.

The slowdown in China's rate of growth that began in 2011 is

changing the equation. Industrial production in July grew 6% over

the year-earlier period, less than half its year-over-year growth

rate of 14% in July 2011. Property development has ground to a halt

as empty malls and apartment buildings dot many of the country's

smaller cities. Office-building construction starts fell nearly 15%

in the first seven months of this year versus a year earlier; in

2014, they'd grown 6.7%.

But retail sales have held up relatively well during the past

few years, with growth slowing to 10.5% in July from 12.2% the same

month last year and 17.2% in 2011.

The contrasting fortunes in the corporate world are stark.

BHP Billiton, the world's biggest miner, which had racked up

$23.6 billion in profit four years ago, last year made only $1.9

billion. On Tuesday it scrapped its long-held belief that China

will produce more than one billion tons of steel a year by the

mid-2020s and now sees output peaking as low as 935 million tons.

U.S. oil giant Chevron Corp. took a $2 billion impairment charge in

the second quarter after a lower crude-price outlook led it to

suspend projects; the company said slower Chinese growth was partly

to blame.

Schneider Electric, one of the world's leading suppliers of

switches, circuit breakers and other electrical gear used in

buildings and power grids, cut its profitability target for the

year, blaming in large part China's slowing growth. The country's

ebbing demand for elevators and escalators as its building boom

cooled hit the Otis elevator unit of United Technologies Corp.,

which in July reported a 5% decline in second-quarter sales.

Caterpillar Inc. said in July that Asia-Pacific sales of its

construction equipment were down 30% in the second quarter, with

much of that decline in China.

Meanwhile, luggage maker Samsonite Wednesday said sales in China

during the first half of the year rose 30% excluding currency

effects, helping push overall revenue to a record $1.2 billion.

Apple said its business in China more than doubled to $13.23

billion in the latest quarter, and Chief Executive Tim Cook assured

spooked investors earlier in the week that its business was still

strong there in July and August. German sportswear brand Adidas

AG's China sales in the first half of the year in China increased

EUR1.16 billion ($1.34 billion), up 20% from a year earlier

excluding currency effects. Much of the growth came from aggressive

expansion across China, where Adidas has more than 8,400

stores.

It is a tale of two economies, said Andrew Polk, economist at

research group Conference Board. "The old growth drivers are

clearly in the tank. The new growth drivers--consumption and

service--are holding up for now, but the jury is still out," Mr.

Polk said.

Some of the strongest corporate performers are targeting a newly

affluent population that looks increasingly like the American

middle class. They are spending for the first time on goodies like

overseas travel, imported food and concert tickets. Demand for

prime splurging products like Japanese diapers, Mexican avocados

and Chilean salmon is surging, and it hasn't been overturned by the

crash in stocks--where average Chinese still have little

invested.

Income is climbing for large segments of the population. Between

2005 and 2012, roughly 50 million urban households graduated into

the middle class, which now numbers around 147 million households,

roughly 49% of China's urban population, according to the Boston

Consulting Group. Those consumers started buying products like Dove

shampoo from Unilever PLC and Crest toothpaste from Procter &

Gamble Co. rather than local goods.

Now, the fastest shift is in households moving to the equivalent

of upper-middle class, with monthly incomes between 12,000 yuan and

20,000 yuan ($1,868 to $3,114) and a taste for spas, organic food

and vacations in Tokyo and Bangkok. BCG estimates there are more

than 25 million of such households now, and the number will more

than triple by 2020.

"We are on the spend side of the economy," said Samsonite Chief

Executive Ramesh Tainwala, adding that many of the company's

customers are first-time overseas travelers. "Despite the 'New

Normal,' the urge to travel has not changed."

Mr. Tainwala said that the price of Samsonite's best-selling

luggage in China has dropped to around $250 from $400 a few years

ago as some of the more reckless spenders of the boom times are

replaced by buyers looking for good value for their money. The

company has reached out to consumers in smaller Chinese cities and

tackled local rivals by stressing its global warranty and

internationally known brand.

To be sure, plenty of consumer-facing firms are also struggling.

Purveyors of luxury goods like Prada SpA have seen sales in China

pummeled by a government crackdown on corruption and extravagance.

Companies like Unilever and P&G that peddle basic consumer

goods have seen sales eroded by a host of savvy local rivals with

soap and shampoo brands that now rival theirs in popularity. Global

car makers have cut back production as sales fall, amid Chinese

government complaints that the companies were overcharging

consumers.

Consumer spending isn't enough to replace the industrial

investment that powered China's economic boom, and if economic

fallout continues, many consumers may lose the jobs that are

fueling their spending. Already Chinese wage growth has slowed in

the past year. Smaller cities, which have been targets for

corporate expansion, may no longer be bright spots for growth,

Conference Board's Mr. Polk said.

Adidas China head Colin Currie said executives plan to keep a

close eye on business, tracking real-time sales data to see if

there is any fallout in China's smallest cities, where the brand

has rapidly expanded in the past five years. The company clusters

its store data by regions and store formats, enabling executives to

compare what strategies are working and to switch everything from

design to distribution for those that aren't.

"We know that the Chinese consumer changes very quickly," said

Mr. Currie. "As a brand and a business, we have to watch these

changes. It's one of our strengths."

Multinationals have seen promise--and sometimes

disappointment--in China's vast consumer market for more than a

century, embodied by an oft-repeated 19th-century saying that if

every man in China added an inch to his shirttail, then the mills

of Lancashire, England, would run for a generation.

Consumer companies were among the first to invest when China

began opening its economy to outsiders in the late 1970s. Coca-Cola

Co., which entered the market in 1978, said in 1980 it would build

its first bottling plant in Beijing. Kentucky Fried Chicken--now

KFC--opened its first outlet in the 1980s and quickly became the

most popular foreign food chain in China.

Heavy industry investment jumped after China joined the World

Trade Organization in 2001. By 2002, foreign direct investment had

jumped to $52.74 billion from $40.4 billion in 1999. By 2011 it had

more than doubled to $124 billion before easing, and last year

totaled $119.57 billion.

Brian Spegele and Phred Dvorak contributed to this article.

Write to Laurie Burkitt at laurie.burkitt@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 26, 2015 19:28 ET (23:28 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

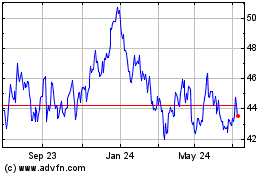

BHP (ASX:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

BHP (ASX:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024