Williams-Sonoma Cuts Annual Guidance, Citing 'Cautious' Shopper

August 24 2016 - 7:00PM

Dow Jones News

Williams-Sonoma Inc. trimmed annual guidance Wednesday for sales

and profit with Chief Executive Laura Alber saying the home-goods

retailer was feeling the effects of "a more cautious consumer."

Comparable-brand sales at the Pottery Barn brand, the company's

largest by revenue, retreated 4.8% during the second quarter, while

profit also slipped. Comparable-brand revenue tracks same-store

sales and online sales.

Williams-Sonoma said it now expect annual adjusted earnings on a

per-share basis between $3.35 and $3.55, down from $3.50 to $3.65,

and revenue between $5.08 billion and $5.23 billion, down from

$5.15 billion to $5.25 billion.

Shares of the San Francisco company slipped 0.9% to $53.66 in

after-hours trading Wednesday.

For the current quarter, the company expects adjusted profit

between 75 cents and 80 cents a share on revenue in the range of

$1.24 billion to $1.29 billion. Analysts surveyed by Thomson

Reuters are a little more optimistic, projecting earnings of 81

cents a share on $1.29 billion in revenue.

Williams-Sonoma, which also owns the chain West Elm as well as

its eponymous brand, has struggled in recent quarters from

increased competition and a difficult macroeconomic

environment.

Total comparable-brand revenue growth was 0.6%, with flat sales

at Williams-Sonoma and a 15.8% jump at West Elm. Williams-Sonoma,

which began selling online in 1999, gets half of its sales from

e-commerce.

Over all, Williams-Sonoma earned $51.8 million, down from $53.7

million a year ago. Earnings on a per-share basis were flat at 58

cents. Revenue rose 2.8% to $1.16 billion.

Earnings excluding items were 58 cents a share.

Williams-Sonoma had projected adjusted earnings of 54 cents to

60 cents a share on revenue between $1.15 billion and $1.18

billion. Analysts surveyed by Thomson Reuters had expected adjusted

earnings of 58 cents a share on $1.17 billion in revenue.

The company projected comparable-brand revenue to remain flat or

climb as high as 4% in the third quarter, while pulling back

full-year guidance to 1% to 4%, from 3% to 6% previously.

Founded in 1956 by Chuck Williams in Sonoma, Calif., the company

has faced increased competition in a crowded sector from rivals

such as Restoration Hardware Holdings Inc. and Crate &

Barrel.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

(END) Dow Jones Newswires

August 24, 2016 18:45 ET (22:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

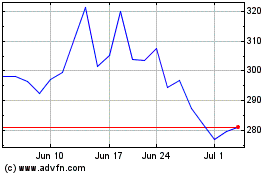

Williams Sonoma (NYSE:WSM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Williams Sonoma (NYSE:WSM)

Historical Stock Chart

From Apr 2023 to Apr 2024