Will Quest Diagnostics (DGX) Miss Earnings Estimates? - Analyst Blog

April 21 2014 - 3:50PM

Zacks

Quest Diagnostics

Inc. (DGX) is scheduled to report its first-quarter 2014

results before the opening bell on Apr 24. Last quarter, Quest

Diagnostics posted a positive earnings surprise of 9.57%. Let’s see

how things are shaping up for this announcement.

Factors at

Play

Barring the fourth quarter of 2013,

Quest Diagnostics delivered negative earnings surprises in the

remaining three quarters of 2013 with an average miss of 2.38%.

Quest Diagnostics is continuously

witnessing challenges with testing volume. Moreover, lower

healthcare utilization and reimbursement pressure from the

government and other payers continue to pose threats. Concerns also

include a poor 2014 revenue outlook provided earlier, indicating

that the industry trend does not seem likely to improve in the near

future.

Although we hold a favorable view

on the company’s massive organizational restructuring strategy

implemented since Jan 2013 to increase operational efficiency and

restore growth, near-term visibility remains poor.

Quest Diagnostics nonetheless has

been focusing on high-potential areas such as gene-based esoteric

testing for cancer, cardiovascular disease, infectious disease and

neurological disorders.

Earnings

Whispers?

Our proven model does not

conclusively show that Quest Diagnostics is likely to beat earnings

this quarter. It is because a stock needs to have both a positive

Earnings ESP (Expected Surprise Prediction) and a Zacks Rank #1, 2

or 3 for this to happen. That is not the case here as you will see

below.

Zacks ESP:

Earnings ESP for Quest Diagnostics is -4.49%, since the Most

Accurate estimate of $0.85 stands below the Zacks Consensus

Estimate of $0.89.

Zacks Rank:

AlthoughQuest Diagnostics’ Zacks Rank #2

(Buy)increases the predictive power of ESP, when combined with a

-4.49% ESP, it makes surprise prediction difficult.

Other Stocks to

Consider

Here are some other companies

having the right combination of elements, i.e., a positive Zacks

Earnings ESP and a Zacks Rank #1, #2 or #3 and hence, worth a

look.

Align Technology

Inc. (ALGN) has an Earnings ESP of +13.89% and holds a

Zacks Rank #1 (Strong Buy). Align is expected to report first

quarter 2014 earnings on Apr 23.

Myriad Genetics

Inc. (MYGN) has an Earnings ESP of +10.87% and holds a

Zacks Rank #1 (Strong Buy). Myriad Genetics will be reporting first

quarter 2014 earnings on May 6.

Cardinal Health,

Inc. (CAH) has an Earnings ESP of +1.00% and holds a Zacks

Rank #2. Cardinal Health will report third quarter fiscal 2014

earnings on May 1.

ALIGN TECH INC (ALGN): Free Stock Analysis Report

CARDINAL HEALTH (CAH): Free Stock Analysis Report

QUEST DIAGNOSTC (DGX): Free Stock Analysis Report

MYRIAD GENETICS (MYGN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

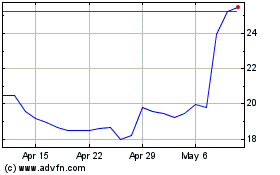

Myriad Genetics (NASDAQ:MYGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

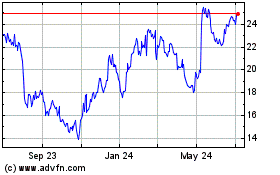

Myriad Genetics (NASDAQ:MYGN)

Historical Stock Chart

From Apr 2023 to Apr 2024