Will Q1 Earnings Be the Low Point for the Year? - Earnings Preview

April 04 2014 - 3:14AM

Zacks

Will Q1 Earnings Be the Low Point for the

Year?

The 2014 Q1 earnings season takes center stage this week with

Alcoa’s (AA) release after the close on Tuesday.

Alcoa isn’t the overall first to report Q1 results, though it is

the first S&P 500 member with the calendar fiscal quarter to

come out with results. Companies with fiscal quarters ending in

February have been reporting since mid-March and all 21 of those

form part of the Q1 tally.

In fairness to Alcoa, however, the market starts paying attention

to the earnings season after their earnings announcement even

though the list of companies that report before it includes such

industry leaders like FedEx (FDX),

Nike (NKE) and others. In total, we have 33

companies reporting Q1 results this week, including 8 S&P 500

members. The reporting cycle really gets into high gear from next,

as the chart below shows.

Expectations for 2014 Q1

Estimates for Q1 started coming down at an accelerated pace as

companies predominantly guided lower on the 2013 Q4 earnings calls,

consistent with the trend we have been seeing for more than a year

now. Total Q1 earnings for companies in the S&P 500 are

currently expected to be down -3.3% from the same period last year,

a material decline from the +2.1% growth expected in early January

2014. Please note that the expected Q1 earnings decline has been

exacerbated by Google’s new class of stock. Excluding Google from

the S&P 500, total S&P 500 earnings would be down (only)

-2.7%.

The negative revision trend is widespread, but is particularly

notable for the Retail, Basic Materials, Autos, Consumer Staples,

and the Energy sectors, as the chart below shows.

With roughly two-thirds of S&P 500 companies beating earnings

expectations in any reporting cycle, actual Q1 results will almost

certainly be better than these pre-season expectations. But Q1 is

unlikely to repeat the performance of the last few quarters where

we would witness a new all-time earnings total record each quarter.

Total earnings for the S&P 500 reached a new all-time record of

$267.6 billion in 2013 Q4.

Current estimates for 2014 Q1 aggregate to a quarterly total of

$248.8 billion, but the expectation is that Q1 will be the low

point for earnings this year, both in terms of earnings totals as

well as the growth rate. Consensus expectations reflect a rebound

in Q2, with the earnings totals in each of the following three

quarters of the year setting new all-time records one after the

other.

The chart below shows the aggregate quarterly earnings for the

S&P 500 as whole.

Given the low Q1 expectations, it wouldn’t take much for companies

to come out ahead of them. Roughly two-thirds of the S&P 500

members beat earnings expectations every quarter any way. So, more

results along those lines would be nothing new and wouldn’t tell us

much about the health of corporate earnings.

What we haven’t seen for a while instead is some evidence of

strength on the revenue front and favorable comments from

management teams about business outlook. Corporate guidance has

been negative for almost two years now, causing estimates to keep

coming down and the long hoped-for earnings growth turnaround

getting pushed forward. Guidance is important in any earnings

season, but it is particularly important this time around given the

relatively elevated expectations for the second half of the year

and beyond.

Scorecard for 2014 Q1 (as of Friday, April

4th)

Total earnings for the 21 S&P 500 members were up +14.2% from

the same period last year, with a ‘beat ratio’ of 57.1% and a

median surprise of +1.9%. Total revenues were in the positive

column as well, up +6.1%, with a revenue ‘beat ratio’ of 47.6% and

a median surprise of +0.1%.

It’s premature to draw any conclusions from this small sample of

results, but the growth rates and beat ratios for these 21

companies in Q1 are weaker than what we have seen from the same

group of companies in other recent quarters. It has overall been a

fairly uninspiring start to the Q1 earnings season.

For a detailed look at the earnings picture, please check out our

weekly Earnings Trends report.

Monday-4/7

- Not much on the economic or earnings calendars.

Tuesday -4/8

- Not much on the economic calendar, though Alcoa will be

reporting results after the close.

- Alcoa’s estimates have inched up in recent days, with the

current Zacks Consensus EPS of 5 cents up a penny over the last 7

days.

- WD-40 Company (WDFC) is the other notable

company reporting results after the close.

Wednesday-4/9

- We will get minutes of the Fed’s March 19 meeting in the

afternoon, where it will be interesting to see discussion about the

economic outlook. Unfortunately for all of us, we will most likely

nothing about the ‘6 months’ comment that the Fed Chairwoman made

in her news conference after the meeting.

- Constellation Brands (STZ) and

Progressive Corp (PGR) will report in the morning,

while Bed, Bath & Beyond (BBBY) will report

after the close.

Thursday -4/10

- While weekly Jobless Claims numbers will come out in the

morning, we will get details about Federal Budget in the

afternoon.

- Family Dollar (FDO), Rite Aid

(RAD), and Pier 1 Imports (PIR) are the notable

companies reporting today, all in the morning.

Friday-4/11

- We will get the March PPI and the advance read on the

University of Michigan Sentiment survey.

- J.P. Morgan (JPM), Wells

Fargo (WFC) and Fastenal (FAST) are the

key reports today, all in the morning.

Here is a list of the 33 companies reporting this week,

including 8 S&P 500 members.

| Company |

Ticker |

Current Qtr |

Year-Ago Qtr |

Last EPS Surprise % |

Report Day |

Time |

| NOVAGOLD RSRCS |

NG |

-0.03 |

-0.04 |

-100 |

Monday |

AMC |

| SCHULMAN(A) INC |

SHLM |

0.34 |

0.27 |

18.75 |

Monday |

AMC |

| TEAM INC |

TISI |

-0.01 |

-0.01 |

0 |

Monday |

AMC |

| ZEP INC |

ZEP |

0.09 |

0.17 |

6.25 |

Monday |

AMC |

| ALCOA INC |

AA |

0.05 |

0.11 |

-33.33 |

Tuesday |

AMC |

| INTL SPEEDWAY |

ISCA |

0.33 |

0.33 |

-6.78 |

Tuesday |

BTO |

| MISTRAS GROUP |

MG |

0.12 |

0.07 |

3.33 |

Tuesday |

AMC |

| SCIENCE APP INT |

SAIC |

0.65 |

N/A |

-12 |

Tuesday |

AMC |

| WD 40 CO |

WDFC |

0.67 |

0.66 |

1.37 |

Tuesday |

AMC |

| BED BATH&BEYOND |

BBBY |

1.6 |

1.68 |

-2.61 |

Wednesday |

AMC |

| PROGRESSIVE COR |

PGR |

0.4 |

0.42 |

0 |

Wednesday |

BTO |

| CONSTELLATN BRD |

STZ |

0.76 |

0.47 |

20.88 |

Wednesday |

BTO |

| ANGIODYNAMICS |

ANGO |

0.1 |

0.08 |

0 |

Wednesday |

AMC |

| APOGEE ENTRPRS |

APOG |

0.31 |

0.15 |

0 |

Wednesday |

AMC |

| API TECH CORP |

ATNY |

0 |

-0.12 |

-800 |

Wednesday |

AMC |

| JOES JEANS INC |

JOEZ |

-0.01 |

0.03 |

-50 |

Wednesday |

AMC |

| MSC INDL DIRECT |

MSM |

0.86 |

0.9 |

5.32 |

Wednesday |

BTO |

| NORTHRN OIL&GAS |

NOG |

0.22 |

0.29 |

-4.35 |

Wednesday |

AMC |

| PENFORD CORP |

PENX |

0.09 |

0.1 |

-172.73 |

Wednesday |

BTO |

| PRICESMART INC |

PSMT |

0.87 |

0.82 |

-2.74 |

Wednesday |

BTO |

| RICHARDSON ELEC |

RELL |

0.05 |

0.04 |

66.67 |

Wednesday |

AMC |

| RUBY TUESDAY |

RT |

-0.07 |

0.1 |

-79.17 |

Wednesday |

AMC |

| SIGMA DESIGNS |

SIGM |

0.01 |

-0.61 |

0 |

Wednesday |

AMC |

| FAMILY DOLLAR |

FDO |

0.91 |

1.21 |

-1.45 |

Thursday |

BTO |

| COMMERCE BANCSH |

CBSH |

0.68 |

0.64 |

-2.82 |

Thursday |

BTO |

| IGATE CORP |

IGTE |

0.37 |

0.47 |

2.27 |

Thursday |

BTO |

| PIER 1 IMPORTS |

PIR |

0.4 |

0.6 |

-7.14 |

Thursday |

BTO |

| RITE AID CORP |

RAD |

0.05 |

0.21 |

0 |

Thursday |

BTO |

| SHAW COMMS-CL B |

SJR |

0.38 |

0.37 |

-4.17 |

Thursday |

BTO |

| TITAN MACHINERY |

TITN |

0.18 |

0.73 |

-46 |

Thursday |

BTO |

| FASTENAL |

FAST |

0.37 |

0.37 |

-2.94 |

Friday |

BTO |

| JPMORGAN CHASE |

JPM |

1.43 |

1.59 |

6.87 |

Friday |

BTO |

| WELLS FARGO-NEW |

WFC |

0.96 |

0.92 |

2.04 |

Friday |

BTO |

ALCOA INC (AA): Free Stock Analysis Report

BED BATH&BEYOND (BBBY): Free Stock Analysis Report

FASTENAL (FAST): Free Stock Analysis Report

FAMILY DOLLAR (FDO): Free Stock Analysis Report

FEDEX CORP (FDX): Free Stock Analysis Report

JPMORGAN CHASE (JPM): Free Stock Analysis Report

NIKE INC-B (NKE): Free Stock Analysis Report

PROGRESSIVE COR (PGR): Free Stock Analysis Report

PIER 1 IMPORTS (PIR): Free Stock Analysis Report

RITE AID CORP (RAD): Free Stock Analysis Report

CONSTELLATN BRD (STZ): Free Stock Analysis Report

WD 40 CO (WDFC): Free Stock Analysis Report

WELLS FARGO-NEW (WFC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

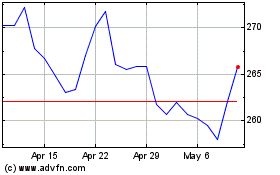

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

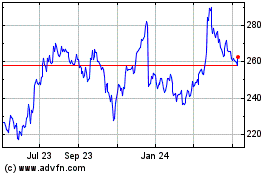

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024