Will NextEra (NEE) Energy Miss this Earnings? - Analyst Blog

April 28 2014 - 5:00PM

Zacks

NextEra Energy

Inc. (NEE) will release its first quarter 2014 financial

results before the market bell on Apr 30, 2014. In the prior

quarter, this utility reported a negative earnings surprise of

1.04%. NextEra Energy currently has a Zacks Rank #3 (Hold). Let’s

see how things are shaping up at NextEra prior to this

announcement.

Factors to Consider this Quarter

The ongoing improvement in the Florida economy resulting in a

declining unemployment rate and an increase in housing permits has

created fresh demand for utility services. This is likely to boost

the prospects of utility operators like NextEra.

Higher revenues notwithstanding, spiraling costs have impacted

NextEra’s margins. The company will be required to lower its total

costs during the upcoming quarters to register improved

performances.

NextEra Energy produces more than 20% of its electricity from

nuclear units. Energy production from nuclear facilities runs the

risk of accidents and these facilities need to go for scheduled

downtimes for routine maintenance and repairs. Incidentally, three

nuclear units went for planned downtime in the first quarter.

Sometimes the downtimes last longer than planned, thereby impacting

electricity production.

Earnings Whispers

Accordingly, our proven model does not conclusively show that

NextEra Energy is likely to beat earnings this quarter. That is

because a stock needs to have both a positive Earnings ESP

(Expected Surprise Prediction) and a Zacks Rank #1, 2 or 3 for this

to happen. This is not the case here.

Negative Zacks ESP: This is because the Most

Accurate estimate stands at $1.08 per share while the Zacks

Consensus Estimate is $1.09, resulting in a -0.92% ESP.

Zacks Rank #3 (Hold): NextEra Energy’s Zacks Rank

#3 combined with a -0.92% ESP makes surprise prediction

difficult. We caution against stocks with Zacks #4 and #5

Ranks (Sell rated stocks) going into the earnings announcement,

especially when the company is seeing negative estimate revisions

momentum.

Other Stocks to Consider

Here are some companies tied to the Electric utility industry worth

considering on the basis of our model, which shows that they have

the right combination of elements to post an earnings beat this

quarter.

Ameren Corporation (AEE) has an earnings ESP of

+6.25% and carries a Zacks Rank #2 (Buy).

Calpine Corp.(CPN) has an earnings ESP of +28.57%

and carries a Zacks Rank #2 (Buy).

Public Service Enterprise Group Inc. (PEG) has an

earnings ESP of +7.61% and carries a Zacks Rank #2 (Buy).

AMEREN CORP (AEE): Free Stock Analysis Report

CALPINE CORP (CPN): Free Stock Analysis Report

NEXTERA ENERGY (NEE): Free Stock Analysis Report

PUBLIC SV ENTRP (PEG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

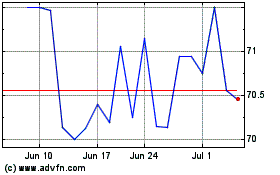

Ameren (NYSE:AEE)

Historical Stock Chart

From Mar 2024 to Apr 2024

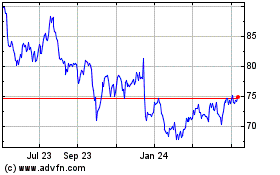

Ameren (NYSE:AEE)

Historical Stock Chart

From Apr 2023 to Apr 2024