Will EMC Corp. (EMC) Beat Earnings Estimates? - Analyst Blog

April 21 2014 - 11:00AM

Zacks

We expect EMC

Corporation (EMC) to beat expectations when it reports

first quarter 2014 results on Apr 23. Last quarter, it posted a

4.0% positive surprise.

Let’s see how things are shaping up for this announcement.

Why a Likely Positive Surprise?

Our proven model shows that EMC is likely to beat earnings because

it has the right combination of two key ingredients.

Positive Zacks ESP: Earnings Surprise Prediction

or Earnings ESP, which represents the difference between the Most

Accurate estimate and the Zacks Consensus Estimate, is at +7.41%.

This is very meaningful and a leading indicator of a likely

positive earnings surprise for shares.

Zacks Rank #3 (Hold): Note that stocks with

Zacks Ranks of #1, #2 and #3 have a significantly higher chance of

beating earnings. The sell rated stocks (#4 and #5) should never be

considered going into an earnings announcement.

The combination of EMC’s Zacks Rank #3 and +7.41% ESP makes us very

confident in looking for a positive earnings beat.

What is Driving the Better Than Expected

Earnings?

We believe that EMC is well positioned to benefit from incremental

data center hardware spending, going forward. EMC’s vast product

portfolio, which has products suitable for any kind of budget, will

boost its market share, going ahead. Additionally, aggressive share

repurchase will drive earnings, going forward.

However, increasing competition from the likes of IBM

Corp. (IBM) and Hewlett-Packard (HPQ) and

a sluggish IT spending outlook for the next couple of years will

continue to keep margins under pressure in the near term.

Other Stocks to Consider

EMC is not the only firm looking up this earnings season. We also

see likely earnings beat coming from this industry peer:

On Semiconductor Corp. (ONNN), Earnings ESP of

+6.67% and Zacks #1 Rank (Strong Buy)

EMC CORP -MASS (EMC): Free Stock Analysis Report

HEWLETT PACKARD (HPQ): Free Stock Analysis Report

INTL BUS MACH (IBM): Free Stock Analysis Report

ON SEMICON CORP (ONNN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

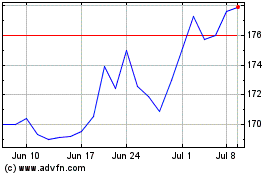

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

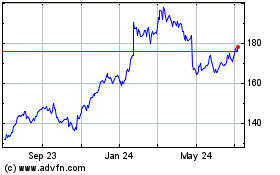

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024