When Fed QE Goes Bust - Real Time Insight

July 16 2012 - 10:17AM

Zacks

I'll admit it. I've been a Keynesian. To me,

pumping money into the economy, and monetizing debt through

quantitiatve easing (i.e., printing new money), was the best course

of action since 2008 because the alternative -- a

Japan-style deflationary spiral -- was unacceptable and entirely

avoidable. Inflation, of any amount, was worth all the

risks.

But something curious is going on. The economy is

not recovering in a robust way. After today's disappointing retail

sales trend continued, Goldman Sachs lowered their 2Q GDP estimate

another 2/10ths to 1.1%. They had dropped it to 1.3% from 1.6%

just last week on more dismal economic data.

Yet financial markets -- stocks, bonds, gold,

commodity prices -- seem to really benefit from QE. Below is a

chart from a group called Phoenix Capital Research which plots the

S&P 500 index minus the 24-hour pre-FOMC price

ramps.

Granted there are other ways of looking at the

effectiveness of QE on both markets and the economy. But today I am

wondering if QE is still a necessary evil, or if it's actually

distorting markets and could possibly damage the long-run health of

the economy.

What do you see for the next 6-18 months of the

US economy, with or without QE?

CRYSHS-AUS DOLR (FXA): ETF Research Reports

CRYSHS-EURO TR (FXE): ETF Research Reports

SPDR-GOLD TRUST (GLD): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

US-OIL FUND LP (USO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

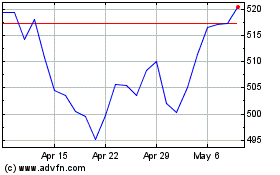

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Mar 2024 to Apr 2024

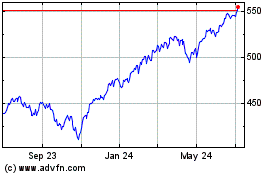

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Apr 2023 to Apr 2024