TIDMJDW

RNS Number : 7528Y

Wetherspoon (JD) PLC

11 September 2015

11 September 2015

J D WETHERSPOON PLC

PRELIMINARY RESULTS

(For the 52 weeks ended 26 July 2015)

FINANCIAL HIGHLIGHTS

Before exceptional items

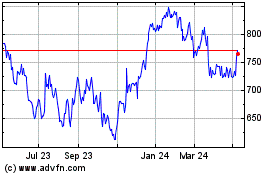

Revenue GBP1,513.9m (2014: GBP1,409.3m) +7.4%

Like-for-like sales +3.3%

Profit before tax GBP77.8m (2014: GBP79.4m) -2.0%

Earnings per share (including shares held Maintained

in trust) 47.0p (2014: 47.0p)

Free cash flow per share 89.8p (2014: +21.2%

74.1p)

Full year dividend 12.0p (2014: 12.0p) Maintained

After exceptional items*

Profit before tax GBP58.7m (2014: GBP78.4m) -25.1%

Earnings per share (including shares +11.9%

held in trust) 36.7p (2014: 32.8p)

* Exceptional items as disclosed in account note 5.

Commenting on the results, Tim Martin, the Chairman of J D

Wetherspoon plc, said:

"I am pleased to report a year of progress for the company, with

record sales and free cash flow.

"As we have previously stated, we believe that pubs are taxed

excessively and that the government would create more jobs and

receive higher levels of overall revenue, if it were to create tax

equality among supermarkets, pubs and restaurants. Supermarkets pay

virtually no VAT in respect of food sales, whereas pubs pay 20% -

and this disparity enables supermarkets to subsidise their

alcoholic drinks sales to the detriment of pubs and restaurants.

Wetherspoon is happy to pay its share of tax and, in this respect,

is a major contributor to the economy. In the year under review, we

paid total taxes of GBP632.4m, an increase of GBP32.2m, compared

with the previous year, which equates to approximately 41.8% of our

sales. This equates to an average payment per pub of GBP673,000 per

annum or GBP12,900 per week.

"Jacques Borel, who has campaigned successfully for lower VAT

for bars and restaurants in many other countries, has also been

campaigning in this country. A large number of companies have

supported his campaign, including Heineken, Pizza Hut, Fuller's and

St Austell, among others. It is disappointing to note that some of

the biggest pub companies, including Enterprise Inns, Mitchells and

Butlers, Greene King and Marston's have failed to support Jacques'

campaign and have not campaigned themselves in any meaningful way

for VAT equality between pubs and supermarkets. Pubs have lost 50%

of their beer sales to supermarkets in the last 35 years (including

many pubs owned by these companies), as VAT has climbed from 8% to

20 %. In this connection, in my opinion, the trade newspaper, the

Publican Morning Advertiser, has entirely lost its legitimacy as a

mouthpiece for individual licensees.

"The limitations of corporate governance systems should be

recognised. Common sense, management skills and business savvy are

more important to commercial success than board structures. All the

major banks and many supermarket and pub companies have recently

suffered colossal business and financial problems, in spite of, or

perhaps because of, their adherence to governance guidelines.

"Wetherspoon increased the minimum hourly rate for staff by 5%

in October 2014 and by a further 8% at the end of July 2015. Both

decisions were taken without the knowledge that the government was

about to announce a new minimum wage, now called a "the living

wage". In addition, as Wetherspoon shareholders are aware, we pay

about 40% of our profits (GBP30.7m in the year under review) as a

bonus or free shares, over 80% of which is paid to people who work

in our pubs. By pushing up the cost of wages by a large factor, the

government is inevitably putting financial pressure on pubs, many

of which have already closed. This financial pressure will be felt

most strongly in areas which are less affluent, since the price

differential in those areas between pubs and supermarkets is far

more important to customers.

"We continue to run the world's biggest real-ale festival, twice

per annum, and have added a cider festival in recent times,

featuring a wide variety of suppliers from the UK, Europe and

elsewhere in the world. Wetherspoon sells far more beers and ciders

from craft and micro-brewers throughout the year than any other pub

company.

"In the six weeks to 6 September 2015, like-for-like sales

increased by 1.4%, with total sales increasing by 5.2%.

"As previously stated on 15 July 2015, a number of factors

likely to influence our trading performance this financial year are

difficult to quantify at this early stage. Positive aspects include

an increase in pub numbers, a better economy and slightly lower

interest rates; less favourable aspects include heightened

competition from supermarkets and restaurant groups and increased

staff, repairs, bar and food costs. We continue to anticipate a

trading performance similar to, or slightly above, that achieved in

the last financial year."

Enquiries:

John Hutson Chief Executive Officer 01923 477777

Ben Whitley Finance Director 01923 477777

Eddie Gershon Company spokesman 07956 392234

Photographs are available at: www.newscast.co.uk

CHAIRMAN'S STATEMENT

Financial performance

I am pleased to report a year of progress for the company, with record sales and free cash

flow. The company was founded in 1979 - and this is the 32nd year since incorporation in 1983.

The table below outlines some key aspects of our performance during that period. Since our

flotation in 1992, earnings per share before exceptional items have grown by an average of

15.0% per annum and free cash flow per share by an average of 17.7%.

Summary accounts for the years ended July 1984 to 2015

Financial Total sales Profit/(loss) Earnings per share Free cash flow Free cash flow per

year before tax and before exceptional share

exceptional items items

GBP000 GBP000 pence GBP000 pence

---------- ----------- --------------------- -------------------- -------------- ---------------------

1984 818 (7) 0.0

1985 1,890 185 0.2

1986 2,197 219 0.2

1987 3,357 382 0.3

1988 3,709 248 0.3

1989 5,584 789 0.6 915 0.4

1990 7,047 603 0.4 732 0.4

1991 13,192 1,098 0.8 1,236 0.6

1992 21,380 2,020 1.9 3,563 2.1

1993 30,800 4,171 3.3 5,079 3.9

1994 46,600 6,477 3.6 5,837 3.6

1995 68,536 9,713 4.9 13,495 7.4

1996 100,480 15,200 7.8 20,968 11.2

1997 139,444 17,566 8.7 28,027 14.4

1998 188,515 20,165 9.9 28,448 14.5

1999 269,699 26,214 12.9 40,088 20.3

2000 369,628 36,052 11.8 49,296 24.2

2001 483,968 44,317 14.2 61,197 29.1

2002 601,295 53,568 16.6 71,370 33.5

2003 730,913 56,139 17.0 83,097 38.8

2004 787,126 54,074 17.7 73,477 36.7

2005 809,861 47,177 16.9 68,774 37.1

2006 847,516 58,388 24.1 69,712 42.1

2007 888,473 62,024 28.1 52,379 35.6

2008 907,500 58,228 27.6 71,411 50.6

2009 955,119 66,155 32.6 99,494 71.7

2010 996,327 71,015 36.0 71,344 52.9

2011 1,072,014 66,781 34.1 78,818 57.7

2012 1,197,129 72,363 39.8 91,542 70.4

2013 1,280,929 76,943 44.8 65,349 51.8

2014 1,409,333 79,362 47.0 92,850 74.1

2015 1,513,923 77,798 47.0 109,777 89.8

Notes

Adjustments to statutory numbers

1. Where appropriate, the earnings per share (EPS), as disclosed

in the statutory accounts, have been recalculated to take account

of share splits, the issue of new shares and capitalisation

issues.

(MORE TO FOLLOW) Dow Jones Newswires

September 11, 2015 02:00 ET (06:00 GMT)

2. Free cash flow per share excludes dividends paid which were

included in the free cash flow calculations in the annual report

and accounts for the years 1995-2000.

3. The weighted average number of shares, EPS and free cash flow

per share include those shares held in trust for employee share

schemes.

4. Before 2005, the accounts were prepared under UKGAAP. All

accounts from 2005 to date have been prepared under IFRS.

Like-for-like sales increased by 3.3% (2014: 5.5%), with total

sales of GBP1,513.9m, an increase of 7.4% (2014: 10.0%).

Like-for-like bar sales increased by 1.2% (2014: 2.7%), food sales

by 7.3% (2014: 12.0%) and slot/fruit machine sales decreased by

2.8% (2014: decreased by 3.1%).

Operating profit before exceptional items decreased by 3.8% to

GBP112.5m (2014: GBP117.0m). The operating margin, before

exceptional items, decreased to 7.4% (2014: 8.3%), mainly as a

result of a lower gross margin and increases in staff costs,

utilities and depreciation.

Profit before tax and exceptional items decreased by 2.0% to

GBP77.8m (2014: GBP79.4m). Earnings per share (including shares

held in trust by the employee share scheme), before exceptional

items, were 47.0p (2014: 47.0p).

Net interest was covered 3.3 times by operating profit before

exceptional items (2014: 3.2 times). Total capital investment was

GBP173.3m in the period (2014: GBP177.5m), with GBP106.3m invested

in new pubs and extensions to existing pubs (2014: GBP97.7m). In

addition, there was expenditure of GBP44.8m on existing pubs and IT

infrastructure (2014: GBP56.2m) and GBP21.6m on freehold

reversions, where Wetherspoon was already a tenant, and investment

properties (2014: GBP23.6m).

Exceptional items totalled GBP12.6m (2014: GBP17.7m). An

exceptional charge of GBP5.2m resulted from a change in our

accounting policy regarding non-consumable inventories, including

crockery, glassware and cutlery. These items were previously

regarded as part of our year end stock-in-hand; we have now decided

to expense these when received by the pubs. An impairment charge of

GBP11.2m was realised in respect of underperforming pubs and a

charge of GBP1.9m was incurred in relation to onerous leases. A

charge of GBP0.8m resulted from a restructuring of our head office.

The total cash effect of these exceptional items was GBP0.8m. These

exceptional items led to an exceptional tax deduction of

GBP1.6m.

We have reviewed the treatment of deferred tax on "rolled-over"

capital gains and found that we had overestimated the tax

liability. This has resulted in a deferred tax credit of

GBP4.8m.

Free cash flow, after capital investment of GBP44.8m on existing

pubs (2014: GBP56.2m), GBP6.8m in respect of share purchases for

employees (2014: GBP7.3m) and payments of tax and interest,

increased by GBP16.9m to GBP109.8m (2014: GBP92.9m). The working

capital inflow was GBP27.3m in the year (2014: GBP29.6m). Free cash

flow per share was 89.8p (2014: 74.1p).

Dividends and return of capital

The board proposes, subject to shareholders' approval, to pay a

final dividend of 8.0p per share (2014: 8.0p per share), on 26

November 2015, to those shareholders on the register on 23 October

2015, giving a total dividend for the year of 12.0p per share

(2014: 12.0p per share). The dividend is covered 3.1 times (2014:

2.8 times). In view of high levels of capital expenditure in recent

years and the potential for advantageous investments in the future,

the board has decided to maintain the dividend at its current level

for the time being.

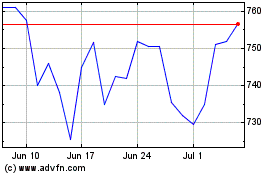

During the year, 3,618,827 shares (representing 2.9% of the

issued share capital) were purchased by the company for

cancellation, at a total cost of GBP26.9m, including stamp duty,

representing an average cost per share of 743p.

Financing

As at 26 July 2015, the company's total net debt, including bank

borrowings and finance leases, but excluding derivatives, was

GBP601.1m (2014: GBP556.6m), an increase of GBP44.5m. Factors which

have led to the increase in debt are investment in new pubs and

extensions of GBP106.3m, investment in existing pubs of GBP44.8m,

the acquisition of freehold reversions of GBP21.6m, share buybacks

of GBP12.7m and dividend payments of GBP14.6m. Year-end

net-debt-to-EBITDA was 3.37 times (2014: 3.21 times).

As at 26 July 2015, the company had GBP240.9m (2014: GBP138.1m)

of unutilised banking facilities and cash balances, with total

facilities of GBP840.0m (2014: GBP690.0m). The company's existing

interest-rate swap arrangements remain in place.

Corporation tax

The overall tax charge (including deferred tax) on

pre-exceptional items is 26.1% (2014: 25.8%). The UK standard

average tax rate for the period was 20.7% (2014: 22.3%). The

difference between the rate of 26.1% and the standard average rate

of UK corporation tax of 20.7% is 5.4% (2014: 3.5%) which is due

primarily to the level of non-qualifying depreciation (depreciation

does not qualify for tax relief).

The pre-exceptional current tax rate, which excludes deferred

tax, has increased by 6.3% to 27.7% (2014: 21.4%), owing mainly to

a reduced amount of expenditure which qualifies for capital

allowances.

The "living wage"

Wetherspoon increased the minimum hourly rate for staff by 5% in

October 2014 and by a further 8% at the end of July 2015. Both

decisions were taken without the knowledge that the government was

about to announce a new minimum wage, now called the "living wage".

In addition, as Wetherspoon shareholders are aware, we pay about

40% of our profits (GBP30.7m in the year under review) as a bonus

or free shares, over 80% of which is paid to people who work in our

pubs.

We believe there to be two main economic issues with regard to

the new living/minimum wage. The first is that pub wages are about

30% of sales. Therefore a pint purchased in a pub at the national

average price of about GBP3.50 will represent about 85 pence in

respect of wages. In contrast, a pint bought in a supermarket, at

an estimated price of GBP1, will only represent about 10 pence of

supermarket wages, since their wage percentage and selling prices

are both far lower those of pubs. By pushing up the cost of wages

by a large factor, the government is inevitably putting financial

pressure on pubs, many of which have already closed. This financial

pressure will be felt most strongly in areas which are less

affluent, since the price differential in those areas between pubs

and supermarkets is far more important to customers. It is certain

that high streets in less affluent areas, which already suffer from

serious problems of empty shops and dereliction, will suffer

further if pubs and other labour-intensive businesses close.

The second issue is that investment is bound to be affected if

businesses feel that important issues, such as the minimum wage,

are to be decided by one or two senior politicians on a whim, for

political reasons, rather than being subject to careful

consideration by organisations such as the Low Pay Commission.

Trade support for VAT equality

Jacques Borel, who has campaigned successfully for lower VAT for

bars and restaurants in many other countries, has also been

campaigning in this country. A large number of companies have

supported his campaign, including Heineken, Pizza Hut, Fuller's and

St Austell, among others. It is disappointing to note that some of

the biggest pub companies, including Enterprise Inns, Mitchells and

Butlers, Greene King and Marston's have failed to support Jacques'

campaign and have not campaigned themselves in any meaningful way

for VAT equality between pubs and supermarkets. Pubs have lost 50%

of their beer sales to supermarkets in the last 35 years (including

many pubs owned by these companies), as VAT has climbed from 8% to

20%.

Of equal or greater concern to many thousands of individual

publicans in Britain is that the main trade newspaper, the Publican

Morning Advertiser (the PMA) has itself failed to support the VAT

campaign in recent years, even though authoritative market

research, as well as common sense, overwhelmingly indicates that

publicans regard VAT equality as critical. In my view, the PMA, one

of Britain's oldest newspapers, has entirely lost its legitimacy as

a mouthpiece for individual licensees.

Contribution to the economy

As we have previously stated, we believe that pubs are taxed

excessively and that the government would create more jobs and

receive higher levels of overall revenue, if it were to create tax

equality among supermarkets, pubs and restaurants. Supermarkets pay

virtually no VAT in respect of food sales, whereas pubs pay 20% -

and this disparity enables supermarkets to subsidise their

alcoholic drinks sales to the detriment of pubs and

restaurants.

Wetherspoon is happy to pay its share of tax and, in this

respect, is a major contributor to the economy. In the year under

review, we paid total taxes of GBP632.4m, an increase of GBP32.2m,

compared with the previous year, which equates to approximately

41.8% of our sales.

This equates to an average payment per pub of GBP673,000 per

annum or GBP12,900 per week.

2015 2014

GBPm GBPm

VAT 294.4 275.1

Alcohol duty 161.4 157.0

PAYE and NIC 84.8 78.4

Business rates 48.7 44.9

Corporation

tax 15.3 18.1

Corporation (2.0) -

tax credit

Machine duty 11.2 11.3

Climate change

levies 6.4 6.3

Carbon tax 3.7 2.7

Fuel duty 2.9 2.1

Landfill tax 2.2 1.5

Stamp duty 1.8 2.1

Premise licence 0.8 0.7

TV Licences 0.8 -

TOTAL TAX 632.4 600.2

TAX PER PUB

(GBP000) 673 662

TAX AS % OF

SALES 41.8% 42.6%

PRE-EXCEPTIONAL

PROFIT AFTER

TAX 57.5 58.9

PROFIT AFTER

TAX AS % OF

SALES 3.8% 4.2%

Corporate governance

(MORE TO FOLLOW) Dow Jones Newswires

September 11, 2015 02:00 ET (06:00 GMT)

In last year's statement, the view was advanced that many

aspects of current corporate governance advice, as laid out in the

Combined Code, were "deeply flawed". The statement pointed out that

"compliant pub companies had often fared disastrously in comparison

with non-compliant ones. In particular, pub companies in which the

CEO became chairman and which had a majority of

executives......usually with previous experience of the pub trade,

avoided making catastrophic errors to which compliant companies

seem prone". It was also pointed out that setting targets for

bonuses had also often backfired, encouraging companies to take

reckless decisions in order to enhance earnings.

Last year's statement was particularly critical of the Code

itself, which placed a huge emphasis on meetings between directors

and shareholders and placed almost no emphasis on directors taking

account of the views of customers and employees- which are far more

important, in practice, to the future well-being of any

company.

It was pointed out that the average institutional shareholder

turns over his portfolio twice annually, so it would be absurd for

directors to take account of the views of "Mr Market" (in the words

of Benjamin Graham), certainly in regard to short-term

shareholders.

Having presented our views in previous annual reports and press

articles, without receiving any dissent from any shareholders or

their representatives, I believe the following propositions

represent the views of sensible shareholders:

-- Modern annual reports are far too long and are often almost

unreadable. They are full of semi-literate business jargon,

including accounting jargon, and are cluttered with badly written

and incomprehensible governance reports.

-- The limitations of corporate governance systems should be

recognised. Common sense, management skills and business savvy are

more important to commercial success than board structures. All the

major banks and many supermarket and pub companies have recently

suffered colossal business and financial problems, in spite of, or

perhaps because of, their adherence to governance guidelines.

-- There should be an approximately equal balance between

executives and non-executives. A majority of executives is not

necessarily harmful, provided non-executives are able to make their

voices heard.

-- It is often better if a chairman has previously been the

chief executive of the company. This encourages chief executives,

who may wish to become chairmen in the future, to take a long-term

view, avoiding problems of profit-maximisation policies in the

years running up to the departure of a chief executive.

-- A maximum tenure of 9 years for non-executive directors is

not advisable, since inexperienced boards, unfamiliar with the

effects of the "last recession" on their companies, are likely to

reduce financial stability.

-- An excessive focus on achieving financial or other targets

for executives can be counter-productive. There's no evidence that

the type of targets preferred by corporate governance guidelines

actually work and there is considerable evidence that attempting to

reach ambitious financial targets is harmful.

-- It is far more important for directors to take account of the

views of employees and customers than of the views of institutional

shareholders. Shareholders should be listened to with respect, but

caution should be exercised in implementing the views of short-term

shareholders. It should also be understood that modern

institutional shareholders may have a serious conflict of interest,

as they are often concerned with their own quarterly portfolio

performance, whereas corporate health often requires objectives

which lie 5, 10 or 20 years in the future.

Board of directors

Further to the 18 December 2014 statement that Ben Whitley had

been appointed interim finance director, the board is pleased to

announce today that Ben is being appointed to the board with effect

from the forthcoming AGM.

Further progress

As in previous years, the company has tried to improve as many

areas of the business as possible. For example, our food hygiene

ratings are at record levels. We have 858 pubs rated on the Food

Standards Agency's website. The average score is 4.93, with 94.1%

of the pubs achieving a top rating of five stars and 5.1% receiving

four stars. We believe this to be the highest average rating for

any substantial pub company. In the separate Scottish scheme, which

records either a 'pass' or a 'fail', all of our 68 pubs have

passed.

In the 2016 Good Beer Guide, a CAMRA publication, 296 of our

pubs have been recommended, more than any other pub company. In

addition, over 937 of our pubs are Cask Marque approved - Cask

Marque is a pub-industry scheme, run in conjunction with several

brewers, which checks and approves the quality of real ale in pubs.

We continue to source our traditional ales from a large number of

microbreweries of varying sizes and believe that we are the biggest

purchaser of microbrewery beer in the UK.

We continue to run the world's biggest real-ale festival, twice

per annum, and have added a cider festival in recent times,

featuring a wide variety of suppliers from the UK, Europe and

elsewhere in the world. Wetherspoon sells far more beers and ciders

from craft and micro-brewers throughout the year than any other pub

company.

We paid GBP30.7m in respect of bonuses and free shares to

employees in the year, slightly more than the previous year, of

which 97.0% was paid to staff below board level and 81.5% was paid

to staff working in our pubs.

In the field of charity, thanks to the work of our dedicated pub

and head-office teams, we continue to raise record amounts of money

for CLIC Sargent, which supports young cancer patients and their

families. In the last year, we raised approximately GBP1.7m,

bringing the total raised to over GBP11.0m - more than any other

corporate partner has raised for this charity.

Property

The company opened 30 pubs during the year, with 6 pubs sold or

closed, resulting in a total estate of 951 pubs at the financial

year end. The average development cost for a new pub (excluding the

cost of freeholds) was GBP2.1m, compared with GBP1.6m a year ago;

four of the pubs included hotel accommodation and the average size

was around 20% bigger than the previous year, factors that

contributed to increases in costs. The full-year depreciation

charge was GBP66.7m (2014: GBP58.1m). We currently intend to open

about 15 to 20 pubs in the year ending July 2016.

Property litigation

We have previously referred to important property litigation

between Wetherspoon and a number of individuals and companies. As a

result of the importance of this litigation and the large sums of

money involved, we intend to reproduce this information for the

benefit of shareholders and the public for the foreseeable

future:

As reported at the interim results in March 2013, Wetherspoon

agreed on an out-of-court settlement with developer Anthony Lyons,

formerly of property leisure agent Davis Coffer Lyons, and has

received approximately GBP1.25m from Mr Lyons.

The payment relates to litigation in which Wetherspoon claimed

that Mr Lyons had been an accessory to frauds committed by

Wetherspoon's former retained agent Van de Berg and its directors

Christian Braun, George Aldridge and Richard Harvey. Mr Lyons

denied the claim - and the litigation was contested.

The claim related to properties in Portsmouth, Leytonstone and

Newbury. The Portsmouth property was involved in the 2008/9 Van de

Berg case itself. In that case, Mr Justice Peter Smith found that

Van de Berg, but not Mr Lyons (who was not a party to the case),

fraudulently diverted the freehold from Wetherspoon to Moorstown

Properties Limited, a company owned by Simon Conway. Moorstown

leased the premises to Wetherspoon. Wetherspoon is still a

leaseholder of this property - a pub called The Isambard Kingdom

Brunel.

The properties in Leytonstone and Newbury (the other properties

in the case against Mr Lyons) were not pleaded in the 2008/9 Van de

Berg case. Leytonstone was leased to Wetherspoon and trades today

as The Walnut Tree public house. Newbury was leased to Pelican plc

and became Café Rouge.

As we have also reported, the company agreed to settle its final

claim in this series of cases and accepted GBP400,000 from property

investor Jason Harris, formerly of First London and now of First

Urban Group. Wetherspoon alleged that Harris was an accessory to

frauds committed by Van de Berg. Harris contested the claim and has

not admitted liability.

Before the conclusion of the above cases, Wetherspoon also

agreed on a settlement with Paul Ferrari of London estate agent

Ferrari Dewe & Co, in respect of properties referred to as the

'Ferrari Five' by Mr Justice Peter Smith.

Further shareholder information about these cases is available

in a short article which I wrote for the trade publication Propel,

which is disclosed later in my chairman's statement.

Current trading and outlook

The biggest danger to the pub industry, as Wetherspoon has

previously pointed out is the VAT disparity between supermarkets

and pubs.

In the six weeks to 6 September 2015, like-for-like sales

increased by 1.4%, with total sales increasing by 5.2%.

As previously stated on 15 July 2015, a number of factors likely

to influence our trading performance this financial year are

difficult to quantify at this early stage. Positive aspects include

an increase in pub numbers, a better economy and slightly lower

interest rates; less favourable aspects include heightened

competition from supermarkets and restaurant groups and increased

staff, repairs, bar and food costs. We continue to anticipate a

trading performance similar to, or slightly above, that achieved in

the last financial year.

Newspaper article

The newspaper article below first appeared in the pub trade

publication Propel and relates to the section on property

litigation referred to above:

"Wed 22(nd) May 2013 - Propel Opinion Extra

(MORE TO FOLLOW) Dow Jones Newswires

September 11, 2015 02:00 ET (06:00 GMT)

Lessons in the property market by Tim Martin

JD Wetherspoon has always been a buyer of freeholds. Our second,

third and fourth pubs were freehold and, by the time of our 1992

flotation, 20 of our 44 pubs were freehold.

I negotiated our first 20 or so pubs myself, dealing directly

with the owners' agents, before employing Christian Braun, of Van

de Berg & Co, in about 1990. Little did I realise that Braun

was a double agent or "mole", who was to burrow deep into our

organisation, undermining the very property foundations that

underpin any retailer.

Following a tip-off in 2005, we terminated VDB's contract and

undertook a review of all our 600 or so property transactions,

using a team of up to a dozen legal and paralegal staff. We

discovered about 50 "back-to-back" transactions in which freeholds,

which were available to buy, had been diverted by VDB to third

parties, who had acquired them at the same time as JDW had taken a

lease - the rent being set at a level which created an immediate

uplift in the value of the reversion.

Proceedings were issued against VDB and its directors, Braun,

George Aldridge and Richard Harvey, in respect of about a dozen of

these transactions. In a 136-page judgment, Mr Justice Peter Smith

found that VDB had fraudulently diverted properties to number of

third parties, but he made no findings against the third parties

themselves.

Following Mr Justice Smith's judgment, JDW issued proceedings

against several third parties: Paul Ferrari of Braun's former

employer Ferrari Dewe & Co; Anthony Lyons, formerly of Davis

Coffer Lyons and Jason Harris, formerly of First London.

Liability was denied by all. The cases were contested and were

settled out of court. JDW received substantial payments in all

three cases.

A number of the pleaded properties in the VDB case, referred to

by the judge as the "Ferrari Five", involved Jersey companies with

nominee owners that were connected to Ferrari. Each of the Jersey

companies had a different name - and care was taken to use

different lawyers and nominees.

Profits from the purchasing companies were usually channelled to

a Jersey holding company called Gecko and money was then

transferred as loans or fees to companies controlled by VDB

directors.

In my opinion, the Lyons case is the most interesting for the

property market and for prospective tenants and purchasers. Lyons

stated in his defence that he was acting in his capacity as an

employee and in accordance with his duties to Davis and Coffer (now

Davis Coffer Lyons).

The Lyons case concerned properties in Portsmouth, Leytonstone

and Newbury, two of which became JDW pubs, with the third becoming

a Café Rouge. The Portsmouth property belonged to British Gas - and

Justice Smith found that VDB bid for the freehold, unbeknown to

JDW, and, once the bid was accepted, agreed with Lyons for JDW to

take a lease and for the freehold to be acquired by Moorstown

Properties, owned by a friend, and subsequently a colleague, of

Lyons - Simon Conway. No findings were made against Lyons, or

indeed Conway, in the VDB case, and neither person was a party to

the case.

Portsmouth was subsequently sold by Moorstown to Scottish

American Investment Company, a few months later, with the benefit

of a lease to JDW for a substantial profit. Illustrating the

Byzantine complexity of the transactions, Lyons' defence stated

that shares in Moorstown were "transferred", before the sale was

completed, to Northcreek which, Companies House shows, was owned by

Roger Myers, then chairman of Café Rouge owner Pelican, and his

family.

The Newbury property was acquired by Riverside Stores, a company

connected to Conway, and was leased at around the same time to Café

Rouge. Newbury was sold shortly after completion for a substantial

profit.

JDW did not allege, and is not alleging, that the Portsmouth and

Newbury transactions are connected and is not alleging that Davis

Coffer Lyons, Myers or Conway are dishonest, but it is a matter of

public importance, as well as of importance to JDW and its

shareholders, for there to be an explanation as to the

circumstances in which Moorstown, a company which clearly benefited

from the Portsmouth fraud by VDB, ended up belonging to the family

of Myers.

A key legal and ethical question for the property market that

emerges from these cases concerns the obligations of estate agents

and investors, in circumstances in which a freehold property is

first offered to a friend or colleague of an agent, who agrees to

acquire it, and the property is then offered by the agent to a

company like Wetherspoon on a "back-to-back" basis. What are the

obligations of the introducing agent? In broad terms, the third

parties in the Wetherspoon litigation argued that they owed no

duties or obligations to Wetherspoon and were not, therefore,

liable to us. The great risk that all agents and investors run, in

these circumstances, is if the retained agent, VDB in this

instance, is itself be dishonest. If so, this may open up the

possibility of a claim by an aggrieved 'end user', such as

Wetherspoon, that the introducing agent participated in the

dishonesty of the retained agent.

JDW has lost many tens of millions of pounds as a result of the

VDB frauds. Rent reviews and "yield compression" have exacerbated

the damage over the years.

Our experience teaches a number of lessons. First, buyers and

tenants should ask their agents to confirm in writing that they

have no direct or indirect interest in any property they are

acquiring and should ask their lawyers to take particular interest

if a freehold is changing hands at the same time as they are

acquiring a lease, or indeed the freehold.

Professionals and investors should also get confirmation in

writing from the "end user" in back-to-back deals that they have

consented to the transaction. Take the retained agent's word for it

at your peril.

Tim Martin is founder and chairman of JD Wetherspoon"

Tim Martin

Chairman

10 September 2015

INCOME STATEMENT for the 52 weeks ended 26 July 2015

J D Wetherspoon plc, company number: 1709784

Notes 52 weeks 52 weeks 52 weeks 52 weeks 52 weeks 52 weeks

ended ended ended ended ended ended

26 July 26 July 26 July 27 July 27 July 27 July

2015 2015 2015 2014 2014 2014

Before Exceptional After Before Exceptional After

exceptional items exceptional exceptional items exceptional

items (note items items (note items

4) 4)

Total Total Total Total Total Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------------- ------ ------------- ------------- ------------- ------------- ------------- -------------

Revenue 2 1,513,923 - 1,513,923 1,409,333 - 1,409,333

Operating costs (1,401,415) (6,013) (1,407,428) (1,292,329) - (1,292,329)

-------------------- ------ ------------- ------------- ------------- ------------- ------------- -------------

Operating profit 3 112,508 (6,013) 106,495 117,004 - 117,004

Property

gains/(losses) 4 (694) (13,053) (13,747) (1,429) - (1,429)

Finance income 7 180 - 180 67 - 67

Finance costs 7 (34,196) - (34,196) (36,280) (997) (37,277)

Profit/(loss)

before taxation 77,798 (19,066) 58,732 79,362 (997) 78,365

Income tax expense 8 (20,343) 6,435 (13,908) (20,499) -(16,744) (37,243)

-------------------- ------ ------------- ------------- ------------- ------------- ------------- -------------

Profit/(loss)

for the year 57,455 (12,631) 44,824 58,863 (17,741) 41,122

Earnings per ordinary share (p):

- Basic 9 48.6 (10.7) 37.9 48.6 (14.7) 33.9

- Diluted(3) 9 47.0 (10.3) 36.7 47.0 (14.2) 32.8

Operating profit per share (p):

- Diluted 9 92.0 (4.9) 87.1 93.4 - 93.4

(MORE TO FOLLOW) Dow Jones Newswires

September 11, 2015 02:00 ET (06:00 GMT)

STATEMENT OF COMPREHENSIVE INCOME for the 52 weeks ended 26 July

2015

Notes 52 weeks 52 weeks

ended ended

26 July 27 July

2015 2014

GBP000 GBP000

---------------------------------------------- ------ --------- ---------

Items which may subsequently be reclassified

to profit or loss

Interest-rate swaps: gain/(loss)

taken to other comprehensive income (9,807) 13,879

Tax on items taken directly to other

comprehensive income 8 1,961 (2,776)

Currency translation differences (2,189) 7

---------------------------------------------- ------ --------- ---------

Net (loss)/gain recognised directly

in other comprehensive income (10,035) 11,110

Profit for the year 44,824 41,122

---------------------------------------------- ------ --------- ---------

Total comprehensive income for the

year 34,789 52,232

---------------------------------------------- ------ --------- ---------

CASH FLOW STATEMENT for the 52 weeks ended 26 July 2015

J D Wetherspoon plc, company number: 1709784

Notes Free cash Free cash

flow flow(1)

52 weeks 52 weeks 52 weeks 52 weeks

ended ended ended ended

26 July 26 July 27 July 27 July

2015 2015 2014 2014

GBP000 GBP000 GBP000 GBP000

Cash flows from operating

activities

Cash generated from operations 10 210,181 210,181 212,505 212,505

Interest received 180 180 78 78

Interest paid (31,931) (31,931) (33,996) (33,996)

Corporation tax paid (13,293) (13,293) (18,070) (18,070)

Gaming machine settlement - (16,696)

Net cash inflow from

operating activities 165,137 165,137 143,821 160,517

------------------------------- ----- ---------- --------- ---------- ---------

Cash flows from investing

activities

Purchase of property,

plant and equipment (37,577) (37,577) (46,300) (46,300)

Purchase of intangible

assets (7,176) (7,176) (9,926) (9,926)

Proceeds on sale of property,

plant and equipment 723 505

Investment in new pubs

and pub extensions (106,339) (97,694)

Freehold reversions (21,612) (14,823)

Investment properties - (8,754)

Lease premiums paid (635) (10)

------------------------------- ----- ---------- --------- ---------- ---------

Net cash outflow from

investing activities (172,616) (44,753) (177,002) (56,226)

------------------------------- ----- ---------- --------- ---------- ---------

Cash flows from financing

activities

Equity dividends paid 12 (14,591) (14,949)

Purchase of own shares

for cancellation (12,714) (24,550)

Purchase of own shares

for

share-based payments (6,831) (6,831) (7,338) (7,338)

Advances under bank loans 11 47,898 92,151

Loan issue costs 11 (3,775) (3,775) (4,103) (4,103)

Finance lease principal

payments 11 (2,648) (5,552)

------------------------------- ----- ---------- --------- ---------- ---------

Net cash inflow/(outflow)

from financing activities 7,339 (10,606) 35,659 (11,441)

------------------------------- ----- ---------- --------- ---------- ---------

Net (decrease)/ increase

in cash and cash equivalents 11 (140) 2,478

------------------------------- ----- ---------- --------- ---------- ---------

Opening cash and cash

equivalents 32,315 29,837

Closing cash and cash

equivalents 32,175 32,315

------------------------------- ----- ---------- --------- ---------- ---------

Free cash flow 9 109,778 92,850

------------------------------- ----- ---------- --------- ---------- ---------

Free cash flow per ordinary

share 9 89.8p 74.1p

BALANCE SHEET for the 52 weeks ended 26 July 2015

J D Wetherspoon plc, company number: 1709784

Notes 26 July 27 July

2015 2014

GBP000 GBP000

---------------------------------- ------ ---------- ----------

Assets

Non-current assets

Property, plant and equipment 13 1,153,756 1,068,067

Intangible assets 14 29,997 26,838

Investment properties 15 8,651 8,713

Other non-current assets 16 10,028 9,766

Deferred tax assets 8 7,994 6,033

Derivative financial instruments - 1,723

---------------------------------- ------ ---------- ----------

Total non-current assets 1,210,426 1,121,140

Assets held for sale 1,220 -

Current assets

Inventories 19,451 22,312

Receivables 26,838 23,901

Cash and cash equivalents 32,175 32,315

---------------------------------- ------ ---------- ----------

Total current assets 78,464 78,528

Total assets 1,290,110 1,199,668

---------------------------------- ------ ---------- ----------

Liabilities

Current liabilities

Borrowings (2,051) (2,636)

Derivative financial instruments - (3,149)

Trade and other payables (283,227) (243,160)

Current income tax liabilities (10,053) (3,872)

Provisions (5,231) (4,442)

Total current liabilities (300,562) (257,259)

Non-current liabilities

Borrowings (631,232) (586,230)

Derivative financial instruments (39,973) (28,740)

Deferred tax liabilities 8 (77,771) (83,686)

Provisions (4,012) (3,055)

Other liabilities (13,667) (13,530)

---------------------------------- ------ ---------- ----------

Total non-current liabilities (766,655) (715,241)

---------------------------------- ------ ---------- ----------

Net assets 222,893 227,168

---------------------------------- ------ ---------- ----------

Shareholders' equity

Share capital 2,387 2,460

Share premium account 143,294 143,294

Capital redemption reserve 2,044 1,971

Hedging reserve (31,979) (24,133)

Retained earnings 107,147 103,576

---------------------------------- ------ ---------- ----------

Total shareholders' equity 222,893 227,168

---------------------------------- ------ ---------- ----------

STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY

Share Share Capital Hedging Currency Retained Total

capital premium redemption reserve translation earnings equity

account reserve differences

Note GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------------- ----- --------- --------- ------------ --------- ------------- ---------- ---------

At 28 July 2013 2,521 143,294 1,910 (35,236) - 102,426 214,915

Total comprehensive

income 11,103 7 41,122 52,232

Profit for the

year 41,122 41,122

Interest-rate

swaps: gain taken

to equity 13,879 13,879

Tax on items

taken directly

to equity 8 (2,776) (2,776)

Currency translation

reserve 7 7

(MORE TO FOLLOW) Dow Jones Newswires

September 11, 2015 02:00 ET (06:00 GMT)

---------------------- ----- --------- --------- ------------ --------- ------------- ---------- ---------

Repurchase of

shares (61) 61 (24,428) (24,428)

Tax on repurchase

of shares (122) (122)

Share-based payments 7,521 7,521

Tax on share-based

payments (663) (663)

Purchase of shares

held in trust (7,304) (7,304)

Tax on purchase

of shares held

in trust (34) (34)

Dividends 12 (14,949) (14,949)

--------- --------- ------------ --------- ------------- ---------- ---------

At 27 July 2014 2,460 143,294 1,971 (24,133) 7 103,569 227,168

Total comprehensive

income (7,846) (2,189) 44,824 34,789

Profit for the

year 44,824 44,824

Interest-rate

swaps: loss taken

to equity (9,807) (9,807)

Tax on items

taken directly

to equity 8 1,961 1,961

Currency translation

reserve (2,189) (2,189)

---------------------- ----- --------- --------- ------------ --------- ------------- ---------- ---------

Repurchase of

shares (73) 73 (26,766) (26,766)

Tax on repurchase

of shares (134) (134)

Share-based payments 8,907 8,907

Tax on share-based

payments 351 351

Purchase of shares

held in trust (6,799) (6,799)

Tax on purchase

of shares held

in trust (32) (32)

Dividends 12 (14,591) (14,591)

At 26 July 2015 2,387 143,294 2,044 (31,979) (2,182) 109,329 222,893

---------------------- ----- --------- --------- ------------ --------- ------------- ---------- ---------

The balance classified as share capital represents

proceeds arising on issue of the company's equity

share capital, comprising 2p ordinary shares and

the cancellation of shares repurchased by the company.

The capital redemption reserve increased owing to

the purchase of a number of shares in the period.

Shares acquired in relation to the employee Share

Incentive Plan and the 2005 Deferred Bonus Scheme

are held in trust, until such time as the awards

vest. At 26 July 2015, the number of shares held

in trust was 4,063,604 (2014: 4,174,284), with a

nominal value of GBP81,272 (2014: GBP83,486) and

a market value of GBP28,993,815 (2014: 30,597,502)

and are included in retained earnings.

Hedging gain/loss arises from the movement of fair

value in the company's financial derivative instruments.

As at 26 July 2015, the company had distributable

reserves of GBP75.2m (2014: GBP79.4m).

Notes to the financial statements

1 Accounting policies and basis of preparation

The preliminary announcement for the 52-week period ended 26

July 2015 has been prepared in accordance with the accounting

policies as disclosed in J D Wetherspoon plc's annual report and

accounts for 2014.

The annual financial information presented in this preliminary

announcement for the 52-week period ended 26 July 2015 is based on,

and is consistent with, that in the company's audited financial

statements for the 52-week period ended 26 July 2015, and those

financial statements will be delivered to the Registrar of

Companies, following the company's annual general meeting. The

independent auditors' report on those financial statements is

unqualified and does not contain any statement under section 498

(2) or 498 (3) of the Companies Act 2006.

Information in this preliminary announcement does not constitute

statutory accounts of the company within the meaning of section 434

of the Companies Act 2006. The full financial statements for the

company for the 52-week period ended 27 July 2014 have been

delivered to the Registrar of Companies. The independent auditors'

report on those financial statements was unqualified and did not

contain a statement under section 498 (2) or 498 (3) of the

Companies Act 2006.

2 Revenue

Revenue disclosed in the income statement is analysed as

follows:

52 weeks 52 weeks

ended ended

26 July 27 July

2015 2014

GBP000 GBP000

--------------------------------- ---------- ----------

Sales of food, beverages, hotel

rooms and machine income 1,513,923 1,409,333

--------------------------------- ---------- ----------

3 Operating profit - analysis of costs by nature

This is stated after charging/(crediting):

52 weeks 52 weeks

ended ended

26 July 27 July

2015 2014

GBP000 GBP000

--------------------------------------- --------- ---------

Concession rental payments 19,300 17,166

Minimum operating lease payments 52,658 52,538

Repairs and maintenance 53,354 56,603

Net rent receivable (1,334) (845)

Depreciation of property, plant

and equipment (note 13) 61,458 54,459

Amortisation of intangible assets

(note 14) 4,775 3,254

Amortisation of other non-current

assets (note 16) 373 321

Depreciation of investment properties

(note 15) 62 41

Share-based payments (note 6) 8,907 7,521

Auditors' remuneration

Fees payable for the audit of the

financial statements

Fees payable for other services: 177 161

- assurance services 30 30

- non-audit services 13 -

--------------------------------------- --------- ---------

Total auditors' fees 220 191

--------------------------------------- --------- ---------

Analysis of continuing operations 52 weeks 52 weeks

ended ended

26 July 27 July

2015 2014

GBP000 GBP000

------------------------------------- ------------ ------------

Revenue 1,513,923 1,409,333

Cost of sales (1,347,361) (1,241,584)

Gross profit 166,562 167,749

Administration costs (54,054) (50,745)

Operating profit before exceptional

items 112,508 117,004

Exceptional items (note 5) (6,013) -

Operating profit after exceptional

items 106,495 117,004

------------------------------------- ------------ ------------

Included within cost of sales is GBP578.0m (2014: GBP531.2m)

related to cost of inventory recognised as expense.

4 Property gains and losses

52 weeks 52 weeks 52 weeks 52 weeks 52 weeks 52 weeks

ended ended ended ended ended ended

26 July 26 July 26 July 27 July 27 July 27 July

2015 2015 2015 2014 2014 2014

Before Exceptional After Before Exceptional After

exceptional items exceptional exceptional items exceptional

items (note items items (note items

4) 4)

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------------------- ------------- ------------ ------------- ------------- ------------ -------------

Loss on disposal

(MORE TO FOLLOW) Dow Jones Newswires

September 11, 2015 02:00 ET (06:00 GMT)

of fixed assets 694 - 694 645 - 645

Impairment of

property, plant

and equipment

(note 13) - 10,705 10,705 1,192 - 1,192

Impairment of

other assets

(note 16) - 490 490 (180) - (180)

Onerous lease

provision / (reversals) - 1,858 1,858 (228) - (228)

Total property

(gains) / losses 694 13,053 13,747 1,429 - 1,429

-------------------------- ------------- ------------ ------------- ------------- ------------ -------------

Impairment charges and onerous lease provisions were considered

exceptional in the current year and not in the prior year, owing to

the magnitude of the current year charge. Please refer to note 4

for further details on exceptional items.

5 Exceptional items

52 weeks ended 52 weeks

26 July 2015 ended

GBP000 27 July

2014

GBP000

------------------------------------- --------------- ---------

Operating exceptional items

Inventory valuation 5,231 -

Restructuring costs 782 -

------------------------------------- --------------- ---------

6,013 -

Exceptional property losses

Onerous lease provision 1,858 -

Property impairment 11,195 -

13,053 -

Other exceptional items

Interest payable on gaming machine

VAT repayment - 997

Income tax expense - current

tax - (4,375)

Exceptional tax items - deferred

tax (4,809) 21,119

Tax effect on operating exceptional (1,626) -

items

(6,435) 17,741

Total exceptional items 12,631 17,741

------------------------------------- --------------- ---------

During the year, the company changed the method used for

calculating the consumption of non-consumable inventories.

Non-consumable inventory comprises items like glassware, plates,

cutlery and cleaning products used in the pubs and hotels. The

company has taken a more prudent view on recognition of

non-consumable inventories as expenses. The change in the

accounting policy for the expected life of those inventories

resulted in an exceptional charge of GBP5,231,000 (2014: GBPNil).

The effect of this change was not presented as a prior-year

adjustment, as management did not believe that previously reported

results were materially affected and the treatment adopted provides

full information.

In the table above, property impairment relates to the situation

in which, owing to poor trading performance, pubs are unlikely to

generate sufficient cash in the future to justify their current

book value.

The onerous lease provision relates to pubs for which future

trading profits, or income from subleases, are not expected to

cover the rent. The provision takes several factors into account,

including the expected future profitability of the pub, but also

the amount estimated as payable on surrender of the lease, where

this is a possible outcome. In the year, GBP1,858,000 (2014:

GBPNil) was charged in respect of onerous leases.

In the year, an exceptional charge of GBP11,195,000 (2014:

GBPNil) was incurred in respect of the impairment of property,

plant and equipment, as required under IAS 36. This comprises an

impairment charge of GBP12,383,000 (2014: GBPNil), offset by

impairment reversals of GBP1,188,000 (2014: GBPNil).

A reduction in the deferred tax liability on rolled-over gains

for differences between the tax-deductible cost and the residual

value of the reinvestment assets has resulted in a credit of

GBP4,809,000. Owing to the magnitude of the reduction and the fact

that it relates to prior periods it was considered exceptional.

6 Employee benefits expenses

52 weeks 52 weeks

ended ended

26 July 27 July

2015 2014

GBP000 GBP000

----------------------- --------- ---------

Wages and salaries 406,821 368,335

Social Security costs 25,291 24,008

Other pension costs 3,500 3,213

Share-based payments 8,907 7,521

----------------------- --------- ---------

444,519 403,077

----------------------- --------- ---------

Directors' emoluments 2015 2014

GBP000 GBP000

----------------------------------------- -------- --------

Aggregate emoluments 1,438 1,623

Aggregate amount receivable under

long-term incentive schemes 971 346

Company contributions to money purchase

pension scheme 97 113

----------------------------------------- -------- --------

2,506 2,082

----------------------------------------- -------- --------

For further information of directors' emoluments, please see the

directors' remuneration report on pages 52 to 60.

The totals below relate to the monthly average number of

employees during the year, not the total number of employees at the

end of the year (including directors on a service contract).

2015 2014

Number Number

---------------------------- ------- -------

Full-time equivalents

Managerial/administration 4,233 4,419

Hourly paid staff 17,885 16,911

---------------------------- ------- -------

22,118 21,330

---------------------------- ------- -------

2015 2014

Number Number

---------------------------- ------- -------

Total employees

Managerial/administration 4,690 4,419

Hourly paid staff 30,041 28,216

---------------------------- ------- -------

34,731 32,635

---------------------------- ------- -------

For details of the Share Incentive Plan and the 2005 Deferred

Bonus Scheme, refer to the remuneration report on pages 52 to

60.

The shares awarded as part of the above schemes are based on the

cash value of the bonuses at the date of the awards. These awards

vest over three years - with their cost spread equally over their

three-year life. The share-based payment charge above represents

the annual cost of bonuses awarded over the past three years.

The company operates two share-based compensation plans. In both

schemes, the fair values of the shares granted are determined by

reference to the share price at the date of the award. The shares

vest at a nil exercise price and there are no market-based

conditions to the shares which affect their ability to vest.

7 Finance income and costs

52 weeks 52 weeks

ended ended

26 July 27 July

2015 2014

GBP000 GBP000

----------------------------------------------- --------- ---------

Finance costs

Interest payable on bank loans and overdrafts 17,202 14,290

Amortisation of bank loan issue costs 2,942 2,320

Interest payable on swaps 13,812 19,300

Interest payable on obligations under

finance leases 240 370

----------------------------------------------- --------- ---------

Total pre-exceptional finance costs 34,196 36,280

Bank interest receivable (180) (67)

----------------------------------------------- --------- ---------

Total pre-exceptional finance income (180) (67)

----------------------------------------------- --------- ---------

Exceptional interest charge (note 5) - 997

----------------------------------------------- --------- ---------

Net finance costs 34,016 37,210

----------------------------------------------- --------- ---------

The net finance costs during the year decreased from GBP37.2m to

GBP34.0m. The finance costs in the income statement were covered

3.3 times (2014: 3.2 times), on a pre-exceptional basis.

8 Income tax expense

(a) Tax on profit on ordinary activities

(MORE TO FOLLOW) Dow Jones Newswires

September 11, 2015 02:00 ET (06:00 GMT)

The standard rate of corporation tax in the UK changed from

21.0% to 20.0%, with effect from 1 April 2015. Accordingly, the

company's profits for this accounting period are taxed at an

effective rate of 20.7% (2014: 22.3%).

52 weeks 52 weeks 52 weeks 52 weeks 52 weeks 52 weeks

ended ended ended ended ended ended

26 July 26 July 26 July 27 July 27 July 27 July

2015 2015 2015 2014 2014 2014

Before Exceptional After Before Exceptional After

exceptional items exceptional exceptional items exceptional

items (note items items (note items

4) 4)

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------ ------------- ------------ ------------- ------------- ------------ -------------

Current income

tax:

Current income

tax charge 19,885 (1,626) 18,259 17,004 (4,375) 12,629

Adjustment in respect

of prior period 1,659 - 1,659 - - -

Total current income

tax 21,544 (1,626) 19,918 17,004 (4,375) 12,629

Deferred tax:

Origination and

reversal of temporary

differences 113 - 113 3,495 21,119 24,614

Adjustment in respect

of prior period (1,314) (4,809) (6,123) - - -

Impact of change - - - - - -

in UK tax rate

------------------------ ------------- ------------ ------------- ------------- ------------ -------------

Total deferred

tax (1,201) (4,809) (6,010) 3,495 21,119 24,614

------------------------ ------------- ------------ ------------- ------------- ------------ -------------

Tax charge in the

income statement 20,343 (6,435) 13,908 20,499 16,744 37,243

------------------------ ------------- ------------ ------------- ------------- ------------ -------------

Tax relating to items charged or credited through equity

Tax on share based

payment

Current tax (446) - (446) - - -

Deferred tax 95 - 95 663 - 663

------------------------ ------------- ------------ ------------- ------------- ------------ -------------

(351) - (351) 663 - 663

Current tax charge

on interest-rate

swaps (1,961) - (1,961) 2,776 - 2,776

Tax charge taken

through equity (2,312) - (2,312) 3,439 - 3,439

------------------------ ------------- ------------ ------------- ------------- ------------ -------------

(b) Reconciliation of the total tax charge

The tax expense after exceptional items in the income statement

for the year is higher (2014: lower) than the standard rate of

corporation tax in the UK of 20.7% (2014: 22.3%), owing largely to

less expenditure qualifying for capital allowances. The differences

are reconciled below:

52 weeks 52 weeks 52 weeks 52 weeks

ended ended ended ended

26 July 26 July 28 July 28 July

2015 2015 2014 2014

Before After Before After

exceptional exceptional exceptional exceptional

items items items items

GBP000 GBP000 GBP000 GBP000

----------------------------------- ------------- ------------- ------------- -------------

Profit before income tax 77,798 58,732 79,362 78,365

Profit multiplied by the UK

standard rate of corporation

tax of 20.7% (2014: 22.3%) 16,078 12,138 17,722 17,499

Abortive acquisition costs

and disposals 163 163 78 78

Other disallowables 155 2,469 186 409

Other allowable deductions (33) (33) (334) (334)

Non-qualifying depreciation 3,577 3,577 3,654 3,654

Deduction for shares and SIPs 29 29 (69) (69)

Re-measurement of other balance

sheet items (342) (342) (331) (331)

Effect of different tax rates

and unrecognised losses in

overseas companies 302 302 - -

Adjust opening and closing

deferred tax to average of

20.67% 69 69 - -

Prior period adjustment -

current tax 1,659 1,659 - (4,375)

Prior period adjustment -

deferred tax (1,314) (6,123) - 21,119

Adjustment to deferred tax

in respect of change in tax

rate - - (407) (407)

----------------------------------- ------------- ------------- ------------- -------------

Total tax expense reported

in the income statement 20,343 13,908 20,499 37,243

----------------------------------- ------------- ------------- ------------- -------------

(c) Deferred tax

The deferred tax in the balance sheet is as follows:

Deferred tax liabilities Accelerated Other temporary

tax depreciation differences Total

GBP000 GBP000 GBP000

----------------------------- ------------------ ---------------- --------

At 27 July 2014 79,306 6,766 86,072

Prior year movement posted

to the income statement (1,515) (4,813) (6,328)

Movement during year posted

to the income statement 304 (25) 279

----------------------------- ------------------ ---------------- --------

At 26 July 2015 78,095 1,928 80,023

----------------------------- ------------------ ---------------- --------

Deferred tax assets Share- Capital Interest-rate Total

based losses swaps

payments carried

forward

GBP000 GBP000 GBP000 GBP000

----------------------------- ---------- --------- -------------- -------

At 27 July 2014 928 1,458 6,033 8,419

Movement during year posted

to the income statement 166 - - 166

Prior year movement posted

to the income statement - (205) - (205)

Taken through equity (95) - 1,961 1,866

----------------------------- ---------- --------- -------------- -------

At 26 July 2015 999 1,253 7,994 10,246

----------------------------- ---------- --------- -------------- -------

The Finance Bill 2015 included legislation to reduce

the main rate of corporation tax to 19% for the financial

years beginning 1 April 2017, 1 April 2018 and 1

April 2019, and at 18% for the financial year beginning

1 April 2020. These changes had not been substantively

enacted at the balance sheet date and consequently

are not included in these financial statements. The

effect of these proposed reductions would be to reduce

the net deferred tax liability to GBP65.8m at 19%

and GBP62.4m at 18%.

(MORE TO FOLLOW) Dow Jones Newswires

September 11, 2015 02:00 ET (06:00 GMT)

Deferred tax assets and liabilities have been offset as

follows:

2015 2014

GBP000 GBP000

----------------------------- -------- --------

Deferred tax liabilities 80,023 86,072

Offset against deferred tax

assets (2,252) (2,386)

----------------------------- -------- --------

Deferred tax liability 77,771 83,686

----------------------------- -------- --------

Deferred tax assets 10,246 8,419

Offset against deferred tax

liabilities (2,252) (2,386)

----------------------------- -------- --------

Deferred tax asset 7,994 6,033

----------------------------- -------- --------

9 Earnings and cash flow per share

Earnings per share are based on the weighted average number of

shares in issue of 122,269,948 (2014: 125,312,581), including those

held in trust in respect of employee share schemes. Earnings per

share, calculated on this basis, are usually referred to as

'diluted', since all of the shares in issue are included.

Accounting standards refer to 'basic earnings' per share, these

exclude those shares held in trust in respect of employee share

schemes.

52 weeks 52 weeks

ended ended

Weighted average number 26 July 27 July

of shares 2015 2014

---------------------------------- ------------ ------------

Shares in issue (used

for diluted EPS) 122,269,948 125,312,581

Shares held in trust (4,063,604) (4,174,284)

----------------------------------- ------------ ------------

Shares in issue less shares held

in trust (used for basic EPS) 118,206,344 121,138,297

----------------------------------- ------------ ------------

The weighted average number of shares held in trust for employee

share schemes has been adjusted to exclude those shares which have

vested, but which remain in the trust.

52 weeks ended 26 July Profit Basic EPS Diluted

2015 GBP000 pence per EPS pence

ordinary per ordinary

share share

------------------------------- -------- ----------- --------------

Earnings (profit after

tax) 44,824 37.9 36.7

Exclude effect of exceptional

items after tax 12,631 10.7 10.3

------------------------------- -------- ----------- --------------

Adjusted earnings before

exceptional items 57,455 48.6 47.0

------------------------------- -------- ----------- --------------

52 weeks ended 27 July Profit Basic EPS Diluted

2014 pence per EPS pence

ordinary per ordinary

share share

----------- --------------

GBP000

------------------------------- ------- ----------- --------------

Earnings (profit after

tax) 41,122 33.9 32.8

Exclude effect of exceptional

items after tax 17,741 14.7 14.2

------------------------------- ------- ----------- --------------

Adjusted earnings before

exceptional items 58,863 48.6 47.0

------------------------------- ------- ----------- --------------

Free cash flow per share

The calculation of free cash flow per share is based on the net

cash generated by business activities and available for investment

in new pub developments and extensions to current pubs, after

funding interest, corporation tax, all other reinvestment in pubs

open at the start of the period and the purchase of own shares

under the employee Share Incentive Plan ('free cash flow'). It is

calculated before taking account of proceeds from property

disposals, inflows and outflows of financing from outside sources

and dividend payments and is based on the weighted average number

of shares in issue, including those held in trust in respect of the

employee share schemes.

Free cash flow per share 52 weeks 52 weeks

ended ended

26 July 27 July

2015 2014

------------------------------ --------- ---------

Free cash flow (GBP000) 109,777 92,850

Free cash flow per share (p) 89.8 74.1

10 Cash generated from operations

52 weeks 52 weeks

ended ended

26 July 27 July

2015 2014

GBP000 GBP000

-------- --------------

Profit for the year 44,824 41,122

Adjusted for:

Tax 13,908 37,243

Net impairment charge 11,195 1,012

Net onerous lease provision 1,858 (228)

Loss on disposal of property, plant

and equipment 694 645

Depreciation of property, plant and

equipment 61,458 54,459

Amortisation of intangible assets 4,775 3,254

Amortisation of other non-current assets 373 321

Depreciation on investment properties 62 41

Aborted properties costs 787 339

Share-based charges 8,907 7,521

Interest receivable (180) (67)

Amortisation of bank loan issue costs 2,942 2,320

Interest payable 31,254 33,960

Exceptional interest - 997

182,857 182,939

Change in inventories 2,861 (2,455)

Change in receivables (2,937) 39

Change in payables 27,400 31,982

------------------------------------------- -------- --------------

Cash flow from operating activities 210,181 212,505

------------------------------------------- -------- --------------

11 Analysis of changes in net debt

At 27 Cash Non-cash At 26 July

July flows movement 2015

2014 GBP000 GBP000

GBP000 GBP000

------------------------------ ---------- --------- ---------- -----------

Cash in hand 32,315 (140) - 32,175

Finance lease creditor

- due in one year (2,636) 2,648 (2,063) (2,051)

Bank loans - due after

one year (584,167) (44,123) (2,942) (631,232)

Finance lease creditor

- due after one year (2,063) - 2,063 -

---------- --------- ---------- -----------

(586,230) (44,123) (879) (631,232)

Net borrowings (556,551) (41,615) (2,942) (601,108)

------------------------------ ---------- --------- ---------- -----------

Interest-rate swap asset

- due after one year 1,723 - (1,723) -

Interest-rate swap liability

- due after one year (28,740) - (11,233) (39,973)

---------- --------- ---------- -----------

(27,017) - (12,956) (39,973)

Interest-rate swaps -

due before one year (3,149) - 3,149 -

Total derivatives (30,166) - (9,807) (39,973)

------------------------------ ---------- --------- ---------- -----------

Net debt (586,717) (41,615) (12,749) (641,081)

------------------------------ ---------- --------- ---------- -----------

Non-cash movements

The non-cash movement in bank loans due after one year relates

to the amortisation of bank loan issue costs.

The movement in interest-rate swaps of GBP9.8m relates to the

change in the 'mark to market' valuations for the year.

(MORE TO FOLLOW) Dow Jones Newswires

September 11, 2015 02:00 ET (06:00 GMT)

12 Dividends paid and proposed

52 weeks 52 weeks

ended ended

26 July 27 July

2015 2014

GBP000 GBP000

--------------------------------------- --------- ---------

Declared and paid during the year:

Dividends on ordinary shares:

- final for 2012/13: 8.0p (2011/12:

8.0p) - 9,987

- interim for 2013/14: 4.0p (2012/13:

4.0p) - 4,962

- final for 2013/14: 8.0p (2012/13: 9,761 -

8.0p)

- interim for 2014/15: 4.0p (2013/14: 4,830 -

4.0p)

Dividends paid 14,591 14,949

--------------------------------------- --------- ---------

Proposed for approval by shareholders

at the AGM:

- final dividend for 2014/15: 8.0p

(2013/14: 8.0p) 9,782 9,751

--------------------------------------- --------- ---------

Dividend cover (times) 3.1 2.8

--------------------------------------- --------- ---------

As detailed in the interim accounts, the board declared

and paid an interim dividend of 4.0p for the financial

year ended 26 July 2015. Dividend cover is calculated

as profit after tax and exceptional items over dividend

paid.

13 Property, plant and equipment

Freehold Short- Equipment, Assets Total

and long- leasehold fixtures under

leasehold property and fittings construction

property

GBP000 GBP000 GBP000 GBP000 GBP000

-------------------------- ----------- ----------- -------------- -------------- ----------

Cost:

At 28 July 2013 702,446 412,955 426,346 36,272 1,578,019

Additions 55,124 17,272 49,721 45,401 167,518

Transfers 23,574 1,995 2,620 (28,189) -

Disposals (1,316) (2,692) (4,429) - (8,437)

Reclassification 8,471 (8,471) - - -

At 27 July 2014 788,299 421,059 474,258 53,484 1,737,100

Additions 63,804 11,366 46,054 39,395 160,619

Transfers 22,383 663 7,054 (30,100) -

Exchange differences (6) (38) (114) - (158)

Transfer to held

for sale (1,532) - (482) - (2,014)

Disposals (43) (4,584) (5,989) - (10,616)

Reclassification 3,116 (3,116) - - -

-------------------------- ----------- ----------- -------------- -------------- ----------

At 26 July 2015 876,021 425,350 520,781 62,779 1,884,931

-------------------------- ----------- ----------- -------------- -------------- ----------

Accumulated depreciation

and impairment:

At 28 July 2013 141,044 183,304 296,202 541 621,091

Provided during

the period 12,196 13,352 28,911 - 54,459

Impairment loss 2,234 (1,179) 137 - 1,192

Disposals (895) (2,910) (3,904) - (7,709)

Reclassification 2,434 (2,434) - - -

At 27 July 2014 157,013 190,133 321,346 541 669,033

Provided during

the period 13,335 14,272 33,851 - 61,458

Exchange differences (1) (6) (18) - (25)

Impairment loss

(reversal) 3,589 4,838 2,278 - 10,705

Transfer to held

for sale (441) - (353) - (794)

Disposals - (4,112) (5,090) - (9,202)

Reclassification 954 (413) - (541) -

----------- ----------- -------------- -------------- ----------

At 26 July 2015 174,449 204,712 352,014 - 731,175

-------------------------- ----------- ----------- -------------- -------------- ----------

Net book amount

at 26 July 2015 701,572 220,638 168,767 62,779 1,153,756

-------------------------- ----------- ----------- -------------- -------------- ----------

Net book amount

at 27 July 2014 631,286 230,926 152,912 52,943 1,068,067

-------------------------- ----------- ----------- -------------- -------------- ----------

Net book amount

at 28 July 2013 561,402 229,651 130,144 35,731 956,928

-------------------------- ----------- ----------- -------------- -------------- ----------

Impairment of property, plant and equipment

In assessing whether a pub has been impaired, the book value of

the pub is compared with its anticipated future cash flows.

Assumptions are used about sales, costs and profit, using a pre-tax

discount rate for future years of 8% (2014: 9%).

If the value, based on future anticipated cash flows, is lower

than the book value, the difference is written off as property

impairment.

As a result of this exercise, a net impairment loss of

GBP10,705,000 (2014: GBP1,192,000) was charged to property losses

in the income statement, as described in note 4.

Management believes that a reasonable change in any of the key

assumptions, for example the discount rate applied to each pub,

could cause the carrying value of the pub to exceed its recoverable

amount, but that the change would be immaterial.

Finance leases

Certain items of IT equipment are subject to finance leases.

The carrying value of these assets, held under finance leases at

26 July 2015, included in equipment, fixtures and fittings, was as

follows:

2015 2014

GBP000 GBP000

------------------ -------- --------

Net book value 5,862 8,580

------------------ -------- --------

14 Intangible assets

GBP000

---------------------------------------------------------- -------

Cost:

At 28 July 2013 35,493

Additions 9,926