Western Digital Corp. (NASDAQ: WDC) today reported revenue of

$4.7 billion, operating income of $232 million and a net loss of

$366 million, or $1.28 per share, for its first fiscal quarter

ended Sept. 30, 2016. The GAAP net loss for the period includes

charges associated with the company’s recent acquisitions and debt

extinguishment charges related to its repricing and repayment of

outstanding debt. Excluding these charges and other non-GAAP

adjustments, first quarter non-GAAP operating income was $632

million and non-GAAP net income was $341 million, or $1.18 per

share.

In the year-ago quarter, the company reported revenue of $3.4

billion, operating income of $322 million and net income of $283

million, or $1.21 per share. Non-GAAP operating income in the

year-ago quarter was $405 million and non-GAAP net income was $366

million, or $1.56 per share.

The company generated $440 million in cash from operations

during the first fiscal quarter of 2017, ending with total cash and

cash equivalents of $4.1 billion. On Aug. 3, 2016, the company

declared a cash dividend of $0.50 per share of its common stock,

which was paid to shareholders on Oct. 17, 2016.

“We are pleased with our performance in the September quarter,

the first full quarter as an integrated company following the

SanDisk acquisition in May,” said Steve Milligan, chief executive

officer. “Demand for both hard drive and flash-based products was

strong across all customer categories, driven by cloud and mobile

applications, as well as better-than-expected PC market trends. We

are encouraged by the uniformly positive response to the new

Western Digital platform from our broadened customer base.

“The Western Digital team is executing very well against our top

business objectives, including the integrations of the legacy HGST,

SanDisk and WD operations, and our transition to next-generation

NAND technology. We are on track to achieve our synergy goals

associated with these integrations and our transition to 3D NAND

continues to progress as planned.”

The investment community conference call to discuss these

results and the company’s guidance for the second fiscal quarter

2017 will be broadcast live over the Internet today at 2 p.m.

Pacific/5 p.m. Eastern. The live and archived conference

call/webcast can be accessed online at investor.wdc.com.

Supplemental financial information, including the company’s

guidance for the second fiscal quarter 2017, will also be posted on

the same website. The telephone replay number in the U.S. is

1-(855) 859-2056 or +1-(404) 537-3406 for international callers.

The required passcode is 87154641.

About Western Digital

Western Digital is an industry-leading provider of storage

technologies and solutions that enable people to create, leverage,

experience and preserve data. The company addresses ever-changing

market needs by providing a full portfolio of compelling,

high-quality storage solutions with customer-focused innovation,

high efficiency, flexibility and speed. Our products are marketed

under the HGST, SanDisk and WD brands to OEMs, distributors,

resellers, cloud infrastructure providers and consumers. Financial

and investor information is available on the company's Investor

Relations website at investor.wdc.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including statements concerning the company’s preliminary

financial results for its first fiscal quarter ended Sept. 30,

2016, integration activities from the company’s acquisitions;

achievement of our synergy goals associated with those

acquisitions; and our transition to 3D NAND technology. These

forward-looking statements are based on management’s current

expectations and are subject to risks and uncertainties that could

cause actual results to differ materially from those expressed or

implied in the forward-looking statements. The preliminary

financial results for the company’s first fiscal quarter ended

Sept. 30, 2016 included in this press release represent the most

current information available to management. The company’s actual

results when disclosed in its quarterly report on Form 10-Q may

differ from these preliminary results as a result of the completion

of the company’s financial closing procedures; final adjustments;

completion of the review by the company’s independent registered

accounting firm and other developments that may arise between now

and the disclosure of the final results. Other risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied in the forward-looking statements

include: volatility in global economic conditions; business

conditions and growth in the storage ecosystem; impact of

competitive products and pricing; market acceptance and cost of

commodity materials and specialized product components; actions by

competitors; unexpected advances in competing technologies; our

development and introduction of products based on new technologies

and expansion into new data storage markets; risks associated with

acquisitions, mergers and joint ventures; difficulties or delays in

manufacturing; and other risks and uncertainties listed in the

company’s filings with the Securities and Exchange Commission (the

“SEC”), including the company’s Form 10-K filed with the SEC on

Aug. 29, 2016, to which your attention is directed. You should not

place undue reliance on these forward-looking statements, which

speak only as of the date hereof, and the company undertakes no

obligation to update these forward-looking statements to reflect

new information or events.

Western Digital, WD, the HGST logo, SanDisk and G-Technology are

registered trademarks or trademarks of Western Digital Corporation

or its affiliates in the U.S. and/or other countries. Other

trademarks, registered trademarks, and/or service marks, indicated

or otherwise, are the property of their respective owners.

WESTERN DIGITAL CORPORATION CONDENSED CONSOLIDATED

BALANCE SHEETS (in millions; unaudited)

Sep. 30, July 1, 2016

2016 ASSETS Current assets: Cash and

cash equivalents $ 4,077 $ 8,151 Short-term investments 248 227

Accounts receivable, net 2,023 1,461 Inventories 2,109 2,129 Other

current assets 666 616 Total current assets 9,123

12,584 Property, plant and equipment, net 3,359 3,503 Notes

receivable and investments in Flash Ventures 1,217 1,171 Goodwill

9,967 9,951 Other intangible assets, net 4,791 5,034 Other

non-current assets 553 619 Total assets $ 29,010 $

32,862

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities: Accounts payable $ 1,946 $ 1,888

Accounts payable to related parties 190 168 Accrued expenses 983

995 Accrued compensation 552 392 Accrued warranty 170 172 Bridge

loan - 2,995 Current portion of long-term debt 78 339

Total current liabilities 3,919 6,949 Long-term debt 13,055 13,660

Other liabilities 1,261 1,108 Total liabilities

18,235 21,717 Total shareholders' equity 10,775

11,145 Total liabilities and shareholders' equity $ 29,010 $ 32,862

WESTERN DIGITAL CORPORATION CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (in millions,

except per share amounts; unaudited) Three

Months Ended Sep. 30, Oct. 2,

2016 2015 Revenue, net $

4,714 $ 3,360 Cost of revenue 3,379 2,405

Gross profit 1,335 955 Operating

expenses: Research and development 639 385 Selling, general and

administrative 396 192 Employee termination, asset impairment and

other charges 68 56 Total operating

expenses 1,103 633 Operating income 232

322 Interest and other expense, net (503 ) (8 )

Income (loss) before income taxes (271 ) 314 Income tax expense

95 31 Net income (loss) $ (366 ) $ 283

Income (loss) per common share: Basic $ (1.28 ) $

1.23 Diluted $ (1.28 ) $ 1.21 Weighted average

shares outstanding: Basic 285 231

Diluted 285 234

WESTERN DIGITAL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(in millions; unaudited)

Three Months Ended Sep. 30,

Oct. 2, 2016 2015

Operating Activities Net income (loss) $ (366 ) $ 283

Adjustments to reconcile net income (loss)

to net cash provided by operations:

Depreciation and amortization 508 236 Stock-based compensation 99

42 Deferred income taxes 147 (7 ) Loss on disposal of assets 4 -

Amortization and write-off of debt discount and issuance costs 247

1 Loss on settlement of convertible debt 5 -

Non-cash portion of employee termination,

asset impairment and other charges

- 18 Other non-cash operating activities, net 1 - Changes in

operating assets and liabilities, net (205 ) (28 )

Net cash provided by operating activities 440

545

Investing Activities Purchases of

property, plant and equipment, net (183 ) (151 ) Activity related

to Flash Ventures, net (27 ) - Investment activity, net 9 (112 )

Strategic investments and other, net (1 ) (10 ) Net

cash used in investing activities (202 ) (273 )

Financing Activities Employee stock plans, net 26 (9

) Proceeds from acquired call option 61 - Repurchases of common

stock - (60 ) Dividends paid to shareholders (142 ) (115 ) Proceeds

from debt, net of issuance costs 3,985 - Repayment of debt

(8,242 ) (31 ) Net cash used in financing activities

(4,312 ) (215 ) Net increase (decrease) in cash and cash

equivalents (4,074 ) 57 Cash and cash equivalents, beginning of

period 8,151 5,024 Cash and cash

equivalents, end of period $ 4,077 $ 5,081

WESTERN DIGITAL CORPORATION RECONCILIATION OF GAAP

TO NON-GAAP FINANCIAL MEASURES (in millions, except

per share amounts; unaudited) Three Months

Ended Sep. 30, Oct. 2, 2016

2015 Reconciliation of GAAP to Non-GAAP Operating

Income GAAP operating income $ 232 $ 322 Non-GAAP adjustments:

Amortization of acquired intangible assets 242 25 Employee

termination, asset impairment and other charges 68 56

Acquisition-related charges 27 - Charges related to cost saving

initiatives 63 - Other - 2 Non-GAAP operating

income $ 632 $ 405

Reconciliation of GAAP

to Non-GAAP Net Income (Loss) GAAP net income (loss) $ (366 ) $

283 Non-GAAP adjustments: Amortization of acquired intangible

assets 242 25 Employee termination, asset impairment and other

charges 68 56 Acquisition-related charges 27 - Charges related to

cost saving initiatives 63 - Convertible debt activity, net 5 -

Debt extinguishment costs 267 - Other 4 2 Income tax adjustments

31 - Non-GAAP net income $ 341 $ 366

Diluted net income (loss) per common share: GAAP $ (1.28 ) $

1.21 Non-GAAP $ 1.18 $ 1.56 Diluted weighted average

shares outstanding: GAAP 285 234 Non-GAAP

290 234

To supplement the condensed consolidated financial statements

presented in accordance with U.S. generally accepted accounting

principles (“GAAP”), the table above sets forth Non-GAAP operating

income, non-GAAP net income and non-GAAP diluted net income per

common share (“Non-GAAP measures”). These Non-GAAP measures are not

in accordance with, or an alternative for, measures prepared in

accordance with GAAP and may be different from Non-GAAP measures

used by other companies. Western Digital Corporation believes the

presentation of these Non-GAAP measures, when shown in conjunction

with the corresponding GAAP measures, provides useful information

to investors for measuring the Company’s earnings performance and

comparing it against prior periods.

Non-GAAP operating income, non-GAAP net income and non-GAAP

diluted net income per common share are Non-GAAP measures defined

as operating income, net income and diluted net income per common

share, respectively, before any charges that may not be indicative

of ongoing operations, or any tax impact related to those charges.

These Non-GAAP measures exclude: amortization of acquired

intangible assets; employee termination, asset impairment and other

charges; convertible debt activity, net; charges related to cost

saving initiatives; acquisition-related charges; debt

extinguishments; other charges; and income tax adjustments.

As described above, we exclude the following items from our

Non-GAAP measures:

Amortization of acquired intangible

assets. We incur expenses from the amortization of acquired

intangible assets over their economic lives. Such charges are

significantly impacted by the timing and magnitude of our

acquisitions and any related impairment charges.

Employee termination, asset impairment and

other charges. From time-to-time, in order to realign our

operations with anticipated market demand or to achieve cost

synergies from the integration of acquisitions, we may terminate

employees and/or restructure our operations. From time-to-time, we

may also incur charges from the impairment of intangible assets and

other long-lived assets. These charges (including any reversals of

charges recorded in prior periods) are inconsistent in amount and

frequency and are not indicative of the underlying performance of

our business.

Acquisition-related charges. In

connection with our business combinations, we incur expenses which

we would not have otherwise incurred as part of our business

operations. These expenses include third-party professional service

and legal fees, third-party integration services, severance costs,

non-cash adjustments to the fair value of acquired inventory,

contract termination costs, and retention bonuses. We may also

experience other accounting impacts in connection with these

transactions. These charges and impacts are related to

acquisitions, are inconsistent in amount and frequency, and are not

indicative of the underlying performance of our business.

Charges related to cost saving

initiatives. In connection with the transformation of our

business, we have incurred charges related to cost saving

initiatives which do not qualify for special accounting treatment

as exit or disposal activities. These charges, which are not

indicative of the underlying performance of our business, primarily

relate to costs associated with rationalizing our channel partners

or vendors, transforming our information systems infrastructure,

integrating our product roadmap, and accelerated depreciation on

assets.

Convertible debt activity, net. We

exclude non-cash economic interest expense associated with the

convertible senior notes, the gains and losses on the conversion of

the convertible senior notes and call option, and unrealized gains

and losses related to the change in fair value of the exercise

option and call option. These charges and gains and losses do not

reflect our cash operating results and are not indicative of the

underlying performance of our business.

Debt extinguishment costs. From

time-to-time, we replace our existing debt with new financing at

more favorable interest rates or utilize available capital to

settle debt early, both of which generate interest savings in

future periods. We incur debt extinguishment charges consisting of

the costs to call the existing debt and/or the write-off of any

related unamortized debt issuance costs. These gains and losses

related to our debt activity occur infrequently and are not

indicative of the underlying performance of our business.

Other charges. From time-to-time,

we sell investments or other assets which are not considered

strategic or necessary to our business; are a party to legal or

arbitration proceedings, which could result in an expense or

benefit due to settlements, final judgments, or accruals for loss

contingencies; or incur other charges or gains which are not a part

of the ongoing operation of our business. The resulting expense or

benefit is inconsistent in amount and frequency.

Income tax adjustments. Income tax

adjustments reflect the difference between income taxes based on a

forecasted annual non-GAAP tax rate and a forecasted annual GAAP

tax rate as a result of the timing of certain non-GAAP pre-tax

adjustments.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161026006770/en/

Western Digital Corp.Media Contact:Jim

Pascoe408.717.6999jim.pascoe@wdc.comorInvestor Contact:Bob

Blair949.672.7834robert.blair@wdc.com

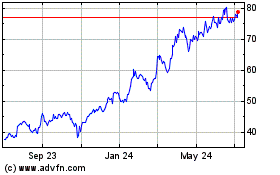

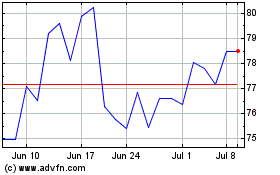

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Apr 2023 to Apr 2024