Wesfarmers Plans New Debt Facility to Fund Homebase Deal

January 17 2016 - 6:15PM

Dow Jones News

By David Winning

SYDNEY--Coal-to-supermarkets conglomerate Wesfarmers Ltd.

(WES.AU) said Monday it would fund the purchase of the Homebase

home-improvement chain in the U.K. with new loans denominated in

British pounds, a move that could prompt changes to the outlook

accompanying its credit ratings.

Wesfarmers has agreed to a deal worth 340 million British pounds

(A$705 million) to buy Homebase from U.K.-listed Home Retail PLC

(HOME.LN). The move marks a major push into overseas markets, with

management planning to rebrand Homebase as Bunnings to bring it

into line with its Australian DIY business.

In a statement, Wesfarmers said it had updated Standard &

Poor's and Moody's Investors Service about the transaction and its

plans to use debt denominated in British pounds.

"Whilst no change is expected to the group's existing credit

ratings (A- and A3 level respectively), the anticipated short-term

impact on credit metrics may result in a change to the group's

outlook," Wesfarmers said.

Wesfarmers hopes to complete the deal by the end of March. It

requires approval from Home Retail shareholders and its banking

syndicate.

-Write to David Winning at david.winning@wsj.com

(END) Dow Jones Newswires

January 17, 2016 18:00 ET (23:00 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

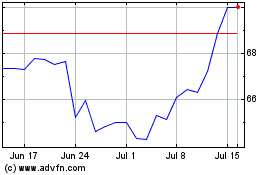

Wesfarmers (ASX:WES)

Historical Stock Chart

From Mar 2024 to Apr 2024

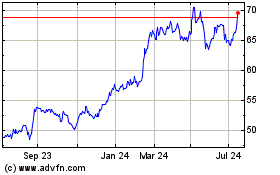

Wesfarmers (ASX:WES)

Historical Stock Chart

From Apr 2023 to Apr 2024