Wendy's Profit, Revenue Top Expectations -- Update

February 09 2016 - 9:25AM

Dow Jones News

By Joshua Jamerson

Wendy's Co. reported fourth-quarter profit that beat

expectations as it continues to see benefits from operating fewer

of its restaurants itself.

The company also said it expects same-restaurant sales growth

for the current year above what analysts were expecting.

Wendy's said it sees same-store sales growth in 2016 of about 3%

in North America, above the projection of 2.5% by analysts surveyed

by Consensus Metrix. The company also projected adjusted per-share

earnings between 35 cents and 37 cents, in-line with the consensus

view of 36 cents by analysts polled by Thomson Reuters.

Like many other restaurant chains, including McDonald's Corp.

and Burger King, a unit of Restaurant Brands International Inc.,

Wendy's has sought a more stable cash flow and higher profits by

selling its company-owned restaurants to franchisees. Wendy's cited

its reduced ownership of restaurants as a reason for its higher

results in the quarter, and said it plans to sell about 315 more

restaurants during 2016.

Wendy's said same-restaurant sales at North American restaurants

rose 4.8% in the quarter and 4.9% at its franchise-operated

locations. The Consensus Metrix projection was for 3.1% growth at

franchised restaurants.

Wendy's had moved from having 78% of its restaurants owned by

franchisees to 85%, and plans to have 95% of its restaurants

franchised this year.

The company also said its leadership succession plan was

proceeding as planned. Chief Executive Emil Brolick plans to retire

in May, with Chief Financial Officer Todd Penegor stepping into the

role. The company is conducting an external search for a new

finance chief to replace Mr. Penegor.

Over all, Wendy's posted earnings of $85.9 million, or 31 cents

a share, compared with a year-earlier profit of $23.3 million, or 6

cents a share. Excluding certain items, earnings from continuing

operations were 12 cents a share, up from 8 cents a year ago.

Analysts, on average, had expected 11 cents a share, according

to Thomson Reuters.

Revenue slipped 4.7% to $464.4 million, largely because of the

ownership of 363 fewer company-operated restaurants in the period.

Analysts had forecast $456 million in revenue.

Rival McDonald's, whose turnaround has shown progress recently,

found success with its all-day breakfast menu in its most

recently-ended quarter. The company in January reported

better-than-expected earnings and same-store sales, buoyed by the

breakfast initiative.

As McDonald's hit its stride with all-day breakfast, Wendy's,

which had struggled to find a value offering that would appeal to

customers, has seen its results helped in recent quarters by its "4

for $4" deal, which includes a Jr. Bacon Cheeseburger, chicken

nuggets, fries and drink.

The company has said the deal is driving customers to its

restaurants and that it has been very profitable.

Wendy's, which reported that it repurchased nearly 100 million

of its shares for $1.1 billion in 2015, said it expects to file its

audited results by March 3.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

February 09, 2016 09:10 ET (14:10 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

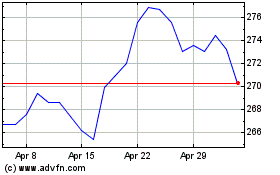

McDonalds (NYSE:MCD)

Historical Stock Chart

From Mar 2024 to Apr 2024

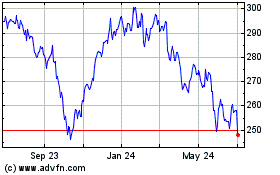

McDonalds (NYSE:MCD)

Historical Stock Chart

From Apr 2023 to Apr 2024