Web Travel Prepares for Long Road -- WSJ

August 10 2017 - 3:02AM

Dow Jones News

By Chris Kirkham

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 10, 2017).

Shares of Priceline Group Inc. fell Wednesday after the online

travel company cut forecasts for growth in hotel bookings.

TripAdvisor Inc. shares initially swooned after that company,

too, said revenue growth would slow, but rebounded by the end of

the trading day.

The reasons behind the reduced forecasts were very different for

the two companies as are the long-term implications, according to

analysts.

TripAdvisor was briefly down more than 4% and Priceline Group

fell by nearly 8% in midday trading. Priceline closed 6.9% lower

and TripAdvisor rose 2.5% on Wednesday.

Both companies make money in online travel, but TripAdvisor is

largely reliant on online advertising revenue associated with its

hotel listings and reviews. Priceline makes money through customers

booking on its sites.

TripAdvisor's revenue per hotel shopper was down 2% from a year

earlier, according to its earnings release Tuesday, and the company

cut revenue-growth expectations for the year. Executives pointed to

a faster-than-expected shift toward mobile devices, where

advertising generates less revenue than on desktop and laptop

computers.

Priceline Group is projecting slower growth in gross bookings

for the third quarter, about 9% to 14%, which compares to 15% to

20% growth for the same quarter last year. The decline Wednesday

was the largest for the company's shares in more than a year.

Analysts said Priceline's dip is likely a one-time blip driven

by the slower growth forecast, and the company has historically

been conservative in its estimates. For TripAdvisor, however, they

see a longer-term challenge as more customers shift to mobile

devices for shopping.

"A mobile shopper monetizes at less than a third of a desktop

shopper," said Shyam Patil, an analyst with Susquehanna Financial

Group. "More of your traffic is going to a channel where you're

making less money off the eyeballs."

The company said mobile accounted for more than 40% of its hotel

shoppers last quarter, which is up from about a third a year ago.

In prepared remarks, the company said the acceleration in mobile

hotel shoppers is a short-term challenge, though it may become a

benefit in the long run as people are likely to have more

opportunities to shop online.

"On the one hand, it highlights our increasing engagement on

this strategic platform," the company said. But less revenue per

shopper "exacerbates the near-term revenue growth headwind." The

company declined to elaborate on comments it made in the earnings

call.

TripAdvisor had been trying to shift more toward a booking model

in recent years where customers would find hotels, read reviews and

book through the site. Executives earlier this year said they were

de-emphasizing the approach after it failed to meet growth

expectations.

"The solution they had clearly didn't work and now they're kind

of left without a new solution," said Mr. Patil. "They're still in

the early stages of figuring this out."

On its earnings call Wednesday, executives pointed to the

non-hotel attractions segment of its business as a bright spot.

Stephen Kaufer, TripAdvisor's president and chief executive, said

the attractions space has "the biggest short-, medium- and

long-term upside for us."

Priceline Group said it is still seeing healthy demand for

global travel. On an earnings call Tuesday, Chief Executive Glenn

Fogel said the slower growth projections were "consistent with our

long-term trends and expectation for the business given our size

now."

TripAdvisor shares are down 14% since the beginning of the year,

while Priceline is up more than 28% over the same period.

Analysts said the slower projected growth for the third quarter

compares to a particularly strong quarter a year before. Mike

Olson, an analyst with Piper Jaffray & Co., said some of the

slower growth may be because the company has reduced some of its ad

spending through third-party channels to grow more direct

business.

He doesn't expect the company's slide to be a long-term one.

"Some people will take a wait-and-see approach to how well

Priceline does with [third-quarter growth]," Mr. Olson said. "If

they're able to see upside in bookings and room night growth, then

that will show this was kind of just a blip on the radar."

Write to Chris Kirkham at chris.kirkham@wsj.com

(END) Dow Jones Newswires

August 10, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

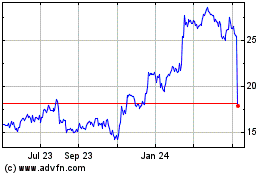

TripAdvisor (NASDAQ:TRIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

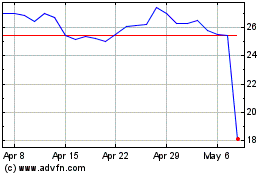

TripAdvisor (NASDAQ:TRIP)

Historical Stock Chart

From Apr 2023 to Apr 2024