Warren Buffett, a Vocal Critic of Donald Trump, Is a Big Winner in Election Rally

December 05 2016 - 7:34AM

Dow Jones News

By Nicole Friedman

Warren Buffett was one of Donald Trump's biggest critics during

the final months of the presidential campaign. Now he is one of the

biggest beneficiaries of a Trump-influenced market rally boosting

the value of everything from banks to railroads.

Mr. Buffett's Berkshire Hathaway Inc. posted its best month in

six years in November and shares are trading at all-time highs near

$240,000. The conglomerate's market capitalization, which stood at

roughly $20 million when Mr. Buffett acquired the former textile

maker in 1965, is hovering just below $400 billion.

Berkshire, which owns traditional businesses like insurers,

railroads, utilities and manufacturers, stands in the echelon of

tech giants. It is the fourth-biggest U.S. company by market

capitalization, according to FactSet, below Apple Inc., Alphabet

Inc. and Microsoft Corp. Mr. Buffett, Berkshire's chairman and

biggest shareholder, is the world's third-richest man, according to

Forbes.

U.S. stocks have risen since the presidential election on the

expectation that Mr. Trump's administration and Republican

leadership in Congress will roll back taxes and regulations. The

S&P 500 has gained 2.4% since Nov. 8 to 2191.95.

In that period, Berkshire Class A shares have risen 7.9% and B

shares are up 7.8%. Both classes of shares fell slightly Friday,

with A shares down 0.3% to $239,070 and Class B down 0.5% to

$159.39.

Mr. Buffett, a Democrat, campaigned for Hillary Clinton and

criticized Mr. Trump during the campaign. After Mr. Trump alleged

at a presidential debate that Mr. Buffett had taken a "massive"

deduction on his taxes, Mr. Buffett publicly released his personal

tax information and challenged the Republican candidate to do the

same.

Mr. Buffett didn't respond to a request for comment. In April,

he told shareholders that Berkshire would "continue to do fine" no

matter which candidate was elected president. Following the

election, Mr. Buffett told CNN that his investing decisions had

been unaffected by the election and that Mr. Trump "deserves

everybody's respect."

"The stock market will be higher 10, 20, 30 years from now," Mr.

Buffett said in a CNN interview aired Nov. 11. "It would have been

with Hillary, and it will be with Trump."

Berkshire stock is often compared with a widespread bet on the

U.S. economy. Berkshire sells electricity, furniture, cars,

newspapers and other goods through its subsidiary companies. Its

BNSF Railway Co. is one of the biggest in the U.S. Berkshire's

investment portfolio owns large stakes in financial companies

including Wells Fargo & Co. and American Express Co., and the

company recently bought shares in four major U.S. airlines. Wells

Fargo stock slid this fall due to its sales-practices scandal but

has risen alongside other banks since the election.

"There is this sense that after this surprise election, under

President Trump there will be more rapid growth than there would

have been otherwise," said Meyer Shields, managing director at

Keefe, Bruyette & Woods. "Berkshire is represented in all

elements of the economy."

Mr. Buffett built Berkshire Hathaway, originally a New England

textiles company, into a massive powerhouse over five decades

through long-term stock investments and dozens of acquisitions. One

of the company's enduring advantages has been its ability to

profitably invest "float," the cash given to the company as

insurance premiums that doesn't have to be paid out until years

later. Berkshire's insurance float stood at $91 billion at the end

of the third quarter, according to the company.

Since Mr. Buffett acquired Berkshire in 1965, its per-share

market value has posted a compounded annual gain of 21% through

2015. Class A shares are up 21% this year.

Some investors may be buying Berkshire shares postelection as a

defensive bet because Mr. Buffett's value-oriented investment

strategy can outperform during market routs, said Paul Lountzis,

president of Lountzis Asset Management LLC, which owns Berkshire

shares.

"It's a safe place to put your money. [Berkshire has] a broad

diverse set of revenues," Mr. Lountzis said. "If we would go into a

very difficult time on the equities side, Berkshire has proven

repeatedly that they are a Fort Knox."

Write to Nicole Friedman at nicole.friedman@wsj.com

(END) Dow Jones Newswires

December 05, 2016 07:19 ET (12:19 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

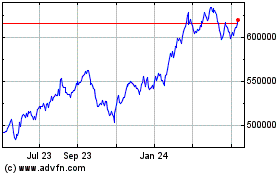

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

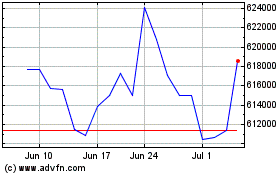

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Apr 2023 to Apr 2024