TIDMWCW

RNS Number : 2121G

Walker Crips Group plc

19 November 2015

19(th) November 2015

Walker Crips Group plc

Results for the six months ended 30 September 2015

Walker Crips Group plc ("Walker Crips", the "Company" or the

"Group"), is a financial services group with activities including

stockbroking, investment and wealth management

HIGHLIGHTS

-- Group revenues increased by 22% to GBP13.3m (2014: GBP10.9m)

-- Gross profit (net revenues) increased by 20% to GBP8.9m (2014: GBP7.4m)

-- Increase in FSCS Levy charged to income for the period to

GBP402,000 (2014 restated: GBP310,000) being a full year's cost

taken completely in the first half year under IFRIC21

-- Profit before taxation up five-fold to GBP589,000 (2014 restated: GBP115,000)

-- Interim dividend increased by 9% to 0.58p per share (2014: 0.53p per share)

-- Fee and non-broking income now 60% of total income (2014:

57%), reflecting the strategy to reduce reliance on

transaction-driven commission revenue

-- Total Assets under Management and Administration (AUMA)

increased by 22% to GBP3.9 billion (30 Sep 2014: GBP3.2 billion; 31

Mar 2015: GBP3.8 billion)

-- Discretionary and Advisory Assets under Management represent

GBP2.1 billion (30 September 2014: GBP1.6 billion), an increase of

31%

David Gelber, Chairman, Walker Crips, says:

"In my year end statement I reported that the Group had started

its new financial year strongly. I am pleased to report that this

trend has continued, despite difficult markets, and is reflected in

the significant progress we have made during the first half.

"Following its acquisition in March 2015, Barker Poland Asset

Management has made its first full contribution to our results and

we continue to increase the proportion of our revenues earned as

fees, rather than through transaction-driven commissions.

"Whilst striving to set higher regulatory standards and client

service levels, incurring increasing related costs, we continue to

drive our strategy for growth, with its focus on premium service

and integrity in all we do for clients. This will enable us to

deliver further value to shareholders through increasing dividends

as we look to the future with growing confidence."

For further information, please contact:

Four Broadgate Tel: +44 (0)20 3697 4200

Roland Cross / Gareth

David

walkercrips@fourbroadgate.com

Walker Crips Group plc Tel: +44 (0)20 3100 8000

Geri Jacks, Group Marketing

Manager

Further information on Walker Crips Group is available on the

Company's website: www.wcgplc.co.uk

Chairman's Statement

Introduction

In my year end statement I reported that the Group had started

its new financial year strongly, I am pleased to report that this

trend has continued, despite difficult markets, and is reflected in

the significant progress we have made during the first half. A rise

in Revenue of 22% to GBP13.3 million for the first half of our

current year has underpinned the strong increase in profit before

tax to GBP0.6 million, which has increased more than five-fold when

compared to the prior year.

It is also pleasing to record that, following its acquisition in

March 2015, Barker Poland Asset Management (BPAM) has made its

first full contribution to our results in line with expectations.

This has also helped to materially increase the proportion of our

revenues earned as fees, rather than through transaction-driven

commissions.

Despite an increase in administrative expenses, a material

proportion of which relate to the development and growth of

acquired businesses, the growth in revenue led to a substantially

improved profit before tax for the period, from the restated prior

period amount of GBP0.1 million to GBP0.6 million.

These results also include uncontrollable costs levied by the

Financial Services Compensation Scheme (FSCS) of GBP402,000 (2014

restated: GBP310,000) being an increase of 30% over the prior

period levy. These results include the impact of reporting the

entire annual FSCS charge in the first half of both years following

the adoption of IFRIC 21 (see Note 1)

The Board is further encouraged by growth of 31% in

Discretionary and Advisory Assets under Management over the last 12

months and of 5% over the current six month period during which the

value of the FTSE100 Index recorded a material decrease.

Trading

Gross Profit (Net Revenue) in the Period increased by 20% to

GBP8.9 million (2014: GBP7.4 million), further demonstrating the

pleasing rate of growth driven by our strategy for our Investment

and Wealth Management businesses in the last few years.

Non-broking income as a proportion of total income increased to

60% (2014: 57%) as the conversion of our client base to

discretionary or portfolio-managed mandates gathers pace, fuelled

by incoming new advisers and the fee-based revenue stream of our

latest corporate acquisition, BPAM.

Higher employment costs, particularly in revenue generating

areas, will yield correspondingly higher revenues after the

inevitable delay in transferring new clients and assets across.

Overall administrative expenses in the Period were GBP8.4 million

(2014 restated: GBP7.4 million).

After payment of the final dividend in relation to the previous

year end, at the Period end, the Group had net assets of GBP21.0

million (31 March 2015: GBP21.0 million) including net cash of

GBP6.9 million (31 March 2015: GBP6.5 million), a very strong

balance sheet from which to generate further growth in line with

the Board's Strategic Plan.

Operations

Investment Management

Discretionary and Advisory assets under management at the Period

end were GBP2.1 billion (30 September 2014: GBP1.6 billion; 31

March 2015: GBP2.0 billion). This increase over the prior year is a

clear reflection of the Company's greater emphasis on fee

generation rather than transactional brokerage. Discretionary

assets were GBP0.94 billion (30 September 2014: GBP0.57 billion)

and Advisory assets were GBP1.19 billion (30 September 2014:

GBP0.98 billion).

Revenues from the Investment Management division increased by

26% during the Period to GBP12.0 million (2014: GBP9.5 million), a

significant improvement driven primarily by additional revenue from

our acquisition BPAM and business transferred in by new investment

managers and advisers.

Against the backdrop of a continuing low interest rate

environment, our Structured Investments business has delivered a

strong performance for the first half of this year. The demand for

our award winning product range continues to be high amongst

investors seeking the balance between equity exposure and capital

preservation, a key element in our defensive range of structured

investments.

Wealth Management

Revenues and profits dipped by 10% and 34% respectively when

compared to an exceptionally good first 6 months last year at our

York-managed wealth management division. However when compared with

the 6 months to 31 March 2015, I am pleased to report an

improvement to both gross revenue (up 18.5%) and profits (up 32%).

Importantly and despite market falls, AUMA of this division (an

increasingly significant measure) has increased by 10.4% to GBP479m

(2014: GBP434m).

Dividend

An increase of 9.4% in the interim dividend to 0.58 pence per

share (2014: 0.53 pence per share) recognises the encouraging

progress being made in the Group's trading performance and the

confidence of much greater profitability in the near future. The

interim dividend will be paid on 11 December 2015 to those

shareholders on the register at the close of business on 27

November 2015.

Directors, Account Executives and Staff

I would like to thank all my fellow directors, account

executives and members of staff for their continued support. Their

professionalism, diligence and loyalty in recent years give the

Company every reason to be regarded as a special place to work, as

we now start to bear the fruits directly resulting from our

collective efforts.

Outlook

Whilst striving to set higher regulatory standards and client

service levels, incurring increasing related costs, we continue to

drive our strategy for growth, with its focus on premium service

and integrity in all we do for clients. This will enable us to

deliver further value to shareholders through increasing dividends

as we look to the future with growing confidence.

Alongside our expansion through the addition of capable

individuals who bring expertise and clients, we also continue to

evaluate target companies and businesses for suitably measured and

value-added acquisitions.

Although we remain cautious due to continued market volatility,

I am pleased to report the Group has continued trading profitably

since the Period end and that it remains in a strong financial

position.

D. M. Gelber

Chairman

19 November 2015

Walker Crips Group plc

Walker Crips Group plc

Condensed Consolidated Income Statement

For the six months ended

30 September 2015

Unaudited Unaudited Audited

Notes Six months Six months Year to

to to

30 September 30 September 31 March

2015 2014 2015

GBP'000 GBP'000 GBP'000

(restated

-note 1)

Continuing operations

Revenue 2 13,265 10,881 22,944

Commission payable (4,397) (3,507) (7,653)

------------- ------------- ---------

Gross profit 8,868 7,374 15,341

Share of after tax profit

of joint venture 6 7 13

(MORE TO FOLLOW) Dow Jones Newswires

November 19, 2015 02:00 ET (07:00 GMT)

Administrative expenses (8,372) (7,408) (15,139)

Operating profit/(loss) 502 (27) 215

Investment revenues 88 143 225

Finance costs (1) (1) (1)

Profit before tax 589 115 439

Taxation (130) (32) (182)

Profit for the period

attributable to equity

holders of the company 459 83 257

------------- ------------- ---------

Earnings per share 4

Basic 1.22p 0.22p 0.69p

Diluted 1.22p 0.22p 0.68p

Walker Crips Group plc

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 September 2015

Unaudited Unaudited Audited

Six months Six months Year to

to to

30 September 30 September 31 March

2015 2014 2015

GBP'000 GBP'000 GBP'000

(restated

-note 1)

Profit for the period 459 83 257

Other comprehensive income:

(Loss) on revaluation

of available-for-sale

investments taken to

equity - - (88)

Deferred tax on profit

on available-for-sale

investments - - 28

Total comprehensive income

for the period

attributable to equity

holders of the company 459 83 197

Walker Crips Group plc

Condensed Consolidated Statement of Financial Position

As at 30 September 2015

Unaudited Unaudited Audited

30 September 30 September 31 March

2015 2014 2015

Notes GBP'000 GBP'000 GBP'000

(restated

-note 1)

Non-current Assets

Goodwill 4,388 2,901 4,388

Other intangible

assets 6,580 1,148 6,631

Property, plant and

equipment 960 801 1,110

Investment in joint

ventures 34 34 28

Available for sale

investments 3 1,034 2,458 2,417

------------- ------------- ---------

12,996 7,342 14,574

Current Assets

Trade and other receivables 41,068 29,413 28,332

Trading Investments 1,793 2,015 2,701

Cash and cash equivalents 6,916 7,857 6,635

------------- ------------- ---------

49,777 39,285 37,668

Total assets 62,773 46,627 52,242

------------- ------------- ---------

Current liabilities

Trade and other payables (38,168) (25,238) (27,537)

Current tax liabilities (363) (355) (239)

Bank Overdrafts (6) (40) (134)

Deferred tax liabilities (740) (202) (741)

Shares to be issued (362) - (298)

------------- ------------- ---------

(39,639) (25,835) (28,949)

Net current assets 10,138 13,450 8,719

------------- ------------- ---------

Long term liability

- deferred cash consideration (1,815) - (1,930)

Long term liability

- shares to be issued (348) - (453)

Net assets 20,971 20,792 20,910

============= ============= =========

Equity

Share capital 2,551 2,515 2,545

Share premium account 2,023 1,818 1,988

Own shares (312) (312) (312)

Revaluation reserve 767 827 767

Other reserves 4,668 4,668 4,668

Retained earnings 11,274 11,276 11,254

Equity attributable

to equity holders

of the company 20,971 20,792 20,910

============= ============= =========

Walker Crips Group plc

Condensed Consolidated Statement of Cash Flows

For the six months ended 30 September 2015

Unaudited Unaudited Audited

Six months Six months Year to

to to

30 September 30 September 31 March

2015 2014 2015

GBP'000 GBP'000 GBP'000

Operating activities

Cash (used by)/generated

from operations (1,243) 953 3,806

Interest received 39 46 78

Interest paid (1) (1) (1)

Tax paid (6) - (337)

Net cash (used) by/generated

from operating activities (1,211) 998 3,546

----------------- ------------------- -------------------------

Investing activities

Purchase of property, plant

and equipment (109) (104) (565)

Purchase of intangible assets (170) (116) (765)

Net sale (purchase) of

investments held for trading 908 (345) (1,031)

Consideration paid on acquisition

of subsidiary - - (1,875)

Net sale proceeds of available

for sale investments 1,383 - -

Dividends received 47 43 42

Net cash generated from/(used

by) investing activities 2,059 (522) (4,190)

----------------- ------------------- -------------------------

Financing activities

Dividends paid (439) (762) (958)

Net cash used in financing

activities (439) (762) (958)

----------------- ------------------- -------------------------

Net increase/(decrease)

in cash and cash equivalents 409 (286) (1,602)

Net cash and cash equivalents

at the start of the period 6,501 8,103 8,103

Net Cash and cash equivalents

at the end of the period 6,910 7,817 6,501

Cash and cash equivalents 6,916 7,857 6,635

Bank overdrafts (6) (40) (134)

----------------- ------------------- -------------------------

6,910 7,817 6,501

----------------- ------------------- -------------------------

Walker Crips Group plc

Condensed Consolidated Statement Of Changes In Equity

For the six months ended 30 September 2015 (GBP000's)

Called Share Own Capital Other Revaluation Retained Total

up premium shares Redemption earnings Equity

share held

capital

Equity as at 31 March

2014 2,515 1,818 (312) 111 4,557 827 11,955 21,471

Profit for the 6

months ended 30 September

2014 (restated -note

1) - - - - - - 83 83

(MORE TO FOLLOW) Dow Jones Newswires

November 19, 2015 02:00 ET (07:00 GMT)

-------- -------- ------- ----------- ----- ----------- --------- -------

Total recognised

income and expense

for the period (restated

-note 1) - - - - - - 83 83

March 2014 final

dividend - - - - - - (392) (392)

Special final dividend - - - - - - (370) (370)

Equity as at 30 September

2014 2,515 1,818 (312) 111 4,557 827 11,276 20,792

(restated -note 1)

Revaluation of investment

at fair value - - - - - (88) - (88)

Deferred tax charge

to equity - - - - - 28 - 28

Profit for the 6

months ended 31 March

2015 - - - - - - 174 174

-------- -------- ------- ----------- ----- ----------- --------- -------

Total recognised

income and expense

for the period - - - - - (60) 174 114

September 2014 interim

dividend - - - - - - (196) (196)

Issue of shares on

acquisition of subsidiary 30 170 - - - - - 200

Equity as at 31 March

2015 2,545 1,988 (312) 111 4,557 767 11,254 20,910

Profit for the 6

months ended 30 September

2015 - - - - - - 459 459

-------- -------- ------- ----------- ----- ----------- --------- -------

Total recognised

income and expense

for the period - - - - - - 459 459

March 2015 final

dividend - - - - - - (439) (439)

Issue of shares on

acquisition of intangible

asset 6 35 - - - - - 41

Equity as at 30 September

2015 2,551 2,023 (312) 111 4,557 767 11,274 20,971

Walker Crips Group plc

Notes to the condensed consolidated financial statements

For the six months ended 30 September 2015

1. Basis of preparation and accounting policies

The Group's consolidated financial statements are prepared in

accordance with International Financial Reporting Standards as

adopted by the EU (IFRS). These condensed financial statements are

presented in accordance with IAS 34 Interim Financial

Reporting.

The condensed consolidated financial statements have been

prepared on the basis of the accounting policies and methods of

computation set out in the Group's consolidated financial

statements for the year ended 31 March 2015.

The condensed consolidated financial statements should be read

in conjunction with the Group's audited financial statements for

the year ended 31 March 2015.The interim financial information is

unaudited and does not constitute statutory accounts as defined in

section 434 of the Companies Act 2006.The Group's financial

statements for the year ended 31 March 2015 have been reported on

by the auditors and delivered to the Registrar of Companies. The

report of the auditors was unqualified and did not draw attention

to any matters by way of emphasis. They also did not contain a

statement under section 498 (2) or (3) of the Companies Act

2006.

New standards and interpretations

In the current period, the Group has adopted IFRIC 21 'Levies'.

IFRIC 21 'Levies' changes the point at which the Group recognises a

liability in respect of Financial Services Compensation Scheme

(FSCS) levies. From 1 April 2015 the Group has recognised a

liability in respect of FSCS levies from the date at which the

triggering event specified in the legislation occurs. The

triggering event for recognition of FSCS levies occurs on the 1(st)

April and requires that the cost of the levies is recognised in

full, immediately. Accordingly the comparatives have been restated

such that the full cost of the levies for the year to 31 March

2015, is recognised in the six months ended 30 September 2014. For

the six months ended 30 September 2014, profits before tax have

been reduced by GBP155,000, profits after tax reduced by

GBP122,000, trade and other receivables reduced by GBP155,000 and

current tax liabilities reduced by GBP33,000.

Going Concern

As both the net asset base and cash position remain healthy, the

directors are satisfied that the Group has sufficient resources to

continue in operation for the foreseeable future, a period of not

less than 12 months from the date of this report. Accordingly, they

also conclude in accordance with guidance from the Financial

Reporting Council, that the use of the going concern basis for the

preparation of the financial statements continues to be

appropriate.

Interests in joint ventures

The Group's share of the assets, liabilities, income and

expenses of jointly controlled entities are accounted for in the

consolidated financial statements under the equity method.

Income from the sale or use of the Group's share of the output

of jointly controlled assets, and its share of the joint venture

expenses, are recognised when it is probable that the economic

benefits associated with the transactions will flow to / from the

Group and their amount can be measured accurately.

Goodwill

Goodwill arising on consolidation represents the excess of the

cost of acquisition over the Group's interest in the fair value of

the identifiable assets and liabilities of a subsidiary or jointly

controlled entity at the date of acquisition. Goodwill is initially

recognised as an asset at cost and reviewed for impairment at least

annually. Any impairment is recognised immediately in the income

statement and is not subsequently reversed in future periods.

Intangible assets

At each period end date, the Group reviews the carrying amounts

of its intangible assets to determine whether there is any

indication that those assets have suffered an impairment loss. If

any such indication exists, the recoverable amount of the asset is

estimated in order to determine the extent of the impairment loss

(if any). Where the asset does not generate cash flows that are

independent from other assets, the Group estimates the recoverable

amount of the cash-generating unit to which the assets belong.

Deferred tax

Deferred tax is the tax expected to be payable or recoverable on

differences between the carrying amounts of assets and liabilities

in the financial statements and the corresponding tax bases used in

the computation of taxable profits, and is accounted for using the

balance sheet liability method. Deferred tax liabilities are

generally recognised for all taxable temporary differences and

deferred tax assets are recognised to the extent that is probable

that taxable profits will be available against which deductible

temporary differences can be utilised.

Principal risks and uncertainties

Under the Financial Conduct Authority's Disclosure and

Transparency Rules, the Directors are required to identify those

material risks to which the company is exposed and take appropriate

steps to mitigate those risks. The principal risks and

uncertainties faced by the Group are discussed in detail in the

Annual Report for the year ended 31 March 2015.

Related party transactions

No transactions took place in the period that would materially

or significantly affect the financial position or performance of

the group.

2. Segmental analysis

Investment Wealth Total

Management Management

Revenue (GBP'000)

6m to 30 September

2015 12,036 1,229 13,265

------------ ------------- ---------------

6m to 30 September

2014 9,514 1,367 10,881

------------ ------------- ---------------

Year to 31 March

2015 20,590 2,404 22,994

------------ ------------- ---------------

Unallocated Operating

Result (GBP'000) Costs Profit/(Loss)

6m to 30 September

2015 990 120 (608) 502

------------ ------------- ------------ ---------------

6m to 30 September

2014 (restated

-note 1) 164 247 (438) (27)

------------ ------------- ------------ ---------------

Year to 31 March

2015 931 338 (1,054) 215

------------ ------------- ------------ ---------------

3. Redemption of available for sale investments

Following the closure and liquidation of the TB Walker Crips

Income from Short Term Lending Fund (STLF), the Group's holding of

1.383m units was redeemed and repaid in full (resulting in no gain

or loss) with GBP1,383,000 being received on 7(th) September

2015.

4. Earnings per share

(MORE TO FOLLOW) Dow Jones Newswires

November 19, 2015 02:00 ET (07:00 GMT)

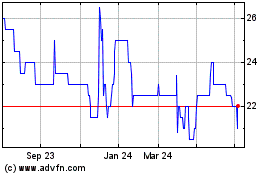

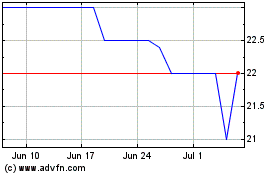

Walker Crips (LSE:WCW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Walker Crips (LSE:WCW)

Historical Stock Chart

From Apr 2023 to Apr 2024