TIDMWCW

RNS Number : 6013P

Walker Crips Group plc

18 November 2016

18(th) November 2016

Walker Crips Group plc

Results for the six months ended 30 September 2016

Walker Crips Group plc ("Walker Crips", the "Company" or the

"Group"), is a financial services group with activities including

stockbroking, investment and wealth management.

HIGHLIGHTS

-- Gross profit (net revenues) increased by 1% to GBP9.0m (2015: GBP8.9m)

-- Profit before taxation decreased by 91% to GBP53,000 (2015:

GBP589,000). Underlying profitability before one-off costs was

GBP0.3 million.

-- Total Assets under Management and Administration (AUMA)

increased by 23% to GBP4.8 billion (30 Sep 2015: GBP3.9 billion; 31

Mar 2016: GBP4.1 billion)

-- Discretionary and Advisory Assets under Management represent

GBP2.7 billion (30 September 2015: GBP2.1 billion), an increase of

29%

-- Fee and non-broking income improved to 61% of total income

(2015: 60%), reflecting the strategy to reduce reliance on

transaction-driven commission revenue

-- Interim dividend maintained at 0.58p per share (2015: 0.58p per share)

David Gelber, Chairman, Walker Crips, says:

"In my year end statement I reported that trading activity in

the opening weeks of the new financial year had been quiet and this

trend continued in difficult conditions during the first quarter,

in the run up to the Brexit vote. I am pleased to report the Group

has traded profitably since the Period end, but we remain cautious

about the short term outlook, due to continued market

uncertainty."

For further information, please contact:

Walker Crips Group plc Tel: +44 (0)20 3100 8000

Geri Jacks, Media Relations

Four Broadgate Tel: +44 (0)20 3697 4200

Roland Cross /Gareth David

walkercrips@fourbroadgate.com

Cantor Fitzgerald Europe Tel: +44 (0)20 7894 8043

Rishi Zaveri

Further information on Walker Crips Group is available on the

Company's website: www.wcgplc.co.uk

Chairman's Statement

Introduction

In my year end statement I reported that trading activity in the

opening weeks of the new financial year had been quiet and this

trend continued in difficult conditions during the run up to the

Brexit vote.

We have continued our strategy of building the systems and

controls to deliver higher client service levels and regulatory

standards. Accordingly, whilst always seeking to control expense,

we have incurred increasing related costs in our drive for growth,

with its focus on premium service and integrity in all that we do

for clients. Specifically we have invested significantly in

compliance resources and client-facing systems and will continue to

do so. This has been one of the main factors that led to Operating

Profit for the period being reduced by a sharp increase in

administrative expenses of GBP0.5 million to GBP8.9 million (2015:

GBP8.4 million). A significant proportion of this increase derives

from a combination of one-off employment costs and growth-related

development costs. The Board has not taken the decision to incur

these costs lightly and tight control of costs will receive

continued management focus and scrutiny given the substantial

regulatory changes ahead.

These increased costs resulted in profit before tax being

reduced by 91% to GBP0.1 million from GBP0.6 million in the prior

year. Underlying profitability before the one-off costs was GBP0.3

million.

Revenues improved in the second quarter, despite continuing

challenging markets, resulting in a small decrease in Revenue of 1%

to GBP13.2 million for the first half of our current year. Income

from both traditional investment management business and from our

structured investments desk during the period was lower than

forecast as volumes slowed significantly leading up to, and

following, the result of the EU Referendum. Since the end of the

period, however, these revenue streams have increased considerably

as the improvement in investor sentiment gathers pace.

The Board is, however, very encouraged that certain long-term

aims are being achieved, noting the growth of 29% in Discretionary

and Advisory Assets under Management over the last 12 months and of

17% over the current six month period during which the value of the

FTSE100 Index recorded a 12% increase. The ongoing expansion of our

client base, predominantly through recruitment of new investment

managers, has only been partially reflected in Revenue for the

current period due to a timing lag of new client assets

transferring to the company from previous employers. The

corresponding increases in Revenue will benefit subsequent

periods.

Trading

Gross Profit (Net Revenue) during the Period increased by 1% to

GBP9.0 million (2015: GBP8.9 million), demonstrating a small uplift

in growth, driven by our strategy for our Investment and Wealth

Management businesses in the last few years.

Non-broking income as a proportion of total income increased to

61% (2015: 60%) as the emphasis of our client base to transfer to

discretionary or portfolio-managed mandates continues.

After payment of the final dividend in relation to the previous

year end, at the Period end, the Group had net assets of GBP20.2

million (31 March 2016: GBP20.6 million) including net cash of

GBP5.9 million (31 March 2016: GBP7.2 million), a robust balance

sheet from which to generate further growth and development in line

with the Board's Strategic Plan, part of which is the continuing

acquisition of individuals or teams of advisers and their clients'

business.

Operations

Investment Management

Discretionary and Advisory assets under management at the Period

end were GBP2.7 billion (30 September 2015: GBP2.1 billion; 31

March 2016: GBP2.3 billion). This increase over the prior year is a

clear reflection of the Company's greater emphasis on fee

generation rather than transactional brokerage. Discretionary

assets were GBP1.24 billion (30 September 2015: GBP0.94 billion)

and Advisory assets were GBP1.52 billion (30 September 2015:

GBP1.19 billion).

Revenues from the Investment Management division increased by 1%

during the Period to GBP12.1 million (2015: GBP12.0 million), with

strong increases in portfolio management fee revenues, being offset

by weaker broking commissions and Structured investment revenues as

a result of the difficult market conditions relating to Brexit.

Wealth Management

Against the backdrop of political uncertainty during the summer,

Revenues and divisional profits reduced by 12% and 70% respectively

when compared to an above average first 6 months last year at our

York-based wealth management division. When compared with the 6

months to 31 March 2016, gross revenue is down 10% and profits down

20%. AUMA of this division has increased by 2.1% to GBP489m (2015:

GBP479m). However the second half is showing a healthy pipeline of

new business.

Dividend

Although your Board is disappointed to be reporting a decline in

profitability for this half year, our confidence in achieving more

favourable second half results enables us to declare an unchanged

interim dividend of 0.58 pence per share (2015: 0.58 pence per

share). This reflects the encouraging progress being made in the

Group's underlying key trading performance indicators. The interim

dividend will be paid on 16 December 2016 to those shareholders on

the register at the close of business on 2 December 2016.

Directors, Account Executives and Staff

I would like to thank all my fellow directors, account

executives and members of staff for their continued support and

hard work during a challenging period. Their professionalism,

diligence and loyalty in recent years give the Company every reason

to be regarded as a special place to work, as we now start to bear

the fruits directly resulting from our recent efforts in further

raising our standards to meet the ever-increasing expectations of

clients, regulators and other stakeholders.

Outlook

The Group remains in a very sound financial position and I am

pleased to report that we have traded profitably since the Period

end. We remain cautious about the short term outlook, due to

continued market uncertainty

David Gelber

Chairman

18 November 2016

Walker Crips Group plc

Walker Crips Group plc

Condensed Consolidated Income Statement

For the six months ended

30 September 2016

Unaudited Unaudited Audited

Notes Six months Six months Year to

to to

30 September 30 September 31 March

2016 2015 2016

GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 2 13,187 13,265 26,070

Commission payable (4,233) (4,397) (8,433)

------------- ------------- ---------

Gross profit 8,954 8,868 17,637

Share of after tax profit

of joint venture 5 6 10

Administrative expenses (8,920) (8,372) (17,774)

Operating profit/(loss) 39 502 (127)

Gain on disposal of investment - - 942

Investment revenues 15 88 131

Finance costs (1) (1) (2)

Profit before tax 53 589 944

Taxation (11) (130) (149)

Profit for the period

attributable to equity

holders of the company 42 459 795

------------- ------------- ---------

Earnings per share 3

Basic 0.11p 1.22p 2.11p

Diluted 0.11p 1.22p 2.11p

Walker Crips Group plc

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 September 2016

Unaudited Unaudited Audited

Six months Six months Year to

to to

30 September 30 September 31 March

2016 2015 2016

GBP'000 GBP'000 GBP'000

Profit for the period 42 459 795

Other comprehensive income:

Reversal of revaluation

of available-for-sale

investments - - (959)

Reversal of deferred

tax charge on revaluation

of available-for-sale

investments - - 192

Total comprehensive income

for the period

attributable to equity

holders of the company 42 459 28

Walker Crips Group plc

Condensed Consolidated Statement of Financial Position

As at 30 September 2016

Unaudited Unaudited Audited

30 September 30 September 31 March

2016 2015 2016

Notes GBP'000 GBP'000 GBP'000

Non-current Assets

Goodwill 4,388 4,388 4,388

Other intangible

assets 8,313 6,580 7,992

Property, plant and

equipment 791 960 841

Investment in joint

ventures 33 34 28

Available for sale

investments 6 57 1,034 57

------------- ------------- ---------

13,582 12,996 13,306

Current Assets

Trade and other receivables 30,274 41,068 38,799

Trading Investments 6 968 1,793 1,237

Cash and cash equivalents 5,972 6,916 7,257

------------- ------------- ---------

37,214 49,777 47,293

Total assets 50,796 62,773 60,599

------------- ------------- ---------

Current liabilities

Trade and other payables (26,554) (38,168) (36,424)

Current tax liabilities (288) (363) (141)

Bank Overdrafts (123) (6) (77)

Deferred tax liabilities (380) (740) (517)

Shares to be issued (1,131) (362) (912)

------------- ------------- ---------

(28,476) (39,639) (38,071)

Net current assets 8,738 10,138 9,222

------------- ------------- ---------

Long term liability

- deferred cash consideration (1,786) (1,815) (1,556)

Long term liability

- shares to be issued (158) (348) (218)

Long term liability

- dilapidation provision (132) - (132)

Net assets 20,244 20,971 20,622

============= ============= =========

Equity

Share capital 7 2,605 2,551 2,595

Share premium account 2,336 2,023 2,279

Own shares (312) (312) (312)

Revaluation reserve - 767 -

Other reserves 4,668 4,668 4,668

Retained earnings 10,947 11,274 11,392

Equity attributable

to equity holders

of the company 20,244 20,971 20,622

============= ============= =========

Walker Crips Group plc

Condensed Consolidated Statement of Cash Flows

For the six months ended 30 September 2016

Unaudited Unaudited Audited

Six months Six months Year to

to to

30 September 30 September 31 March

2016 2015 2016

GBP'000 GBP'000 GBP'000

Operating activities

Cash used by operations (168) (1,243) (1,119)

Interest received 13 39 85

Interest paid (1) (1) (2)

Tax paid - (6) (120)

Net cash used by operating

activities (156) (1,211) (1,156)

--------------------- ----------------- ---------

Investing activities

Purchase of property, plant

and equipment (160) (109) (247)

Purchase of intangible assets (199) (170) (810)

Net sale of investments

held for trading 269 908 1,464

Consideration paid on acquisition

of subsidiary (600) - (13)

Net sale proceeds of available

for sale investments - 1,383 2,044

Dividends received 2 47 54

Net cash (used by)/generated

from investing activities (688) 2,059 2,492

--------------------- ----------------- ---------

Financing activities

Dividends paid (487) (439) (657)

Net cash used in financing

activities (487) (439) (657)

--------------------- ----------------- ---------

Net (decrease)/ increase

in cash and cash equivalents (1,331) 409 679

Net cash and cash equivalents

at the start of the period 7,180 6,501 6,501

Net Cash and cash equivalents

at the end of the period 5,849 6,910 7,180

Cash and cash equivalents 5,972 6,916 7,257

Bank overdrafts (123) (6) (77)

--------------------- ----------------- ---------

5,849 6,910 7,180

--------------------- ----------------- ---------

Walker Crips Group plc

Condensed Consolidated Statement Of Changes In Equity

For the six months ended 30 September 2016 (GBP000's)

Called Share Own Capital Other Revaluation Retained Total

up premium shares Redemption earnings Equity

share held

capital

Equity as at 31 March

2015 2,545 1,988 (312) 111 4,557 767 11,254 20,910

Profit for the 6

months ended 30 September

2015 - - - - - - 459 459

-------- -------- ------- ----------- ----- ----------- --------- -------

Total recognised

income and expense

for the period - - - - - - 459 459

March 2015 final

dividend - - - - - - (439) (439)

Issue of shares on

acquisition of intangible

asset 6 35 - - - - - 41

Equity as at 30 September

2015 2,551 2,023 (312) 111 4,557 767 11,274 20,971

Reversal of revaluation

of

available-for-sale

investments - - - - - (959) - (959)

Reversal of deferred

tax

charge on revaluation

of

available-for-sale

investments - - - - - 192 - 192

Profit for the 6

months ended 31 March

2016 - - - - - - 336 336

-------- -------- ------- ----------- ----- ----------- --------- -------

Total recognised

income and expense

for the period - - - - - - 336 336

September 2015 interim

dividend - - - - - - (218) (218)

Issue of shares on

acquisition of subsidiary 44 256 - - - - - 300

Equity as at 31 March

2016 2,595 2,279 (312) 111 4,557 - 11,392 20,622

Profit for the 6

months ended 30 September

2016 - - - - - - 42 42

-------- -------- ------- ----------- ----- ----------- --------- -------

Total recognised

income and expense

for the period - - - - - - 42 42

March 2016 final

dividend - - - - - - (487) (487)

Issue of shares on

acquisition of intangible

asset 10 57 - - - - - 67

Equity as at 30 September

2016 2,605 2,336 (312) 111 4,557 - 10,947 20,244

Walker Crips Group plc

Notes to the condensed consolidated financial statements

For the six months ended 30 September 2016

1. Basis of preparation and accounting policies

The Group's consolidated financial statements are prepared in

accordance with International Financial Reporting Standards as

adopted by the EU (IFRS). These condensed financial statements are

presented in accordance with IAS 34 Interim Financial

Reporting.

The condensed consolidated financial statements have been

prepared on the basis of the accounting policies and methods of

computation set out in the Group's consolidated financial

statements for the year ended 31 March 2016.

The condensed consolidated financial statements should be read

in conjunction with the Group's audited financial statements for

the year ended 31 March 2016.The interim financial information is

unaudited and does not constitute statutory accounts as defined in

section 434 of the Companies Act 2006.The Group's financial

statements for the year ended 31 March 2016 have been reported on

by the auditors and delivered to the Registrar of Companies. The

report of the auditors was unqualified and did not draw attention

to any matters by way of emphasis. They also did not contain a

statement under section 498 (2) or (3) of the Companies Act

2006.

New standards and interpretations

A number of new standards and amendments to standards and

interpretations are effective for annual periods beginning after 1

April 2016 and have not been applied in preparing these

consolidated financial statements. None of these are expected to

have a significant effect on the consolidated financial statements

of the Group except for IFRS 9 'Financial Instruments', IFRS 15

'Revenue from Contracts with Customers' and IFRS 16 'Leases'. The

effective dates of IFRS 9, IFRS 15 and IFRS 16 are not until 2019,

2019 and 2020 year ends respectively; the Group has therefore

decided not to implement these standards early.

Going Concern

As both the net asset base and cash position remain healthy, the

directors are satisfied that the Group has sufficient resources to

continue in operation for the foreseeable future, a period of not

less than 12 months from the date of this report. Accordingly, they

also conclude in accordance with guidance from the Financial

Reporting Council, that the use of the going concern basis for the

preparation of the financial statements continues to be

appropriate.

Interests in joint ventures

The Group's share of the assets, liabilities, income and

expenses of jointly controlled entities are accounted for in the

consolidated financial statements under the equity method.

Income from the sale or use of the Group's share of the output

of jointly controlled assets, and its share of the joint venture

expenses, are recognised when it is probable that the economic

benefits associated with the transactions will flow to / from the

Group and their amount can be measured accurately.

Goodwill

Goodwill arising on consolidation represents the excess of the

cost of acquisition over the Group's interest in the fair value of

the identifiable assets and liabilities of a subsidiary or jointly

controlled entity at the date of acquisition. Goodwill is initially

recognised as an asset at cost and reviewed for impairment at least

annually. Any impairment is recognised immediately in the income

statement and is not subsequently reversed in future periods.

Intangible assets

At each period end date, the Group reviews the carrying amounts

of its intangible assets to determine whether there is any

indication that those assets have suffered an impairment loss. If

any such indication exists, the recoverable amount of the asset is

estimated in order to determine the extent of the impairment loss

(if any). Where the asset does not generate cash flows that are

independent from other assets, the Group estimates the recoverable

amount of the cash-generating unit to which the asset belongs.

Deferred tax

Deferred tax is the tax expected to be payable or recoverable on

differences between the carrying amounts of assets and liabilities

in the financial statements and the corresponding tax bases used in

the computation of taxable profits, and is accounted for using the

balance sheet liability method. Deferred tax liabilities are

generally recognised for all taxable temporary differences and

deferred tax assets are recognised to the extent that is probable

that taxable profits will be available against which deductible

temporary differences can be utilised.

Principal risks and uncertainties

Under the Financial Conduct Authority's Disclosure and

Transparency Rules, the Directors are required to identify those

material risks to which the company is exposed and take appropriate

steps to mitigate those risks. The principal risks and

uncertainties faced by the Group are discussed in detail in the

Annual Report for the year ended 31 March 2016.

Related party transactions

No transactions took place in the period that would materially

or significantly affect the financial position or performance of

the group.

2. Segmental analysis

Investment Wealth Total

Management Management

Revenue (GBP'000)

6m to 30 September

2016 12,102 1,085 13,187

------------ ------------- ---------------

6m to 30 September

2015 12,036 1,229 13,265

------------ ------------- ---------------

Year to 31 March

2016 23,639 2,431 26,070

------------ ------------- ---------------

Unallocated Operating

Result (GBP'000) Costs Profit/(Loss)

6m to 30 September

2016 776 36 (773) 39

------------ ------------- ------------ ---------------

6m to 30 September

2015 990 120 (608) 502

------------ ------------- ------------ ---------------

Year to 31 March

2016 987 165 (1,279) (127)

------------ ------------- ------------ ---------------

3. Earnings per share

The calculation of basic earnings per share for continuing

operations is based on the post-tax profit for the period of

GBP42,000 (2015: GBP459,000) and on 38,304,050 (2015: 37,531,391)

ordinary shares of 6 2/3p, being the weighted average number of

ordinary shares in issue during the period.

The effect of the exercise of outstanding options would be to

reduce the reported earnings per share. Any remaining outstanding

options expired during the prior period. The calculation of diluted

earnings per share is based on 38,304,050 (2015: 37,643,593)

ordinary shares, being the weighted average number of ordinary

shares in issue during the period adjusted for dilutive potential

ordinary shares.

4. Dividends

The interim dividend of 0.58 pence per share (2015: 0.58 pence)

is payable on 16 December 2016 to shareholders on the register at

the close of business on 2 December 2016. The interim dividend has

not been included as a liability in this interim report.

5. Total Income (GBP'000)

Six months Six months Year Ended

Ended Ended 31 March

30 September 30 September 2016

2016 2015

Revenue 13,187 13,265 26,070

Net Investment revenues 14 87 129

-------------- -------------- -----------

13,201 13,352 26,199

-------------- -------------- -----------

The Group's income can also be categorised as follows for the

purpose of measuring a Key Performance Indicator, non-broking

income to total income.

Six months % Six months % Year %

Income (GBP'000) Ended Ended Ended

30 September 30 September 31 March

2016 2015 2016

Broking 5,174 39 5,345 40 10,007 38

Non-Broking 8,027 61 8,007 60 16,192 62

-------------- ---- -------------- ---- ---------- ----

13,201 100 13,352 100 26,199 100

-------------- ---- -------------- ---- ---------- ----

6. Investments

Available-for-sale investments

Qualifying

Collective

Life Policy Equity Investment

investments investments scheme Total

GBP'000 GBP'000 GBP'000 GBP'000

Fair value

At 1 April 2015 - 1,034 1,383 2,417

Additions in the period - - - -

Disposals in the year - - (1,383) (1,383)

Recognised in comprehensive income - - - -

----------------------------------- ------------ ------------ ----------- --------

At 30 September 2015 - 1,034 - 1,034

Additions in the period 57 - - 57

Disposals in the period - (1,034) - (1,034)

Recognised in comprehensive income - - - -

At 31 March 2016 57 - - 57

Additions in the year - - - -

Disposals in the year - - - -

Recognised in comprehensive income - - - -

----------------------------------- ------------ ------------ ----------- --------

At 30 September 2016 57 - - 57

Equity investments comprise the Group's investment in a life

policy investment. The fair value is based upon the life company's

forecast terminal value. During the period to 30 September 2016

there were no movements in available for sale investments.

During the period to 30 September 2015, following the closure

and liquidation of the TB Walker Crips Income from Short Term

Lending Fund (STLF), a qualifying collective investment scheme

(QCIS), the Group's holding of 1.383m units was redeemed and repaid

in full (resulting in no gain or loss) with GBP1,383,000 being

received on 7th September 2015.

As at 30 As at 30 As at As at 30 6 Months

September September 31 March September to 30 September

2016 2015 2016 2016 2015

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------- ---------- ---------- --------- ---------- ----------------

Trading investments

Fair value 968 1,793 1,237 968 1,793

--------------------- ---------- ---------- --------- ---------- ----------------

Trading investments represent investments in equity securities

and bonds that present the Group with opportunity for return

through dividend income, interest and trading gains. The fair

values of these securities are based on quoted market prices.

The following provides an analysis of financial instruments that

are measured subsequent to initial recognition at fair value,

grouped into Levels 1 to 3 based on the degree to which the fair

value is observable:

-- Level 1 fair value measurements are those derived from quoted

prices (unadjusted) in active markets for identical assets or

liabilities. The trading investments fall within this category;

-- Level 2 fair value measurements are those derived from inputs

other than quoted prices included within Level 1 that are

observable for the asset or liability, either directly (i.e. as

prices) or indirectly (i.e. derived from prices). The Group does

not hold financial instruments in this category; and

-- Level 3 fair value measurements are those derived from

valuation techniques that include inputs for the asset or liability

that are not based on observable market data (unobservable inputs).

The Group's available-for-sale investments fall within this

category.

The following tables analyse within the fair value hierarchy the

Group's Investments measured at fair value.

At 30 September 2016 Level 1 Level 2 Level 3 Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------------------------- ---------- ---------- ---------- ----------

Financial assets held at fair value through profit and loss 968 _ 57 1,025

------------------------------------------------------------- ---------- ---------- ---------- ----------

At 30 September 2015 Level 1 Level 2 Level 3 Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------------------------- ---------- ---------- ---------- ----------

Financial assets held at fair value through profit and loss 1,793 _ 1,034 2,827

------------------------------------------------------------- ---------- ---------- ---------- ----------

At 31 March 2016 Level 1 Level 2 Level 3 Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------------------------- ---------- ---------- ---------- ----------

Financial assets held at fair value through profit and loss 1,237 _ 57 1,294

------------------------------------------------------------- ---------- ---------- ---------- ----------

7. Issue of share capital

During the period to 30 September 2016, 150,574 new Ordinary

Shares were issued and allotted to the sellers of Barker Poland

Asset Management (BPAM) in order to satisfy the Group's obligation

in connection with the payment of year one deferred consideration.

The BPAM business has met the targets required to trigger a payment

by the Group of the full amount of the first of 3 potential

payments.

During the period to 30 September 2015, 95,476 new Ordinary

Shares were issued and allotted to fulfil contractual obligations

of employees of the Group.

Directors' Responsibility Statement

The Directors confirm that to the best of their knowledge:

(a) The condensed set of financial statements contained within

the half yearly financial report has been prepared in accordance

with IAS 34 'Interim Financial Reporting' as adopted by the EU;

(b) The half yearly report from the Chairman (constituting the

interim management report) includes a fair review of the

information required by DTR 4.2.7R; and

(c) The half yearly report from the Chairman includes a fair

review of the information required by DTR 4.2.8R as far as

applicable.

On Behalf of the Board

Rodney FitzGerald

Chief Executive Officer

18 November 2016

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LLFFVLTLTLIR

(END) Dow Jones Newswires

November 18, 2016 11:00 ET (16:00 GMT)

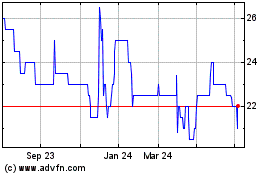

Walker Crips (LSE:WCW)

Historical Stock Chart

From Mar 2024 to Apr 2024

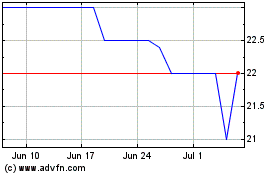

Walker Crips (LSE:WCW)

Historical Stock Chart

From Apr 2023 to Apr 2024