TIDMWCW

RNS Number : 1576R

Walker Crips Group plc

25 June 2015

25 June 2015

News Release

Walker Crips Group plc

Continued growth in core business after a year of expansion

Walker Crips Group plc ("Walker Crips", the "Company" or the

"Group"), the financial services group with activities covering

stockbroking, investment and wealth management services, announces

unaudited results for the year ended 31 March 2015.

Highlights

-- Group revenues increased by 11.1% to GBP23.0m (2014: GBP20.7m)

-- Gross profit (net revenues) increased by 8.5% to GBP15.3m (2014: GBP14.1m)

-- Operating profit, before exceptional expenses, up 14.9% to GBP0.54m(2014: GBP0.47m)

-- Reported pre-tax profit of GBP0.44m which includes Barker

Poland Asset Management LLP (BPAM) acquisition (2014: GBP2.5m which

included investment disposal gains of GBP1.84m)

-- BPAM acquisition, together with branch openings and

expansion, gives the group a national footprint with 13 offices

nationwide

-- Non-broking income as a percentage of total income increased

to 56.3% (2014: 52.7%), reflecting further reduction in reliance on

transaction-driven commission revenue

-- Discretionary and advisory assets under management increased

by 50.3% to GBP2.0 billion (2014: GBP1.33 billion). Together with

administered assets (AUMA), total assets increased by 26.7% to

GBP3.8 billion (2014: GBP3.0 billion)

-- Proposed final dividend increased by 10.4% to 1.17p per share

(2014: 1.06p per share) bringing total dividends for the year to

1.70p per share (2014: 1.57p per share)

David Gelber, Chairman, Walker Crips, says:

"As the UK economic recovery continues, supported by political

stability after the decisive general election, we are confident

that the Group is well positioned to continue making strides, which

will produce higher dividends and added value for the benefit of

shareholders.

"Trading activity in the opening weeks of the new financial year

has started strongly. Despite increasing competition and

significant regulatory initiatives, including MIFiD II over the

next 18 months, it is our emphasis on service and integrity which

will drive our public profile and competitive positioning to

deliver underlying growth in the next phase of the Group's

development."

For further information, please contact:

Walker Crips Group plc Tel: +44 (0)20 3100 8000

Louie Perry, Media Relations

Broadgate Mainland Tel: +44 (0)20 7726 6111

Roland Cross, Director Mob: 07831 401 309

Cantor Fitzgerald Europe Tel: +44 (0) 20 7894

7667

Rishi Zaveri

Further information on Walker Crips Group is available on the

Company's website: www.wcgplc.co.uk

Chairman and Chief Executive's Statement

Performance overview

This year's results build on the momentum of growth in our core

business of investment and wealth management, flowing from the

Group's adoption of a refocused strategy in mid-2012. Operating

profit before exceptional expenses increased, for the second year

running, by 14.9% to GBP0.54m (2014: GBP0.47m). After net

investment revenues and exceptional costs of GBP0.33m, incurred

through the acquisition of the investment management firm Barker

Poland Asset Management LLP (BPAM), pre-tax profits were GBP0.44m,

compared to GBP2.5m in 2014, when we benefited from investment

disposal gains of GBP1.84m.

We have continued to advance the delivery of our strategy for

growth and have consolidated the progress we have made over the

previous two years. We now look ahead to continuing our expansion

and business transformation. A big step was made with the

acquisition of BPAM, the group's first corporate acquisition in ten

years, which concluded at the end of a year in which regional

expansion has also gathered pace. Further growth in numbers of

fee-generating investment managers and advisers has continued with

an additional 14 taken on during the year, bringing our total

number of fee earning personnel to 120. Along with the opening of a

branch in Truro, we expanded in Birmingham, London and York, giving

us a truly national footprint, with 13 offices nationwide.

At a time when our peers have reported decreases in commission

revenues, we have shown resilience by stabilising our own broking

income levels at GBP10.2m (2014: GBP9.9m) through gathering new

clients who come with the increasing number of investment

management personnel deciding to join us in this exciting phase of

expansion. As well as commission from stockbroking, the higher

level of fees generated from our rapidly increasing pool of

clients' assets under management and administration (AUMA) has, in

turn, led to a robust increase in revenue by 11.1% to GBP23.0m from

GBP20.7m in the prior year.

Earnings per share (EPS) for the year were 0.69 pence (2014: 5.5

pence). EPS in 2014 of course included the effect of the one-off

disposal of our investment in Liontrust Convertible Loan Stock.

Dividend

In recognition of this year's sound progress and the continued

confidence in the group's longer term prospects, the Board is

recommending a 10.4% increase in the final dividend to 1.17 pence

per share (2014: 1.06 pence per share).

Combined with the interim dividend of 0.53 pence per share

(2014: 0.51 pence per share excluding the special dividend), this

makes a total dividend for the year of 1.70 pence per share (2014:

1.57 pence per share). This increase of 8.3% reflects the further

progress made during the year driven by the turnaround in Operating

Profit before exceptionals over the past two years.

The final dividend will be paid on 7 August 2015 to shareholders

on the register at the close of business on 17 July 2015.

Strategy for growth

Since the disposal of non-core subsidiaries in 2012 and 2013,

our remaining businesses of investment management and wealth

management have continued to target higher net worth and affluent

clients. The strategic evolution, from traditional private client

stockbroker to an integrated investment and wealth management

group, continues to be reinforced by our commitment to a long

established set of values, premium service, strong culture and

integrity in all we do for clients and this has continued to

attract new business. We put clients first, a principle that has

underpinned our longevity, sound reputation and independence, which

are valued by clients. We operate within a framework of strong

corporate governance and growing financial strength.

Acquisition

After assessing many prospective targets to identify a suitable

earnings-enhancing acquisition, we completed the purchase of the

membership interests in BPAM on 6 March 2015. BPAM is based in

London and provides investment and wealth management services to a

loyal and established base of private clients on a predominantly

discretionary basis. They hold dear to the same values as we do and

have a culture aimed at clients and suitable investments. The

business fits well within the Walker Crips business philosophy.

Apart from opportunities for cost synergies, the addition of

capable investment managers and advisers and their discretionary

fee based recurring revenue stream is a key step in achieving the

additional scale needed to reach one of the Company's stated

medium-term targets - to take our Assets under Management and

Administration through the threshold of GBP5 billion.

Operations

As a result of our growing client base, gross profit increased

by 8.5% to GBP15.3m.

Administration expenses before exceptional costs for the period

correspondingly increased by 8.1% and have been largely contained

despite the expected increase in employment and regulatory costs

associated with our current and proposed revenue generating

initiatives. A lease for additional floor space at our London

headquarters has recently been entered into in response to the

stream of additional advisers we are welcoming, and to capitalise

on a significant premises cost saving for our new subsidiary,

BPAM.

One of our key performance indicators, non-broking income

expressed as a proportion of total income, was higher at 56.3%

(2014: 52.7%), further diminishing our reliance on

transaction-driven commission revenue.

Investment Management

The Company's assets under management have grown substantially,

and are set to continue to do so, as our pipeline of potential new

recruits and their clients remains healthy.

Discretionary and Advisory assets under management (AUM) at the

year end were GBP2.0bn (31 March 2014: GBP1.33bn), reflecting the

strategic emphasis and the longer term revenue benefits of asset

gathering alongside transactional brokerage. Commission income from

broking remained stable, whilst investment management fees

increased by 23.8% to GBP10.4m (2014: GBP8.4m).

Gross revenues from the investment management division increased

by 12.6% during the Period to GBP20.6m (2014: GBP18.3m), another

marked improvement and clear demonstration that the scope for

additional expansion is a realistic prospect in a very competitive

sector, where the reduction in the quality of service caused by

increase in scale through mergers and acquisitions is repeatedly

being evidenced amongst our peers. This has led to disenchantment

amongst the affected advisers of competitors, who invariably seek

stability and reliability of service for their clients in a more

efficient, technologically competent and successful organisation

such as ours.

After receiving another boost to the ISA regime in the last

budget, investors now have much greater flexibility ensuring that

subscriptions into our ISA stocks and shares products continued

their dramatic growth by 48% this year (2014: 32%). Forthcoming

additional tax-efficient transferability allowances will also

encourage inherited funds to remain under our management.

The Structured Investments division produced another strong

year, as it continued to strengthen its position with the

professional adviser community. The current year is also promising,

with a backdrop of global economic growth and the outlook for a

sustained low interest rate environment, both of which serve to

underpin demand for structured investment products.

In addition, our Alternative Investments management team

delivered substantial growth in new clients and assets from the

Investor Immigration Programme and the greater profitability

generated by the Equity Arbitrage desk continues to be a welcome

success.

Wealth Management

Our innovative Wealth Management division, run from York,

continues to be driven by focused management and a competent team

of advisers, who provide a committed, high-quality service to its

widening client base.

In the year to 31 March 2015, our York operation benefited from

the first full year's figures from the new Inverness office and

delivered an improved operating profit. Since the advent of the

Retail Distribution Review and pension freedoms, activity remains

strong, boosted also by continued Auto Enrolment activity and a

helpful Spring Budget, which bodes well for a productive year

ahead.

The Pensions division, which is also based in York,

administering SIPP (Self Invested Personal Pension) and SSAS (Small

Self Administered Scheme) produced a resilient performance with

SIPPs experiencing 8% net growth in funds under administration,

ending the year at GBP105 million (2014: GBP97 million). SSAS

assets under our care at the year end amounted to GBP200 million

(2014: GBP206 million).

Regulation

Preparations are well under way to meet the challenges posed by

the European Parliament's MiFID II initiative. We continue to fully

support and reinforce FCA guidance on its drive to ensure advice

given to clients by our account executives is suitable and properly

recorded. Our culture of serving clients in their best interests is

now well established in our DNA.

Statement of Financial Position

As at 31 March 2015, the Group maintained a steady level of net

assets of GBP21.0m (2014: GBP21.4m), including net cash of GBP6.5m

(2014: GBP8.1m), a decrease of GBP1.6m mainly due to the initial

cash consideration of GBP1.8m for the recent acquisition of

BPAM.

Going Concern

The Group continues to maintain a robust financial position.

Having conducted detailed cash flow and working capital forecasts

and appropriate stress-testing on liquidity, profitability and

regulatory capital, taking account of possible adverse changes in

trading performance, the Board has more than sufficient grounds to

believe the Group is well placed to manage its business risks

adequately; and that it will be able to operate within the level of

its current financing arrangements and regulatory capital limits.

Accordingly, the Board continues to adopt the going concern basis

for the preparation of the financial statements.

Directors, Account Executives and Staff

After another year of increasing numbers of revenue generators

and the absorption of investment business, through transfers of

clients and their assets, we would like to thank all our fellow

directors, investment managers and advisers, and members of our

operations team for their continuing hard work and diligence in

shouldering this burden. The Walker Crips team remains true to the

core values of your Company; and their integrity, courtesy,

fairness, diligence, responsibility and loyalty make it an

appealing firm for prospective clients and professionals to

join.

Annual General Meeting

This year's Annual General Meeting will be held at the South

Place Hotel, 3 South Place, London, EC2M 2AF on 31 July 2015, at

11.00 am.

Outlook

Your Board is committed to continuing the execution of the

Strategic Plan and the long term value for the Group it is

creating. As the economy recovers, and with political stability

largely assured after the recent decisive UK general election, we

are confident that the Group is well positioned to continue making

strides, which will ultimately produce higher dividends and added

value for the benefit of shareholders.

Trading activity in the opening weeks of the new financial year

has started strongly.

Despite increasing competition and significant demands from

regulatory initiatives over the next 18 months, it is our emphasis

on service and integrity which will drive our public profile and

competitive positioning to deliver underlying growth in the next

phase of the Group's development.

D. M. Gelber R. A. FitzGerald FCA

Chairman Chief Executive Officer

25 June 2015 25 June 2015

Consolidated income statement

year ended 31 March 2015

2015 2014

Notes GBP'000 GBP'000

-------------------------------------- ----- -------- --------

Continuing operations

Revenue 9 22,994 20,688

Commission payable (7,653) (6,584)

-------------------------------------- ----- -------- --------

Gross profit 15,341 14,104

Share of after tax profits of

joint ventures 13 17

-------------------------------------- ----- -------- --------

Administrative expenses - other (14,810) (13,651)

Administrative expenses - exceptional

item 5 (329) -

-------------------------------------- ----- -------- --------

Total administrative expenses (15,139) (13,651)

-------------------------------------- ----- -------- --------

Operating profit 215 470

-------------------------------------- ----- -------- --------

Analysed as:

Profit before tax and exceptional

item 544 470

Administrative expenses - exceptional

item (329) -

-------------------------------------- ----- -------- --------

Operating profit 215 470

Gains on disposal of investments 6 - 1,836

Loss on disposal of subsidiary

undertaking 7 - (13)

Investment revenues 9 225 240

Finance costs (1) (4)

-------------------------------------- ----- -------- --------

Profit before tax 439 2,529

Taxation (182) (495)

-------------------------------------- ----- -------- --------

Profit for the year attributable

to equity holders of the company 257 2,034

-------------------------------------- ----- -------- --------

Earnings per share

Basic 4 0.69 5.50

Diluted 4 0.68 5.39

-------------------------------------- ----- -------- --------

Consolidated statement of comprehensive income

year ended 31 March 2015

2015 2014

Notes GBP'000 GBP'000

--------------------------------------------------- ------ -------- --------

(Loss)/Profit on revaluation of available-for-sale

investments taken to equity (88) 243

Deferred tax on profit on available-for-sale

investments 28 (35)

Long Term Incentive Plan (LTIP) credit

to equity - 13

----------------------------------------------------------- -------- --------

Net (loss)/profit recognised directly

in equity (60) 221

Profit for the year 257 2,034

----------------------------------------------------------- -------- --------

Total comprehensive income for the

year attributable to equity holders

of the company 197 2,255

----------------------------------------------------------- -------- --------

Consolidated statement of financial position

31 March 2015

Group Group

2015 2014

Notes GBP'000 GBP'000

--------------------------------- ------ -------- --------

Non-current assets

Goodwill 4,388 2,901

Other intangible assets 6,631 1,168

Property, plant and equipment 1,110 872

Interest in joint ventures 28 38

Available-for-sale investments 2,417 2,404

----------------------------------------- -------- --------

14,574 7,383

Current assets

Trade and other receivables 28,332 46,648

Trading investments 2,701 1,670

Deferred tax asset - -

Cash and cash equivalents 6,635 8,173

----------------------------------------- -------- --------

37,668 56,491

---------------------------------------- -------- --------

Total assets 52,242 63,874

----------------------------------------- -------- --------

Current liabilities

Trade and other payables (27,537) (41,801)

Current tax liabilities (239) (330)

Deferred tax liabilities (741) (202)

Bank overdrafts (134) (70)

Shares to be issued (298) -

----------------------------------------- -------- --------

(28,949) (42,403)

---------------------------------------- -------- --------

Net current assets 8,719 14,088

Long Term Liability - Deferred

Cash Consideration (1,930) -

Long Term Liability - Shares to

be issued (453) -

--------------------------------- ------ -------- --------

Net assets 20,910 21,471

----------------------------------------- -------- --------

Equity

Share capital 2,545 2,515

Share premium account 1,988 1,818

Own shares (312) (312)

Retained earnings 11,254 11,955

Revaluation reserve 767 827

Other reserves 4,668 4,668

----------------------------------------- -------- --------

Equity attributable to equity

holders of the company 20,910 21,471

----------------------------------------- -------- --------

Consolidated statement of cash flows

year ended 31 March 2015

2015 2014

Note GBP'000 GBP'000

------------------------------------ ----- -------- --------

Operating activities

Cash generated/(used) by operations 3,806 (3,074)

Interest received 78 229

Interest paid (1) (4)

Tax paid (337) -

------------------------------------------- -------- --------

Net cash generated/(used) by

operating activities 3,546 (2,849)

------------------------------------------- -------- --------

Investing activities

Purchase of property, plant

and equipment (565) (542)

Net purchase of investments

held for trading (1,031) (1,036)

Net sale proceeds/cost of available

for sale investments - 5,466

Consideration paid on acquisition

of businesses (765) (602)

Net proceeds on sale of subsidiary - 292

Consideration paid on acquisition

of subsidiary (1,875) -

Dividends received 46 42

------------------------------------------- -------- --------

Net cash (used)/generated by

investing activities (4,190) 3,620

------------------------------------------- -------- --------

Financing activities

Issue of new shares - 6

Dividends paid (958) (522)

------------------------------------------- -------- --------

Net cash used in financing

activities (958) (516)

------------------------------------------- -------- --------

Net (decrease)/increase in

cash and cash equivalents (1,602) 255

Net cash and cash equivalents

at beginning of year 8,103 7,848

------------------------------------------- -------- --------

Net cash and cash equivalents

at end of year 6,501 8,103

------------------------------------------- -------- --------

Cash and cash equivalents 6,635 8,173

Bank overdrafts (134) (70)

------------------------------------------- -------- --------

6,501 8,103

------------------------------------------ -------- --------

Notes to the Accounts

year ended 31 March 2015

1. The financial information set out in the announcement does

not constitute the company's statutory accounts for the years ended

31 March 2015 or 2014. The financial information for the year ended

31 March 2014 is derived from the statutory accounts for that year

which have been delivered to the Registrar of Companies. The

auditor's report on those accounts was unqualified and did not

contain a statement under s. 498(2) or (3) Companies Act 2006. The

statutory accounts for the year ended 31 March 2015 are yet to be

signed but will be finalised on the basis of the financial

information presented by the directors in this preliminary

announcement and will be delivered to the Registrar of Companies

following the company's annual general meeting.

2. Going concern

The Group has healthy financial resources together with a long

established, well proven and tested business model. As a

consequence, the directors believe that the Group is well placed to

manage its business risks successfully despite the current

difficult climate.

After conducting enquiries, the directors believe that the

company and the Group have adequate resources to continue in

existence for the foreseeable future. Accordingly, they continue to

adopt the going concern basis in preparing the financial

statements.

3. Whilst the information as set out in the preliminary

announcement is prepared in accordance with International Financial

Reporting Standards ('IFRS') the announcement itself does not

contain sufficient information to comply with IFRS.

The accounting policies are consistent with those applied in the

full financial statements and are consistent with those of the

prior year.

4. Earnings per share

The calculation of basic earnings per share for continuing

operations is based on the post-tax profit for the financial year

of GBP257,000 (2014: GBP2,034,000) and on 37,017,924 (2014:

36,967,116) ordinary shares of 6(2) /(3) pence, being the weighted

average number of ordinary shares in issue during the year.

The effect of options granted would be to reduce the reported

earnings per share. The calculation of diluted earnings per share

is based on 37,629,174 (2014: 37,717,319) ordinary shares, being

the weighted average number of ordinary shares in issue during the

period adjusted for the dilutive effect of potential ordinary

shares.

5. Administrative expenses - exceptional item

As a result of its materiality the directors decided to disclose

certain amounts separately in order to present results which are

not distorted by significant non-recurring events.

2015 2014

GBP'000 GBP'000

---------------------------------------- ------------ ------------

Short Term Lending Fund winding down

costs 68 -

Costs incurred on acquisitions 261 -

---------------------------------------- ------------ ------------

329 -

---------------------------------------- ------------ ------------

Towards the end of the year, a decision was made to wind down

our Short Term Lending Fund. All investors are expected to receive

a full return of sums invested before September 2015.

Administrative costs associated with the wind down have been

provided for in this year's results. Acquisition costs are largely

made up of legal and professional costs being incurred and payable

on completion of the acquisition of BPAM on 6 March 2015.

6. Gain on disposal of investments

During the period to 31 March 2015, there were no gains or

losses on disposal of investments.

During the period to 31 March 2014, conversion and disposal of

Liontrust Convertible Unsecured Loan Stock (CULS) with a nominal

value of GBP3.03 million and the redemption of the remaining

holding with a nominal value of GBP0.07 million, yielded a profit

of GBP1,836,000.

Due to its level of materiality and one-off nature, the Board

has decided to disclose these items separately.

7. Loss on disposal of subsidiary undertaking

During the period to 31 March 2015, there were no gains or

losses on disposal of subsidiary undertakings.

During the period to 31 March 2014 the Group completed the

disposal of its subsidiary Keith Bayley Rogers & Co Limited

(following FCA approval) on 31 May 2013, realising a loss of

GBP13,000.

8. Segmental analysis

For management purposes the Group is currently organised into

two operating divisions - Investment Management and Wealth

Management. These divisions, both of which conduct business in the

United Kingdom only, are the basis on which the Group reports its

primary segment information.

Consolidated

year ended

Investment Wealth 31 March

Management Management 2015

2015 GBP'000 GBP'000 GBP'000

------------------------------- ----------- ----------- ------------

Revenue

External sales 20,590 2,404 22,994

------------------------------- ----------- ----------- ------------

Result

Segment result 931 338 1,269

Unallocated corporate expenses (1.054)

------------------------------- ----------- ----------- ------------

Operating profit 215

Investment revenues 225

Finance costs (1)

------------------------------- ----------- ----------- ------------

Profit before tax 439

Tax (182)

------------------------------- ----------- ----------- ------------

Profit after tax 257

------------------------------- ----------- ----------- ------------

Consolidated

year ended

Investment Wealth 31 March

Management Management 2015

2015 GBP'000 GBP'000 GBP'000

---------------------------------- ----------- ----------- ------------

Other information

Capital additions 552 13 565

Depreciation 380 16 396

Statement of financial position

Assets

Segment assets 35,133 1,856 36,989

Unallocated corporate assets 15,253

---------------------------------- ----------- ----------- ------------

Consolidated total assets 52,242

---------------------------------- ----------- ----------- ------------

Liabilities

Segment liabilities 28,614 615 29,229

Unallocated corporate liabilities 2,103

---------------------------------- ----------- ----------- ------------

Consolidated total liabilities 31,332

---------------------------------- ----------- ----------- ------------

Consolidated

year ended

Investment Wealth 31 March

Management Management 2014

2014 GBP'000 GBP'000 GBP'000

--------------------------------- ----------- ----------- ------------

Revenue

External sales 18,290 2,398 20,688

--------------------------------- ----------- ----------- ------------

Result

Segment result 1,150 221 1,371

Unallocated corporate expenses (901)

--------------------------------- ----------- ----------- ------------

Operating profit 470

Gains on disposal of investments 1,836

Loss on disposal of subsidiary

undertaking (13)

Investment revenues 240

Finance costs (4)

--------------------------------- ----------- ----------- ------------

Profit before tax 2,529

Tax (495)

--------------------------------- ----------- ----------- ------------

Profit after tax 2,034

--------------------------------- ----------- ----------- ------------

Consolidated

year ended

Investment Wealth 31 March

Management Management 2014

2014 GBP'000 GBP'000 GBP'000

---------------------------------- ----------- ----------- ------------

Other information

Capital additions 508 34 542

Depreciation 292 14 306

Statement of financial position

Assets

Segment assets 48,377 1,724 50,101

Unallocated corporate assets 13,773

---------------------------------- ----------- ----------- ------------

Consolidated total assets 63,874

---------------------------------- ----------- ----------- ------------

Liabilities

Segment liabilities 41,348 542 41,890

Unallocated corporate liabilities 513

---------------------------------- ----------- ----------- ------------

Consolidated total liabilities 42,403

---------------------------------- ----------- ----------- ------------

9. Revenue

An analysis of the Group's revenue is as follows:

2015 2015 2014 2014

Broking Non-broking 2015 Broking Non-broking 2014

income income Total income income Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ -------- ------------ -------- -------- ------------ --------

Stockbroking commission 10,152 - 10,152 9,904 - 9,904

Fees and other revenue - 10,438 10,438 - 8,386 8,386

------------------------ -------- ------------ -------- -------- ------------ --------

Investment Management 10,152 10,438 20,590 9,904 8,386 18,290

Wealth Management - 2,404 2,404 - 2,398 2,398

------------------------ -------- ------------ -------- -------- ------------ --------

Revenue 10,152 12,842 22,994 9,904 10,784 20,688

Net investment revenue - 224 224 - 236 236

------------------------ -------- ------------ -------- -------- ------------ --------

Total income 10,152 13,066 23,218 9,904 11,020 20,924

------------------------ -------- ------------ -------- -------- ------------ --------

% of total income 43.7 56.3 100.0 47.3 52.7 100.0

------------------------ -------- ------------ -------- -------- ------------ --------

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR DMGZVRDFGKZM

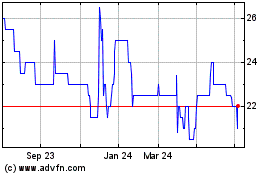

Walker Crips (LSE:WCW)

Historical Stock Chart

From Mar 2024 to Apr 2024

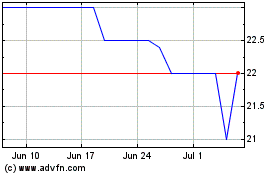

Walker Crips (LSE:WCW)

Historical Stock Chart

From Apr 2023 to Apr 2024