TIDMWCW

RNS Number : 3101L

Walker Crips Group plc

18 July 2017

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain

18 July 2017

News Release

Walker Crips Group plc

Strong second half of year helps lift annual revenues by nearly

12% and assets under management and administration increase by

26.8%

Walker Crips Group plc ("Walker Crips", the "Company" or the

"Group"), the financial services group with activities covering

stockbroking, investment and wealth management services, announces

audited results for the year ended 31 March 2017.

Highlights

-- Group revenues increased by 12% to GBP29.2 million (2016:

GBP26.1 million)

-- Underlying operating profit, before tax and exceptional

items, increased to GBP1,142,000 (2016: GBP651,000)

-- Reported profit before tax decreased to GBP804,000 (2016:

GBP944,000)

-- Discretionary and advisory assets under management increased

by 39.1% to a high of GBP3.2 billion (2016: GBP2.3 billion)

-- Non-broking income as a percentage of total income remains

steady at 61.7% (2016: 61.8%)

-- Proposed final dividend increased by 1.6% to 1.29 pence per

share (2016: 1.27 pence per share), bringing total dividends for

the year to 1.87 pence per share (2016: 1.85 pence per share)

-- Achieved GBP5bn AUMA target a year ahead of strategic

objective

-- Record turnover for second year in succession

David Gelber, Chairman, Walker Crips, says:

"The delivery of personal investment advice and investment

management remains at the core of our approach as we looked to

refine our client-focused strategy regularly during the year. Our

aim is to increase shareholder value by growing revenue, improving

efficiency and continuing to increase our dividend payments.

"We continue to advance the delivery of our strategy for growth

in a fast-moving sector in which the pace of change in regulation

and technology are a constant.

"In recent years we have achieved substantial growth, continuing

to refine our strategy and business model to make further strides

towards attaining our long-term strategic goals. We are now even

more committed to increasing our service proposition through

greater use of technology that is relevant to clients,

intermediaries and our own advisers."

For further information, please contact:

Walker Crips Group plc Tel: +44 (0)20 3100 8000

Geri Jacks/Bridgette Campbell,

Media Relations

Four Broadgate Tel: +44 (0)20 3697 4200

Roland Cross/Anthony Cornwell

Cantor Fitzgerald Europe Tel: +44 (0) 20 7894

7667

Marc Milmo

Further information on Walker Crips Group is available on the

Company's website at www.wcgplc.co.uk

Chairman's Statement

This year has shown strong performances for the business, in

which we have reached record highs and have concentrated on

delivering initiatives to move forward with confidence into

2017/2018.

Overview of 2016/2017

The financial year ended 31 March 2017 can be split into two

halves. In the first six months of the financial year, the

uncertainty surrounding the run-up to the Brexit referendum and the

subsequent challenging markets slowed revenue growth. This, coupled

with a combination of non-recurring employment costs and

growth-related development costs, saw our profitability fall well

below our expectation. We saw a stronger performance, in the last

six months, when improved market conditions favourably impacted by

the result of the US presidential elections, helped increase both

revenues and profit.

Importantly our assets under management and administration, a

key metric of performance, continue to grow. Whilst we have

recently experienced the benefits of more upbeat market conditions,

the full ramifications of the negotiations on Brexit, together with

the uncertainty arising from the outcome of the UK general

election, have yet to emerge. Therefore, we will be monitoring

developments closely in the interests of both shareholders and

clients.

Dividend

In recognition of this year's progress, and notwithstanding the

need to continue monitoring an increasing cost base, the Board is

recommending a 1.6% increase in the final dividend to 1.29 pence

per share (2016: 1.27 pence per share). This increase in the

dividend reflects the Board's confidence in the Group's long-term

prospects and prudent use of available reserves.

Combined with the interim dividend of 0.58 pence per share

(2016: 0.58 pence per share), the total dividend for the year is

1.87 pence per share (2016: 1.85 pence per share), a 1.1% increase.

The final dividend will be paid on 15 September 2017 to

shareholders on the register at the close of business on 1

September 2017.

Strategy

The delivery of high quality personal investment advice and

strong investment management capability remains at the core of our

approach. As highlighted at the time of the interim results, we

have sought to refine our client-focused strategy during the year

to ensure premium service and integrity in all that we do for our

clients. We aim to increase shareholder value by growing revenue,

improving efficiency and continuing to increase our dividend

payments.

We continue to advance the delivery of our strategy for growth

in a fast-moving sector in which the pace of change in regulation

and technology are a constant. Whilst preserving our healthy cash

balance as a buffer for unforeseen events in these potentially

turbulent times, we remain committed to providing a complete range

of services through our core business of investment management and

advice, not only to high net worth and mass affluent clients but

also to clients with smaller portfolios. We also remain committed

to our financial planning and wealth management division as we

increasingly look to position ourselves favourably with

intermediary professionals and their clients.

After four years of rapid expansion, including the corporate

acquisition of Barker Poland Asset Management LLP in 2015, we are

currently concentrating on successfully delivering the many

continuing initiatives to deliver growth and satisfy increasing

regulatory obligations. The Board is acutely aware of the demands

our recent expansion has placed on our personnel, particularly the

financial, compliance and operational teams in Romford, where we

maintain investment and increase resources to mitigate the risks

associated with growth.

Culture, Governance and the Board

By setting the right example at the top, the Board has

prioritised the communication of good conduct and the appropriate

culture across all who represent the Company. We expect all

personnel to exemplify good culture and behaviour to achieve good

outcomes for clients and market contacts. Those aspects which need

to be cascaded down throughout the organisation are identified by

implementing a formal process of measuring and reporting against

suitable metrics. The executive directors and senior management,

through daily contact with employees and associates alike,

endeavour to demonstrate strong leadership and to be inspiring role

models while providing coupled with effective supervision.

Directors, Account Executives and Staff

After another year of attracting new revenue generators to the

group, and absorbing their additional investment business through

transfers of clients and their assets, we would like to thank all

our fellow Directors, Investment Managers and Advisers, and members

of our operations team for their hard work and diligence in

assisting in this process.

The Board and in particular the Executive Directors have

undergone a year of structural change in the governance and

oversight of the business. We reported last year the newly created

role of Group Compliance Director into which Guy Jackson has made

an effective contribution since joining in May 2016. After managing

the York office profitably for over ten years, David Hetherton has

taken retirement from his role as Executive Director, Wealth

Management and we wish him well. Last year, Robert Elliott advised

the Board of his intention to retire as Non-executive Director and

also as Chairman of the Audit Committee and he will not be seeking

to be re-elected to the Board at the forthcoming AGM. We will still

benefit from his experience as a business leader and Chartered

Accountant within our divisions. Clive Bouch, whom many colleagues

will remember as a former partner with Deloitte LLP, has a

long-standing relationship with the Company and we are delighted

that he has joined the Board to serve as Chairman of the Audit

Committee. His guidance, based on his recent relevant Board

experience in several sectors of financial services, will be an

invaluable asset to the Group.

Looking Ahead

In recent years we have achieved substantial growth, continuing

to refine our strategy and business model to make further strides

towards attaining our long-term strategic goals. We are now even

more committed to increasing our service proposition through

greater use of technology that is relevant to clients,

intermediaries and our own advisers. Our willingness to innovate

beyond our traditional business using our stable capital base is

well established.

D. M. Gelber

Chairman

17 July 2017

CEO's Statement

The year to 31 March 2017 saw a rise in annual revenue of 12% to

a record GBP29.2 million and underlying operating profit before tax

and exceptional items of GBP1.14 million, an improvement of 75.4%

over last year, reflecting the continuing strength of our strategy

for growth.

Overview

After a difficult first half, it is pleasing to report that the

Group saw a rise in annual Revenue of 12% to a record GBP29.2

million for the current full year. Profit before tax fell 14.8% to

GBP0.8 million from GBP0.94 million. However, when adjusted for

exceptional administrative expenses and the prior year gain of

GBP0.94 million on the sale of Euroclear shares, there was an

underlying improvement of 49% to GBP1.16 million from GBP0.78

million.

Notwithstanding the improvement, the Board and executive

management remain focused on improving the gross margin, managing

the administrative cost-base and maintaining revenue growth.

The market's strength since September has demonstrated its

resilience to the potential repercussions of the Brexit vote and

also the surprise at the Trump victory in the USA. This strength,

alongside inflows of new assets (being mainly client lists acquired

during the year) has enabled our Assets under Management and

Administration (AUMA) to grow by 26.8% to a record high of GBP5.2

billion, with a corresponding positive effect on our portfolio

managed revenues in our final quarter.

The proportion of less volatile non-broking income as a

percentage of total income has remained steady at 61.7% (2016:

61.8%) and cash reserves of GBP7.69m (2016: GBP7.20m) have also

been maintained.

Statement of Financial Position

As at 31 March 2017, the Group's financial position remains

strong with a 6.6% increase in the level of net assets to GBP21.8m

(2016: GBP20.5m), including an increase in net cash held at the

year end date of GBP7.69m (2016: GBP7.2m) despite higher dividend

payments of GBP716,000 (2016: GBP657,000) and acquisition cash

consideration payments of GBP1,098,000 (2016: GBP823,000).

Reconciliation of Profit Reconciliation of Operating

before tax profit/ (loss) to Operating

to Adjusted profit before profit before tax and

tax exceptional items 2017 2016

2017 2016 GBP000 GBP000

GBP000 GBP000 ------------- -------- --------

------------- -------- -------- Operating

Profit profit

before (loss) 782 (127)

tax 804 944 Exceptional

Exceptional items 360 778

items 360 778 ------------- -------- --------

Gain on Adjusted

Euroclear operating

sale - (942) profit 1,142 651

------------- -------- -------- ------------- -------- --------

Adjusted

profit

before

tax 1,164 780

------------- -------- --------

Operations

Although we have seen an increase in administrative expenses and

development expenses, a material proportion of which relates to

exceptional items and development expenses associated with enhanced

systems and controls for meeting higher client service levels and

regulatory standards, costs were strictly monitored and headcount

has been largely restricted to incoming revenue earners, their

support teams and administrative sections directly affected by our

growth.

During the last eighteen months our Executive Directors and

Investment Managers have been heavily engaged in a major upgrading

of our systems, monitoring and record-keeping in order to develop

our own rising regulatory standards and those seen across our

sector. This has led to a significant re-definition of the way in

which we communicate with our substantial client base alongside a

much greater use of technology. We are moving forward to complete

the hard yards of this exercise imminently. The outcome is intended

to reinforce our current offering to clients by continuing to build

and maintain a closer and deeper understanding of each client's

circumstances and requirements, thereby ensuring the suitability of

the individual service being provided. We are hugely appreciative

of our clients' continuing understanding throughout this

time-consuming but important process, which should see a much

improved premium service delivered to our clients. We firmly

believe it will underpin our prosperity with a stronger foundation

to ensure a company-wide emphasis on good client outcomes in a

manner aligned with our culture. The costs associated with these

developments and improvements were recorded mainly in the prior

year and in the first half of the current financial year.

Preparations are well underway to meet the challenges posed by

the UK's adoption of the European Parliament's MiFID II Directive.

We continue to fully support and reinforce Financial Conduct

Authority ('FCA') guidance on its drive to ensure that advice given

to clients by our account executives is suitable, well-explained

and properly recorded.

Encouragingly, following its acquisition in March 2015, Barker

Poland Asset Management LLP (BPAM) has delivered its second full

contribution to our results above our expectations which has helped

our stated aim of materially increasing the proportion of our

revenues earned as fees, rather than through transaction-driven

commissions. This is a key performance indicator reflecting the

changing shape of the business from traditional stockbroking to an

increasingly integrated investment and wealth management model.

Investment Management

The Group's assets under management have grown to record levels.

We recognise the growing importance of scale, which gives clients

and market participants a degree of reassurance of the security of

their assets and the strength and stability of the organisation.

With total Assets Under Management and Administration (AUMA) at the

year end standing at a high of GBP5.2 billion (31 March 2016:

GBP4.1 billion), our target of GBP5bn AUMA by 2018 has already been

achieved with GBP10bn being a realistic milestone for the

future.

Discretionary and Advisory Assets Under Management (AUM) at the

year end were GBP3.2bn (31 March 2016: GBP2.3bn). This pleasing

increase resulted partly from the inflow of AUM from the clients of

new Advisers and Investment Managers, alongside transactional

revenue and positive investment markets. Commission income from

broking and investment activity showed a strong recovery in the

second half of the year, after a poor first half that had been

negatively affected by Brexit. Net investment management fees

signalled growth on the back of new AUM and portfolio values

increased by 5.1% to GBP8.2m (2016: GBP7.8m).

Gross revenues from the Investment Management division increased

by 14.4% during the period to GBP27.0m (2016: GBP23.6m), which

contributed to this segment's significantly improved reported

result compared to the previous year. Management believe that the

scope for additional expansion continues to be a realistic

prospect. The new and meaningful increase in the annual ISA

allowance from GBP15,240 to GBP20,000 provides an incentive to

clients to continue investing into our ISA wrapper enabling income

and capital gain to remain tax free. The number of new ISA

subscriptions this year was higher by 9.7%, alongside a similarly

impressive increase for Junior ISAs of 16.8%. Assets under

management within our ISAs soared by 26% to GBP764 million from

last year's GBP600 million.

The Structured Investments division has produced an excellent

year of results for investors with many 'kick-out' style products

maturing early with healthy gains against a backdrop of strong

equity market performance. Despite a financial year dominated by

political uncertainty, re-investment rates amongst investors have

remained strong. Our competitive range of structured investment

products continues to garner strong support amongst the financial

adviser community, enabling us to broaden our client base and

assets under management.

In addition, our Alternative Investments management team

delivered substantial growth in revenues and funds under management

through the Tier 1 (Investor) Visa Investment Programme and Short

Term Lending (property financing) mandates. The equity arbitrage

desk continues to perform well, delivering even greater

profitability compared to last year.

Wealth Management

Our Wealth Management division, run from York, continues to be

driven by a focused management team and a highly qualified team of

Advisers, who provide a committed, quality service to a growing

client base.

Complementing this division, our Ebor Pensions business

administers Self Invested Personal Pensions (SIPP) and Small Self-

Administered Schemes (SSAS), along with a small number of Funded

Unapproved Retirement Benefit Schemes (FURBS).

AUMA of the combined divisions within our Wealth Management arm

increased to GBP514 million (2016: GBP501 million). Turnover from

Wealth Management fell slightly reflecting the shift towards taking

lower recurring fees as opposed to higher initial revenue and this

has contributed to the lower reported result for this segment

compared to the previous year. However, a degree of cost cutting

and growth in on-going activity has led to an anticipated

improvement in profitability at the start of the current calendar

year. There has been a pleasing continuation of this in the opening

weeks of the new financial year.

Outlook

In keeping with our plans for expansion, we are finalising the

move of our London head office to new more modern, high quality

premises within central London before the end of 2017.

Trading activity in the opening weeks of the new financial year

has continued the positive momentum seen in the last quarter of the

year ended 31 March 2017 and your Board correspondingly looks to

the immediate future with greater optimism, albeit tempered by

potential political challenges and geopolitical headwinds.

Despite the present threat to political stability caused by the

recent outcome of the UK general election and the significant

demands we face from our continuing regulatory initiatives over the

next 18 months, it is our emphasis on integrity, service and good

customer outcomes which will drive our public profile and

competitive positioning to deliver underlying growth in the next

phase of the Group's development.

R. A. FitzGerald FCA

Chief Executive Officer

17 July 2017

Consolidated income statement

year ended 31 March 2017

2017 2016

Notes GBP'000 GBP'000

---------------------------------------- ------- --------------- --------------

Revenue 3 29,215 26,070

Commission payable (10,009) (8,433)

Share of after tax profits of

joint ventures 12 10

---------------------------------------- ------- --------------- --------------

Administrative expenses - other (18,076) (16,996)

Administrative expenses - exceptional

items 5 (360) (778)

---------------------------------------- ------- --------------- --------------

Total administrative expenses (18,436) (17,774)

Operating profit/(loss) 782 (127)

---------------------------------------- ------- --------------- --------------

Analysed as:

Operating profit before tax and

exceptional item 1,142 651

Administrative expenses - exceptional

items 5 (360) (778)

---------------------------------------- ------- --------------- --------------

Operating profit/(loss) 782 (127)

Gain on disposal of available-for-sale

investments 6 - 942

Investment revenues 24 131

Finance costs (2) (2)

---------------------------------------- ------- --------------- --------------

Profit before tax 804 944

Taxation (196) (149)

---------------------------------------- ------- --------------- --------------

Profit for the year attributable

to equity holders of the Company 608 795

---------------------------------------- ------- --------------- --------------

Earnings per share

Basic 7 1.56 2.11

Diluted 7 1.56 2.11

---------------------------------------- ------- --------------- --------------

Consolidated statement of comprehensive income

year ended 31 March 2017

2017 2016

GBP'000 GBP'000

-------------------------------------- ------------- -------------

Addition/(reversal) of revaluation

of available-for-sale investments - (959)

Reversal of deferred tax charge

on revaluation of available-for-sale

investments - 192

--------------------------------------- ------------- -------------

Net loss recognised directly in

equity - (767)

Profit for the year 608 795

--------------------------------------- ------------- -------------

Total comprehensive income for the

year attributable to equity holders

of the Company 608 28

--------------------------------------- ------------- -------------

Consolidated statement of financial position

year ended 31 March 2017

Restated Restated

Group Group Group

2017 2016 2015

GBP'000 GBP'000 GBP'000

------------------------------- -------- --------------- ------------------

Non-current assets

Goodwill 4,388 4,388 4,388

Other intangible assets 8,294 7,992 6,631

Property, plant and equipment 836 841 1,110

Interest in joint ventures 40 28 28

Available-for-sale investments 68 57 2,417

-------------------------------- -------- --------------- ----------------

13,626 13,306 14,574

------------------------------- -------- --------------- ----------------

Current assets

Trade and other receivables 52,179 38,799 28,332

Financial assets held for

trading 1,086 1,237 2,701

Cash and cash equivalents 7,729 7,257 6,635

-------------------------------- -------- --------------- ----------------

60,994 47,293 37,668

------------------------------- -------- --------------- ----------------

Total assets 74,620 60,599 52,242

-------------------------------- -------- --------------- ----------------

Current liabilities

Trade and other payables (51,402) (36,572)* (27,685)*

Current tax liabilities (288) (117)* (215)*

Deferred tax liabilities (308) (512)* (736)*

Bank overdrafts (35) (77) (134)

Shares to be issued - deferred

consideration (366) (912) (298)

-------------------------------- -------- --------------- ----------------

(52,399) (38,190)* (29,068)*

------------------------------- -------- --------------- ----------------

Net current assets 8,595 9,103* 8,600*

-------------------------------- -------- --------------- ----------------

Long-term liabilities

Deferred cash consideration (372) (1,556) (1,930)

Shares to be issued - (218) (453)

Dilapidation provision - (132) -

-------------------------------- -------- --------------- ----------------

(372) (1,906) (2,383)

------------------------------- -------- --------------- ----------------

Net assets 21,849 20,503* 20,791*

-------------------------------- -------- --------------- ----------------

Equity

Share capital 2,826 2,595 2,545

Share premium account 3,502 2,279 1,988

Own shares (312) (312) (312)

Retained earnings 11,165 11,273* 11,135*

Revaluation reserve - - 767

Other reserves 4,668 4,668 4,668

-------------------------------- -------- --------------- ----------------

Equity attributable to

equity holders of the Company 21,849 20,503* 20,791*

-------------------------------- -------- --------------- ----------------

* Amounts have been restated and are explained further in Note 9.

Consolidated statement of cash flows

year ended 31 March 2017

2017 2016

GBP'000 GBP'000

--------------------------------------------- -------------- --------------

Operating activities

Cash generated/(used) by operations 2,883 (1,119)

Tax paid (229) (120)

--------------------------------------------- -------------- --------------

Net cash generated/(used) by operating

activities 2,654 (1,239)

--------------------------------------------- -------------- --------------

Investing activities

Purchase of property, plant and equipment (499) (247)

Net sale of investments held for trading 151 1,464

Net sale proceeds/cost of available-for-sale

investments - 2,044

Consideration paid on acquisition of

client lists (1,098) (810)

Deferred consideration paid on acquisition

of subsidiary - (13)

Dividends received 4 54

Interest received 20 85

Net cash (used)/ generated by investing

activities (1,422) 2,577

--------------------------------------------- -------------- --------------

Financing activities

Dividends paid (716) (657)

Interest paid (2) (2)

--------------------------------------------- -------------- --------------

Net cash used by financing activities (718) (659)

--------------------------------------------- -------------- --------------

Net increase in cash and cash equivalents 514 679

Net cash and cash equivalents at beginning

of year 7,180 6,501

--------------------------------------------- -------------- --------------

Net cash and cash equivalents at end

of year 7,694 7,180

--------------------------------------------- -------------- --------------

Cash and cash equivalents 7,729 7,257

Bank overdrafts (35) (77)

--------------------------------------------- -------------- --------------

7,694 7,180

--------------------------------------------- -------------- --------------

Consolidated statement of changes in equity

year ended 31 March 2017

Called

up Own

share Share shares Capital Retained Total

capital premium held redemption Other Revaluation earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- --------- --------- --------- ------------ --------- ------------ ---------- ---------

Restated* equity

as at

31 March 2015 2,545 1,988 (312) 111 4,557 767 11,135 20,791

Reversal of revaluation

of

available-for-sale

investments - - - - - (959) - (959)

Reversal of deferred

tax charge

on revaluation

of available-for-sale

investments - - - - - 192 - 192

Comprehensive

income for the

year - - - - - - 795 795

----------------------- --------- --------- --------- ------------ --------- ------------ ---------- ---------

Total comprehensive

income

for the year - - - - - (767) 795 28

----------------------- --------- --------- --------- ------------ --------- ------------ ---------- ---------

Contributions

by and

distributions

to owners

Dividends paid - - - - - - (657) (657)

Issues of shares

on acquisition

of intangibles

and as

deferred consideration 50 291 - - - - - 341

----------------------- --------- --------- --------- ------------ --------- ------------ ---------- ---------

Total contributions

by and distributions

to owners 50 291 - - - - (657) (316)

----------------------- --------- --------- --------- ------------ --------- ------------ ---------- ---------

Restated* equity

as at

31 March 2016 2,595 2,279 (312) 111 4,557 - 11,273 20,503

Total comprehensive

income for the

year - - - - - - 608 608

Contributions

by and

distributions

to owners

----------------------- --------- --------- --------- ------------ --------- ------------ ---------- ---------

Dividends paid - - - - - - (716) (716)

Issue of shares

on acquisition

of intangibles**

and as deferred

consideration 231 1,223 - - - - - 1,454

----------------------- --------- --------- --------- ------------ --------- ------------ ---------- ---------

Total contributions

by and distributions

to owners 231 1,223 - - - - (716) 738

----------------------- --------- --------- --------- ------------ --------- ------------ ---------- ---------

Equity as at

31 March 2017 2,826 3,502 (312) 111 4,557 - 11,165 21,849

----------------------- --------- --------- --------- ------------ --------- ------------ ---------- ---------

* Equity as at 31 March 2015, restated Note 9.

** The acquisition of intangibles includes the deferred taxation

at 20% arising on consolidation.

Extract from Statement of Directors' Responsibilities

Pursuant to Rule 4 of the Disclosure Guidance and Transparency

Rules, each of the Directors, whose names and functions are listed

on page 24 of the Annual Report and Accounts confirm that, to the

best of their knowledge:

-- The Group Financial Statements have been prepared in

accordance with IFRSs as adopted by the EU and Article 4 of the IAS

Regulation and give a true and fair view of the assets,

liabilities, financial position and profit and loss of the

Group.

-- The Annual Financial Report includes a fair review of the

development and performance of the business and the financial

position of the Group and the Company, together with a description

of the principal risks and uncertainties that they face.

On behalf of the Board

D Gelber

Chairman

17 July 2017

Notes to the Accounts

year ended 31 March 2017

1. Basis of preparation of financial statements

The financial information set out in these financial statements

does not constitute the Group's statutory accounts for the years

ended 31 March 2017 and 2016.

The statutory accounts for 31 March 2017 to which these

non-statutory accounts relate have not been delivered to the

registrar of companies.

The auditor's report has been signed and was unqualified.

This preliminary announcement is based on the Group financial

statements which are prepared in accordance with IFRS.

2. Going concern

The Group continues to maintain a robust financial position.

Having conducted detailed cash flow and working capital projections

and appropriate stress-testing on liquidity, profitability and

regulatory capital, taking account of possible adverse changes in

trading performance, the Board is satisfied the Group is well

placed to manage its business risks adequately; and that it will be

able to operate within the level of its current financing

arrangements and regulatory capital limits imposed by our

regulator, the Financial Conduct Authority (FCA). Accordingly, the

Board continues to adopt the going concern basis for the

preparation of the financial statements.

3. Revenue

An analysis of the Group's revenue is as follows:

2017 2017 2016 2016

Broking Non-broking 2017 Broking Non-broking 2016

income income Total income income Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ -------- ------------ -------- -------- ------------ --------

Stockbroking commission 11,194 - 11,194 10,007 - 10,007

Fees and other revenue* - 15,795 15,795 - 13,632 13,632

------------------------ -------- ------------ -------- -------- ------------ --------

Investment Management 11,194 15,795 26,989 10,007 13,632 23,639

Wealth Management - 2,226 2,226 - 2,431 2,431

------------------------ -------- ------------ -------- -------- ------------ --------

Revenue 11,194 18,021 29,215 10,007 16,063 26,070

Net investment revenue - 22 22 - 129 129

------------------------ -------- ------------ -------- -------- ------------ --------

Total income 11,194 18,043 29,237 10,007 16,192 26,199

------------------------ -------- ------------ -------- -------- ------------ --------

% of total income 38.3 61.7 100.0 38.2 61.8 100.0

------------------------ -------- ------------ -------- -------- ------------ --------

* Includes Investment Management, Structured Investments,

Alternative Investments.

4. Segmental analysis

For segmental reporting purposes, the Group currently has two

operating segments, Investment Management, being portfolio based

transaction execution and investment advice and Wealth Management,

being financial planning and pension advice. Unallocated corporate

expenses, assets and liabilities are not considered to be allocable

accurately, or fairly, under any known basis of allocation and are

therefore disclosed separately.

The investment management division activities focus

predominantly on investment management of various types of

portfolios and asset classes.

The wealth management division provides advisory and

administrative services to clients in relation to their financial

planning, life insurance, inheritance tax and pension arrangements.

These divisions, both of which conduct business in the United

Kingdom only, are the basis on which the Group reports its primary

segment information.

Consolidated

year ended

Investment Wealth 31 March

Management Management 2017

2017 GBP'000 GBP'000 GBP'000

--------------------------------------- ----------- ----------- ------------

Revenue

External sales 26,989 2,226 29,215

--------------------------------------- ----------- ----------- ------------

Result

Segment result 2,420 72 2,492

Unallocated corporate expenses (1,710)

--------------------------------------- ----------- ----------- ------------

Operating profit 782

Gain on disposal of available-for-sale

investments _

Investment revenues 24

Finance costs (2)

--------------------------------------- ----------- ----------- ------------

Profit before tax 804

Tax (196)

--------------------------------------- ----------- ----------- ------------

Profit after tax 608

--------------------------------------- ----------- ----------- ------------

Consolidated

year ended

Investment Wealth 31 March

Management Management 2017

2017 GBP'000 GBP'000 GBP'000

---------------------------------- ----------- ----------- ------------

Other information

Capital additions 497 2 499

Depreciation 486 18 504

Statement of financial position

Assets

Segment assets 67,362 2,213 69,575

Unallocated corporate assets 5,045

---------------------------------- ----------- ----------- ------------

Consolidated total assets 74,620

---------------------------------- ----------- ----------- ------------

Liabilities

Segment liabilities 51,623 738 52,361

Unallocated corporate liabilities 410

---------------------------------- ----------- ----------- ------------

Consolidated total liabilities 52,771

---------------------------------- ----------- ----------- ------------

Consolidated

year ended

Investment Wealth 31 March

Management Management 2016

2016 GBP'000 GBP'000 GBP'000

---------------------------------------- ----------- ----------- ------------

Revenue

External sales 23,639 2,431 26,070

---------------------------------------- ----------- ----------- ------------

Result

Segment result 987 165 1,152

Unallocated corporate expenses (1,279)

---------------------------------------- ----------- ----------- ------------

Operating loss (127)

Gains on disposal of available-for-sale

investments 942

Investment revenues 131

Finance costs (2)

---------------------------------------- ----------- ----------- ------------

Profit before tax 944

Tax (149)

---------------------------------------- ----------- ----------- ------------

Profit after tax 795

---------------------------------------- ----------- ----------- ------------

Restated

Consolidated

Restated year ended

Investment Wealth 31 March

Management Management 2016

2016 GBP'000 GBP'000 GBP'000

---------------------------------- ------------ ----------- -------------

Other information

Capital additions 231 16 247

Depreciation 497 19 516

Statement of financial position

Assets

Segment assets 52,131 1,963 54,094

Unallocated corporate assets 6,505

---------------------------------- ------------ ----------- -------------

Consolidated total assets 60,599

---------------------------------- ------------ ----------- -------------

Liabilities

Segment liabilities 39,137* 543 39,680*

Unallocated corporate liabilities 416

---------------------------------- ------------ ----------- -------------

Consolidated total liabilities 40,096*

---------------------------------- ------------ ----------- -------------

*Amounts have been restated and are explained further in Note

9

5. Administrative expenses - exceptional items

As a result of its materiality the Directors decided to disclose

certain amounts separately in order to present results which are

not distorted by significant exceptional events.

2017 2016

GBP'000 GBP'000

------------------------------------------ ------------ -------------

Costs incurred on suitability project (58) 778

Exceptional employment-related costs 418 -

------------------------------------------ ------------ -------------

360 778

------------------------------------------ ------------ -------------

During the period to 31 March 2016, and as disclosed in the

prior year, the Group incurred substantial legal and professional

adviser costs of an exceptional nature to improve its regulatory

control framework in relation to suitability of advice given to

clients.

In the year to 31 March 2017, GBP58,000 of the estimated costs

provided in the prior year were not required and therefore have

been reversed. In the year to 31 March 2017, the Group also

incurred significant legal fees and other costs in connection with

employment matters of an exceptional nature.

6. Gain on disposal of available-for-sale investments

Net gains comprise:

2017 2016

GBP'000 GBP'000

------------------------------------------- ------------- -------------

Gain on disposal of available for sale

investments _ 942

------------------------------------------- ------------- -------------

There were no gains or losses on the disposal of investments in

the current period.

During the period to 31 March 2016, the Group disposed of its

holding of 1,809 shares in Euroclear plc realising a gain of

GBP942,000. Due to their level of materiality and one-off nature,

the Board has decided to disclose this item separately

7. Earnings per share

The calculation of basic earnings per share for continuing

operations is based on the post-tax profit for the financial year

of GBP608,000 (2016: GBP795,000) and on 38,974,002 (2016:

37,678,525) Ordinary Shares of 6(2) /3 pence, being the weighted

average number of Ordinary Shares in issue during the year.

8. Contingent liability

During the year, two Group companies, Walker Crips Group plc

(WCG) and Walker Crips Stockbrokers Limited (WCSB), received draft

proceedings in respect of a potential claim, from a former listed

corporate client of Keith Bayley Rogers & Co (KBR), a former

subsidiary of the Group.

The corporate client alleges that its former Executive Chairman

and his associates misappropriated assets of GBP5.6 million from it

between 2010 -2014 and used these assets to purchase and sell

shares in the client through the brokerage of WCG, WCSB and KBR.

The client asserts that WCG and WCSB acted dishonestly to assist

the Chairman to perpetrate the alleged fraud and was party to an

unlawful means conspiracy to cause it loss. It is also claimed that

WCG, WCSB are vicariously liable for any wrongdoing on the part of

KBR. The potential quantum of the claim is in excess of GBP1

million. The claims are strenuously denied by the Directors and the

Directors consider the claim to be without any merit, as supported

by a legal opinion obtained by WCG and WCSB, which advises that the

claims are "weak". A detailed response denying liability for the

claims was submitted to the client's representatives in December

2016. The Directors have heard nothing further from the former KBR

client since then.

9. Prior year adjustment

An adjustment has been made to retained earnings brought forward

at 1 April 2015 to reflect unused holiday entitlement costs of

GBP148,000 at 31 March 2015 together with the tax impact of

GBP29,000 and reducing retained earnings by GBP119,000 as at 31

March 2015 and 2016. Movements in the liability since are

considered immaterial and there is therefore no impact to profit

before tax for subsequent years.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR OKODKCBKDNOD

(END) Dow Jones Newswires

July 18, 2017 02:00 ET (06:00 GMT)

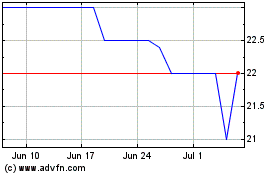

Walker Crips (LSE:WCW)

Historical Stock Chart

From Mar 2024 to Apr 2024

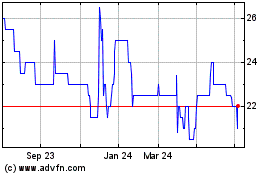

Walker Crips (LSE:WCW)

Historical Stock Chart

From Apr 2023 to Apr 2024