By Sarah Nassauer and Anne Steele

Wal-Mart Stores Inc. and Home Depot Inc. on Tuesday showed they

can still find ways to entice shoppers to their physical stores,

despite a continuing consumer shift toward online buying.

Both big box retailers reported strong sales over the holiday

season, unlike other brick-and-mortar competitors such as Target

Corp. and Macy's Inc., showing that some retailers are managing to

capitalize on a strengthening economy.

Wal-Mart said more shoppers came to its stores and spent more

when they did, as the company invested heavily to lower prices and

improve customer service. "Versus two years ago, our stores are in

better shape than they were and you're seeing the results of that,"

said Wal-Mart's chief financial officer, Brett Biggs, in an

interview.

On Tuesday, the world's biggest retailer reported that sales in

U.S. stores open at least 12 months rose 1.8% in the quarter ended

Jan. 31, the 10th consecutive quarter of gains. But the strength of

the company's U.S. store business continues to come at the expense

of profits, which fell 18% in the quarter. The retail behemoth is

investing billions to raise U.S. store worker wages, lower prices

and expand e-commerce sales to better compete with Amazon.com

Inc.

Home Depot's same-store sales rose 5.8% in the fourth quarter,

driven by a strong housing market that prompted customers to start

bigger home-improvement projects and replenish their toolboxes.

U.S. home values have recouped all of the losses of the recent

housing bust, in September eclipsing a record set in July 2006,

according to data from S&P CoreLogic S&P Indices.

The retailer also pointed out that while its online sales are

growing, nearly half of those orders were fulfilled through

in-store pickup. "While we are seeing significant growth in our

online business, our stores have never been more relevant," Home

Depot's chief executive, Craig Menear, said during a call with

analysts.

Wal-Mart and Home Depot's performance contrasts with many other

brick-and-mortar retailers, which are challenged by shoppers

gravitating to less-profitable online shopping and discounters

offering low prices.

Macy's longtime Chief Executive Terry Lundgren said Tuesday that

record U.S. car sales indicate consumers have spent a bigger

portion of their budget on big-ticket items lately. "At some point

in time you've got to believe that everybody's going to have a

brand-new car," Mr. Lundgren said, after the department store chain

reported its eighth straight quarter of falling comparable-store

sales. "There's dollars that are going to be freed up for other

categories of spending."

Investors have become wary of the retail market after Target,

Macy's and Kohl's Corp. reported weak holiday sales. Warren

Buffett's Berkshire Hathaway Inc. dumped $900 million worth of

Wal-Mart shares at the end of 2016, nearly exiting the stock,

according to federal filings.

In 2016, while retail sales rose across the board, online

retailers took much of the spoils. During the year, spending rose

11% at online retailers and fell almost 6% at department stores,

according to Commerce Department figures.

Macy's, which is closing stores and laying off thousands of

staffers, on Tuesday reported a 2.1% drop in comparable-store sales

in the latest quarter. Its profit fell 13%. Macy's said it raised

$673 million from selling real estate and would continue to explore

options for its properties.

The retailer on Tuesday said its problems could be fixed, even

as shoppers increasingly do their purchasing online.

"There's lots of concern out there with our ability to bounce

back, but internally we've got a lot people on our team who have

seen this movie or some version of it," Mr. Lundgren said on a

conference call. Although he will step aside as CEO next month, he

said Macy's "made strategic decisions in 2016 that will carry us

through."

Wal-Mart's sales grew in most of its categories, particularly

clothes and health products. Revenue rose 1% to $130.9 billion, and

excluding currency swings, it said revenue would have climbed to

$133.6 billion.

The company has worked to strengthen its e-commerce

capabilities, purchasing Jet.com Inc. for $3.3 billion last

September. Online sales, however, grew more slowly in the fourth

quarter after a previous quarter of acceleration, rising 16% in its

first full quarter that included Jet.com sales, compared with a 21%

uptick the previous quarter. That quarter included some sales from

Yihaodian, the Chinese online retailer Wal-Mart sold last June,

said a spokesman.

Overall for the period that ended in January, Wal-Mart reported

a profit of $3.76 billion, or $1.22 a share, down from $4.57

billion, or $1.43 a share, in the year-earlier quarter.

Wal-Mart executives said that the first quarter of fiscal year

2018 has thus far been "soft," in part because the government has

worked to prevent fraud by delaying tens of billions in early tax

refunds that often go to low- and middle-income shoppers,

Wal-Mart's core consumer.

"Nothing has markedly changed about the consumer overall," said

Mr. Biggs. In past years the Internal Revenue Service delayed a

smaller number of refunds and spending was pushed into the

following quarter, he said.

In a research note, the Buckingham Research Group called

Wal-Mart's sales figures strong, "but the question that remains

unanswered in our minds is when can sales growth overcome

investment spending and translate into earnings growth?"

--Joshua Jamerson contributed to this article.

Write to Sarah Nassauer at sarah.nassauer@wsj.com and Anne

Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

February 21, 2017 16:57 ET (21:57 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

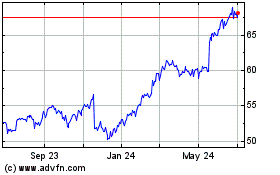

Walmart (NYSE:WMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

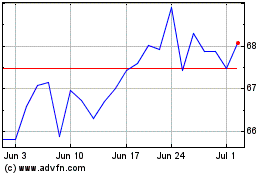

Walmart (NYSE:WMT)

Historical Stock Chart

From Apr 2023 to Apr 2024