Wal-Mart Eyes Indian Expansion - Analyst Blog

March 30 2011 - 5:30AM

Zacks

Wal-Mart Stores Inc. (WMT), the world's biggest

retailer, may form an alliance with India’s biggest retailer Future

Group.

The company hopes to pick a stake in the back-end operations of

Future Group’s Big Bazaar. WMT also has an eye on expansion in

the front-end business when regulation in India becomes flexible

enough to permit foreign players to enter into front-end

retail.

Future Group is one of India’s leading business houses with

multiple businesses spanning across the consumption space. While

retail forms the core business activity of Future Group,

subsidiaries are present in consumer finance, capital, insurance,

leisure and entertainment, brand development, retail real estate

development, retail media and logistics.

Senior officials of the Future Group and Wal-Mart have met at

least five times in the past four months. Future Group owner

Kishore Biyani visited Wal-Mart's headquarters in the US, last

December where he met Doug McMillon, president and CEO of the

American company. The alliance between the two retailers may give a

whole new shape to organized retail in India.

In fiscal 2006, Wal-Mart entered into a joint venture with

Bharti Group in India with the venture named as Bharti Walmart.

Bharti Walmart is operational in the wholesale and back-end

segments, the two areas where foreign players can operate in India.

However, Wal-Mart seems to be unhappy with the pace of expansion of

the business. As per the data from the Registrar of Companies, the

joint venture reported a loss of Rupees 151 crores in calendar year

2009. This might be one of the reasons that prompted Wal-Mart to

seek another partner to expand operations in India.

Based in Bentonville, Arkansas, Wal-Mart Stores operates retail

outlets in various formats across the world. The company conducts

its business through three segments: Walmart U.S.,

International and Sam’s Club.

Wal-Mart has a significant presence in the international market.

The international segment of the company consists of retail

operations in 14 countries and Puerto Rico. Total sales at the

international segment came in at $100,107 million in fiscal 2010,

up 1.3% year over year. We believe that the significant

international presence has boosted growth and will continue to do

so in the coming years.

Though Wal-Mart’s significant international presence helps to

diversify its customer base, fluctuations in currency exchange

rates can adversely impact the company’s international sales.

Further, Wal-Mart operates in a highly competitive retail market.

All three business segments of the company compete for customers,

employees, store sites, products and services. The company is in

direct competition with Costco Wholesale

Corporation (COST) and Target Corp.

(TGT)

We maintain our long-term “Neutral” recommendation on Wal-Mart.

The quantitative Zacks #3 Rank (short-term Hold rating) for the

company indicates no clear directional pressure on the stock over

the near term.

COSTCO WHOLE CP (COST): Free Stock Analysis Report

TARGET CORP (TGT): Free Stock Analysis Report

WAL-MART STORES (WMT): Free Stock Analysis Report

Zacks Investment Research

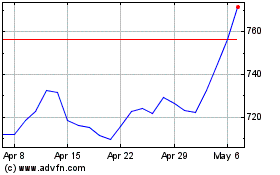

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Apr 2023 to Apr 2024