Solid execution against strategic priorities

drives results in line with expectations

WEX Inc. (NYSE:WEX), a leading provider of corporate payment

solutions, today reported financial results for the three months

ended June 30, 2015.

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20150729005419/en/

Second Quarter 2015 Financial Results

Total revenue for the second quarter of 2015 increased 6% to

$213.7 million from $201.6 million for the second quarter of 2014.

Net income to common shareholders on a GAAP basis was $26.5

million, or $0.68 per diluted share, compared with $43.3 million,

or $1.11 per diluted share, for the second quarter last year.

On a non-GAAP basis, the Company's adjusted net income for the

second quarter of 2015 decreased 9% to $48.3 million, or $1.25 per

diluted share, from $53.1 million, or $1.36 per diluted share, for

the same period a year ago. Note that adjusted net income has been

revised to exclude the impact of foreign currency remeasurement

gains and losses and related hedges. With the revision of adjusted

net income, full year guidance now excludes the impact of these

foreign currency remeasurement gains and losses and related hedges.

See Exhibit 1 for a full reconciliation of adjusted net income.

"I am pleased to report solid top and bottom line results this

quarter that were in line with our expectations. WEX Europe

Services and Evolution1 continue to progress better than

anticipated, which have partially offset softness in macroeconomic

factors, including continued fuel price headwinds. As we move into

the second half of the year, I am encouraged by the momentum our

team is demonstrating across our high-growth verticals and

geographies and the underlying organic growth in the business,"

said Melissa Smith, WEX's president and chief executive

officer.

Smith continued, "Overall, I remain optimistic about the

trajectory of our long term growth. Our guidance assumes that 2015

will continue to be a year of investment as we ramp our global

operations and optimize the efficiency of our expanded

infrastructure and assets. We have established the building blocks

we need to retain our market leadership in our core segments while

expanding our reach in high-growth, emerging industries. We will

continue to seek strategic acquisitions that complement our

business or enhance our offering in the market."

Second Quarter 2015 Performance Metrics

Where applicable, the performance metrics listed below have been

revised for and include WEX Europe Services, which WEX acquired in

December 2014:

- Average number of vehicles serviced

worldwide was approximately 9.8 million, an increase of 24% from

the second quarter of 2014.

- Total fuel transactions processed

increased 5% from the second quarter of 2014 to 103.1 million.

Payment processing transactions increased 11% to 86.7 million.

- Average expenditure per payment

processing transaction decreased 22% from the second quarter of

2014 to $68.98.

- U.S. retail fuel price decreased 27% to

$2.74 per gallon from $3.76 per gallon in the second quarter of

2014.

- Total corporate card purchase volume

grew 31% to $5.7 billion, from $4.3 billion for the second quarter

of 2014.

Financial Guidance and Assumptions

- For the third quarter of 2015, WEX

expects revenue in the range of $224 million to $233 million and

adjusted net income in the range of $54 million to $57 million, or

$1.38 to $1.46 per diluted share.

- For the full year 2015, the Company

expects revenue in the range of $847 million to $872 million and

adjusted net income in the range of $192 million to $201 million,

or $4.94 to $5.14 per diluted share.

Third quarter 2015 guidance is based on an assumed average U.S.

retail fuel price of $2.77 per gallon, and approximately 39 million

shares outstanding. Full-year 2015 guidance is based on an assumed

average U.S. retail fuel price of $2.68 per gallon and

approximately 39 million shares outstanding. The fuel prices

referenced above are based on the applicable NYMEX

futures price.

The Company's guidance also assumes that third quarter 2015

credit loss will range between 6 and 11 basis points, and full year

2015 fleet credit loss will range between 7 and 10 basis points.

Our guidance also includes $11 million to $14 million of after tax

losses related to WEX Europe Services.

The Company's guidance excludes the impact of non-cash,

mark-to-market adjustments on the Company's fuel-price-related

derivative instruments, foreign currency remeasurement gains and

losses and related hedges, stock-based compensation, restructuring

charges, gain on divestitures and the amortization of purchased

intangibles as well as the related tax and non-controlling interest

impacts of the forgoing adjustments.

Additional Information

Exhibit 1 reconciles adjusted net income, which has not been

determined in accordance with GAAP, to net income as determined in

accordance with GAAP for the three and six months ended

June 30, 2015 and 2014.

Management uses the non-GAAP measures presented within this news

release to evaluate the Company's performance on a comparable

basis, to lessen the volatility associated with its derivative

instruments and foreign exchange rates on financial results.

Management believes that investors may find these measures useful

for the same purposes, but cautions that they should not be

considered a substitute for, or superior to, disclosure in

accordance with GAAP.

To provide investors with additional insight into its

operational performance, WEX has included in this news release a

table of selected non-financial metrics for the five quarters ended

June 30, 2015. This table is presented as Exhibit 2. The Company is

also providing selected segment revenue information for the three

and six months ended June 30, 2015 and 2014 in Exhibit 3.

Conference Call Details

In conjunction with this announcement, WEX will host a

conference call today, July 29, 2015, at 10:00 a.m. (ET). As

previously announced, the conference call will be webcast live on

the Internet, and can be accessed at the Investor Relations section

of the WEX website, http://www.wexinc.com. The live conference call

also can be accessed by dialing (866) 334-7066 or (973) 935-8463.

The Conference ID number is 62983827. A replay of the webcast will

be available on the Company's website.

About WEX Inc.

WEX Inc. (NYSE: WEX) is a leading provider of corporate payment

solutions. From its roots in fleet card payments beginning in 1983,

WEX has expanded the scope of its business into a multi-channel

provider of corporate payment solutions representing approximately

9.8 million vehicles and offering exceptional payment security and

control across a wide spectrum of business sectors. WEX serves a

global set of customers and partners through its operations around

the world, with offices in the United States, Australia, New

Zealand, Brazil, the United Kingdom, Italy, France, Germany,

Norway, and Singapore. WEX and its subsidiaries employ

approximately 2,000 associates. The Company has been publicly

traded since 2005, and is listed on the New York Stock Exchange

under the ticker symbol “WEX.” For more information, visit

www.wexinc.com and follow WEX on Twitter at @WEXIncNews.

Forward-Looking Statements

This news release contains forward-looking statements, including

statements regarding: financial guidance; assumptions underlying

the Company's financial guidance; business momentum; optimism about

trajectory for long term growth trends; and, plans for strategic

acquisitions. Any statements that are not statements of historical

facts may be deemed to be forward-looking statements. When used in

this news release, the words "may," "could," "anticipate," "plan,"

"continue," "project," "intend," "estimate," "believe," "expect"

and similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain

such words. These forward-looking statements are subject to a

number of risks and uncertainties that could cause actual results

to differ materially, including: the effects of general economic

conditions on fueling patterns, payments, transaction processing

activity and the commercial activity of fleets; the effects of the

Company’s business expansion and acquisition efforts; the Company’s

failure to successfully integrate the businesses it has acquired;

the failure of corporate investments to result in anticipated

strategic value; the impact and size of credit losses; the impact

of changes to the Company's credit standard; breaches of the

Company’s technology systems and any resulting negative impact on

our reputation, or liabilities, or loss of relationships with

customers or merchants; fuel price volatility and changes in fleet

fuel efficiency; the Company’s failure to maintain or renew key

agreements; failure to expand the Company’s technological

capabilities and service offerings as rapidly as the Company’s

competitors; the actions of regulatory bodies, including banking

and securities regulators, or possible changes in banking

regulations impacting the Company’s industrial bank and the Company

as the corporate parent; the impact of foreign currency exchange

rates on the Company’s operations, revenue and income; changes in

interest rates; the impact of the Company’s outstanding notes on

its operations; financial loss if the Company determines it

necessary to unwind its derivative instrument position prior to the

expiration of a contract; the incurrence of impairment charges if

our assessment of the fair value of certain of our reporting units

changes; the uncertainties of litigation; as well as other risks

and uncertainties identified in Item 1A of our Annual Report for

the year ended December 31, 2014, filed on Form 10-K with the

Securities and Exchange Commission on February 26, 2015. The

Company's forward-looking statements do not reflect the potential

future impact of any alliance, merger, acquisition, disposition or

stock repurchases. The forward-looking statements speak only as of

the date of this earnings release and undue reliance should not be

placed on these statements. The Company disclaims any obligation to

update any forward-looking statements as a result of new

information, future events or otherwise.

WEX INC. CONDENSED CONSOLIDATED STATEMENTS

OF INCOME (in thousands, except per share data)

(unaudited) Three months ended Six months

ended June 30, June 30, 2015

2014 2015 2014 Revenues Fleet

payment solutions

$ 135,520 $ 145,828

$

264,010 $ 281,263 Other payment solutions

78,133

55,753

151,928 102,386 Total

revenues

213,653 201,581

415,938 383,649

Expenses Salary and other personnel

59,091 43,426

117,508 87,328 Restructuring

-

-

8,559

-

Service fees

33,941 27,831

64,011 54,136 Provision

for credit losses

3,983 6,803

7,897 15,893 Technology

leasing and support

10,021 7,151

19,455 14,178

Occupancy and equipment

5,034 3,761

10,031 8,127

Depreciation, amortization and impairment

20,759 15,176

42,146 30,194 Operating interest expense

1,357 1,599

2,936 2,887 Cost of hardware and equipment sold

684

2,255

1,793 3,203 Other

15,865 13,250

31,659

25,837

Gain on divestiture

-

-

(1,215 )

-

Total operating expenses

150,735 121,252

304,780 241,783 Operating income

62,918 80,329

111,158 141,866 Financing interest

expense

(11,916 ) (7,276 )

(24,004 )

(14,632 ) Net foreign currency (loss) gain

(2,161 )

1,238

(6,537 ) 2,271 Net realized and unrealized loss

on fuel price derivative instruments

(6,000 ) (7,561

)

(3,251 ) (5,716 ) Income before income taxes

42,841 66,730

77,366 123,789 Income taxes

16,441 23,881

30,933 44,860

Net income 26,400 42,849

46,433 78,929

Less: Net loss attributable to non-controlling interests

(92

) (484 )

(2,404 ) (946 )

Net earnings

attributable to WEX Inc. $ 26,492 $ 43,333

$ 48,837 $ 79,875

Net

earnings attributable to WEX Inc. per share: Basic

$

0.68 $ 1.12

$ 1.26 $ 2.05 Diluted

$

0.68 $ 1.11

$ 1.26 $ 2.05

Weighted average

common shares outstanding: Basic

38,739 38,856

38,798 38,911 Diluted

38,799 38,946

38,880

39,031

WEX INC. CONDENSED

CONSOLIDATED BALANCE SHEETS (in thousands, except per share

data) (unaudited) June 30, December

31, 2015 2014 Assets Cash and cash

equivalents

$ 184,332 $ 284,763 Accounts receivable

(less reserve for credit losses of $9,665 in 2015 and $13,919 in

2014)

1,972,141 1,865,538

Securitized accounts receivable,

restricted

104,259

-

Income taxes receivable

-

6,859 Available-for-sale securities

18,672 18,940 Fuel price

derivatives, at fair value

16,668 40,969 Property, equipment

and capitalized software (net of accumulated depreciation of

$176,950 in 2015 and $169,382 in 2014)

114,729 105,596

Deferred income taxes, net

11,415 5,764 Goodwill

1,089,271 1,117,149 Other intangible assets, net

461,727 497,297 Other assets

206,559 175,506

Total assets $ 4,179,773 $

4,118,381

Liabilities and Stockholders’ Equity

Accounts payable

$ 596,526 $ 425,956 Accrued expenses

125,865 137,227 Income taxes payable

3,032

-

Deposits

905,193 979,553

Securitized debt

89,176

-

Borrowed federal funds

50,500

-

Revolving line-of-credit facilities and term loan

720,970

901,564 Deferred income taxes, net

58,766 44,004 Notes

outstanding

400,000 400,000 Other debt

51,446 52,975

Amounts due under tax receivable agreement

64,516 69,637

Other liabilities

10,837 13,154

Total

liabilities 3,076,827 3,024,070 Commitments and

contingencies Redeemable non-controlling interest

14,992

16,590

Stockholders’ Equity Common stock $0.01 par value;

175,000 shares authorized; 43,077 shares issued in 2015 and 43,021

in 2014; 38,745 shares outstanding in 2015 and 38,897 in 2014

431 430 Additional paid-in capital

183,655 179,077

Non-controlling interest

13,165 17,396 Retained earnings

1,130,567 1,081,730 Accumulated other comprehensive income

(67,522 ) (50,581 ) Less treasury stock at cost;

4,428 shares in 2015 and 4,218 shares in 2014

(172,342

) (150,331 )

Total stockholders’ equity

1,087,954 1,077,721

Total liabilities and

stockholders’ equity $ 4,179,773 $

4,118,381

Exhibit 1

Reconciliation of Adjusted Net Income to GAAP Net Earnings

(in thousands) (unaudited) Three

months ended Six months ended June 30, June

30, 2015 2014

2015

2014 Adjusted Net Income attributable to WEX Inc.

$ 48,317 $ 53,100

$

94,535 $ 94,091 Unrealized loss on fuel price

derivatives

(14,956 ) (4,896 )

(24,301

) (2,073 ) Net foreign currency (loss) gain

(2,161

) 1,238

(6,537 ) 2,271 Amortization of

acquired intangible assets

(12,016 ) (8,330 )

(24,175 ) (16,617 ) Stock-based compensation

(3,942 ) (3,117 )

(7,160 ) (5,540 )

Restructuring

-

-

(8,559 )

-

Gain on divestiture

-

-

1,215

-

Expenses and adjustments related to acquisitions

-

(500 )

-

(500 ) ANI adjustments attributable to non-controlling interests

765 271

3,618 420 Tax impact

10,485

5,567

20,201 7,823

Net earnings

attributable to WEX Inc. $ 26,492 $

43,333

$ 48,837 $ 79,875

Beginning in the second quarter of 2015, adjusted net income

attributable to WEX Inc. excludes foreign currency remeasurement

gains and losses and related hedges. For comparative purposes,

adjusted net income attributable to WEX Inc. for the prior periods

has been revised to reflect the exclusion of net foreign currency

gains and losses and differs from the figure previously reported

due to this adjustment. We believe this adjustment facilitates the

comparison of operating results and helps identify trends in our

businesses.

Although adjusted net income is not calculated in accordance

with generally accepted accounting principles (GAAP), this measure

is integral to the Company's reporting and planning processes. The

Company considers this measure integral because it eliminates the

non-cash volatility associated with the fuel price related

derivative instruments, and excludes other specified items that the

Company's management excludes in evaluating the Company's

performance. Specifically, in addition to evaluating the Company's

performance on a GAAP basis, management evaluates the Company's

performance on a basis that excludes the above items because:

- Exclusion of the non-cash,

mark-to-market adjustments on fuel-price related derivative

instruments helps management identify and assess trends in the

Company's underlying business that might otherwise be obscured due

to quarterly non-cash earnings fluctuations associated with

fuel-price-related derivative contracts.

- The non-cash, mark-to-market

adjustments on derivative instruments are difficult to forecast

accurately, making comparisons across historical and future

quarters difficult to evaluate.

- Net foreign currency gains and losses

primarily result from the remeasurement to functional currency of

foreign currency cash, receivable and payable balances, certain

intercompany notes and any gain or loss on foreign currency hedges

relating to these items. The exclusion of these items will improve

the comparison of operating results.

- The amortization of purchased

intangibles, deferred loan costs associated with the extinguishment

of debt, acquisition related expenses, non-cash adjustments related

to the Company's tax receivable agreement and adjustments

attributable to non-controlling interest have no significant impact

on the ongoing operations of the business.

- Stock-based compensation is different

from other forms of compensation, as it is a non-cash expense. For

example, a cash salary generally has a fixed and unvarying cash

cost. In contrast, the expense associated with an equity-based

award is generally unrelated to the amount of cash ultimately

received by the employee, and the cost to us is based on a

stock-based compensation valuation methodology and underlying

assumptions that may vary over time.

- Restructuring charges are related to

employee termination benefits from certain identified initiatives

to further streamline the business, improve the Company's

efficiency, and to globalize the Company's operations, all with an

objective to improve scale and increase profitability going

forward. We exclude these items when evaluating our continuing

business performance as such items are not consistently recurring

and do not reflect expected future operating expense, nor provide

meaningful insight into the fundamentals of current or past

operations of our business.

- The gain or loss from a divestiture is

not indicative of the performance of the ongoing operations of the

business.

- The Company considers certain

acquisition-related costs, such as investment banking fees,

financing fees and warranty and indemnity insurance, to be

unpredictable, dependent on factors that may be outside of our

control and unrelated to the continuing operations of the acquired

business or the Company. In addition, the size and complexity of an

acquisition, which often drives the magnitude of

acquisition-related costs, may not be indicative of such future

costs. The Company believes that excluding acquisition-related

costs facilitates the comparison of our financial results to the

Company's historical operating results and to other companies in

our industry.

For the same reasons, WEX believes that adjusted net income may

also be useful to investors as one means of evaluating the

Company's performance. However, because adjusted net income is a

non-GAAP measure, it should not be considered as a substitute for,

or superior to, net income, operating income or cash flows from

operating activities as determined in accordance with GAAP. In

addition, adjusted net income as used by WEX may not be comparable

to similarly titled measures employed by other companies.

The tax impact of the foregoing adjustments is the difference

between the Company’s U.S. GAAP tax provision and a pro forma tax

provision based upon the Company’s adjusted net income before

taxes. The methodology utilized for calculating the Company’s

adjusted net income tax provision is the same methodology utilized

in calculating the Company’s U.S. GAAP tax provision. The Company

is unable to reconcile our adjusted net income guidance to the

comparable GAAP measure because of the difficulty in predicting the

amounts to be adjusted.

Exhibit 2 Selected Non-Financial Metrics

Q2 2015 Q1 2015 Q4 2014 Q3 2014

Q2 2014

Fleet Payment Solutions – Payment Processing

Revenue:(1) Payment

processing transactions (000s)

86,700 81,934 79,195 80,379

78,390 Gallons per payment processing transaction

23.1 23.1

23.4 23.1 23.2 Payment processing gallons of fuel (000s)

2,005,051 1,890,048 1,850,304 1,859,894 1,816,204 Average US

fuel price (US$ / gallon)

$ 2.74 $ 2.57 $ 3.17 $ 3.61

$ 3.76 Average Australian fuel price (US$ / gallon)

$

3.91 $ 3.73 $ 4.63 $ 5.22 $ 5.44 Payment processing $ of

fuel (000s)

$ 5,980,928 $ 5,344,929 $ 6,071,384 $

6,842,202 $ 6,933,978 Net payment processing rate

1.34

% 1.36 % 1.37 % 1.37 % 1.36 % Fleet payment processing

revenue (000s)

$ 80,127 $ 72,943 $ 83,336 $ 93,462 $

94,550

Other Payment Solutions – Payment Processing

Revenue:(2) Payment solutions purchase volume (000s)

$ 5,682,989 $ 5,039,867 $ 4,500,724 $ 5,477,610 $

4,339,339 Net interchange rate

0.84 % 0.87 % 0.89 %

0.83 % 0.86 % Payment solutions processing revenue (000s)

$

47,433 $ 43,837 $ 40,279 $ 45,476 $ 37,460

(1) As of December 1, 2014, includes metrics for WEX Europe

Services where applicable.

(2) Excludes payment processing revenue from rapid! PayCard and

UNIK. As of July 16, 2014, includes interchange volume and

associated revenue for Evolution1.

Definitions and explanations:

Payment processing transactions represents the total number of

purchases made by fleets that have a payment processing

relationship with WEX.

Payment processing gallons of fuel represents the total number

of gallons of fuel purchased by fleets that have a payment

processing relationship with WEX.

Payment processing dollars of fuel represents the total dollar

value of the fuel purchased by fleets that have a payment

processing relationship with WEX.

Net payment processing rate represents the percentage of the

dollar value of each payment processing transaction that WEX

records as revenue from merchants less any discounts given to

fleets or strategic relationships.

Payment solutions purchase volume represents the total dollar

value of all transactions that use corporate card products

including single use account products.

Net interchange rate represents the percentage of the dollar

value of each transaction that WEX records as revenue less any

discounts given to customers.

Exhibit 3 Segment Revenue Information (in

thousands) (unaudited) Fleet Payment Solutions (in

thousands)

Three months ended June

30,

Increase (decrease)

Six months ended June

30,

Increase (decrease) 2015 2014 Amount

Percent

2015 2014 Amount Percent

Revenues Payment processing revenue

$

80,127 $ 94,550 $ (14,423 ) (15 )%

$ 153,070 $

180,252 $ (27,182 ) (15 )% Transaction processing revenue

4,927 5,250 (323 ) (6 )%

9,610 10,140 (530 ) (5 )%

Account servicing revenue

25,360 20,112 5,248 26 %

49,243 39,467 9,776 25 % Finance fees

19,069 17,661

1,408 8 %

38,064 34,981 3,083 9 % Other

6,037

8,255 (2,218 ) (27 )%

14,023 16,423

(2,400 ) (15 )% Total revenues

$ 135,520 $ 145,828 $

(10,308 ) (7 )%

$ 264,010 $ 281,263 $ (17,253 ) (6 )%

Other Payment Solutions

Three months ended June

30,

Increase (decrease)

Six months ended June

30,

Increase (decrease) (in thousands) 2015 2014

Amount Percent

2015 2014 Amount Percent

Revenues

Payment processing revenue

$ 47,954 $ 40,147 $ 7,807

19 %

$ 92,446 $ 72,049 $ 20,397 28 % Transaction

processing revenue

1,309 1,652 (343 ) (21 )%

2,916

3,347 (431 ) (13 )% Account servicing revenue

13,114 3,596

9,518 265 %

26,179 6,769 19,410 287 % Finance fees

1,332 1,352 (20 ) (1 )%

2,528 2,794 (266 ) (10 )%

Other

14,424 9,006 5,418 60 %

27,859 17,427 10,432 60 % Total

revenues

$ 78,133 $ 55,753 $ 22,380 40 %

$

151,928 $ 102,386 $ 49,542 48 %

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150729005419/en/

News media:WEX Inc.Jessica Roy, 207-523-6763Jessica.Roy@wexinc.comorInvestors:WEX

Inc.Michael E. Thomas, 207-523-6743Michael.Thomas@wexinc.com

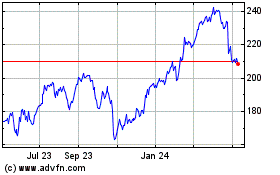

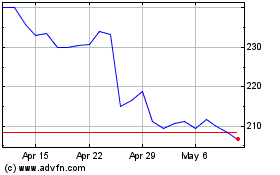

WEX (NYSE:WEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

WEX (NYSE:WEX)

Historical Stock Chart

From Apr 2023 to Apr 2024