WEX Inc. (NYSE: WEX), a leading provider of corporate payment

solutions, today reported financial results for the three months

ended March 31, 2017.

First Quarter 2017 Financial Results

Total revenue for the first quarter of 2017 increased 41% to

$291.4 million from $205.9 million for the first quarter of 2016.

During the quarter, higher fuel prices positively impacted revenue

by $15.4 million when compared to the prior year period. The impact

of foreign currency translation was not material.

Net earnings attributable to shareholders on a GAAP basis

increased $6.3 million to $29.4 million, or $0.68 per diluted

share, compared with $23.1 million, or $0.59 per diluted share, for

the first quarter of 2016. The Company's adjusted net income

attributable to shareholders, which is a non-GAAP measure, for the

first quarter of 2017 was $52.9 million, or $1.23 per diluted

share, up 26% from $0.98 per diluted share for the same period last

year. See Exhibit 1 for a full explanation and reconciliation of

adjusted net income attributable to shareholders and adjusted net

income attributable to shareholders per diluted share to the

comparable GAAP measures.

“I am pleased to report a strong start to the year, highlighted

by a top line beat and bottom line results at the upper end of our

guidance range,” said Melissa Smith, WEX’s president and chief

executive officer. “We have been executing against our strategic

priorities of driving growth, leading through technology, and

leveraging our investments. In particular, I am encouraged by the

trajectory of our organic growth, the success of the EFS

integration, the diversification that the health and travel

businesses add to our organization, and our international expansion

this quarter.”

Smith continued, “Overall, our performance this quarter is a

result of our leading customer service, strategic partnerships and

innovative product offerings. We look forward carrying this

momentum through 2017 as we open up additional market growth

opportunities, establish new client relationships, and solidify

existing ones."

First Quarter 2017 Performance Metrics

- Average number of vehicles serviced

worldwide was approximately 10.6 million, an increase of 11% from

the first quarter of 2016.

- Total fuel transactions processed

increased 24% from the first quarter 2016 to 123.9 million. Payment

processing transactions increased 15% to 102.8 million.

- Average expenditure per payment

processing transaction was $68.90, which represents an increase of

42% from the first quarter of 2016.

- U.S. retail fuel price increased 22% to

$2.40 per gallon from $1.97 per gallon in the first quarter of

2016.

- Total Travel and Corporate Solutions

card purchase volume grew 35% to $6.6 billion, from $4.9 billion in

the first quarter of 2016.

- Total Health and Benefits Solutions

purchase volume grew 23% to $1.3 billion, from $1.1 billion in the

first quarter of 2016.

Financial Guidance and Assumptions

The Company provides revenue guidance on a GAAP basis and

earnings guidance on a non-GAAP basis, due to the uncertainty and

indeterminate amount of certain elements that are included in

reported GAAP earnings.

- For the full year 2017, the Company

expects revenue in the range of $1.165 billion to $1.205 billion

and adjusted net income in the range of $221 million to $237

million, or $5.15 to $5.50 per diluted share.

- For the second quarter of 2017, WEX

expects revenue in the range of $286 million to $296 million and

adjusted net income in the range of $51 million to $54 million, or

$1.19 to $1.26 per diluted share.

"The entire organization performed well this past quarter, with

our net revenue growing in excess of 40%, in part due to the return

on the investments we made in 2016. As we continue our progress in

2017, we expect to further strengthen our financial position,

continue to drive organic growth, and further expand into

high-value, attractive markets," said Roberto Simon, WEX's chief

financial officer.

Second quarter 2017 guidance is based on an assumed average U.S.

retail fuel price of $2.45 per gallon. Full-year 2017 guidance is

based on an assumed average U.S. retail fuel price of $2.44 per

gallon. The fuel prices referenced above are based on the

applicable NYMEX futures price from last week. Our guidance assumes

approximately 43 million shares outstanding for the second quarter

and full year 2017.

The Company's guidance also assumes that second quarter 2017

fleet credit loss will range between 11 and 16 basis points, and

full year 2017 fleet credit loss will range between 10 and 15 basis

points.

The Company's adjusted net income guidance, which is a non-GAAP

measure, excludes unrealized gains and losses on derivative

instruments, net foreign currency remeasurement gains and losses,

acquisition and divestiture related items, stock-based

compensation, restructuring and other costs, debt issuance cost

amortization, similar adjustments attributed to our non-controlling

interest and certain tax related items.

Additional Information

Management uses the non-GAAP measures presented within this news

release to evaluate the Company's performance on a comparable

basis. Management believes that investors may find these measures

useful for the same purposes, but cautions that they should not be

considered a substitute for, or superior to, disclosure in

accordance with GAAP.

WEX historically used fuel-price derivative instruments to

mitigate financial risks associated with the variability in fuel

prices in North America. Starting with the second quarter of 2016,

there were no longer any fuel price related derivatives

outstanding.

To provide investors with additional insight into its

operational performance, WEX has included in this news release in

Exhibit 2, a table illustrating the impact of foreign currency

translations and fuel prices for each of our operating segments for

the three months ended March 31, 2017 and 2016, and in Exhibit 3, a

table of selected non-financial metrics for the five quarters ended

March 31, 2017. The Company is also providing selected segment

revenue information for the three months ended March 31, 2017 and

2016 in Exhibit 4.

Conference Call Details

In conjunction with this announcement, WEX will host a

conference call today, April 27, 2017, at 9:00 a.m. (ET). As

previously announced, the conference call will be webcast live on

the Internet, and can be accessed at the Investor Relations section

of the WEX website, http://www.wexinc.com. The live conference call

also can be accessed by dialing (866) 334-7066 or (973) 935-8463.

The Conference ID number is 3130644. A replay of the webcast will

be available on the Company's website.

About WEX Inc.

WEX Inc. (NYSE: WEX) is a leading provider of corporate payment

solutions. From its roots in fleet card payments beginning in 1983,

WEX has expanded the scope of its business into a multi-channel

provider of corporate payment solutions representing more than 10

million vehicles and offering exceptional payment security and

control across a wide spectrum of business sectors. WEX serves a

global set of customers and partners through its operations around

the world, with offices in the United States, Australia, New

Zealand, Brazil, the United Kingdom, Italy, France, Germany,

Norway, and Singapore. WEX and its subsidiaries employ more than

2,700 associates. The Company has been publicly traded since 2005,

and is listed on the New York Stock Exchange under the ticker

symbol “WEX.” For more information, visit www.wexinc.com and follow

WEX on Twitter at @WEXIncNews.

Forward-Looking Statements

This news release contains forward-looking statements, including

statements regarding: management’s expectations for future growth

opportunities; market growth opportunities; trajectory for future

growth; client expansion; business momentum; strengthening of

financial position; expansion into high-value markets; financial

guidance; and, assumptions underlying the Company's financial

guidance. Any statements that are not statements of historical

facts may be deemed to be forward-looking statements. When used in

this news release, the words "may," "could," "anticipate," "plan,"

"continue," "project," "intend," "estimate," "believe," "expect"

and similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain

such words. These forward-looking statements are subject to a

number of risks and uncertainties that could cause actual results

to differ materially, including: the effects of general economic

conditions on fueling patterns as well as payment and transaction

processing activity; the impact of foreign currency exchange rates

on the Company’s operations, revenue and income; changes in

interest rates; the impact of fluctuations in fuel prices; the

effects of the Company’s business expansion and acquisition

efforts; potential adverse changes to business or employee

relationships, including those resulting from the completion of an

acquisition; competitive responses to any acquisitions; uncertainty

of the expected financial performance of the combined operations

following completion of an acquisition; the ability to successfully

integrate the Company's acquisitions, including Electronic Funds

Source LLC's operations and employees; the ability to realize

anticipated synergies and cost savings; unexpected costs, charges

or expenses resulting from an acquisition; the Company's failure to

successfully operate and expand ExxonMobil's European and Asian

commercial fuel card programs; the failure of corporate investments

to result in anticipated strategic value; the impact and size of

credit losses; the impact of changes to the Company's credit

standards; breaches of the Company’s technology systems or those of

our third-party service providers and any resulting negative impact

on our reputation, liabilities or relationships with customers or

merchants; the Company’s failure to maintain or renew key

agreements; failure to expand the Company’s technological

capabilities and service offerings as rapidly as the Company’s

competitors; failure to successfully implement the Company’s

information technology strategies and capabilities in connection

with its outsourcing arrangement and any resulting cost associated

with that failure; the actions of regulatory bodies, including

banking and securities regulators, or possible changes in banking

or financial regulations impacting the Company’s industrial bank,

the Company as the corporate parent or other subsidiaries or

affiliates; the impact of the Company’s outstanding notes on its

operations; the impact of increased leverage on the Company's

operations, results or borrowing capacity generally, and as a

result of acquisitions specifically; the incurrence of impairment

charges if our assessment of the fair value of certain of our

reporting units changes; the uncertainties of litigation; as

well as other risks and uncertainties identified in Item 1A of our

Annual Report for the year ended December 31, 2016, filed on Form

10-K with the Securities and Exchange Commission on March 6, 2017.

The Company's forward-looking statements do not reflect the

potential future impact of any alliance, merger, acquisition,

disposition or stock repurchases. The forward-looking statements

speak only as of the date of this earnings release and undue

reliance should not be placed on these statements. The Company

disclaims any obligation to update any forward-looking statements

as a result of new information, future events or otherwise.

WEX INC.

CONDENSED CONSOLIDATED STATEMENTS OF

INCOME

(in thousands, except per share

data)

(unaudited)

Three months ended March 31, 2017

2016 Revenues Payment processing revenue

$ 136,378 $ 111,057 Account servicing revenue

61,539 44,522 Finance fee revenue

43,372 23,506 Other

revenue

50,068 26,843 Total revenues

291,357 205,928

Expenses Salary and other personnel

83,585

63,410 Restructuring

484

1,589 Service fees

36,750 36,759 Provision for credit losses

12,231 3,917 Technology leasing and support

12,516

11,076 Occupancy and equipment

6,367 5,712 Depreciation and

amortization

49,238 22,264 Operating interest expense

4,848 1,386 Cost of hardware and equipment sold

1,029

905 Other expenses

23,557 17,783 Total

operating expenses

230,605 164,801 Operating

income

60,752 41,127 Financing interest expense

(27,148 ) (21,558 ) Net foreign currency gain

8,442 16,124 Net unrealized gains on interest rate swap

agreements

1,565 — Net realized and unrealized gain on fuel

price derivatives

— 711 Income before income

taxes

43,611 36,404 Income taxes

14,535 13,183

Net income 29,076 23,221 Less: Net (loss) gain

from non-controlling interest

(325 ) 135

Net earnings attributable to shareholders $

29,401 $ 23,086

Net earnings attributable

to WEX Inc. per share: Basic

$ 0.69 $ 0.60

Diluted

$ 0.68 $ 0.59

Weighted average common

shares outstanding: Basic

42,871 38,756 Diluted

43,119 38,850

WEX INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except per share

data)

(unaudited)

March 31, 2017 December

31,2016

Assets Cash and cash equivalents

$

203,995 $ 190,930 Accounts receivable (less reserve for

credit losses of $23,566 in 2017 and $20,092 in 2016)

2,246,815 2,054,701 Securitized accounts receivable,

restricted

101,185 97,417 Income taxes receivable

9,792 10,765 Available-for-sale securities

23,413

23,525 Property, equipment and capitalized software (net of

accumulated depreciation of $240,160 in 2017 and $228,336 in 2016)

171,254 167,278 Deferred income taxes, net

7,042

6,934 Goodwill

1,840,844 1,838,441 Other intangible assets,

net

1,228,670 1,265,468 Other assets

342,752

341,638

Total assets $ 6,175,762

$ 5,997,097

Liabilities and Stockholders’ Equity

Accounts payable

$ 674,114 $ 617,118 Accrued expenses

290,808 331,579 Deposits

1,040,675 1,118,823

Securitized debt

92,676 84,323 Revolving line-of-credit

facilities and term loans, net

1,795,640 1,599,291 Deferred

income taxes, net

163,465 152,906 Notes outstanding, net

395,718 395,534 Other debt

107,699 125,755 Amounts

due under tax receivable agreement

47,302 47,302 Other

liabilities

18,447 18,719

Total

liabilities 4,626,544 4,491,350 Commitments and

contingencies

Stockholders’ Equity

Common stock $0.01 par value; 175,000

shares authorized; 47,327 shares issued in 2017 and 47,173 in 2016;

42,899 shares outstanding in 2017 and 42,841 in 2016

473 472 Additional paid-in capital

545,135 547,627

Non-controlling interest

8,275

8,558 Retained earnings

1,273,935

1,244,271 Accumulated other comprehensive loss

(106,258

) (122,839 ) Treasury stock at cost; 4,428 shares in 2017

and 2016

(172,342 ) (172,342 )

Total stockholders’

equity 1,549,218 1,505,747

Total

liabilities and stockholders’ equity $ 6,175,762

$ 5,997,097

Exhibit 1

Reconciliation of GAAP Net Earnings

Attributable to Shareholders to Adjusted Net Income Attributable to

Shareholders

(in thousands, excepts per share

data)(unaudited)

Three months ended March 31, 2017

2016

per dilutedshare

per dilutedshare

Net earnings attributable to shareholders $

29,401 $ 0.68 $ 23,086 $

0.59 Unrealized (gains) losses on derivative instruments

(1,565 ) (0.04 ) 5,007 0.13 Net foreign

currency remeasurement gain

(8,442 ) (0.20

) (16,124 ) (0.42 ) Acquisition and divestiture related

items

40,114 0.93 27,945 0.72 Stock-based

compensation

6,457 0.15 4,243 0.11 Restructuring and

other costs

1,747 0.04 1,589 0.04 Debt issuance cost

amortization

1,954 0.05 772 0.02 ANI adjustments

attributable to non-controlling interest

(799 )

(0.02 ) 69 — Tax related items

(15,979

) (0.37 ) (8,515 ) (0.22 )

Adjusted net income attributable to shareholders $

52,888 $ 1.23 $ 38,072 $ 0.98

The Company's non-GAAP adjusted net income excludes unrealized

gains and losses on derivatives, net foreign currency remeasurement

gains and losses, acquisition and divestiture related items,

stock-based compensation, restructuring and other costs, debt

issuance cost amortization, similar adjustments attributed to our

non-controlling interest and certain tax related items.

Although adjusted net income is not calculated in accordance

with generally accepted accounting principles (GAAP), this non-GAAP

measure is integral to the Company's reporting and planning

processes and the chief operating decision maker of the Company

uses pre-tax adjusted income to allocate resources. The Company

considers this measure integral because it excludes specified items

that the Company's management excludes in evaluating the Company's

performance. Specifically, in addition to evaluating the Company's

performance on a GAAP basis, management evaluates the Company's

performance on a basis that excludes the above items because:

- Exclusion of the non-cash,

mark-to-market adjustments on derivative instruments, including

fuel price related derivatives and interest rate swap agreements,

helps management identify and assess trends in the Company's

underlying business that might otherwise be obscured due to

quarterly non-cash earnings fluctuations associated with these

derivative contracts. The non-cash, mark-to-market adjustments on

derivative instruments are difficult to forecast accurately, making

comparisons across historical and future quarters difficult to

evaluate.

- Net foreign currency gains and losses

primarily result from the remeasurement to functional currency of

cash, receivable and payable balances, certain intercompany notes

denominated in foreign currencies and any gain or loss on foreign

currency hedges relating to these items. The exclusion of these

items helps management compare changes in operating results between

periods that might otherwise be obscured due to currency

fluctuations.

- The Company considers certain

acquisition-related costs, including certain financing costs,

ticking fees, investment banking fees, warranty and indemnity

insurance, certain integration related expenses and amortization of

acquired intangibles, as well as gains and losses from divestitures

to be unpredictable, dependent on factors that may be outside of

our control and unrelated to the continuing operations of the

acquired or divested business or the Company. In prior periods not

reflected above, the Company has adjusted for goodwill impairments

and acquisition related asset impairments. In addition, the size

and complexity of an acquisition, which often drives the magnitude

of acquisition-related costs, may not be indicative of such future

costs. The Company believes that excluding acquisition-related

costs and gains or losses of divestitures facilitates the

comparison of our financial results to the Company's historical

operating results and to other companies in our industry.

- Stock-based compensation is different

from other forms of compensation, as it is a non-cash expense. For

example, a cash salary generally has a fixed and unvarying cash

cost. In contrast, the expense associated with an equity-based

award is generally unrelated to the amount of cash ultimately

received by the employee, and the cost to the Company is based on a

stock-based compensation valuation methodology and underlying

assumptions that may vary over time.

- Restructuring costs are related to

employee termination benefits from certain identified initiatives

to further streamline the business, improve the Company's

efficiency, create synergies, and to globalize the Company's

operations, all with an objective to improve scale and increase

profitability going forward. We exclude these items when evaluating

our continuing business performance as such items are not

consistently occurring and do not reflect expected future operating

expense, nor provide insight into the fundamentals of current or

past operations of our business.

- Debt issuance cost amortization is a

non-cash item and is unrelated to the continuing operations of the

Company. Because these costs are dependent upon the financing

method which can vary widely company to company, we believe that

excluding these costs helps to facilitate comparison to historical

results as well as to other companies within our industry.

- The adjustments attributable to

non-controlling interests, including adjustments to the redemption

value of a non-controlling interest, and the non-cash adjustments

related to tax receivable agreement have no significant impact on

the ongoing operations of the business.

- The tax related items are the

difference between the Company’s U.S. GAAP tax provision and a pro

forma tax provision based upon the Company’s adjusted net income

before taxes as well as the impact from certain discrete tax items.

The methodology utilized for calculating the Company’s adjusted net

income tax provision is the same methodology utilized in

calculating the Company’s U.S. GAAP tax provision.

For the same reasons, WEX believes that adjusted net income may

also be useful to investors as one means of evaluating the

Company's performance. However, because adjusted net income is a

non-GAAP measure, it should not be considered as a substitute for,

or superior to, net income, operating income or cash flows from

operating activities as determined in accordance with GAAP. In

addition, adjusted net income as used by WEX may not be comparable

to similarly titled measures employed by other companies. The

Company is unable to reconcile our adjusted net income guidance to

the comparable GAAP measure because of the difficulty in predicting

the amounts to be adjusted.

The table below shows the impact of certain macro factors on

reported revenue:

Exhibit 2

Segment Revenue Results

(in

thousands)(unaudited)

Fleet Solutions

Travel and

CorporateSolutions

Health and EmployeeBenefit

Solutions

Total WEX Inc. Three months ended March 31,

2017 2016

2017 2016

2017 2016

2017 2016 Reported

revenue

$ 190,823 121,074

$

47,713 $ 45,142

$ 52,821 $

39,712

$ 291,357 $ 205,928 FX impact

(favorable) / unfavorable

81 —

915 —

(1,861

) —

(865 ) — PPG impact (favorable) /

unfavorable

(15,431 ) —

—

—

— —

(15,431 ) —

To determine the impact of foreign exchange translation (“FX”)

on revenue, revenue from entities whose functional currency is not

denominated in U.S. dollars, as well as revenue from purchase

volume transacted in non-U.S. denominated currencies, were

translated using the weighted average exchange rates for the same

period in the prior year.

To determine the impact of price per gallon of fuel (“PPG”) on

revenue, revenue variable to changes in fuel prices was calculated

based on the average retail price of fuel for the same period in

the prior year for the portion of our business that earns revenue

based on a percentage of fuel spend. For the portions of our

business that earns revenue based on margin spreads, revenue was

calculated utilizing the comparable margin from the prior year.

The table below shows the impact of certain macro factors on

Adjusted Net Income:

Segment Estimated Earnings Impact

(in thousands)

(unaudited)

Fleet Solutions

Travel and

CorporateSolutions

Health and EmployeeBenefit

Solutions

Three months ended March 31, 2017 2016

2017 2016

2017 2016 FX impact

(favorable) / unfavorable

$ 56 —

$

254 —

$ (307 ) — PPG

impact (favorable) / unfavorable

(8,875 ) —

—

—

— — Realized gain on hedge settlement

—

3,636

— —

—

—

To determine the estimated earnings impact of FX, revenue and

expenses from entities whose functional currency is not denominated

in U.S. dollars, as well as revenue and variable expenses from

purchase volume transacted in non-US denominated currencies, were

translated using the weighted average exchange rates for the same

period in the prior year, net of tax and non-controlling interest

where applicable.

To determine the estimated earnings impact of PPG, revenue and

certain variable expenses impacted by changes in fuel prices, were

adjusted based on the average retail price of fuel for the same

period in the prior year for the portion of our business that earns

revenue based on a percentage of fuel spend, net of applicable

taxes. For the portions of our business that earn revenue based on

margin spreads, revenue was adjusted to the comparable margin from

the prior year, net of non-controlling interest and applicable

taxes.

Exhibit 3Selected Non-Financial Metrics

(unaudited)

Q1 2017 Q4 2016 Q3 2016 Q2 2016

Q1 2016

Fleet Solutions – Payment Processing Revenue:

Payment processing transactions (000s)

102,765 99,662 102,947 94,155 89,097 Gallons per payment

processing transaction

27.0 27.4 27.0 22.6 22.7 Payment

processing gallons of fuel (000s)

2,775,590 2,731,994

2,776,622 2,126,372 2,018,310 Average US fuel price (US$ / gallon)

$ 2.40 $ 2.30 $ 2.24 $ 2.29 $ 1.97 Average Australian

fuel price (US$ / gallon)

$ 3.76 $ 3.50 $ 3.45 $ 3.29

$ 3.10 Payment processing $ of fuel (000s)

$

7,080,117 $ 6,672,281 $ 6,593,406 $ 5,236,151 $ 4,336,399

Net payment processing rate

1.22 % 1.23 % 1.26 % 1.35

% 1.44 % Payment processing revenue (000s)

$ 86,262 $

81,767 $ 83,132 $ 70,711 $ 62,290

Travel and Corporate Solutions

– Payment Processing Revenue: Purchase volume (000s)

$

6,599,797 $ 6,351,741 $ 7,138,956 $ 5,595,326 $ 4,879,001

Net interchange rate

0.53 % 0.71 % 0.74 % 0.77 % 0.71

% Payment processing revenue (000s)

$ 34,875 $ 45,390

$ 52,551 $ 43,194 $ 34,626

Health and Employee Benefit

Solutions: Purchase volume (000s)

$ 1,347,219 $

803,045 $ 875,598 $ 1,051,839 $ 1,092,552

Definitions and explanations:

Payment processing transactions represents the total number of

purchases made by fleets that have a payment processing

relationship with WEX.

Payment processing gallons of fuel represents the total number

of gallons of fuel purchased by fleets that have a payment

processing relationship with WEX.

Payment processing dollars of fuel represents the total dollar

value of the fuel purchased by fleets that have a payment

processing relationship with WEX.

Net payment processing rate represents the percentage of the

dollar value of each payment processing transaction that WEX

records as revenue from merchants less any discounts given to

fleets or strategic relationships.

Purchase volume in the Travel and Corporate Solutions segment

represents the total dollar value of all transactions that use WEX

corporate card products and virtual card products.

Net interchange rate represents the percentage of the dollar

value of each transaction that WEX records as revenue less any

discounts given to customers.

Purchase volume in the Health and Employee Benefit Solutions

segment represents the total US dollar value of all transactions

where interchange is earned by WEX.

Exhibit 4

Segment Revenue Information

(in thousands)

(unaudited)

Fleet Solutions

Three months endedMarch

31,

Increase (decrease) 2017

2016 Amount Percent

Revenues

Payment processing revenue

$ 86,262 $ 62,290 $

23,972 38.5 % Account servicing revenue

36,069 25,438 10,631

41.8 % Finance fee revenue

36,429 21,938 14,491 66.1 % Other

revenue

32,063 11,408

20,655 181.1 % Total revenues

$ 190,823

$ 121,074 $ 69,749 57.6 %

Travel and Corporate

Solutions

Three months endedMarch

31,

Increase (decrease) 2017

2016 Amount Percent

Revenues Payment

processing revenue

$ 34,875 $ 34,626 $ 249 0.7 %

Account servicing revenue

155 272 (117 ) (43.0 )% Finance

fee revenue

223 75 148 197.3 % Other revenue

12,460 10,169 2,291

22.5 % Total revenues

$ 47,713 $ 45,142 $

2,571 5.7 %

Health and Employee Benefit Solutions

Three months endedMarch

31,

Increase (decrease) 2017

2016 Amount Percent

Revenues Payment

processing revenue

$ 15,241 $ 14,141 $ 1,100 7.8 %

Account servicing revenue

25,315 18,812 6,503 34.6 % Finance

fee revenue

6,720 1,493 5,227 350.1 % Other revenue

5,545 5,266 279

5.3 % Total revenues

$ 52,821 $ 39,712 $ 13,109 33.0

%

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170427005315/en/

News media:WEX Inc.Jessica Roy, 207-523-6763Jessica.Roy@wexinc.comorInvestors:WEX

Inc.Steve Elder, 207-523-7769Steve.Elder@wexinc.com

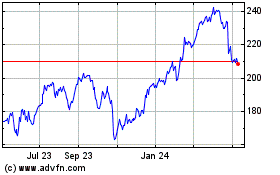

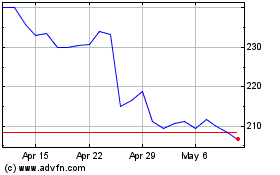

WEX (NYSE:WEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

WEX (NYSE:WEX)

Historical Stock Chart

From Apr 2023 to Apr 2024