WEX Board of Directors Authorizes New Stock Repurchase Program

September 26 2017 - 6:30AM

Business Wire

Authorization Provides Flexibility to

Repurchase up to $150 Million of Company Stock

WEX Inc. (NYSE:WEX) a leading provider of corporate payment

solutions, today announced that the board of directors has

authorized a share repurchase program under which up to $150

million worth of the company's common stock may be repurchased.

Repurchases may be made from time to time until September 30,

2021 through open market purchases, privately negotiated

transactions, block trades or otherwise. Repurchases are subject to

the availability of stock, prevailing market conditions, trading

price of the stock and the Company's financial performance. The

repurchase program does not obligate the Company to acquire any

specific number of shares and may be discontinued or suspended at

any time. The Company is not scheduled to acquire any shares at

this time. All instructions for the repurchase of shares under this

program must be in compliance with Rule 10b-18 and the covenants of

any credit facility or indentures then outstanding. Purchases may

be executed utilizing the safe harbor provisions of Rule 10b5-1 of

the Securities Exchange Act.

Forward Looking Statement Disclaimer

This news release contains forward-looking statements, including

statements regarding: the Company’s intention to engage in

repurchases of its common stock; the conditions under which such

repurchases may occur; the amount of any such repurchases; and, the

timeframe during which such repurchases may occur. Any statements

that are not statements of historical facts may be deemed to be

forward-looking statements. When used in this news release, the

words "may," "could," "anticipate," "plan," "continue," "project,"

"intend," "estimate," "believe," "expect" and similar expressions

are intended to identify forward-looking statements, although not

all forward-looking statements contain such words. These

forward-looking statements are subject to a number of risks and

uncertainties that could cause actual results to differ materially,

including: the effects of general economic conditions on fueling

patterns as well as payment and transaction processing activity;

the impact of foreign currency exchange rates on the Company’s

operations, revenue and income; changes in interest rates; the

impact of fluctuations in fuel prices; the effects of the Company’s

business expansion and acquisition efforts; potential adverse

changes to business or employee relationships, including those

resulting from the completion of an acquisition; competitive

responses to any acquisitions; uncertainty of the expected

financial performance of the combined operations following

completion of an acquisition; the ability to successfully integrate

the Company's acquisitions, including Electronic Funds Source LLC's

operations and employees; the ability to realize anticipated

synergies and cost savings; unexpected costs, charges or expenses

resulting from an acquisition; the Company's failure to

successfully operate and expand ExxonMobil's European and Asian

commercial fuel card programs; the failure of corporate investments

to result in anticipated strategic value; the impact and size of

credit losses; the impact of changes to the Company's credit

standards; breaches of the Company’s technology systems or those of

our third-party service providers and any resulting negative impact

on our reputation, liabilities or relationships with customers or

merchants; the Company’s failure to maintain or renew key

agreements; failure to expand the Company’s technological

capabilities and service offerings as rapidly as the Company’s

competitors; failure to successfully implement the Company’s

information technology strategies and capabilities in connection

with its technology outsourcing and insourcing arrangements and any

resulting cost associated with that failure; the actions of

regulatory bodies, including banking and securities regulators, or

possible changes in banking or financial regulations impacting the

Company’s industrial bank, the Company as the corporate parent or

other subsidiaries or affiliates; the impact of the Company’s

outstanding notes on its operations; the impact of increased

leverage on the Company's operations, results or borrowing capacity

generally, and as a result of acquisitions specifically; the

incurrence of impairment charges if our assessment of the fair

value of certain of our reporting units changes; the uncertainties

of litigation; as well as other risks and uncertainties identified

in Item 1A of our Annual Report for the year ended December 31,

2016, filed on Form 10-K with the Securities and Exchange

Commission on March 6, 2017 and our Quarterly Report on Form 10-Q

for the three months ended March 31, 2017 filed with the Securities

and Exchange Commission on May 8, 2017. The Company's

forward-looking statements do not reflect the potential future

impact of any alliance, merger, acquisition, disposition or stock

repurchases. The forward-looking statements speak only as of the

date of this earnings release and undue reliance should not be

placed on these statements. The Company disclaims any obligation to

update any forward-looking statements as a result of new

information, future events or otherwise.

About WEX Inc.

WEX Inc. (NYSE: WEX) is a leading provider of corporate payment

solutions. From its roots in fleet card payments beginning in 1983,

WEX has expanded the scope of its business into a multi-channel

provider of corporate payment solutions representing more than 10

million vehicles and offering exceptional payment security and

control across a wide spectrum of business sectors. WEX serves a

global set of customers and partners through its operations around

the world, with offices in the United States, Australia, New

Zealand, Brazil, the United Kingdom, Italy, France, Germany,

Norway, and Singapore. WEX and its subsidiaries employ more than

2,700 associates. The Company has been publicly traded since 2005,

and is listed on the New York Stock Exchange under the ticker

symbol “WEX.” For more information, visit www.wexinc.com and follow

WEX on Twitter at @WEXIncNews.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170926005256/en/

WEX Inc.Jessica Roy,

207-523-6763Jessica.Roy@wexinc.comorInvestor relations:WEX

Inc.Steve Elder, 207-523-7769Steve.Elder@wexinc.com

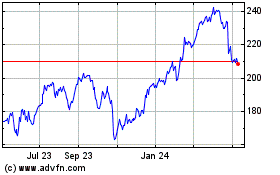

WEX (NYSE:WEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

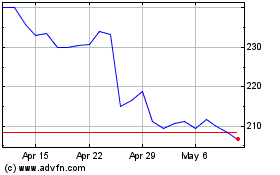

WEX (NYSE:WEX)

Historical Stock Chart

From Apr 2023 to Apr 2024