Vodafone's Revenue Steadily Improves Amid Europe Recovery -- Update

February 04 2016 - 4:51AM

Dow Jones News

By Simon Zekaria

LONDON-- Vodafone Group PLC on Thursday said improved demand in

Europe, the mobile operator's most important market, underpinned a

rise in fiscal third-quarter revenue.

The U.K.-based group said its revenue, excluding handset sales,

acquisitions and mergers, on a constant currency basis--its

preferred sales measure--rose 1.4% in the three months to

end-December. This was a turnaround from a 0.4% decline in the same

period a year ago, and up from 1.2% growth in the previous three

months. Vodafone's performance was in line with market

forecasts.

It is Vodafone's sixth consecutive quarter of improving revenue

by that metric.

In Europe, Vodafone posted revenue of GBP6.04 billion ($8.81

billion), down 0.6% on the same basis, but improved from a 2.7%

fall in the same period a year earlier and a 1% fall in the

previous three months.

In nominal terms, excluding handset sales, Vodafone's overall

revenue fell 6.3% to GBP9.17 billion, in line with forecasts.

"We have taken another step forward," said Chief Executive

Vittorio Colao. Vodafone cited improving top-line trends in Germany

and Italy as boosting trading, that countered Spain's worsening

performance and a slowdown in mobile sales.

In early dealing, Vodafone's shares ticked up 1.5% to 216

pence.

Analysts say telecoms firms in Europe are benefiting from demand

for faster-speed mobile Internet data and media-driven bundled

subscriptions, pricing and a recovery in consumer spending.

Vodafone also says the burden of regulation is easing in the

continent.

Write to Simon Zekaria at simon.zekaria@wsj.com

Central to Vodafone's revenue growth is building customer

loyalty by connecting products and services for retail bundling,

such as high-definition television and Internet broadband. These

multi-service packages keep down "churn," or the rate at which

customers leave services.

"We have maintained our good commercial momentum in mobile and

are beginning to accelerate in fixed [services]," said Mr.

Colao.

Vodafone is spending billions of dollars to improve its

world-wide fixed and mobile telecoms networks to raise consumer

sales from increased Internet browsing and move the business out of

a yearslong tough period, which dented its numbers. It is

particularly focused on building speed, capacity and coverage in

Europe, including with fiber-optic cable rollouts.

To cement its recovery in Europe, Vodafone is also seeking

partnerships.

Wednesday, Vodafone confirmed it is discussing a potential

venture with rival Liberty Global to jointly house their businesses

in the Netherlands. The move came four months after it shelved the

so-called asset swap talks with Liberty--media mogul John Malone's

U.S. cable giant, that is also focused on Europe.

The two companies, eager to shore up their businesses across

Europe's competitive telecoms and media markets, have also long

been connected with the possibility of a full-blown merger, but

neither company has commented on that scenario. RBC analysts say

industrial logic for a merger, producing $30 billion of synergies,

remains high.

On Thursday, Mr. Colao declined to comment further on any talks

with Liberty, but said the Vodafone remains "pragmatic" as it hones

the reach of its operations.

In emerging telecoms economies, Vodafone noted a "strong"

quarterly performance in South Africa.

Mr. Colao noted a disappointing performance in India, its major

developing market along with Turkey, but said Vodafone's intention

to a launch an initial public offering of its Indian business is on

track.

The company's improving fortunes overall have been reflected by

changes to its guidance. In November, the Newbury, England-based

firm said it now expects fiscal-year earnings before interest,

taxes, depreciation and amortization of between GBP11.7 billion and

GBP12 billion. Its previous guidance was for the lower end of the

range at GBP11.5 billion.

Thursday, it confirmed that improved forecast.

Write to Simon Zekaria at simon.zekaria@wsj.com

(END) Dow Jones Newswires

February 04, 2016 04:36 ET (09:36 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

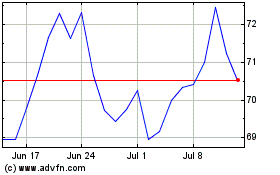

Vodafone (LSE:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

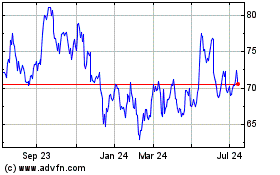

Vodafone (LSE:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024