Vodafone Raises Full-Year Earnings Guidance -- Update

November 10 2015 - 4:37AM

Dow Jones News

By Simon Zekaria

LONDON-- Vodafone Group PLC on Tuesday signaled the continued

recovery of its key European markets after raising its full-year

earnings guidance despite swinging to a first-half loss on

infrastructure costs.

The U.K.-based telecommunications giant reported a net loss of

GBP1.7 billion ($2.57 billion) for the six months to Sept. 30,

compared with a GBP5.42 billion profit in the same period last

year. Vodafone is spending heavily on its network across the world,

including mobile spectrum, to boost consumer sales from increased

Internet data usage and move the business out of a tough

period.

Earnings before interest, taxes, depreciation and amortization

fell 1.7% to GBP5.79 billion although beat analysts' forecast of

GBP5.69 billion. Operating profit before exceptional items--a key

performance metric--fell 6.5% to GBP1.64 billion.

But the world's second-largest mobile operator by subscribers

after China Mobile Ltd. said revenue excluding mergers,

acquisitions and currency effects rose 2.8% to GBP20.3 billion,

slightly above consensus forecasts of GBP20.2 billion. Revenue was

down 2.3% on a reported basis.

Second-quarter revenue excluding handset sales, mergers,

acquisitions and currency effects rose 1.2%. This is an improvement

from a 0.8% rise in the previous three months and a 1.5% fall in

the same period a year earlier.

In Europe, revenue on the same basis fell 1%--an improvement on

a decline of 1.5% posted in the previous three months and the fifth

consecutive quarter of improving performance, with southern Europe

in particular showing a strong rate of recovery. Vodafone also said

the burden of regulation and macroeconomic pressures are easing in

Europe.

"We expect progress to continue in the second half of the year,"

Chief Executive Vittorio Colao said.

The Newbury, U.K.-based firm now expects full-year Ebitda of

between GBP11.7 billion and GBP12 billion. It previously guided the

bottom end of the range at GBP11.5 billion.

The company also boosted its interim dividend by 2.2% to 3.7

pence a share.

Vodafone shares rose more than 4% in early trading in London.

"The overall takeaways are encouraging," said Jefferies analyst

Jerry Dellis.

For years, Vodafone has been stung by its high exposure to

Europe's anemic wireless markets; a region where it generates most

of its sales. Pinched consumer spending, intensive competition and

regulation have combined to curtail the company's performance in

its main geographies of Germany, Spain and Italy, as well as

elsewhere.

Still, this year it has hailed the recovery of its key European

business, backed up by deal-making and network investment to meet

consumer demand for faster-speed mobile Internet data and

media-driven bundled subscriptions, which include

pay-television.

The focus on Vodafone's regional performance has intensified in

recent months after it failed to come to an agreement with

U.S.-based cable giant Liberty Global over an asset swap.

High-speed data infrastructure is one of Vodafone's chief

concerns. It said it now has nearly 30 million so-called

fourth-generation wireless customers. In the first half, mobile

data traffic grew 75%, it said, with average usage per customer in

Europe jumping 39% in the second quarter.

While Vodafone's focus on Europe was strengthened by the sale of

its U.S. operations, its greatest growth comes from emerging

markets such as Turkey, India and South Africa. In the second

quarter, revenue on the same basis from emerging markets rose 6.7%,

up modestly from the previous quarter.

Mr. Colao told reporters the company is ready to launch an

initial public offering of its Indian business and would make a

decision after the end of the fiscal year. "We are preparing for

it," he said.

"The market is huge. The potential is huge," said Mr. Colao, on

telecom prospects in India.

The company said it is moving to reporting in euros from April 1

2016.

Write to Simon Zekaria at simon.zekaria@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 10, 2015 04:22 ET (09:22 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

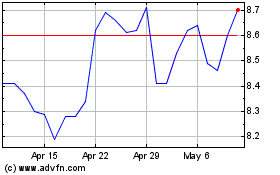

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

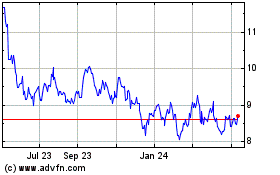

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024