TIDMVOD

RNS Number : 9263E

Vodafone Group Plc

22 July 2016

Trading update for the quarter ended 30 June 2016

22 July 2016

Highlights

-- Q1 Group organic service revenue grew 2.2%*; Europe 0.3%*, AMAP 7.7%*

-- Europe remains stable despite lower roaming fees: Germany

1.6%*, Spain 1.3%*, Italy 1.2%*, UK -3.2%*

-- Sustained growth in AMAP: India 6.4%*, Vodacom 4.4%*, Turkey 19.5%*, Egypt 9.4%*

-- 4G adoption drives ongoing data growth: 4G customers doubled to 52.5m and data volumes +63%

-- Strong fixed momentum continues with 348,000 broadband net

adds, up 32%, of which 217,000 are on-net

-- Enterprise growth of 2.6%* as VGE and fixed share gains

continue to offset pressure in mobile

Quarter ended

30 June

---------------------

Restated(1) Growth

--------------------

2016 2015 Reported Organic*

EURm EURm % %

-------------------------- ------- ------------ --------- ---------

Group revenue(1) 13,377 14,007 (4.5)

Europe 8,715 9,005 (3.2)

Africa, Middle East

& Asia Pacific ('AMAP') 4,365 4,655 (6.2)

Alternative performance

measures*

------- ------------ --------- ---------

Group service revenue(1) 12,278 12,699 (3.3) 2.2

Europe 8,129 8,273 (1.7) 0.3

AMAP 3,906 4,135 (5.5) 7.7

Vittorio Colao, Group Chief Executive, commented:

"We continued to make good progress during the first quarter. In

Europe, our growth remains stable despite regulatory pressure on

roaming revenue, with good performance in Germany, Spain and Italy

while we are focussed on improving our performance in the UK. Our

growth momentum in AMAP remains strong, with excellent performance

in South Africa, Turkey and Egypt and ongoing recovery in India.

Customers in multiple markets are attracted by our 'more-for-more'

commercial offerings of larger data bundles and extra services,

while we are seeing continued success with our fixed broadband and

enterprise strategies."

Notes:

* Alternative performance measures are presented

to provide readers with additional financial

information that is regularly reviewed by management

and should not be viewed in isolation or as

an alternative to the equivalent GAAP measure.

Alternative performance measures include, among

other metrics, organic growth, marked with an

"*", which presents performance on a comparable

basis, both in terms of merger and acquisition

activity and movements in foreign exchange rates.

See "Alternative performance measures" on page

10 for further details.

1 With effect from 1 April 2016, the Group's presentation

currency was changed from pounds sterling to

the euro to better align with the geographic

split of the Group's operations. The service

revenue and revenue amounts presented for the

quarter ended 30 June 2015 have been restated

into euros. Group revenue and service revenue

include the results of Europe, AMAP, Other (which

includes the results of partner markets) and

eliminations.

OPERATING REVIEW

Group

Quarter ended

Quarter ended 30 June 2015

30 June 2016 (restated) Organic*

---------------------------- ----------------------------

Service Other Service Other Reported service

revenue revenue Revenue revenue revenue Revenue revenue revenue

EURm EURm EURm EURm EURm EURm % %

-------------- -------- -------- -------- -------- -------- -------- --------- ---------

Europe 8,129 586 8,715 8,273 732 9,005 (3.2) 0.3

AMAP 3,906 459 4,365 4,135 520 4,655 (6.2) 7.7

Other 263 54 317 326 57 383

Eliminations (20) - (20) (35) (1) (36)

-------- -------- -------- -------- -------- -------- --------- ---------

Total 12,278 1,099 13,377 12,699 1,308 14,007 (4.5) 2.2

-------- -------- -------- -------- -------- -------- --------- ---------

Group total revenue was EUR13.4 billion and Group service

revenue was EUR12.3 billion. Total revenue declined 4.5%, including

a 5.3 percentage point negative impact from foreign exchange rate

movements.

On an organic basis, Group service revenue increased 2.2%* (Q4:

2.5%*) and, excluding the impact of mobile termination rate ('MTR')

cuts, Group service revenue grew 2.4%* (Q4: 3.0%*).

Europe

Quarter ended

Quarter ended 30 June 2015

30 June 2016 (restated) Organic*

---------------------------- ----------------------------

Service Other Service Other Reported service

revenue revenue Revenue revenue revenue Revenue revenue revenue

EURm EURm EURm EURm EURm EURm % %

-------------- -------- -------- -------- -------- -------- -------- --------- ---------

Germany 2,479 106 2,585 2,441 211 2,652 (2.5) 1.6

Italy 1,281 192 1,473 1,265 189 1,454 1.3 1.2

UK 1,758 84 1,842 1,979 101 2,080 (11.4) (3.2)

Spain 1,128 117 1,245 1,113 122 1,235 0.8 1.3

Other

Europe 1,528 89 1,617 1,512 109 1,621 (0.2) 1.2

Eliminations (45) (2) (47) (37) - (37)

-------- -------- -------- -------- -------- -------- --------- ---------

Total 8,129 586 8,715 8,273 732 9,005 (3.2) 0.3

-------- -------- -------- -------- -------- -------- --------- ---------

Revenue decreased 3.2% for the quarter, with foreign exchange

movements contributing a 1.9 percentage point negative impact.

On an organic basis, service revenue increased by 0.3%* (Q4:

0.5%*), despite the impact of regulatory pressures, reflecting

growth in all our markets with the exception of the UK, Netherlands

and Greece. Our growth was supported by 'more-for-more' value

enhancement initiatives in many of our markets and continued

commercial momentum in both consumer and fixed.

The decline in mobile service revenue moderated in Q1 to -0.8%*

(Q4: -1.1%*), supported by continued growth in our contract base

and further signs of ARPU stabilisation across multiple markets.

Fixed service revenue trends continue to be robust with growth of

3.3%* (Q4: 5.4%*) driven by broadband customer growth.

Germany

Service revenue increased by 1.6%* (Q4: 1.6%*), a second quarter

of growth led by improvements in fixed revenue, which were offset

by a decline in mobile revenue due to regulatory pressure on

roaming charges.

Mobile service revenue declined 0.3%* (Q4: 0.3%*), reflecting

lower roaming revenues and a stronger first quarter in the prior

fiscal year. Excluding roaming, performance improved with mobile

prepaid revenue stabilising. Mobile contract net additions were

modest at 8,000 (Q4: 49,000), with lower volumes in the indirect

channels. We continue to focus on more profitable growth in the

direct channels and our 'more-for-more' customer value enhancement

strategy. Pricing pressure continues in Enterprise. Contract churn

was broadly stable at 14.1%. We increased our 4G coverage to 89%

and now have 8.4 million 4G customers.

Fixed service revenue growth improved to 4.7%* (Q4: 3.8%*),

driven by steady growth in cable and further stabilising DSL

revenue performance. KDG continued to perform strongly. During a

seasonally slower quarter we added 108,000 broadband subscribers

(Q1 FY16: 70,000), of which 92,000 were on cable and the remainder

on DSL.

Italy

Service revenue increased by 1.2%* (Q4: 1.3%*), benefitting from

mobile ARPU growth, partially offset by the reversal of the leap

year effect that supported the fourth quarter of the last fiscal

year.

Mobile service revenue grew 1.4%* (Q4: 1.6%*) thanks to prepaid

ARPU growth, partially offset by a decline in our customer base.

Despite a highly competitive value segment, our mobile contract net

additions stabilised after a period of decline aided by our

market-leading network quality. The competitive pricing environment

in enterprise continued, resulting in further customer losses. As

at 30 June 2016 we have 96% population coverage on our 4G network

and 6.8 million 4G customers.

Fixed service revenue was stable at +0.1%* (Q4: -0.2%*), with

continued momentum in consumer customer growth offset by increased

price pressure. We added 46,000 broadband customers in the quarter

(Q4: 63,000), with 41% of our gross additions taking fibre-based

services. Enel have begun their deployment of Fibre-To-The-Home

(FTTH) services, with initial customers in Perugia enjoying speeds

of up to 1Gbps.

UK

UK service revenue declined 3.2%* (Q4: -0.1%*), reflecting the

impact of operational challenges following a billing system

migration, lower out of bundle revenues and the benefit of a large

Enterprise contract win in the first quarter of the prior fiscal

year.

Mobile service revenue declined 3.6%* (Q4: -1.9%*) with consumer

contract in-bundle revenue growth being more than offset by a

decline in out of bundle usage compared to the prior year and the

impact of expanding roaming propositions in enterprise mobile. We

added 26,000 new contract customers (Q4: 1,000) and reduced

consumer contract churn to 15.5% (Q4: 18.9%), supported by

stabilising customer service levels. We had 7.5m 4G customers at

the period end, with 4G coverage at 95% on the Ofcom definition

(Q4: 91%) as we accelerated our coverage expansion.

Fixed service revenue which is predominately enterprise related

declined 1.8%* (Q4: 5.5%*), reflecting a large Enterprise contract

win in the first quarter of the prior fiscal year and having been

supported by strong carrier revenue growth in the fourth quarter.

In broadband momentum continues and we secured 137,000 customers by

the period end (Q4: 109,000). Field trials for Vodafone TV are

underway.

Spain

Service revenue returned to growth of 1.3%* (Q4: -3.2%*) for the

first time since 2008. Excluding the impact of handset financing,

service revenue grew 4.9%* (Q4: 0.6%*). This performance

improvement was supported by several factors, particularly

'more-for-more' propositions during the quarter for both new and

existing customers and a higher customer base. This tariff change

contributed to higher churn levels in both fixed and mobile,

however these effects decreased throughout the quarter, with mobile

churn returning to more normal levels in the month of June.

Vodafone One, our fully integrated cable, mobile and TV service,

reached 1.9 million customers at the period end, up from 291,000

one year ago.

We continue to grow our mobile base, adding 53,000 mobile

contract customers in the quarter (Q4: 105,000). Our 4G population

coverage reached 92% at 30 June 2016 and we have 5.9 million 4G

customers.

Broadband subscriber additions slowed to 1,000 due primarily to

higher churn following tariff changes. We launched our DSL TV

proposition in the quarter, which supported TV subscriber growth of

52,000 despite typical seasonal pressures due to the end of the

football season.

Other Europe

Service revenue rose 1.2%* (Q4: 2.1%*), with all markets except

Greece, the Netherlands and Malta achieving growth during the

quarter.

In the Netherlands, service revenue declined 2.2%* (Q4: -1.3%*),

with growth in fixed more than offset by mobile price competition,

which continues to impact the consumer customer base, as well as

regulatory pressure on roaming revenue. We are making good progress

with integration planning for our Joint Venture with Ziggo, and

continue to expect the transaction to close around the end of

calendar 2016.

In Portugal, fixed service revenue continues to grow strongly

and mobile is stabilising as the shift towards lower priced

convergent offers begins to moderate. In Ireland, service revenue

grew 2.8%* (Q4: 2.4%*) supported by accelerated growth in fixed

line and stable mobile trends. In Greece service revenue growth

(now including HOL for the first time on an organic basis) was

impacted by the transfer of HOL carrier service revenue to Group.

Excluding this effect service revenue was stable despite

challenging macroeconomic conditions.

AMAP

Quarter ended

Quarter ended 30 June 2015

30 June 2016 (restated) Organic*

---------------------------- ----------------------------

Service Other Service Other Reported service

revenue revenue Revenue revenue revenue Revenue revenue revenue

EURm EURm EURm EURm EURm EURm % %

-------------- -------- -------- -------- -------- -------- -------- --------- ---------

India 1,510 9 1,519 1,569 4 1,573 (3.4) 6.4

Vodacom 992 183 1,175 1,172 292 1,464 (19.7) 4.4

Other

AMAP 1,407 267 1,674 1,399 224 1,623 3.1 11.5

Eliminations (3) - (3) (5) - (5)

-------- -------- -------- -------- -------- -------- --------- ---------

Total 3,906 459 4,365 4,135 520 4,655 (6.2) 7.7

-------- -------- -------- -------- -------- -------- --------- ---------

Revenue decreased 6.2%, with strong organic growth offset by a

12.6 percentage point adverse impact from foreign exchange

movements, particularly with regards to the South African rand,

Turkish lira, Egyptian pound and Indian rupee.

On an organic basis service revenue increased 7.7%* (Q4: 8.1%*)

driven by growth in all our major markets. The region continues to

see strong customer growth, with 2.8 million added in the quarter,

and an increasing number of our customers are now using data, with

12.9 million active data users added in the quarter. Customer usage

continues to grow throughout the region, with voice and data usage

up 6.4% and 63% respectively.

With effect from 1 April 2016, the Group changed the reporting

of certain dealer commissions in India. Organic service revenue

growth rates for the quarter ended 30 June 2016 of Vodafone India

and the Group have been amended to exclude the impact of this

change, which had no effect on earnings or cash flows.

India

Service revenue growth improved to 6.4%* (Q4: 5.3%) as voice

revenue returned to growth and regulatory impacts reduced.

Excluding regulatory drags including MTR cuts, roaming price caps

and an increase in service tax, service revenue grew 7.7%* compared

to 10.2%* in the fourth quarter of the prior fiscal year. The

slower pace of growth mainly reflects the reversal of the leap-year

effect and lower intra circle roaming revenues.

Data browsing revenue growth of 22.3%* slowed from the pace of

prior quarters, reflecting lower customer growth. Our active data

customer base increased to 69.7 million customers from 66.8 million

one year ago. The 3G / 4G customer base grew to 32.3 million, up

46%, and smartphone penetration in our four biggest urban areas is

now 54%. Voice revenues returned to growth as competition eased,

despite lower average minutes of use per customer. Total mobile

customers increased 1.4 million giving a closing customer base of

199.4 million.

We added 3,300 new 3G sites in the quarter, taking the total to

59,000 and our population coverage to 96% of target urban areas. We

have 9,700 4G sites with coverage of 45% of our data revenues

across five key circles. We expect 4G coverage to increase to over

60% of our data revenues by year-end, ahead of the upcoming

spectrum auction.

Preparations continue for a potential IPO of Vodafone India.

Vodacom

Service revenue grew 4.4%* (Q4: 6.3%*), with strong customer and

data growth in South Africa offset by a slowdown in international

customer growth following new customer registration processes.

South Africa service revenue grew 5.7%* (Q4: 6.5%*), supported

by customer growth in both prepaid and contract (prepaid net

additions 891,000, Q4: 728,000). Our 'Just 4 U' targeted individual

pricing strategy continues to support voice revenues. Data revenue

growth remains robust at 18.0%* (Q4: 18.9%*), and data now

contributes 38% of South Africa's service revenues. The growth in

data is supported by sustained investment in 3G and 4G network

coverage and capacity. Network leadership and customer focus

contributed to a record low consumer contract mobile churn rate of

5.3%.

Vodacom's International operations outside South Africa, which

now represent 25% of Vodacom Group service revenue, saw a sharp

slowdown in growth to 4.4%* (Q4: 10.2%*). Customer growth numbers

were impacted by stricter compliance on customer registration

requirements in Tanzania, the DRC and Mozambique. The customer

growth trend is now improving as acquisition procedures become more

efficient across all channels. M-Pesa continues to perform well,

with over 8.3 million customers (up from 5.6 million a year

ago).

Other AMAP

Service revenue increased 11.5%* (Q4: 12.1%), with strong growth

in Turkey, Egypt and Ghana.

Service revenue in Turkey was up 19.5%* (Q4 22.3%*), supported

by strong growth in consumer contract and enterprise and an

increased contribution from fixed line. Egypt grew 9.4%* (Q4:

11.2%*), driven by sustained growth in data usage and mobile ARPU

expansion. Service revenue in Ghana grew 20.3%* (Q4: 21.3%*) aided

by customer growth and increasing data usage.

In New Zealand, service revenue was up 1.8%* (Q4: 0.4%*), driven

by strong fixed line performance and mobile customer growth across

both consumer and enterprise. In June we announced our intention to

merge with Sky Network Television in New Zealand, thereby creating

the country's leading integrated telecommunications and media

group. Vodafone will become a 51% shareholder in the combined

group, will receive NZ$1.25 billion in cash and will look to

realise the benefits of an estimated NZ$850 million NPV from

synergies. Sky shareholders have voted in favour of the transaction

but completion is still subject to local regulatory approvals. The

transaction is expected to complete around the end of calendar

2016.

Strategic progress

Customer eXperience eXcellence ('CXX')

The Group's customer experience excellence programme is our core

marketing strategy for brand and service differentiation. With CXX

we aim to deliver an outstanding and differentiated experience for

our customers, building on the significantly improved network

quality delivered by Project Spring. Given the strategic importance

of the programme, CXX performance indicators (primarily Net

Promoter Scores and brand consideration) represent up to 40% of the

annual bonus award for employees across the Group.

The programme focuses on four key aspects of our customers'

experience with Vodafone, summarised by the acronym 'CARE'. As the

initiatives described below illustrate, we made progress in each of

these areas during the quarter:

-- 'Connectivity that is reliable and secure':

We now have 'Network guarantee' pledges in

14 markets, promising customers' their money

back if the network fails to live up to their

expectations (typically, during the first 30

days for new customers). Our 4G roaming footprint

now covers 100 countries, twice as many as

our best local competitor in the majority of

our markets.

-- 'Always in control': For the first time, more

than half of our European mobile customers

(and almost two-thirds of our contract customers)

take advantage of our European 'worry-free'

roaming offers, with roaming either included

in their tariff or available at a modest daily

rate. Penetration of the 'My Vodafone' app

reached 35% across the group, and is as high

as 60% in Italy. The app is now available across

21 markets, with customers able to monitor

their usage in real time in 13 of these markets.

-- 'Reward Loyalty': 16 markets have now implemented

tailored reward programmes for specific customer

segments, aiming to delight and surprise loyal

customers. This has contributed to a 0.3 percentage

points year-on-year and 1.6 percentage points

quarter-on-quarter improvement in overall consumer

contract churn during the quarter to 16.6%.

-- 'Easy Access': We now provide convenient support

to our customers through a 24/7 Live chat platform

in 14 markets. The 'first contact resolution'

rate in several of these markets is now over

80%, compared to 65% for the overall group.

The success of the variety of CXX initiatives now underway is

apparent from a further overall improvement in Net Promoter Scores

during the quarter, with 12 out of 21 operating companies achieving

a market leading position, representing 368.4 million customers and

over half of Group service revenues.

Data

Customer demand for data continues to grow very quickly,

stimulated by the increasing availability of great TV, sport and

video on smartphones and tablets, the improving reliability and

speed of mobile networks, the increasing size and quality of

smartphone screens and the continued deflation in unitary data

pricing.

Data traffic in Q1 grew 63% (Q4: 67%). We doubled our 4G

customer base year-on-year to 52.5 million across the 21 countries

where we offer 4G, with 5.7 million customers added in the quarter.

Although take-up continues to be rapid, only 30% of our European

customer base is taking a 4G service, providing us with a very

substantial opportunity for future growth. Customers who move to 4G

typically buy bigger data packages and see their data consumption

double; average usage per smartphone customer in Europe is up 57%

year-on-year to 1.3GB per month, and over half of the data traffic

in Europe is now on 4G.

In our emerging markets, data adoption is also rapid, supported

by our significant network investment and the relative scarcity of

fixed line internet access. The 3G/4G mobile data customer base is

88.9 million, up 50.7% year-on-year. In India we have launched 4G

in five circles, covering 45% of data revenues, and expect to reach

over 60% in the current financial year. Given the high cost of

spectrum, we intend to take a disciplined approach to further 4G

rollout.

Unified communications

We are becoming an integrated operator, for both households and

businesses, in our main markets. We market high speed broadband

services to 74.4 million households across Europe, and through

organic investment and acquisition, 29.9 million of these

households are 'on-net' - serviced by our own fibre or cable

infrastructure.

We continue to achieve strong customer growth across our

footprint. We now have 13.7 million broadband customers, with

348,000 new broadband customers added in the quarter, In Europe, we

added 254,000 new broadband customers of which 81% were on-net.

This brings the total European on-net customer base to 5.8 million,

representing on-net penetration of just 19% which leaves

significant opportunity for future profitable growth. In Q1, 26.4%

of our service revenue in Europe came from fixed line.

Enterprise

Services to business customers comprised 27.8% of our Group

service revenue, and 32.1% in Europe during Q1. Our relationships

with business customers are expanding from traditional mobile voice

and data services to embrace total communications, IoT, Cloud &

Hosting and IP-VPN provision. These new areas offer both market

growth and market share opportunities for us.

Overall, Enterprise revenues grew 2.6%* in the quarter. Vodafone

Global Enterprise ('VGE'), which provides services to our biggest

international customers, achieved revenue growth of 6.3%*, driven

by our unmatched geographical presence and the increasing trend

among multinational corporations to retain a single provider of

services across borders. Our total IoT connections increased by

38.6% year-on-year to 41.3 million, with revenue growing

20.1%*.

Summary and outlook(1)

Trading in the first quarter was consistent with management's

expectations underlying the outlook statement for the 2017

financial year. The Group therefore confirms its outlook for the

2017 financial year.

Notes:

* Alternative performance measures are presented

to provide readers with additional financial

information that is regularly reviewed by management

and should not be viewed in isolation or as

an alternative to the equivalent GAAP measure.

Alternative performance measures include, among

other metrics, organic growth, marked with an

"*", which presents performance on a comparable

basis, both in terms of merger and acquisition

activity and movements in foreign exchange rates.

See "Alternative performance measures" on page

10 for further details.

1 Full details on this guidance are available

on page 7 of the Group's year end results announcement

for the year ended 31 March 2016.

ADDITIONAL INFORMATION

Service revenue - quarter ended 30 June

Group and

Regions Group Europe AMAP

-------------------- -------------------- --------------------

Restated Restated Restated

2016 2015 2016 2015 2016 2015

EURm EURm EURm EURm EURm EURm

--------- --------- --------- --------- --------- ---------

Mobile in-bundle 5,454 5,337 4,058 3,966 1,396 1,322

Mobile out-of-bundle 2,854 3,397 1,142 1,416 1,708 1,978

Mobile incoming 791 838 421 439 371 399

Fixed 2,575 2,600 2,142 2,110 295 292

Other 604 527 366 342 136 144

--------- --------- --------- --------- --------- ---------

Service revenue 12,278 12,699 8,129 8,273 3,906 4,135

Other revenue 1,099 1,308 586 732 459 520

--------- --------- --------- --------- --------- ---------

Revenue 13,377 14,007 8,715 9,005 4,365 4,655

--------- --------- --------- --------- --------- ---------

Growth

----------------------------------------------------------------

Reported Organic* Reported Organic* Reported Organic*

% % % % % %

--------- --------- --------- --------- --------- ---------

Revenue (4.5) 1.5 (3.2) (1.3) (6.2) 8.6

Service revenue (3.3) 2.2 (1.7) 0.3 (5.5) 7.7

--------- --------- --------- --------- --------- ---------

Operating

Companies Germany Italy UK

-------------------- -------------------- --------------------

Restated Restated Restated

2016 2015 2016 2015 2016 2015

EURm EURm EURm EURm EURm EURm

--------- --------- --------- --------- --------- ---------

Mobile in-bundle 1,097 1,058 708 640 880 926

Mobile out-of-bundle 217 275 206 268 302 392

Mobile incoming 72 75 92 92 91 114

Fixed 969 926 210 210 405 450

Other 124 107 65 55 80 97

--------- --------- --------- --------- --------- ---------

Service revenue 2,479 2,441 1,281 1,265 1,758 1,979

Other revenue 106 211 192 189 84 101

--------- --------- --------- --------- --------- ---------

Revenue 2,585 2,652 1,473 1,454 1,842 2,080

--------- --------- --------- --------- --------- ---------

Growth

----------------------------------------------------------------

Reported Organic* Reported Organic* Reported Organic*

% % % % % %

--------- --------- --------- --------- --------- ---------

Revenue (2.5) (2.5) 1.3 1.3 (11.4) (3.4)

Service revenue 1.6 1.6 1.3 1.2 (11.2) (3.2)

--------- --------- --------- --------- --------- ---------

Spain India Vodacom

-------------------- -------------------- --------------------

Restated Restated Restated

2016 2015 2016 2015 2016 2015

EURm EURm EURm EURm EURm EURm

--------- --------- --------- --------- --------- ---------

Mobile in-bundle 559 547 398 350 345 396

Mobile out-of-bundle 110 130 827 929 512 613

Mobile incoming 43 37 164 169 47 60

Fixed 365 356 69 67 41 47

Other 51 43 52 54 47 56

--------- --------- --------- --------- --------- ---------

Service revenue 1,128 1,113 1,510 1,569 992 1,172

Other revenue 117 122 9 4 183 292

--------- --------- --------- --------- --------- ---------

Revenue 1,245 1,235 1,519 1,573 1,175 1,464

--------- --------- --------- --------- --------- ---------

Growth

----------------------------------------------------------------

Reported Organic* Reported Organic* Reported Organic*

% % % % % %

--------- --------- --------- --------- --------- ---------

Revenue 0.8 0.8 (3.4) 6.7 (19.7) 3.3

Service revenue 1.3 1.3 (3.8) 6.4 (15.4) 4.4

--------- --------- --------- --------- --------- ---------

Note:

* Alternative performance measures are presented

to provide readers with additional financial

information that is regularly reviewed by management

and should not be viewed in isolation or as

an alternative to the equivalent GAAP measure.

Alternative performance measures include, among

other metrics, organic growth, marked with an

"*", which presents performance on a comparable

basis, both in terms of merger and acquisition

activity and movements in foreign exchange rates.

See "Alternative performance measures" on page

10 for further details.

Mobile customers - quarter ended 30 June 2016

(in thousands)

Contract Prepay

1 April net additions/ net additions/ Other 30 June

Country 2016 (disconnections) (disconnections) movements 2016 Contract

---------------- -------- ------------------ ------------------ ----------- -------- ---------

Europe

Germany 30,334 8 (72) - 30,270 54.8%

Italy 24,143 - (318) - 23,825 18.9%

UK 18,197 26 (249) - 17,974 67.9%

Spain 14,319 53 (26) - 14,346 78.9%

---------------- -------- ------------------ ------------------ ----------- -------- ---------

86,993 87 (665) - 86,415 51.6%

---------------- -------- ------------------ ------------------ ----------- -------- ---------

Other

Europe

Netherlands 5,030 (17) 18 - 5,031 76.4%

Ireland 1,986 11 (30) - 1,967 50.7%

Portugal 4,850 14 (76) - 4,788 39.6%

Romania 8,461 35 (8) - 8,488 41.4%

Greece 5,732 (5) 63 - 5,790 27.5%

Czech

Republic 3,424 49 (6) - 3,467 67.5%

Hungary 2,807 26 (35) - 2,798 60.7%

Albania 1,842 1 12 - 1,855 4.3%

Malta 307 1 - - 308 21.1%

---------------- -------- ------------------ ------------------ ----------- -------- ---------

34,439 115 (62) - 34,492 46.4%

---------------- -------- ------------------ ------------------ ----------- -------- ---------

Europe 121,432 202 (727) - 120,907 50.2%

---------------- -------- ------------------ ------------------ ----------- -------- ---------

AMAP

India 197,947 653 783 - 199,383 7.4%

Vodacom(1) 70,397 62 475 - 70,934 7.4%

---------------- -------- ------------------ ------------------ ----------- -------- ---------

268,344 715 1,258 - 270,317 7.4%

---------------- -------- ------------------ ------------------ ----------- -------- ---------

Other

AMAP

Turkey 22,161 345 (131) - 22,375 45.5%

Egypt 38,505 19 519 - 39,043 6.6%

New Zealand 2,402 18 (19) - 2,401 39.5%

Qatar 1,548 (1) (89) - 1,458 16.2%

Ghana 7,892 127 65 - 8,084 1.9%

---------------- -------- ------------------ ------------------ ----------- -------- ---------

72,508 508 345 - 73,361 19.2%

---------------- -------- ------------------ ------------------ ----------- -------- ---------

AMAP 340,852 1,223 1,603 - 343,678 9.9%

---------------- -------- ------------------ ------------------ ----------- -------- ---------

Group 462,284 1,425 876 - 464,585 20.4%

---------------- -------- ------------------ ------------------ ----------- -------- ---------

Note:

1 Vodacom refers to the Group's interests in Vodacom

Group Limited and its subsidiaries, including

those located outside of South Africa.

Fixed broadband customers - quarter ended 30 June 2016

(in thousands)

1 April Net additions/ Other 30 June

Country 2016 (disconnections) movements 2016

---------------- -------- ------------------ ----------- --------

Europe

Germany 5,825 108 - 5,933

Italy 1,970 46 - 2,016

UK 109 28 - 137

Spain 3,022 1 - 3,023

---------------- -------- ------------------ ----------- --------

10,926 183 - 11,109

---------------- -------- ------------------ ----------- --------

Other Europe

Netherlands 106 17 - 123

Ireland 239 8 - 247

Portugal 442 24 - 466

Romania 56 2 - 58

Greece 551 20 - 571

Czech Republic 14 - - 14

Hungary - - - -

Albania - - - -

Malta 3 - - 3

---------------- -------- ------------------ ----------- --------

1,411 71 - 1,482

---------------- -------- ------------------ ----------- --------

Europe 12,337 254 - 12,591

---------------- -------- ------------------ ----------- --------

AMAP

India - - - -

Vodacom(1) 1 1 - 2

---------------- -------- ------------------ ----------- --------

1 1 - 2

---------------- -------- ------------------ ----------- --------

Other AMAP

Turkey 363 61 - 424

Egypt 213 18 - 231

New Zealand 412 12 - 424

Qatar 6 (1) - 5

Ghana 41 3 - 44

---------------- -------- ------------------ ----------- --------

1,035 93 - 1,128

---------------- -------- ------------------ ----------- --------

AMAP 1,036 94 - 1,130

---------------- -------- ------------------ ----------- --------

Group 13,373 348 - 13,721

---------------- -------- ------------------ ----------- --------

Note:

1 Vodacom refers to the Group's interests in Vodacom

Group Limited and its subsidiaries, including

those located outside of South Africa.

ALTERNATIVE PERFORMANCE MEASURES

In the discussion of the Group's reported operating results,

information is presented to provide readers with additional

financial information that is regularly reviewed by management.

However, this additional information presented is not uniformly

defined by all companies including those in the Group's industry.

Accordingly, it may not be comparable with similarly titled

measures and disclosures by other companies. Additionally, certain

information presented is derived from amounts calculated in

accordance with IFRS but is not itself an expressly permitted GAAP

measure. Such alternative performance measures should not be viewed

in isolation or as an alternative to the equivalent GAAP

measure.

Service revenue

Service revenue comprises all revenue related to the provision

of ongoing services including, but not limited to, monthly access

charges, airtime usage, roaming, incoming and outgoing network

usage by non-Vodafone customers and interconnect charges for

incoming calls. We believe that it is both useful and necessary to

report this measure for the following reasons:

-- It is used for internal performance reporting;

-- It is used in setting director and management

remuneration; and

-- It is useful in connection with discussions

with the investment analyst community.

A reconciliation of reported service revenue to the respective

closest equivalent GAAP measure, revenue, is provided where used in

the Operating Review on pages 2 to 6.

Organic growth

All amounts in this document marked with an "*" represent

"organic growth" which presents performance on a comparable basis

in terms of merger and acquisition activity and foreign exchange

rates. While "organic growth" is neither intended to be a

substitute for reported growth, nor is it superior to reported

growth, we believe that the measure provides useful and necessary

information to investors and other interested parties for the

following reasons:

-- it provides additional information on underlying

growth of the business without the effect of

certain factors unrelated to its operating

performance;

-- it is used for internal performance analysis;

and

-- it facilitates comparability of underlying

growth with other companies (although the term

"organic" is not a defined term under IFRS

and may not, therefore, be comparable with

similarly titled measures reported by other

companies).

With effect from 1 April 2016, the Group changed the reporting

of certain dealer commissions in India. The impact on revenues for

the current and prior quarters was not material. Organic service

revenue growth rates for the quarter ended 30 June 2016 of Vodafone

India and the Group have been amended to exclude the impact of this

change, which had no effect on earnings or cash flows.

Reconciliations of organic growth to reported growth are shown

where used or in the table below.

Other

activity

Restated (including Foreign

2016 2015 Reported M&A) exchange Organic

EURm EURm % pps pps %

------------------ ------- --------- --------- ----------- --------- --------

Quarter ended 30

June

Revenue

Germany 2,585 2,652 (2.5) - - (2.5)

Italy 1,473 1,454 1.3 - - 1.3

UK 1,842 2,080 (11.4) - 8.0 (3.4)

Spain 1,245 1,235 0.8 - - 0.8

Other Europe 1,617 1,621 (0.2) - - (0.2)

Eliminations (47) (37)

------- --------- --------- ----------- --------- --------

Europe 8,715 9,005 (3.2) - 1.9 (1.3)

------------------- ------- --------- --------- ----------- --------- --------

India 1,519 1,573 (3.4) 2.7 7.4 6.7

Vodacom 1,175 1,464 (19.7) 3.9 19.1 3.3

Other AMAP 1,674 1,623 3.1 - 11.2 14.3

Eliminations (3) (5)

------- --------- --------- ----------- --------- --------

AMAP 4,365 4,655 (6.2) 2.2 12.6 8.6

------------------- ------- --------- --------- ----------- --------- --------

Other 317 383

Eliminations (20) (36)

------- --------- --------- ----------- --------- --------

Total 13,377 14,007 (4.5) 0.7 5.3 1.5

------------------- ------- --------- --------- ----------- --------- --------

ALTERNATIVE PERFORMANCE MEASURES

Other

activity

Restated (including Foreign

2016 2015 Reported M&A) exchange Organic

EURm EURm % pps pps %

------------------------ ------- --------- --------- ----------- --------- --------

Quarter ended 30

June

Service revenue

Germany 2,479 2,441 1.6 - - 1.6

------- --------- --------- ----------- --------- --------

Mobile service

revenue 1,510 1,515 (0.3) - - (0.3)

Fixed service

revenue 969 926 4.6 - 0.1 4.7

------------------------ ------- --------- --------- ----------- --------- --------

Italy 1,281 1,265 1.3 - (0.1) 1.2

------- --------- --------- ----------- --------- --------

Mobile service

revenue 1,071 1,055 1.5 - (0.1) 1.4

Fixed service

revenue 210 210 - - 0.1 0.1

------------------------ ------- --------- --------- ----------- --------- --------

UK 1,758 1,979 (11.2) - 8.0 (3.2)

------- --------- --------- ----------- --------- --------

Mobile service

revenue 1,353 1,529 (11.5) - 7.9 (3.6)

Fixed service

revenue 405 450 (10.0) - 8.2 (1.8)

------------------------ ------- --------- --------- ----------- --------- --------

Spain 1,128 1,113 1.3 - - 1.3

Other Europe 1,528 1,512 1.1 - 0.1 1.2

------- --------- --------- ----------- --------- --------

Netherlands 426 435 (2.1) - (0.1) (2.2)

Ireland 242 235 3.0 - (0.2) 2.8

Other 860 842

------------------------ ------- --------- --------- ----------- --------- --------

Eliminations (45) (37)

------- --------- --------- ----------- --------- --------

Europe 8,129 8,273 (1.7) 0.1 1.9 0.3

------- --------- --------- ----------- --------- --------

Mobile service

revenue 5,987 6,163 (2.9) - 2.1 (0.8)

Fixed service

revenue 2,142 2,110 1.5 - 1.8 3.3

------------------------ ------- --------- --------- ----------- --------- --------

India 1,510 1,569 (3.8) 2.8 7.4 6.4

Vodacom 992 1,172 (15.4) - 19.8 4.4

------- --------- --------- ----------- --------- --------

South Africa 734 880 (16.6) - 22.3 5.7

International

operations 243 268 (9.3) - 13.7 4.4

Other 15 24

------------------------ ------- --------- --------- ----------- --------- --------

Other AMAP 1,407 1,399 0.6 - 10.9 11.5

------- --------- --------- ----------- --------- --------

Turkey 585 543 7.7 - 11.8 19.5

Egypt 362 393 (7.9) - 17.3 9.4

New Zealand 274 291 (5.8) - 7.6 1.8

Ghana 69 56 23.2 - (2.9) 20.3

Other 117 116

------------------------ ------- --------- --------- ----------- --------- --------

Eliminations (3) (5)

------- --------- --------- ----------- --------- --------

AMAP 3,906 4,135 (5.5) 1.1 12.1 7.7

------------------------- ------- --------- --------- ----------- --------- --------

Other 263 326

Eliminations (20) (35)

------------------------- ------- --------- --------- ----------- --------- --------

Total service revenue 12,278 12,699 (3.3) 0.4 5.1 2.2

Other revenue 1,099 1,308

------------------------- ------- --------- --------- ----------- --------- --------

Total revenue 13,377 14,007 (4.5) 0.7 5.3 1.5

------------------------- ------- --------- --------- ----------- --------- --------

Other metrics

Group - Enterprise

service revenue 3,409 3,511 (2.9) 1.1 4.4 2.6

Group - IoT revenues 174 149 16.8 (0.1) 3.4 20.1

Vodafone Global

Enterprise service

revenue 801 766 4.6 (0.7) 2.4 6.3

India - Data browsing

revenue 311 274 13.5 - 8.8 22.3

South Africa -

Data revenue 277 297 (6.7) - 24.7 18.0

Group - Service

revenue excluding

the impact of MTR

cuts 12,278 12,699 (3.3) 0.6 5.1 2.4

Spain - Service

revenue excluding

the impact of handset

financing 1,128 1,113 1.3 3.6 - 4.9

India - Service

revenue excluding

the impact of MTR

cuts and other 1,510 1,569 (3.8) 4.1 7.4 7.7

------------------------- ------- --------- --------- ----------- --------- --------

ALTERNATIVE PERFORMANCE MEASURES

Other

activity

Restated (including Foreign

2016 2015 Reported M&A) exchange Organic

EURm EURm % pps pps %

------------------------ ------- --------- --------- ----------- --------- --------

Quarter ended 31

March

Service revenue

Germany 2,462 2,423 1.6 - - 1.6

------- --------- --------- ----------- --------- --------

Mobile service

revenue 1,505 1,501 0.3 - - 0.3

Fixed service

revenue 957 922 3.8 - - 3.8

------------------------ ------- --------- --------- ----------- --------- --------

Italy 1,263 1,246 1.4 - (0.1) 1.3

------- --------- --------- ----------- --------- --------

Mobile service

revenue 1,055 1,038 1.6 - - 1.6

Fixed service

revenue 208 208 - - (0.2) (0.2)

------------------------ ------- --------- --------- ----------- --------- --------

UK 1,903 2,093 (9.1) 5.4 3.6 (0.1)

------- --------- --------- ----------- --------- --------

Mobile service

revenue 1,412 1,493 (5.4) - 3.5 (1.9)

Fixed service

revenue 491 600 (18.2) 20.0 3.7 5.5

------------------------ ------- --------- --------- ----------- --------- --------

Spain 1,094 1,131 (3.3) - 0.1 (3.2)

Other Europe 1,516 1,481 2.4 (0.1) (0.2) 2.1

------- --------- --------- ----------- --------- --------

Netherlands 428 434 (1.4) - 0.1 (1.3)

Ireland 238 232 2.6 - (0.2) 2.4

Other 850 815

------------------------ ------- --------- --------- ----------- --------- --------

Eliminations (36) (44)

------- --------- --------- ----------- --------- --------

Europe 8,202 8,330 (1.5) 1.1 0.9 0.5

------- --------- --------- ----------- --------- --------

Mobile service

revenue 5,995 6,101 (1.7) (0.2) 0.8 (1.1)

Fixed service

revenue 2,207 2,229 (1.0) 5.2 1.2 5.4

------------------------ ------- --------- --------- ----------- --------- --------

India 1,532 1,547 (1.0) - 6.3 5.3

Vodacom 992 1,183 (16.1) - 22.4 6.3

------- --------- --------- ----------- --------- --------

South Africa 717 888 (19.3) - 25.8 6.5

International

operations 259 271 (4.4) - 14.6 10.2

Other 16 24

------------------------ ------- --------- --------- ----------- --------- --------

Other AMAP 1,404 1,477 (4.9) 7.0 10.0 12.1

------- --------- --------- ----------- --------- --------

Turkey 560 536 4.5 - 17.8 22.3

Egypt 390 463 (15.8) 21.3 5.7 11.2

New Zealand 272 303 (10.2) - 10.6 0.4

Ghana 68 62 9.7 - 11.6 21.3

Other 114 113

------------------------ ------- --------- --------- ----------- --------- --------

Eliminations 2 (14)

------- --------- --------- ----------- --------- --------

AMAP 3,930 4,193 (6.3) 2.2 12.2 8.1

------------------------- ------- --------- --------- ----------- --------- --------

Other 338 453

Eliminations (63) (95)

------------------------- ------- --------- --------- ----------- --------- --------

Total service revenue 12,407 12,881 (3.7) 1.8 4.4 2.5

Other revenue 1,125 1,380

------------------------- ------- --------- --------- ----------- --------- --------

Total revenue 13,532 14,261 (5.1) 1.6 4.6 1.1

------------------------- ------- --------- --------- ----------- --------- --------

Other metrics

Group - Enterprise

service revenue 3,489 3,538 (1.4) 3.4 (0.5) 1.5

Group - IoT revenues 122 111 9.9 28.2 (2.5) 35.6

Vodafone Global

Enterprise service

revenue 699 637 9.7 (5.0) (2.6) 2.1

India - Data browsing

revenue 294 231 27.3 - 7.7 35.0

South Africa -

Data revenue 260 289 (10.0) - 28.9 18.9

Group - Service

revenue excluding

the impact of MTR

cuts 12,407 12,881 (3.7) 2.3 4.4 3.0

Spain - Service

revenue excluding

the impact of handset

financing 1,094 1,131 (3.3) 3.8 0.1 0.6

India - Service

revenue excluding

the impact of MTR

cuts and other 1,532 1,547 (1.0) 4.9 6.3 10.2

------------------------- ------- --------- --------- ----------- --------- --------

OTHER INFORMATION

Notes

1. Vodafone, the Vodafone Portrait, the Vodafone

Speechmark, Vodacom, Vodafone One and M-Pesa

are trademarks of the Vodafone Group. The Vodafone

Rhombus is a registered design of the Vodafone

Group. Other product and company names mentioned

herein may be the trademarks of their respective

owners.

2. All growth rates reflect a comparison to the

quarter ended 30 June 2015 unless otherwise

stated.

3. References to "the quarter" are to the quarter

ended 30 June 2016 unless otherwise stated.

References to the "previous quarter" are to

the quarter ended 31 March 2016 unless otherwise

stated. References to the "year" or "current

financial year" are to the financial year ending

31 March 2017 and references to the "prior financial

year" are to the financial year ended 31 March

2016 unless otherwise stated.

4. All amounts marked with an "*" represent organic

growth which presents performance on a comparable

basis, both in terms of merger and acquisition

activity and movements in foreign exchange rates.

5. Vodacom refers to the Group's interests in Vodacom

Group Limited ('Vodacom') in South Africa and

its subsidiaries, including its operations in

The Democratic Republic of the Congo, Lesotho,

Mozambique and Tanzania.

6. Quarterly historical information including information

for service revenue, mobile customers, churn,

voice usage, messaging volumes, data volumes,

ARPU, smartphones and fixed broadband customers

is provided in a spreadsheet available at vodafone.com/investor.

7. This trading update contains references to our

website. Information on our website is not incorporated

into this update and should not be considered

part of this update. We have included any website

as an inactive textual reference only.

Definition of terms

Term Definition

--------------------- -------------------------------------------------

ARPU Average revenue per user, defined

as customer revenue and incoming revenue

divided by average customers.

--------------------- -------------------------------------------------

Enterprise The Group's customer segment for businesses.

--------------------- -------------------------------------------------

Fixed service Service revenue relating to provision

revenue of fixed line and carrier services.

--------------------- -------------------------------------------------

Incoming revenue Comprises revenue from termination

rates for voice and messaging to Vodafone

customers.

--------------------- -------------------------------------------------

Mobile in-bundle Represents revenue from bundles that

revenue include a specified number of minutes,

messages or megabytes of data that

can be used for no additional charge,

with some expectation of recurrence.

Includes revenue from all contract

bundles and add-ons lasting 30 days

or more as well as revenue from prepay

bundles lasting seven days or more.

--------------------- -------------------------------------------------

Mobile out-of-bundle Revenue from minutes, messages or

megabytes of data which are in excess

of the amount included in customer

bundles.

--------------------- -------------------------------------------------

Mobile service Service revenue relating to the provision

revenue of mobile services.

--------------------- -------------------------------------------------

Organic growth An alternative performance measure

which presents performance on a comparable

basis, both in terms of merger and

acquisition activity and movements

in foreign exchange rates. See "Alternative

performance measures" on page 10 for

further details.

--------------------- -------------------------------------------------

Other revenue Other revenue includes revenue from

connection fees and equipment sales.

--------------------- -------------------------------------------------

Reported growth Reported growth is based on amounts

reported in euros as determined under

IFRS.

--------------------- -------------------------------------------------

Service revenue Service revenue comprises all revenue

related to the provision of ongoing

services including, but not limited

to, monthly access charges, airtime

usage, roaming, incoming and outgoing

network usage by non-Vodafone customers

and interconnect charges for incoming

calls. See "Alternative performance

measures" on page 10 for further details.

--------------------- -------------------------------------------------

VGE Vodafone Global Enterprise (VGE),

which serves the Group's biggest multi-national

customers.

--------------------- -------------------------------------------------

Internet of The network of physical objects embedded

Things ('IoT') with electronics, software, sensors,

(formerly and network connectivity, including

Machine-to-Machine built-in mobile SIM cards, that enables

('M2M')) these objects to collect data and

exchange communications with one another

or a database.

--------------------- -------------------------------------------------

For definition of other terms please refer to pages 200 to 201

of the Group's Annual Report for the year ended 31 March 2016.

Forward-looking statements

This report contains "forward-looking statements" within the

meaning of the US Private Securities Litigation Reform Act of 1995

with respect to the Group's financial condition, results of

operations and businesses and certain of the Group's plans and

objectives.

In particular, such forward-looking statements include, but are

not limited to: expectations regarding the Group's financial

condition or results of operations including the confirmation of

the Group's guidance for the 2017 financial year, expectations for

the Group's future performance generally; statements relating to

the Group's Project Spring investment programme; expectations

regarding the operating environment and market conditions and

trends; intentions and expectations regarding the development,

launch and expansion of products, services and technologies; growth

in customers and usage; expectations regarding spectrum licence

acquisitions; expectations regarding EBITDA, capital expenditure,

free cash flow, and foreign exchange rate movements; and

expectations regarding the integration or performance of current

and future investments, associates, joint ventures, non-controlled

interests and newly acquired businesses.

Forward-looking statements are sometimes, but not always,

identified by their use of a date in the future or such words as

"will", "anticipates", "aims", "could", "may", "should", "expects",

"believes", "intends", "plans" or "targets" (including in their

negative form). By their nature, forward-looking statements are

inherently predictive, speculative and involve risk and uncertainty

because they relate to events and depend on circumstances that may

or may not occur in the future. There are a number of factors that

could cause actual results and developments to differ materially

from those expressed or implied by these forward-looking

statements. These factors include, but are not limited to, the

following: changes in economic or political conditions in markets

served by operations of the Group; greater than anticipated

competitive activity; higher than expected costs or capital

expenditures; slower than expected customer growth and reduced

customer retention; changes in the spending patterns of new and

existing customers; the Group's ability to expand its spectrum

position or renew or obtain necessary licences; the Group's ability

to achieve cost savings; the Group's ability to execute its

strategy in fibre deployment, network expansion, new product and

service roll-outs, mobile data, Enterprise and broadband and in

emerging markets; changes in foreign exchange rates, as well as

changes in interest rates; the Group's ability to realise benefits

from entering into partnerships or joint ventures and entering into

service franchising and brand licensing; unfavourable consequences

to the Group of making and integrating acquisitions or disposals;

changes to the regulatory framework in which the Group operates;

the impact of legal or other proceedings; loss of suppliers or

disruption of supply chains; developments in the Group's financial

condition, earnings and distributable funds and other factors that

the Board takes into account when determining levels of dividends;

the Group's ability to satisfy working capital and other

requirements; changes in statutory tax rates or profit mix; and/or

changes in tax legislation or final resolution of open tax

issues.

Furthermore, a review of the reasons why actual results and

developments may differ materially from the expectations disclosed

or implied within forward-looking statements can be found under

"Forward-looking statements" and "Risk management" in the Group's

Annual Report for the year ended 31 March 2016. The Annual Report

can be found on the Group's website (vodafone.com/investor). All

subsequent written or oral forward-looking statements attributable

to the Company, to any member of the Group or to any persons acting

on their behalf are expressly qualified in their entirety by the

factors referred to above. No assurances can be given that the

forward-looking statements in this document will be realised.

Subject to compliance with applicable law and regulations, Vodafone

does not intend to update these forward-looking statements and does

not undertake any obligation to do so.

For further information:

Vodafone Group Plc

Investor Relations Media Relations

Telephone: +44 7919 990 www.vodafone.com/media/contact

230

Copyright (c) Vodafone Group 2016

- ends -

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCDMGZNRMZGVZM

(END) Dow Jones Newswires

July 22, 2016 02:00 ET (06:00 GMT)

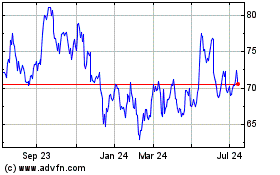

Vodafone (LSE:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

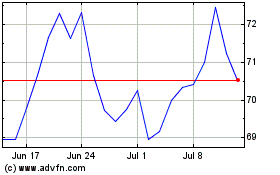

Vodafone (LSE:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024