TIDMVOD

RNS Number : 6066G

Vodafone Group Plc

07 June 2013

7 June 2013

Vodafone Group Plc ("Vodafone" or the "Company")

2013 Annual Report

2013 Notice of Annual General Meeting

In accordance with Listing Rule 9.6.1, Vodafone has uploaded a

copy of each of the above documents to the National Storage

Mechanism.

The 2013 Annual Report is available at vodafone.com/ar2013 and

the 2013 Notice of Annual General Meeting is available at

vodafone.com/agm.

A condensed set of Vodafone's financial statements and

information on important events that have occurred during the

financial year ended 31 March 2013 and their impact on the

financial statements were included in Vodafone's preliminary

results announcement released on 21 May 2013. That information,

together with the information set out below, which is extracted

from the 2013 Annual Report, constitute the material required by

Disclosure and Transparency Rule 6.3.5 which is required to be

communicated to the media in full unedited text through a

Regulatory Information Service. This announcement is not a

substitute for reading the full 2013 Annual Report. Page and note

references in the text below refer to page numbers in the 2013

Annual Report and notes to the financial statements.

PRINCIPAL RISK FACTORS AND UNCERTAINTIES

1. Our business could be adversely affected by a failureor

significant interruption to our telecommunications networks or IT

systems.

We are dependent on the continued operation of

telecommunications networks. As the importance of mobile and fixed

communication in everyday life increases, as well as during times

of crisis, organisations and individuals look to us to maintain

service. Major failures in the network or our IT systems may result

in service being interrupted resulting in serious damage to our

reputation and consequential customer and revenue loss.

There is a risk that an attack on our infrastructure by a

malicious individual or group could be successful and impact the

availability of critical systems. Our network is also susceptible

to interruption due to a physical attack and theft of our network

components as the value and market for network components increases

(for example copper, batteries, generators and fuel).

2. We could suffer loss of consumer confidence and/or

legalaction due to a failure to protect our customer

information.

Mobile networks carry and store large volumes of

confidentialpersonal and business voice traffic and data. We host

increasingquantities and types of customer data in both enterprise

and consumer segments. We need to ensure our service environments

are sufficiently secure to protect us from loss or corruption of

customer information. Failure to protect adequately customer

information could have a material adverse effect on our reputation

and may lead to legal action against the Group.

3. Increased competition may reduce our market share and

profitability.

We face intensifying competition where all operators are looking

to secure a share of the potential customer base. Competition could

lead to a reduction in the rate at which we add new customers, a

decrease in the size of our market share and a decline in our

average revenue per customer, if customers choose to receive

telecommunications services or other competing services from

alternate providers. Competition can also lead to an increase in

customer acquisition and retention costs. The focus of competition

in many of our markets has shifted from acquiring new customers to

retaining existing customers, as the market for mobile

telecommunications has become increasingly mature.

4. Regulatory decisions and changes in the regulatoryenvironment

could adversely affect our business.

We have ventures in both emerging and mature markets, spanninga

broad geographical area including Europe, Africa, Middle East, Asia

Pacific and the US. We need to comply with an extensive range of

requirements that regulate and supervise the licensing,

construction and operation of our telecommunications networks and

services. Pressure on political and regulatory institutions both to

deliver direct consumer benefit and protect consumers' interests,

particularly in recessionary periods, can lead to adverse impacts

on our business. Financial pressureson smaller competitors can

drive them to call for regulators to protect them. Increased

financial pressures on governments may lead them to target foreign

investors for further taxes or licence fees.

5. Our existing service offerings could become disadvantaged as

compared to those offered by converged competitors or other

technology providers.

In a number of markets we face competition from providers

whohave the ability to sell converged services (combinations of

fixed line, broadband, public Wi-Fi, TV and mobile) on their

existing infrastructure which we cannot either replicate or provide

at a similar price point. Additionally, the combination of services

may allow competitors to subsidise the mobile component of their

offering. This could lead to an erosion of our customer base and

reduce the demand for our core services and impact our future

profitability.

Advances in smartphone technology places more focus on

applications, operating systems, and devices rather than the

underlying services provided by mobile operators. The development

of applications which make use of the internet as a substitute for

some of our more traditional services, such as messaging and voice,

could erode revenue. Reduced demand for our core services of voice,

messaging and data and the development of services by application

developers, operating system providers, and handset suppliers could

significantly impact our future profitability.

6. Severely deteriorating economic conditions could impact one

or more of our markets.

Economic conditions in many of the markets where we

operate,especially in Europe, continue to deteriorate or stagnate.

Theseconditions, combined with the impact of austerity measures,

resultin lower levels of disposable income and may result in

significantly lower revenue as customers give up their mobile

devices or move to cheaper tariffs.

There is also a possibility of one or more countries exiting the

eurozone, causing currency devaluation in certain countries and

possibly leading to a reduction in our revenue and impairment of

our financial and non-financial assets. This may also lead to

further adverse economic impacts elsewhere.

7. Our business may be impacted by actual or perceived health

risks associated with the transmission of radio waves from mobile

telephones, transmitters and associated equipment.

Concerns have been expressed that the electromagnetic

signalsemitted by mobile telephone handsets and base stations may

pose health risks. We are not aware that such health risks have

been substantiated, however, in the event of a major scientific

finding supporting this view this might result in prohibitive

legislation being introduced by governments (or the European

Union), a major reduction in mobile phone usage (especially by

children), a requirement to move base station sites, significant

difficulty renewing or acquiring site leases, and/or major

litigation. An inadequate response to electromagnetic fields

('EMF') issues may result in loss of confidence in the industry and

Vodafone.

8. Failure to deliver enterprise service offerings may adversely

affect our business.

By expanding our enterprise service offerings through thegrowth

of Vodafone Global Enterprise, the acquisitions of CWW

andTelstraClear, and the establishment of cloud, hosting and

international carrier services, the Group increasingly provides

fixed and mobile communication services to organisations that may

provide vital national services. These organisations rely on our

networks and systems 24 hours a day, 365 days a year to deliver

their products and services to their customers. A failure to build

and maintain our infrastructure to the required levels of

resilience for enterprise customers and to deliver to our

contracted service level agreements may result in a costly business

impact and cause serious damage to our reputation.

9. We depend on a number of key suppliers to operate our

business.

We depend on a limited number of suppliers for

strategicallyimportant network and IT infrastructure and associated

supportservices to operate and upgrade our networks and provide key

services to our customers. Our operations could be adversely

impacted by the failure of a key supplier who could no longer

support our existing infrastructure, by a key supplier commercially

exploiting their position in a product area following the corporate

failures of/the withdrawal from a specific market by competitors,

or by major suppliers significantly increasing prices on long-term

programmes where the cost or technical feasibility of switching

supplier becomes a significant barrier.

10. We may not satisfactorily resolve major tax disputes.

We operate in many jurisdictions around the world and from time

to time have disputes on the amount of tax due. In particular, in

spite of the positive India Supreme Court decision relating to an

ongoing tax case in India, the Indian government has introduced

retrospective tax legislation which would in effect overturn the

court's decision and has raised challenges around the pricing of

capital transactions.Such or similar types of action in other

jurisdictions, including changes in local or international tax

rules or new challenges by tax authorities, may expose us to

significant additional tax liabilities which would affect the

results of the business.

11. Changes in assumptions underlying the carrying value of

certain Group assets could result in impairment.

Due to the substantial carrying value of goodwill

underInternational Financial Reporting Standards, revisions to

theassumptions used in assessing its recoverability, including

discount rates, estimated future cash flows or anticipated changes

in operations, could lead to the impairment of certain Group

assets. While impairment does not impact reported cash flows, it

does result in a non-cash charge in the consolidated income

statement and thus no assurance can be given that any future

impairments would not affect our reported distributable reserves

and, therefore, our ability to make dividend distributions to our

shareholders or repurchase our shares.

RELATED PARTY TRANSACTIONS

The Group has a number of related parties including joint

ventures (refer to note 14), associates (refer to note 15), pension

schemes (refer to note A5 for the Group's contributions), directors

and Executive Committee members(refer to note 4 for amounts paid to

them).

Transactions with joint ventures and associates

Related party transactions with the Group's joint ventures and

associates primarily comprise fees for the use of products and

services including network airtime and access charges, and cash

pooling arrangements.

No related party transactions have been entered into during the

year which might reasonably affect any decisions made by the users

of these consolidated financial statements except as disclosed

below. Transactions between the Company and its joint ventures are

not material to the extent that they have not been eliminated

through proportionate consolidation or disclosed below.

2013 2012 2011

GBPm GBPm GBPm

------------------------------------------------- ------ ------ ------

Sales of goods and services to associates 241 195 327

Purchase of goods and services from associates 105 107 171

Purchase of goods and services from joint

ventures 329 207 206

Net interest receivable from joint ventures(1) (14) (7) (14)

------------------------------------------------- ------ ------ ------

Trade balances owed:

by associates 21 15 52

to associates 19 18 23

by joint ventures 119 9 27

to joint ventures 27 89 67

Other balances owed by joint ventures(1) 337 365 176

------------------------------------------------- ------ ------ ------

Note:

1 Amounts arise primarily through Vodafone Italy, Vodafone

Hutchison Australia, Indus Towers and Cornerstone, and represent

amounts not eliminated on consolidation. Interest is paid in line

with market rates.

Amounts owed by and owed to associates are disclosed within

notes 17 and 18. Dividends received from associates are disclosed

in the consolidated statement of cash flows.

Transactions with directors other than compensation

During the three years ended 31 March 2013, and as of 20 May

2013, neither any director nor any other executive officer, nor any

associate of any director or any other executive officer, was

indebted to the Company.

During the three years ended 31 March 2013, and as of 20 May

2013, the Company has not been a party to any other material

transaction, or proposed transactions, in which any member of the

key management personnel (including directors, any other executive

officer, senior manager, any spouse or relative of any of the

foregoing or any relative of such spouse) had or was to have a

direct or indirect material interest.

DIRECTORS' RESPONSIBILITY STATEMENT

As set out above, this statement is repeated here solely for the

purposes of complying with Disclosure and Transparency Rule 6.3.5.

This statement relates to and is extracted from the 2013 Annual

Report. It is not connected to the extracted information presented

in this announcement or the preliminary results announcement

released on 21 May 2013.

"The Board confirms to the best of its knowledge:

-- the consolidated financial statements, prepared in accordance

with IFRS as issued by the IASB and IFRS as adopted by the EU, give

a true and fair view of the assets, liabilities, financial position

and profit or loss of the Group; and

-- the directors' report includes a fair review of the

development and performance of the business and the position of the

Group together with a description of the principal risks and

uncertainties that it faces.

The directors are responsible for preparing the annual report in

accordance with applicable law and regulations. Having taken advice

from the Audit and Risk Committee, the Board considers the report

and accounts, taken as a whole, as fair, balanced and

understandable and that it provides the information necessary for

shareholders to assess the Company's performance, business model

and strategy.

Neither the Company nor the directors accept any liability to

any person in relation to the annual report except to the extent

that such liability could arise under English law. Accordingly, any

liability to a person who has demonstrated reliance on any untrue

or misleading statement or omission shall be determined in

accordance with section 90A and schedule 10A of the Financial

Services and Markets Act 2000.

By Order of the Board

Rosemary Martin

Company Secretary

21 May 2013"

This document contains "forward-looking statements" within the

meaning of the US Private Securities Litigation Reform Act of 1995

with respect to the Group's financial condition, results of

operations and businesses and certain of the Group's plans and

objectives. Forward-looking statements are sometimes, but not

always, identified by their use of a date in the future or such

words as "will", "anticipates", "aims", "could", "may", "should",

"expects", "believes", "intends", "plans" or "targets". By their

nature, forward-looking statements are inherently predictive,

speculative and involve risk and uncertainty because they relate to

events and depend on circumstances that will occur in the future.

There are a number of factors that could cause actual results and

developments to differ materially from those expressed or implied

by these forward-looking statements. A review of the reasons why

actual results and developments may differ materially from the

expectations disclosed or implied within forward-looking statements

can be found under "Forward-looking statements" on pages 185 and

186 of the 2013 Annual Report. All subsequent written or oral

forward-looking statements attributable to the Company or any

member of the Group or any persons acting on their behalf are

expressly qualified in their entirety by the factors referred to

above. No assurances can be given that the forward-looking

statements in this document will be realised. Subject to compliance

with applicable law and regulations, Vodafone does not intend to

update these forward-looking statements and does not undertake any

obligation to do so.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACSUBUVROKANRAR

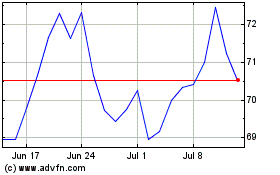

Vodafone (LSE:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

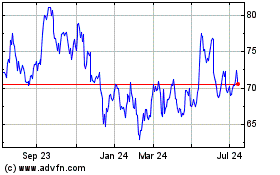

Vodafone (LSE:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024