Vodafone Bond Issue Raises GBP600 Million, More than Planned

November 19 2015 - 10:04AM

Dow Jones News

By Ian Walker

LONDON--Vodafone Group PLC (VOD.LN) has raised 600 million

pounds ($912.58 million) of new debt, which it will use for general

company purposes and to buy cash-settled call options, GBP100

million more than originally planned.

Earlier Thursday the Newbury, England based firm, announced a

plan to raise GBP500 million through the issue of equity-linked

bonds due 2020, and buy cash-settled call options to hedge its

equity exposure.

The bonds will be issued at par and the coupon has been fixed at

zero.

Morgan Stanley & Co. Intl. acted as sole global coordinator

for the offering and together with HSBC Bank as joint

bookrunner.

Write to Ian Walker at ian.walker@wsj.com; @IanWalk40289749

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 19, 2015 09:49 ET (14:49 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

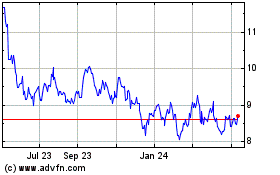

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

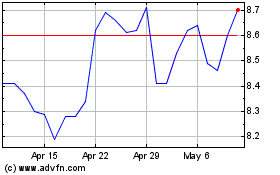

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024