Vivo Energy Bets on Africa With $3 Billion IPO--Update

October 18 2017 - 10:40AM

Dow Jones News

By Ben Dummett

LONDON--Vivo Energy Investments B.V., a major licensee of Royal

Dutch Shell PLC's fuels and lubricants in Africa, is eyeing an

initial public that could value the company at more than $3

billion, according to people familiar with the matter.

The planned offering represents a bet that Africa's improving

economic growth prospects in part due to a rebound in commodity

prices and a growing middle class in parts of the continent will

help drive retail and consumer fuel demand.

Based in the Netherlands, Vivo distributes and markets

Shell-branded products across 16 African countries, including

lubricants and liquefied petroleum gas to customers in the

aviation, marine and mining industries. It also operates a network

of more than 1,780 fuel stations across the continent under the

Shell banner.

Africa's economy is expected to generate real economic growth of

3.7% in 2018, according to estimates from the International

Monetary Fund. In some of the countries where Vivo operates such as

Mali, Burkina Faso and Ghana economic growth next year is expected

to range between 5% and 8.9%, depending on the specific country,

according to the IMF.

Vivo is working with a group of global investment banks as

underwriters for the offering and is looking at the London Stock

Exchange for a listing, according to some of the people familiar

with the matter. Details about the issue's potential size couldn't

be learned, but it would likely value the entire company at more

than $3 billion, according to people familiar with the effort.

Vivo was created in 2011 after Shell sold the majority of its

downstream operations in 14 African markets for $1 billion to Vitol

S.A and Helios Investment Partners, a private-equity firm focused

on Africa. At that time, Shell retained a 20% stake but earlier

this year the company sold it to Vitol and Helios for $250

million.

A successful IPO by Vivo could spur other commodities traders

such as Trafigura Group Pte. Ltd. to take similar action.

Trafigura, along with Angola's Sonangol Holdings LDA, own Puma

Energy, a midstream and downstream energy company.

Vivo's planned offering comes amid a surge in IPOs in Europe as

companies and their owners seek to take advantage of strong equity

markets to raise new capital to fund growth plans and to reap some

of the profit from their holding.

In the third quarter, proceeds from European IPOs more than

doubled to EUR8.2 billion ($9.64 billion) from EUR3.8 billion in

the same period last year, according to PricewaterhouseCoopers

International Ltd., with the London Stock Exchange drawing the most

activity with 36% of all European IPOs. That share compares with

17% in the year-ago quarter that suffered from an uncertain market

climate following U.K.'s vote to split from the European Union.

The LSE, which is competing with the New York Stock Exchange for

a possible international listing of Saudi Arabian Oil Co. and its

massive IPO, is also benefiting from an influx of cross border IPOs

this year. Those include the $879 million IPO of Russian gold

producer Polyus PJSC in July and the listing earlier in the year of

Dubia-based ADES International Holding, a provider of onshore

energy drilling and production services company in the Middle East

and Africa, PwC notes.

Sarah Kent contributed to this article.

Write to Ben Dummett at ben.dummett@wsj.com

(END) Dow Jones Newswires

October 18, 2017 10:25 ET (14:25 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

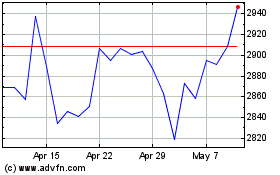

Shell (LSE:SHEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

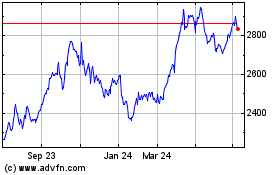

Shell (LSE:SHEL)

Historical Stock Chart

From Apr 2023 to Apr 2024