TIDMVOF

RNS Number : 8655I

VinaCapital Vietnam Opp. Fund Ld

30 March 2015

30 March 2015

VinaCapital Vietnam Opportunity Fund Limited

Interim results for the six months ended 31 December 2014

VinaCapital Vietnam Opportunity Fund Limited (the "Company" or

"VOF"), an investment company focused on Vietnam, today announces

its interim results for the six months ended 31 December 2014 ("the

Period").

Financial highlights:

-- Net Asset Value ("NAV") of USD742.3 million (30 June 2014, restated: USD771.4 million)

-- NAV per share of USD3.27 (30 June 2014, restated: USD3.24).

Operational highlights:

-- As at 31 December 2014, the Company has spent a total of

USD197.1 million overall repurchasing 97.9 million shares,

representing 30.2% of total shares in issue.

-- Shareholders supported the recommendations by members of the

Board regarding all six resolutions which were put to a vote at the

Company's Annual General Meeting (AGM) held on 26 November 2014 in

Singapore.

Notes to Editors:

VinaCapital is the leading investment management and real estate

development firm in Vietnam, with a diversified portfolio of USD1.5

billion in assets under management. VinaCapital was founded in 2003

and boasts a team of managing directors who bring extensive

international finance and investment experience to the firm. Our

mission is to produce superior returns for investors by using our

experience and knowledge to identify the key trends and

opportunities that emerge as Vietnam continues to develop its

economy. To achieve this, VinaCapital has industry-leading asset

class teams covering capital markets, private equity, fixed income,

venture capital, real estate and infrastructure.

VinaCapital manages three closed-end funds trading on the AIM

Market of the London Stock Exchange. These funds are: VinaCapital

Vietnam Opportunity Fund Limited (VOF), VinaLand Limited (VNL), and

Vietnam Infrastructure Limited (VNI). VinaCapital also co-manages

the USD32 million DFJ VinaCapital L.P. technology venture capital

fund with Draper Fisher Jurvetson.

VinaCapital has offices in Ho Chi Minh City, Hanoi, Danang, Nha

Trang, Singapore and Yangon. More information about VinaCapital is

available at www.vinacapital.com.

More information on the Company is available at

www.vinacapital.com/vof.

Enquiries:

David Dropsey

VinaCapital Investment Management Limited

Investor Relations/Communications

+84 8 3821 9930

david.dropsey@vinacapital.com

Philip Secrett

Grant Thornton UK LLP, Nominated Adviser

+44 (0)20 7383 5100

philip.j.secrett@uk.gt.com

Hiroshi Funaki / Andrew Davies

Edmond de Rothschild Securities, Broker

+44 (0)20 7845 5960

funds@lcfr.co.uk

David Benda / Hugh Jonathan

Numis Securities Limited, Broker

+44 (0)20 7260 1000

funds@numis.com

Andrew Walton

FTI Consulting, Public Relations (London)

+44 (0)20 7269 7204

andrew.walton@fticonsulting.com

VOF Chairman's Statement - interim FY 2015

Investment Performance

During the first six months of the 2015 Fiscal Year, which

covers the period from 1 July 2014 to 31 December 2014, the net

asset value (NAV) per share of Vinacapital Vietnam Opportunity Fund

("VOF" or the "Company") rose by 0.9%, which compares with a

decline of 6.0% in the Vietnamese Index in US Dollar terms. This

return combines contributions from the components which make up

VOF's portfolio, and the most important of these are set out

below:

Listed Stocks: +1.1% (58% of assets, including our holdings in

VinaLand Ltd, Vietnam Infrastructure Ltd and OTC stocks)

Real Estate: -1.5% (16% of assets)

Private Equity: +2.7% (8% of assets)

Hospitality: +0.4% (9% of assets)

Balance of assets: 9%, held in cash or equivalent

There was also an accretion to NAV of 0.9% from the effect of

the share buybacks conducted during the period, which amounted to a

value of $30.6 million.

The results achieved in the listed part of the portfolio are

very good compared to the equity benchmark and reflect an

underweight position in the Oil & Gas sector, which fell

sharply during the fourth calendar quarter of 2014. Within the peer

group, the performance was in the middle of the pack, with the

biggest determinant of the pecking order being the sector

weighting. It is worth noting that for large funds, it is in effect

impossible to achieve an index weight in this industry because the

largest stock, PetroVietnam Gas, represents nearly 14% of the index

but has a free float of only 3% of its equity, the balance being

owned by the State.

The returns in other parts of the portfolio reflect small

changes in directors' valuation of the assets. Two real estate

projects were written down modestly, while a provision against one

of the private equity holdings was written back after it was

recovered.

There were two transactions of note during the period. The first

was the sale of our 23.6% holding of An Giang Plant Protection

(AGPP) to Standard Chartered Private Equity in Singapore for $63.1

million. This investment was originally purchased five years ago

and the sale represents an IRR of 23.7% per annum over the holding

period. It is encouraging that foreign investors continue to see

attractive opportunities in the country and that the original

investment rationale of taking a large stake in an illiquid asset

has borne fruit for shareholders.

The second was a new $34.5 million private equity investment for

56% of one of Vietnam's largest dairy businesses, International

Dairy Products (IDP) in conjunction with Japanese private equity

investor Daiwa. IDP is a significant business, generating around

$80 million of sales annually from the yoghurt, milk and

nutritional products markets. New management has been brought in

and the objective is to inject fresh impetus into the marketing

strategy.

The Manager also reduced the holding in Vinamilk, which has for

a long time been VOF's largest position, in order to realise some

profits. Shares to the value of $21 million were sold at a premium

to the market price, reflecting the scarcity of stock available to

overseas portfolio investors because of the limits on foreign

ownership. The position in Vinamilk is still the largest in our

listed portfolio, representing 10% of VOF's assets. The holding in

Kinh Do Corporation, a bakery and confectionery business, was

realized for proceeds of $32 million on the basis that the Manager

believed that the company was fully valued.

VOF's strategy has been to reduce its holdings in direct real

estate while increasing holdings in so called equitisation

opportunities, which come about as a result of the privatization

process. As far as real estate goes, the market remains quite

subdued and it is disappointing that there have been no significant

disposals during the period. Negotiations are ongoing for the sale

of a number of projects, but progress is slow and intermittent. The

Board remains hopeful that significant disposals will be made over

the course of 2015.

The proportion of assets invested in OTC stocks has fallen (from

9% to 3%) because of the sale of AGPP but the Manager's intention

is to add new positions as and when attractive opportunities become

available. The Vietnamese government has ambitions to privatize a

huge slate of companies, but these are often small, low quality

businesses which do not fit with VOF's investment strategy. A

handful of interesting opportunities are expected to become

available over the next few months but, as with everything which

involves bureaucracy, the timing is very uncertain.

In private equity, the pipeline has a number of interesting

opportunities in media, agriculture and education; and the Manager

is optimistic that another significant investment can be made this

year. In the meantime, exit opportunities for existing positions

are being actively sought.

Share Price

The discount to net asset value remains a persistent problem and

currently sits at around 22%. We have continued to buy back shares,

notching up close to $200 million since we began the programme. In

previous statements we have speculated as to the cause of the

problem, but the evidence is that it cannot be solved by simply

buying stock back. A more complete approach is needed. In practice,

there are four levers the Board can pull:

1. We can define the Company's strategy clearly so that any

unwarranted discount from investor uncertainty disappears. One of

the proximate causes of the discount is almost certainly the

holding in direct real estate. Property assets in Vietnam typically

trade at significant discounts to their net asset values, no doubt

because investors question those values in the absence of an active

and transparent market. We have been very clear that it is our

intention to reduce our exposure to this area and I reiterate that

commitment here. It is worth noting that the limited number of

transactions which have taken place are clearing at prices close to

the directors' valuation levels;

2. We can attempt to influence the demand for shares. This

involves communicating the 'story' to as wide an audience as

possible, ensuring that the listing of the Company is in the best

possible market, its governance is good and that information is

clear, transparent and easily available. The manager is spending

more time and effort on seeking new shareholders and increasing the

demand for the shares. As mentioned in the annual report, the Board

is still considering the benefits of applying for a premium listing

on the Main Market of the London Stock Exchange and it will alter

its corporate structure and governance to comply with best

practice. This is a project for the second half of the year.

3. We can influence the supply of stock. The primary vector

through which we attempt this is by buying stock back, but it is

also possible to achieve the same goal through other means. For the

time being we are persisting with the buyback programme, but other

mechanisms are under constant review.

4. We can offer shareholders some form of restructuring of the

Company. This is a potentially radical solution and is likely to be

both expensive and divisive of the shareholder base. Nevertheless,

if the Board felt that it was in the Company's best interests to

consider such an option, it would do so.

For now, we are using the first three levers and expect these

initiatives to increase demand for the shares and to yield results

over time. In particular, we had hoped to be moving more quickly on

proposals to list the shares on the Main Market in London but we

have been delayed by the regulatory requirement to issue full year

accounts to a new accounting standard as described below.

Changes to Accounting Standards

As noted in the last Annual Report and Accounts, the recent

amendments to International Financial Reporting Standards

introduced in IFRS10A the concept of investment entities. By

adopting IFRS10A from the date of this Interim Report, the Company

is now exempt from the requirement to consolidate investments where

it has a controlling stake and all of our investments are recorded

at fair value through profit or loss. This change requires the

restatement of the accounts as at 30 June 2014. The NAV per share

reported in this Interim Statement of $3.27 compares with a

restated NAV of $3.24 as at 30 June 2014. The latter figure

represents a $0.03 reduction compared with the number stated in our

last annual report, reflecting the consequences of the application

of the new standard. In the notes to this Interim Report we set out

some quite complex reconciliations of the accounts to 30 June 2014

as previously published and the same accounts under the new IFRS

requirements. The restatement in itself is complex, but the

resulting accounts are more appropriate to the nature of VOF as a

fund. However, there are some aspects of IFRS10A which are

potentially confusing. In particular:

- All assets, including cash, are classified as Level 3, a

classification normally reserved for private equity investments,

because they are held via subsidiaries. In note 22b we have

recategorised these assets on a look-through basis;

- Cash, as it appears on the balance sheet, is not

representative of the total cash held by the Company because of the

Level 3 classification described above. As at 31 December 2014, net

cash held was approximately 9% of assets; and

- The classification of assets as either current or non-current

would have been confusing under IFRS10A, so we have opted to

present the balance sheet in order of liquidity as opposed to using

the current and non-current classifications.

Aside from these points, the accounts should be more easy to

read than hitherto.

Outlook

Since the end of the year, the Vietnamese market has risen and

is ahead of the general emerging market benchmarks which continue

to struggle in this era of US Dollar strength. Vietnam itself has

seen inflation fall substantially while GDP growth marginally

exceeded expectations in the last year. The effect of the dramatic

swing in oil prices is minimal, as Vietnam is both a producer and

an importer of oil. The country continues to attract increasing

levels of foreign direct investment; this was estimated at $12.4

billion in 2014, a 7% increase over the previous year. Much of this

investment is in manufacturing and a $2 billion trade surplus was

achieved in 2014. It is well known that economic growth does not

necessarily correlate with stock market returns but given a market

which does not look as overvalued as some, and some foreign

investor interest, the prospects for the year ahead are reasonably

positive.

CONDENSED INTERIM BALANCE SHEET

31 December

2014 30 June 2014

Note USD'000 USD'000

Unaudited Restated

ASSETS

Cash and cash equivalents 7 940 1,311

Short-term receivables from a related

party 20 197 331

Trade and other receivables - 100

Financial assets at fair value through

profit or loss 9 744,508 773,653

Prepayments for acquisitions of

investment properties 10 6,250 6,250

------------ ------------

Total assets 751,895 781,645

EQUITY AND LIABILITIES

EQUITY

Share capital 11 3,246 3,246

Additional paid-in capital 722,064 722,064

Treasury shares 12 (196,531) (165,939)

Retained earnings 213,471 212,009

------------ ------------

742,250 771,380

Total equity ------------ ------------

LIABILITIES

Other payables 22 19

Payables to related parties 13 9,623 10,246

------------ ------------

9,645 10,265

Total liabilities ------------ ------------

Total equity and liabilities 751,895 781,645

Net asset value, USD per share 17(c) 3.27 3.24

CONDENSED INTERIM STATEMENT OF CHANGES IN EQUITY

Share Additional Treasury Retained Total

capital paid-in capital shares earnings equity

USD'000 USD'000 USD'000 USD'000 USD'000

Balance at 1 July 2013

(restated) 3,246 722,064 (113,639) 123,026 734,697

Profit for the six-month

period to

31 December 2013 (restated) - - - 34,357 34,357

---------- -------------- -------------- ------------ ------------

Total comprehensive

income (restated) - - - 34,357 34,357

Transactions with owners

Shares repurchased - - (28,560) - (28,560)

---------- -------------- -------------- -------------- --------------

Balance at 31 December

2013 (restated) 3,246 722,064 (142,199) 157,383 740,494

Balance at 1 July 2014

(restated) 3,246 722,064 (165,939) 212,009 771,380

Profit for the six-month

period to

31 December 2014 - - - 1,462 1,462

Total comprehensive ---------- -------------- -------------- ------------ ------------

income - - - 1,462 1,462

Transactions with owners

Shares repurchased - - (30,592) - (30,592)

Balance at 31 December ---------- -------------- -------------- -------------- --------------

2014 3,246 722,064 (196,531) 213,471 742,250

CONDENSED INTERIM STATEMENT OF COMPREHENSIVE INCOME

Six months ended

--------------------------

31 December 31 December

2014 2013

Note USD'000 USD'000

Unaudited Restated

Net gain on financial assets at fair

value through profit or loss 14 17,096 40,706

General and administration expenses 15 (15,634) (6,499)

Other income - 150

---------- ----------

1,462 34,357

Operating profit ---------- ----------

Profit before tax 1,462 34,357

Corporate income tax 16 - -

---------- ----------

Profit for the period 1,462 34,357

Earnings per share

* basic and diluted (USD per share) 17(a),(b) 0.01 0.14

---------- ----------

Total comprehensive income for the period 1,462 34,357

CONDENSED INTERIM STATEMENT OF CASH FLOWS

Six months ended

--------------------------

31 December 31 December

2014 2013

USD'000 USD'000

Unaudited Restated

Operating activities

Profit before tax 1,462 34,357

Adjustment for:

Unrealised gain on financial assets at

fair value through profit or loss (16,982) (40,706)

---------- ----------

(15,520) (6,349)

Change in financial assets at fair value

through profit or loss 15,535 14,808

Change in trade receivables and other

assets 234 2,428

Change in trade payables and other liabilities (620) (8,099)

---------- --------

Net cash (outflow)/inflow from operating (371) 2,788

activities ---------- --------

Net change in cash and cash equivalents

for the period (371) 2,788

Cash and cash equivalents at the beginning

of the period 1,311 4,502

Cash and cash equivalents at the end ---------- ----------

of the period 940 7,290

The condensed interim statement of cash flow does not include

payments made for share repurchases of USD30.6 million (period

ended 31 December 2013: USD28.6 million) because these payments

were made by a subsidiary.

NOTES TO THE CONDENSED INTERIM FINANCIAL STATEMENTS

1 GENERAL INFORMATION

VinaCapital Vietnam Opportunity Fund Limited ("the Company") is

a limited liability company incorporated in the Cayman Islands. The

registered office of the Company is PO Box 309GT, Ugland House,

South Church Street, George Town, Grand Cayman, Cayman Islands. The

Company's primary objective is to undertake various forms of

investment primarily in Vietnam, but it may also invest in

Cambodia, Laos and Southern China. The Company is quoted on the AIM

market of the London Stock Exchange under the ticker symbol

VOF.

The Company does not have a fixed life but the Company's

Admission Document to the AIM market of the London Stock Exchange

states that the Board considers it desirable that shareholders

should have the opportunity to review the future of the Company at

appropriate intervals. Accordingly, the Board intends that a

special resolution will be proposed every fifth year that the

Company ceases to continue as presently constituted. If the

resolution is not passed, the Company will continue to operate. If

the resolution is passed, the Directors will be required to

formulate proposals to be put to shareholders to reorganise,

unitise or reconstruct the Company or for the Company to be wound

up. The Board tabled such a special resolution on 22 July 2013 and

it was not passed, allowing the Company to continue as presently

constituted for another five years.

The condensed interim financial statements for the six-month

period ended 31 December 2014 were approved for issue by the Board

on 30 March 2015.

2 BASIS OF PREPARATION

These condensed interim financial statements for the six-month

period ended 31 December 2014 have been prepared in accordance with

International Accounting Standard 34, "Interim Financial Reporting"

as issued by the International Accounting Standards Board ("IASB").

They do not include all of the information required in the annual

financial statements which are prepared in accordance with

International Financial Reporting Standards ("IFRS"). Accordingly,

these financial statements are to be read in conjunction with the

annual consolidated financial statements of the Company and its

subsidiaries for the year ended 30 June 2014.

3 ACCOUNTING POLICIES

The accounting policies adopted are consistent with those of the

previous financial year except as described below:

-- The Company has adopted the "Investment Entities" amendments

to IFRS 10, "Consolidated financial statements". The amendments

define an investment entity and introduce an exception from the

consolidation requirements for investment entities. On adoption,

the Company has determined that it meets the definition of an

investment entity (see Note 4.1 below). As a result, it has changed

its accounting policy with respect to its investments in

subsidiaries. The Company's subsidiaries, which were previously

consolidated, are now accounted for at fair value through profit or

loss. This change in accounting policy has been applied

retrospectively in accordance with the transition provision of IFRS

10 and the amendments to IFRS 10. The impact of the change has been

disclosed in Note 3.2 below.

-- The Company has adopted amendments to IFRS 12, "Disclosure of

interests in other entities", which introduce new disclosure

requirements related to investment entities. Required disclosures

are presented in Note 6.

-- IAS 27 (revised 2011), "Separate financial statements" and

amendments to IAS 27 have been adopted by the Company. The standard

prescribes the accounting and disclosure requirements when an

entity prepares separate financial statements. The amendments

require an investment entity as defined in IFRS 10 to present

separate financial statements as its only financial statements in

the case where it measures all of its subsidiaries at fair value

through profit or loss and to disclose that fact.

-- The Company has opted to value all of its investments at fair

value in accordance with IAS 28 (revised 2011), "Investments in

associates and joint ventures". As a result, the Company has ceased

the application of equity accounting to its investments in

associates. It now classifies its investments in associates as

financial assets at fair value through profit or loss. The Company

has applied this change in accounting policy retrospectively in

accordance with IAS 8, "Accounting policies, changes in accounting

estimates and errors".

3.1 Subsidiaries and associates

As a result of the adoption the amendments to IFRS 10 and the

fair value option under IAS 28, the Company has changed its

accounting policy with respect to its investments in subsidiaries

and associates. Its subsidiaries and associates which were

previously consolidated or equity accounted, are now accounted for

at fair value through profit and loss. At the date of initial

application of IFRS 10, the Company measured these investments at

fair value through profit or loss as if it had done so since

inception. As part of the required retrospective application of

those changes, the Company adjusted retained earnings at the

beginning of the immediately preceding period for any difference

between:

(a) the previous carrying amount of the investments; and

(b) the fair value of the Company's investments in subsidiaries and associates.

The cumulative amount of any fair value adjustments previously

recognised in other comprehensive income was transferred to

retained earnings at the beginning of the

period immediately preceding the date of initial

application.

At the end of each half of the financial year, the fair values

of a selection of investments in subsidiaries and associates are

assessed such that the fair values of all investments in

subsidiaries and associates are assessed at least once each

financial year. The fair values of the majority of these

investments are estimated by a qualified independent professional

services firm, KPMG Limited. The valuations by this professional

services firm are prepared using a number of approaches such as

adjusted net asset valuations, discounted cash flows,

income-related multiples and price-to-book ratio. These estimated

fair values are used by the Audit and Valuation Committee ("AVC")

as the primary basis for estimating each subsidiary's or

associate's fair value.

Any gain or loss arising from a change in the fair value of

investments in subsidiaries and associates is recognised in the

statement of comprehensive income.

3.2 Impacts of changes in accounting policies

As a result of the changes in the Company's accounting policies,

financial statements for prior periods were restated. The Company

changed from preparing consolidated financial statements to issuing

separate financial statements with its investments in subsidiaries

and associates classified as financial assets at fair value through

profit or loss. The Company has opted to present the balance sheet

in order of liquidity as opposed to using the current and

non-current classifications. The following tables show the

adjustments recognised for each individual line item.

Balance sheet as at 30 June 2014

30 June 2014 30 June 2014

(Consolidated) Adjustments (Restated)

USD'000 USD'000 USD'000

Assets

Non-current

Plant and equipment 3,114 (3,114) -

Investment properties 4,175 (4,175) -

Investments in associates 169,505 (169,505) -

Prepayments for acquisition of

investment properties 7,895 (1,645) 6,250

Financial assets at fair value

through profit or loss 4,697 604,787 609,484

Available-for-sale financial assets 6,033 (6,033) -

Other non-current assets 792 (792) -

------------ ------------ ------------

196,211 419,523 615,734

Total non-current assets ------------ ------------ ------------

Current

Inventories 7,216 (7,216) -

Trade and other receivables 14,515 (14,415) 100

Short-term loans to related parties 5,235 (5,235) -

Short-term receivables from related

parties - 331 331

Financial assets at fair value

through profit or loss 552,339 (388,170) 164,169

Other financial assets 4,695 (4,695) -

Cash and cash equivalents 21,551 (20,240) 1,311

------------ ------------ ------------

605,551 (439,640) 165,911

Total current assets ------------ ------------ ------------

Assets classified as held for

sale 3,726 (3,726) -

------------ ------------ ------------

Total assets 805,488 (23,843) 781,645

30 June 2014 30 June 2014

(Consolidated) Adjustments (Restated)

USD'000 USD'000 USD'000

Equity and liabilities

Equity

Equity attributable to shareholders of the Company

Share capital 3,246 - 3,246

Additional paid-in capital 722,064 - 722,064

Treasury shares (165,939) - (165,939)

Revaluation reserve 33,281 (33,281) -

Translation reserve (19,186) 19,186 -

Retained earnings 205,489 6,520 212,009

---------- ---------- ----------

Total equity attributable to shareholders of the 778,955 (7,575) 771,380

Company ---------- ---------- ----------

Non-controlling interests 849 (849) -

----------

---------- ---------- 771,380

779,804 (8,424) ----------

Total equity ---------- ---------- --

Liabilities

Non-current

Other long-term liabilities 189 (189) -

---------- ---------- --------

189 (189) -

Total non-current liabilities ---------- ---------- --------

Current

Short-term borrowings 7,839 (7,839) -

Trade and other payables 4,566 (4,547) 19

Payables to related parties 13,090 (2,844) 10,246

---------- ---------- ----------

Total current liabilities 25,495 (15,230) 10,265

25,684 (15,419) 10,265

Total liabilities ---------- ---------- ----------

805,488 (23,843) 781,645

Total equity and liabilities ---------- ---------- ----------

Net asset value, USD per share attributable to

shareholders of the Company 3.27 (0.03) 3.24

Statement of income for the six months ended 31 December

2013

Six months ended

---------------------------------------------

31 December 31 December

2013 Adjustments 2013

USD'000 USD'000 USD'000

(Consolidated) (Restated)

Revenue 4,856 (4,856) -

(3,289) 3,289 -

Cost of sales ---------- ---------- ----------

Gross profit 1,567 (1,567) -

Dividend income 10,169 (10,169) -

Interest income 831 (831) -

Net gains from financial assets

at fair value through profit

or loss, net 32,655 8,051 40,706

Selling, general and administration

expenses (8,405) 1,906 (6,499)

Other income 880 (730) 150

Other expenses (653) 653 -

---------- ---------- ----------

37,044 (2,687) 34,357

Operating profit ---------- ---------- ----------

Finance income 44 (44) -

(370) 370 -

Finance costs ---------- ---------- ----------

Finance costs - net (326) 326 -

Share of losses of associates,

net of tax (12,996) 12,996 -

---------- ---------- ----------

(13,322) 13,322 -

---------- ---------- ----------

Profit before tax 23,722 10,635 34,357

Corporate income tax (18) 18 -

Withholding taxes imposed on

investment income (321) 321 -

---------- ---------- ----------

Profit for the period 23,383 10,974 34,357

Profit attributable to:

Owners of the Company 23,536 (23,536) -

Non-controlling interests (153) 153 -

---------- ---------- ----------

23,383 (23,383) -

---------- ---------- ----------

Earnings per share

- basic and diluted (USD per

share) 0.09 0.05 0.14

Statement of comprehensive income for the six months ended 31

December 2013

Six months ended

--------------------------------------------------

31 December 31 December

2013 Adjustments 2013

USD'000 USD'000 USD'000

(Consolidated) (Restated)

Profit for the period 23,383 10,974 34,357

Other comprehensive income

Items that will be reclassified

subsequently to profit or loss

- Currency translation differences 847 (847) -

---------- ------------ ------------

847 (847) -

Items that will not be reclassified

subsequently to profit or loss

* Share of revaluation reserves of associates 780 (780) -

------------ ------------ ------------

Other comprehensive income for 1,627 (1,627) -

the period ------------ ------------ ------------

Total comprehensive income for

the period 25,010 9,347 34,357

Statement of cash flow for the six months ended 31 December

2013

Six months ended

-------------------------------------------------

31 December 31 December

2013 Adjustments 2013

USD'000 USD'000 USD'000

(Consolidated) (Restated)

Operating activities

Profit before tax 23,722 10,635 34,357

Adjustments for:

Depreciation and amortisation 279 (279) -

Unrealised gains on financial assets

at fair value through profit or

loss (28,316) (12,390) (40,706)

Impairment of assets 159 (159) -

Share of losses of associates 12,996 (12,996) -

Unrealised foreign exchange gain

- net (18) 18 -

Interest expense 128 (128) -

---------- ------------ ----------

Profits/(loss) before changes in 8,950 (15,299) (6,349)

working capital ---------- ------------ ----------

Change in financial assets at fair

value through profit or loss - 14,808 14,808

Change in trade receivables and

other assets 1,917 511 2,428

Change in inventories 521 (521) -

Change in trade payables and other

liabilities (8,219) 120 (8,099)

Income taxes paid (339) 339 -

------------ ------------ ----------

2,830 (42) 2,788

Net cash inflow from operating activities ------------ ------------ ----------

Investing activities

Dividends received 1,355 (1,355) -

Purchases of plant and equipment (158) 158 -

Purchases of financial assets (18,246) 18,246 -

Investments in associates (982) 982 -

Proceeds from disposals of financial

assets 50,794 (50,794) -

Shareholder loans refunded 237 (237) -

Proceeds from disposals of investments 1,613 (1,613) -

---------- ------------ ----------

34,613 (34,613) -

Net cash inflow from investing activities ---------- ------------ ----------

Financing activities

Interest paid (128) 128 -

Payments for shares repurchased (28,560) 28,560 -

Loan proceeds from banks 3,187 (3,187) -

Loan repayment to banks (2,906) 2,906 -

---------- ---------- ----------

Net cash outflow from financing

activities (28,407) 28,407 -

---------- ---------- ----------

Net increase in cash and cash equivalents

for the period 9,036 (6,248) 2,788

Cash and cash equivalents at the

beginning of the period 53,392 (48,890) 4,502

Exchange differences on cash and

cash equivalents 18 (18) -

Cash and cash equivalents at the ---------- ---------- ----------

end of the period 62,446 (55,156) 7,290

4 CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS

When preparing the condensed interim financial statements, the

Company relies on a number of judgements, estimates and assumptions

about recognition and measurement of assets, liabilities, income

and expenses. The actual results may differ from the

judgements.

Information about significant judgements, estimates and

assumptions which have the greatest effect on the recognition and

measurement of assets, liabilities, income and expenses were the

same as those that applied to the last annual consolidated

financial statements for the year ended 30 June 2014.

4.1 Eligibility to qualify as an investment entity

The Company has determined that it is an investment entity under

the definition in IFRS 10 as it meets the following criteria:

(a) the Company has obtained funds from investors for the

purpose of providing those investors with investment management

services;

(b) the Company's business purpose is to invest funds solely for

returns from capital appreciation, investment income or both;

and

(c) the performance of investments made by the Company are

substantially measured and evaluated on a fair value basis.

The Company also meets the typical characteristics of an

investment entity:

-- it holds more than one investment;

-- it has more than one investor;

-- it has investors that are not its related parties; and

-- it has ownership interests in the form of equity or similar interests.

As a consequence, the Company does not consolidate its

subsidiaries and accounts for them at fair value through profit or

loss. See Note 3.2 above for information regarding the impact of

the change in accounting policy.

4.2 Fair value of subsidiaries and associates

As at 31 December 2014, 100% (30 June 2014: 100%) of the

financial assets at fair value through profit and loss relate to

the Company's investments in the subsidiaries and associates that

have been fair valued in accordance with the policies set out

above. The Company has investments in a number of subsidiaries and

associates which were established to hold underlying investments.

These investments include listed and unlisted securities, private

equity and real estate assets. Where an active market exists (for

example, for listed securities), the fair value of the subsidiary

or associate reflects the asset value of the underlying holdings.

Where no active market exists, valuation techniques as set out in

Note 3.1 are used. The shares of the subsidiaries and associates

are not publicly traded; return of capital to the Company can only

be made by divesting the underlying investments of the subsidiaries

and associates. As a result, the carrying value of the subsidiaries

and associates may not be indicative of the value ultimately

realised on divestment.

The fair value of the investments in subsidiaries and associates

is primarily based on their net asset value. These subsidiaries and

associates hold investments in real estate, listed and unlisted

securities and private equities. Information about the significant

judgements, estimates and assumptions that are used in the

valuation of these investments is discussed below.

Valuation of listed and unlisted securities, private equities

and real estate

The fair values of listed securities are based on quoted market

prices at the close of trading on the reporting date. For unlisted

securities which are traded in an active market, the fair value is

the average quoted prices at the close of trading obtained from a

minimum sample of three reputable securities companies at the

reporting date. Other relevant measurement bases are used if broker

quotes are not available or if better and more reliable information

is available.

The fair value of financial assets that are not traded in an

active market (for example, unlisted securities, private equities

and real estate where market prices are not readily available) is

determined by using valuation techniques. The Company uses its

judgement to select a variety of methods and make assumptions that

are mainly based on market conditions existing at each reporting

date. Independent valuations are also obtained from appropriately

qualified independent valuation firms. The valuations may vary from

the actual prices that would be achieved in an arm's length

transaction at the reporting date.

A number of the Company's real estate investments are

co-invested with VinaLand Limited ("VNL"), another fund managed by

the Investment Manager. In most cases VNL holds a controlling stake

in the joint venture company and therefore exerts control over the

investment. As both funds are managed by the same Investment

Manager, each fund's investment objectives for each property are

generally the same. However, given VNL's recently established

investment objective of disposing of a portion of its portfolio,

the Company would potentially be put in a position where sales may

be triggered earlier than ideally desired. The Board reviews all

such decisions and under normal circumstances is not prepared to

assume the development risk that would result from continuing to

hold an investment which VNL is selling. The Company also holds a

stake in VNL itself and supports the board of that company in its

objective of disposing of a portion of its assets.

As at 31 December 2014 and 30 June 2014, the Company classifies

its investments in subsidiaries and associates as Level 3 within

the fair value hierarchy, because they are held by subsidiaries and

associates which are not publicly traded, even when the underlying

assets are readily realisable.

5 SEGMENT ANALYSIS

In identifying its operating segments, management follows the

subsidiaries' sectors of investment which are based on internal

management reporting information. The operating segments by

investment portfolio include capital markets, real estate and

hospitality, private equity and cash (including cash and cash

equivalents, bonds, and short-term deposits) sectors.

Each of the operating segments are managed and monitored

individually by the Investment Manager as each requires different

resources and approaches. The Investment Manager assesses segment

profit or loss using a measure of operating profit or loss from the

underlying investment assets of the subsidiaries. Although IFRS 8

requires measurement of segmental profit or loss, the majority of

expenses are common to all segments and, therefore, cannot be

individually allocated. There have been no changes from prior

periods in the measurement methods used to determine reported

segment profit or loss.

The majority of the liabilities are payables for general

expenses; therefore, liabilities are not disclosed in the sector

analysis.

Segment information can be analysed as follows:

Statement of income

Capital markets Real Private equity

estate Hospitality Total

USD'000 USD'000 USD'000 USD'000 USD'000

Six months ended

31 December 2014 (unaudited)

Net gain/(loss) on financial

assets at fair value through

profit or loss 11,403 (5,035) 4,746 5,982 17,096

General and administration expenses

(Note 15) (13,737) (902) (409) (586) (15,634)

---------- ---------- ---------- ---------- ----------

Profit before tax (2,334) (5,937) 4,337 5,396 1,462

Six months ended

31 December 2013 (restated)

Net gain/(loss) on financial assets at fair

value through profit or loss 43,867 (3,423) 117 145 40,706

General and administration expenses (Note 15) (5,036) (860) (525) (78) (6,499)

Other income - 150 - - 150

---------- ---------- ---------- ---------- ----------

Profit before tax 38,831 (4,133) (408) 67 34,357

5

Balance sheet

Assets

Capital Real Private

markets estate Hospitality equity Cash Total

USD'000 USD'000 USD'000 USD'000 USD'000 USD'000

As at 31 December 2014

(unaudited)

Cash and cash equivalents - - - - 940 940

Short-term receivables from a

related party 197 - - - - 197

Financial assets at fair value

through profit or loss 513,292 106,683 73,372 51,161 - 744,508

Prepayments for acquisitions

of investment properties - 6,250 - - - 6,250

------------ ------------ ------------ ---------- ---------- ------------

Total assets 513,489 112,933 73,372 51,161 940 751,895

As at 30 June 2014 (restated)

Cash and cash equivalents - - - - 1,311 1,311

Short-term receivables from a

related party 331 - - - - 331

Trade and other receivables 100 - - - - 100

Financial assets at fair value

through profit or loss 583,985 111,718 68,626 9,324 - 773,653

Prepayments for acquisitions of

investment properties - 6,250 - - - 6,250

------------ ------------ ------------ ---------- ---------- ------------

Total assets 584,416 117,968 68,626 9,324 1,311 781,645

6 INTERESTS IN SUBSIDIARIES AND ASSOCIATES

6.1 Subsidiaries

The Company had the following principal subsidiaries as at 31

December 2014:

As at

----------------------- ------------------------------

31.12.2014 30.6.2014

% of % of

Country Company Company

Name of incorporation interest interest Nature of the business

Holding company for

listed,

Vietnam Investment Property unlisted securities

Holding Limited BVI 100 100 and real estate

Holding company for

Vietnam Investment Property listed,

Limited BVI 100 100 and unlisted securities

Holding company for

listed,

unlisted securities

Vietnam Ventures Limited BVI 100 100 and real estate

Holding company for

listed,

unlisted securities

Vietnam Investments Limited BVI 100 100 and real estate

Holding company for

Asia Value Investment listed,

Limited BVI 100 100 and unlisted securities

Holding company for

Vietnam Master Holding listed

2 Limited BVI 100 100 securities

Holding company for

VOF Investment Limited BVI 100 100 listed,

unlisted securities

and real estate

Holding company for

listed

VOF PE Holding 5 Limited BVI 100 100 securities

Holding company for

Visaka Holding Limited BVI 100 100 treasury

shares

Holding company for

listed

Portal Global Limited BVI 100 100 securities

Holding company for

listed

Winstar Resources Limited BVI 100 100 securities

Holding company for

Howard Holding Pte. Limited Singapore 100 100 private equity

Holding company for

Fraser Investment Pte. listed

Limited Singapore 100 100 securities

SE Asia Master Holding Holding company for

7 Pte Limited Singapore 100 100 private equity

Holding company for

Alright Assets Limited Singapore 100 100 real estate

Holding company for

VTC Espero Limited Singapore 100 100 real estate

American Home Vietnam

Co., Limited Vietnam 100 100 Ceramic tiles

Yen Viet Joint Stock

Company Vietnam 65 65 Birdnest products

International Dairy Products Vietnam 56 - Dairy products

Joint Stock Company ("IDP")

There is no legal restriction to the transfer of funds from the

BVI or Singapore subsidiaries to the Company. Cash held in

Vietnamese subsidiaries is subject to restrictions imposed by

co-investors and the Vietnamese government and therefore it cannot

be transferred out of Vietnam unless such restrictions are

satisfied.

The Company has commitments under investment certificates it has

received for real estate projects jointly invested with VinaLand

Limited, a related party under common management, and other

agreements it has entered into, to acquire and develop, or make

additional investments in investment properties and leasehold land

in Vietnam. Further investments in many of these arrangements are

at the Company's discretion.

6.2 Associates

As at

----------------------- ----------------------------

31.12.2014 30.6.2014

Name Country % of % of Nature of the business

of incorporation Company Company

interest interest

Pacific Alliance Land Holding company

Limited BVI 25 25 for

VinaSquare project

Holding company

Sunbird Group Limited BVI 25 25 for

Pham Hung project

VinaCapital Danang Resorts Holding company

Limited BVI 25 25 for

Danang Resorts project

Vietnam Property Holdings Holding company

Limited BVI 25 25 for

Danang Golf project

Prosper Big Investment Holding company

Limited BVI 25 25 for

Century 21 project

VinaCapital Commercial Holding company

Center Singapore 12.75 12.75 for

Capital Square phase

Private Limited 1

Holding company

Mega Assets Pte. Limited Singapore 25 25 for

Capital Square phase

2

SIH Real Estate Pte. Holding company

Limited Singapore 25 25 for

Capital Square phase

3

Holding company

VinaLand Eastern Limited Singapore 25 25 for

Phu Hoi City project

6.3 Financial risks

The Company owns a number of subsidiaries for the purpose of

holding investments in listed and unlisted securities, debt

instruments, private equity and real estate. The Company, via these

underlying investments, is subject to financial risks which are

further disclosed in Note 22. The Investment Manager makes

investment decisions after performing extensive due diligence on

the underlying investments, their strategies, financial structure

and the overall quality of management.

7 CASH AND CASH EQUIVALENTS

31 December 30 June

2014 2014

USD'000 USD'000

Restated

Cash in banks 940 1,311

As at the balance sheet date, cash and cash equivalents are

denominated in USD. Please refer to Note 9 for the balance of cash

and cash equivalents held at the Company's subsidiaries.

8 FINANCIAL INSTRUMENTS BY CATEGORY

Financial

assets at

Loans and receivables fair value

through profit Total

or loss

USD'000 USD'000 USD'000

As at 31 December 2014

(unaudited)

Cash and cash equivalents 940 - 940

Short-term receivables

from a related party 197 - 197

Financial assets at

fair value through profit

or loss - 744,508 744,508

---------- ------------ ------------

Total 1,137 744,508 745,645

Financial assets denominated

in:

* USD 1,137 744,508 745,645

As at 30 June 2014 (restated)

Cash and cash equivalents 1,311 - 1,311

Short-term receivables

from a related party 331 - 331

Trade and other receivables 100 - 100

Financial assets at

fair value through profit

or loss - 773,653 773,653

---------- ---------- --------------

Total 1,742 773,653 775,395

Financial assets denominated

in:

* USD 1,742 773,653 775,395

All financial liabilities are short term in nature and their

carrying values approximate their fair values. There are no

financial liabilities that must be accounted for at fair value

through profit or loss (30 June 2014: nil).

9 FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS

Financial assets at fair value through profit and loss comprise

the Company's investments in subsidiaries and associates. The

underlying assets and liabilities of the subsidiaries and

associates carried at fair value are disclosed in the following

table:

31 December 30 June

2014 2014

USD'000 USD'000

Restated

In Vietnam

Cash and cash equivalents 74,413 19,795

Government bonds - 19,241

Ordinary shares - listed 381,072 423,563

Ordinary shares - unlisted and over-the-counter

("OTC") 41,441 88,689

Private equity 51,161 9,324

Hospitality 63,143 67,148

Real estate projects 103,139 111,718

Other assets, net of liabilities 3,026 8,632

------------ ------------

717,395 748,110

In countries other than Vietnam

Ordinary shares - listed 27,113 25,543

------------ ------------

27,113 25,543

------------ ------------

744,508 773,653

The sectors of the major underlying investments held by in the

Company's subsidiaries are as follows:

31 December 30 June

2014 2014

USD'000 USD'000

Restated

Consumer goods 150,822 149,599

Construction 107,342 101,599

Financial services 51,329 54,542

Agriculture 28,586 94,251

Energy, minerals and petroleum 61,351 57,642

Pharmaceuticals 28,415 28,886

Real estate 169,058 166,236

Hospitality 63,143 67,148

Government bonds - 19,241

As at 31 December 2014, an underlying holding, Vietnam Dairy

Products Joint Stock Company, within financial assets at fair value

through profit or loss amounted to 10% of the net asset value of

the Company (30 June 2014: 12%). There were no other holdings that

had a value exceeding 10% of the net asset value of Company as at

31 December 2014 or 30 June 2014.

10 PREPAYMENTS FOR ACQUISITIONS OF INVESTMENT PROPERTIES

31 December

2014 30 June 2014

USD'000 USD'000

Restated

Historical costs 8,986 8,986

Less: cumulative allowance for impairment

losses (2,736) (2,736)

-------- --------

6,250 6,250

There were no movements in the prepayments and allowance for

impairment during the period (30 June 2014: none).

Prepayments are made by the Company to property vendors where

the final transfer of the properties is pending the approval of the

relevant authorities and/or subject to either the Company or the

vendor completing certain performance conditions set out in

agreements.

As at 31 December 2014, due to market conditions, impairment

allowances of USD2.7 million (30 June 2014: USD2.7 million) have

been taken against the prepayments for acquisitions of investments.

The relevant recoverable amounts are fair values less costs to sell

estimated by an independent professional qualified valuer who holds

recognised relevant professional qualifications and has recent

experience in the locations and categories of the properties for

which the prepayments are made.

The valuations by independent valuation companies are prepared

based upon direct comparison with sales of other similar properties

in the area and the expected future discounted cash flows of each

property using a yield that reflects the risks inherent therein.

Discount rates applied vary from 15% to 22% (30 June 2014: 15% to

22%). If the sale prices of similar properties had

increased/decreased, it is expected that the recoverable amounts of

these prepayments would have moved up/down accordingly. On the

other hand, if discount rates had risen/dropped, their recoverable

amounts would have decreased/increased as a result.

It is the Company's view that all of its prepayments for

acquisitions of investments are in Level 3 of the fair value

hierarchy.

11 SHARE CAPITAL

31 December 2014 30 June 2014

---------------------- ----------------------

Number of Number of

shares USD'000 shares USD'000

Ordinary shares of USD0.01 each:

Authorised 500,000,000 5,000 500,000,000 5,000

Issued and fully paid 324,610,259 3,246 324,610,259 3,246

12 TREASURY SHARES

31 December 2014 30 June 2014

------------------------------ ------------------------------

Number Number

of shares USD'000 of shares USD'000

Opening balance (1

July 2014/

1 July 2013) 86,355,265 165,939 63,233,988 113,639

Shares repurchased

during the period/year 11,544,882 30,592 23,121,277 52,300

---------------- ---------- ---------------- ----------

Closing balance 97,900,147 196,531 86,355,265 165,939

During the period, the Company purchased 11,544,882 of its

ordinary shares (year ended 30 June 2014: 23,121,277 shares) for

total cash consideration of USD30.6 million (year ended 30 June

2014: USD52.3 million). The consideration was paid with cash from

one of the Company's subsidiaries. All purchases had been fully

settled by the balance sheet dates.

13 PAYABLES TO RELATED PARTIES

31 December 30 June

2014 2014

USD'000 USD'000

Restated

Management fees payable to the

Investment Manager (Note 20) 1,009 1,013

Incentive fees payable to the

Investment

Manager (Note 20) 8,360 9,013

Other payables to related parties 254 220

-------- ----------

9,623 10,246

All payables to related parties are short-term in nature.

Therefore, their carrying values are considered a reasonable

approximation of their fair values.

14 NET GAINS FROM FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS

Six months ended

------------------------------------

31 December 2014 31 December 2013

USD'000 USD'000

Restated

Financial assets at fair value through profit or loss:

* Gains from the realisation of financial assets, net 114 -

* Unrealised gains 16,982 40,706

---------- ----------

Total 17,096 40,706

The above net gains on financial assets at fair value through

profit or loss include dividend and interest income of USD8.4

million earned by the Company's subsidiaries during the period

(period ended 31 December 2013: USD11.0 million).

15 GENERAL AND ADMINISTRATION EXPENSES

Six months ended

-------------------------------

31 December

2014 31 December 2013

USD'000

Investment management fees (Note 20(a)) 6,007 5,722

Incentive fees (*) 8,360 -

Directors' fees 236 232

Custodian, secretarial & administration fees 175 153

Others 856 392

---------- ----------

15,634 6,499

(*) The structure of the incentive fee is set out in Note 20(b).

As at 31 December 2014, the Company accrued an incentive fee of

USD8.4 million based on the Company's performance up to that date.

Any incentive fee will not crystallise until the Company's

financial year end on 30 June 2015, therefore the accrued amount

will change depending on the performance of the Company during the

second half of the financial year.

16 INCOME TAX EXPENSE

The Company is incorporated in the Cayman Islands. Under the

current laws of the Cayman Islands, there are no income, state,

corporation, capital gains or other taxes payable by the

Company.

A number of subsidiaries are established in Vietnam and

Singapore and are subject to corporate income tax in those

countries. The income tax payable by these subsidiaries is included

in their fair values as disclosed in the line item "Financial

assets at fair value through profit or loss" on the balance

sheet.

The relationship between the estimated income tax expense based

on the applicable income tax rate of 0% and the tax expense

actually recognised in the condensed interim statement of income

can be reconciled as follows:

Six months ended

--------------------------

31 December 31 December

2014 2013

USD'000

USD'000 Restated

1,462 34,357

(Loss)/profit before tax ---------- ----------

Applicable tax rate 0% 0%

---------- ----------

Income tax - -

There is no deferred income tax.

17 EARNINGS PER SHARE AND NET ASSET VALUE PER SHARE

(a) Basic

Basic earnings per share is calculated by dividing the

(loss)/profit from operations of the Company by the weighted

average number of ordinary shares in issue during the six-month

period excluding ordinary shares purchased by the Company and held

as treasury shares (Note 12).

Six months ended

--------------------------

31 December 31 December

2014 2013

USD'000 USD'000

Restated

Profit for the period (USD'000) 1,462 34,357

Weighted average number of ordinary shares in issue 233,572,409 250,626,969

Basic earnings per share (USD per share) 0.01 0.14

(b) Diluted

Diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares outstanding to assume

conversion of all dilutive potential ordinary shares. The Company

has no category of potentially dilutive ordinary shares. Therefore,

diluted earnings per share is equal to basic earnings per

share.

(c) Net asset value per share

Net Asset Value ("NAV") per share is calculated by dividing the

net asset value of the Company by the number of outstanding

ordinary shares in issue as at the reporting date excluding

ordinary shares purchased by the Company and held as treasury

shares (Note 12). NAV is determined as total assets less total

liabilities.

As at 31 December As at 30 June

2014 2014

(Restated)

Net asset value (USD'000) 742,250 771,380

Number of outstanding ordinary shares on issue 226,710,112 238,254,994

Net asset value per share (USD/share) 3.27 3.24

18 SEASONALITY

The Company's management believes that the impact of seasonality

on the condensed interim financial information is not material.

19 DIRECTORS REMUNERATION

The aggregate directors' fees for the six-month period amounted

to USD204,944 (six months ended 31 December 2013: USD172,500), of

which there was no outstanding amount payable at the reporting date

(30 June 2014: nil).

The details of remuneration for each director are summarised

below:

Six months ended

------------------------------------

31 December 2014 31 December 2013

USD USD

Steven Bates 47,500 47,500

Martin Adams 40,000 40,000

Martin Glynn (*) 32,444 40,000

Michael Gray 45,000 45,000

Bich Thuy Dam 40,000 -

------------ ------------

204,944 172,500

(*) resigned 27 November 2014

20 RELATED PARTIES

(a) Management fees

Under an amended and restated investment management agreement

dated 24 June 2013 which became effective as of 1 July 2013 (the

"Amended Management Agreement"), the Investment Manager receives a

fee at an annual rate of 1.5% of the NAV, payable monthly in

arrears.

Total management fees for the six-month period amounted to

USD6.0 million (30 June 2014: USD5.7 million), with USD1 million

(30 June 2014: USD1 million) in outstanding accrued fees due to the

Investment Manager at the reporting date.

(b) Incentive fees

Prior to 1 July 2013 the Investment Manager was paid an

incentive fee equal to 20% of the increase in the NAV of the

Company over an 8% per annum hurdle rate, with a catch up.

Under the Amended Management Agreement dated 24 June 2013 and

the latest amendment dated 15 October 2014, from 1 July 2013 the

incentive fee was changed to be 15% of the increase in NAV per

share over a hurdle rate of 8% per annum. A catch up is no longer

applied. Furthermore, for the purposes of calculating incentive

fees, the Company's net assets are segregated into a Direct Real

Estate Portfolio and a Capital Markets Portfolio. A separate

incentive fee is calculated for each portfolio so that for any

balance sheet date it will be possible for an incentive fee to

become payable in relation to one, both, or neither, portfolio

depending upon the performance of each portfolio. However, the

maximum incentive fee that can be paid in any given year in respect

to a portfolio is 1.5% of the NAV of that portfolio at the balance

sheet date. Any incentive fees earned in excess of the cap may be

paid out in subsequent years providing that certain performance

targets are met.

Total incentive fees for the six-month period amounted to USD8.4

million (31 Dec 2013 : nil), with USD8.4 million (30 June 2014:

USD9 million) in outstanding accrued fees due to the Investment

Manager at the reporting date.

(c) Other balances with related parties

31 December 2014 30 June 2014

USD'000 USD'000

Receivables from the Investment Manager on management fees rebate 197 331

Payables to the Investment Manager on expenses paid on behalf 254 220

21 COMMITMENTS

The Company's real estate associates has a broad range of

commitments under investment licences which it has received for

real estate projects jointly invested with VinaLand Limited, a

related party under common management, and other agreements it has

entered into, to acquire and develop, or make additional

investments in investment properties and leasehold land in Vietnam.

Further investments in many of these arrangements are at the

Company's discretion.

22 FINANCIAL RISK MANAGEMENT

(a) Financial risk factors

The Company has set up a number of subsidiaries as well as

invested in some associates for the purpose of holding investments

in listed and unlisted securities, debt instruments, private equity

and real estate in Vietnam and overseas with the objective of

achieving medium to long-term capital appreciation and providing

investment income. The Company accounts for these subsidiaries and

associates as financial assets at fair value through profit or

loss. The fair values are therefore subject to a variety of

financial risks: market risk (including currency risk, interest

rate risk, and price risk), credit risk and liquidity risk. The

Company's overall risk management programme focuses on the

unpredictability of financial markets and seeks to minimise

potentially adverse effects on the Company's financial performance.

The Company's risk management is coordinated by the Investment

Manager who manages the distribution of the assets to achieve the

investment objectives.

The condensed interim financial statements do not include all

financial risk management information and disclosures required in

the annual financial statements; they should be read in conjunction

with the annual consolidated financial statements of the Company

and its subsidiaries as at 30 June 2014.

There have been no significant changes in the management of risk

or in any risk management policies since the last balance sheet

date.

Foreign exchange risk

The Company's subsidiaries' exposure to risk resulting from

changes in currency exchange rates is moderate as, although

transactions in Vietnam are settled in the VND, the value of the

VND has in recent times been closely tied to that of the USD, the

reporting currency.

Neither the Company nor any of its subsidiaries or associates

hedges currency exposure, but cash may be held in either VND or

USD. The Board and Investment Manager regularly review the costs

and potential benefits of currency hedging. The Company did not

enter into any currency hedges in the reporting period and it is

considered unlikely that it will do so in the foreseeable

future.

As at 31 December 2014 and 30 June 2014, the fair value of the

Company's investments in subsidiaries and associates is exposed to

foreign currency risk mainly because they hold financial assets and

liabilities denominated in VND. As at the reporting date, had the

VND weakened/strengthened by 5 per cent in relation to the USD,

with all other variables held constant, the balance of financial

assets held at fair value through profit or loss would have been

lower/higher by USD33.7 million (30 June 2014: USD37.1

million).

Price risk

Price risk is the risk that the value of an instrument will

fluctuate as a result of changes in market prices, whether caused

by factors specific to an individual investment, its issuer, or

factors affecting all instruments traded in the market.

The Company's subsidiaries invest in listed and unlisted equity

securities and are exposed to market price risk of these

securities.

The majority of the Company's subsidiaries' equity investments

are publicly traded on either of Vietnam's stock exchanges (HOSE or

HNX).

All securities investments present a risk of loss of capital.

This risk is managed through the careful selection of securities

and other financial instruments within specified limits and by

holding a diversified portfolio of listed and unlisted instruments.

In addition, the performance of investments held by the Company is

monitored by the Investment Manager on a monthly basis and reviewed

by the Board of Directors on a quarterly basis.

If the prices of the securities had increased/decreased by 10

per cent, the Company's financial assets held at fair value through

profit or loss would have been higher/lower by USD42.2 million (30

June 2014: USD51.2 million).

The Company's associates invest in a number of real estate

projects. The fair values of the underlying properties have a

direct impact on the fair values of these investment in associates.

The Investment Manager closely monitors indicators that may affect

property valuations. The Board of Directors is also highly involved

through its quarterly review of these valuations.

If the fair values of real estate properties had gone up/down by

10%, the Company's financial assets at fair value would have been

risen/dropped by USD10.6 million (30 June 2014: USD12.1

million).

Interest rate risk

The Company's subsidiaries' exposure to interest rate risk is

related to interest bearing financial assets and financial

liabilities. Cash and cash equivalents, and government bonds are

subject to interest at fixed rates. They are exposed to fair value

changes due to interest rate changes. The Company's subsidiaries

had no significant financial liabilities with floating interest

rates. As a result, the Company had limited exposure to cash flow

and interest rate risk.

(b) Fair value estimation

The table below analyses financial instruments carried at fair

value, by valuation method. The different levels have been defined

as follows:

-- Level 1: Quoted prices (unadjusted) in active markets for identical assets or liabilities;

-- Level 2: Inputs other than quoted prices included within

Level 1 that are observable for the asset or liability, either

directly (that is, as prices) or indirectly (that is, derived from

prices); and

-- Level 3: Inputs for the asset or liability that are not based on observable market data

(that is, unobservable inputs).

There are no financial liabilities of the Company which were

carried at fair value through profit or loss as at 30 June 2014 and

31 December 2014.

The level into which financial assets are classified is

determined based on the lowest level of significant input to the

fair value measurement.

Financial assets measured at fair value in the balance sheet are

grouped into the following fair value hierarchy:

Level 3 Total

USD'000 USD'000

As at 31 December 2014 (unaudited)

Financial assets at fair value through

profit or loss 744,508 744,508

------------ --------------

744,508 744,508

As at 30 June 2014 (restated)

Financial assets at fair value through

profit or loss 773,653 773,653

------------ --------------

773,653 773,653

All of the Company's financial assets at fair value through

profit or loss are classified as Level 3, because they represent

the Company's interests in private entities which hold the

Company's underlying investments. If these investments were held at

the Company level, as at 31 December 2014, they would be presented

as follows:

Level Level Level

1 2 3 Total

USD'000 USD'000 USD'000 USD'000

Cash and cash equivalents 74,413 - - 74,413

Ordinary shares - listed 408,185 - - 408,185

Ordinary shares - unlisted

and OTC - 38,763 2,678 41,441

Private equity - - 51,161 51,161

Hospitality - - 63,143 63,143

Real estate projects - 7,401 95,738 103,139

Other assets, net of liabilities - - 3,026 3,026

---------- ---------- ---------- ----------

482,598 46,164 215,746 744,508

Investments whose values are based on quoted market prices in

active markets, and are therefore classified within Level 1,

include actively traded equities, government bonds and private

equity investments which have committed prices at the balance sheet

date. The Company does not adjust the quoted price for these

instruments.

Financial instruments which trade in markets that are not

considered to be active but are valued based on quoted market

prices and dealer quotations are classified within Level 2. These

include investments in listed equities and over-the-counter ('OTC')

equities. As Level 2 investments

include positions that are not traded in active markets,

valuations may be adjusted to reflect illiquidity and/or

non-transferability, which are generally based on available market

information.

Specific valuation techniques used to value the Company's

underlying investments include:

-- Quoted market prices or dealer quotes;

-- Use of discounted cash flow technique to present value the estimated future cash flows;

-- Other techniques, such as the latest market transaction price.

The fair value of the Company's investments and associates are

estimated using approaches as described in Note 3.1. As observable

prices are not available for these investments, the Company

classifies these as Level 3 fair values.

Changes in Level 3 financial assets at fair value through profit

or loss

31 December 30 June

2014 2014

USD'000 USD'000

Opening balance (1 July 2014/1 July

2013) 773,653 730,538

Realised gains 114 -

Unrealised 16,982 119,070

Other reductions due to payments

on behalf of the Company and its

subsidiaries (46,241) (75,955)

------------ ------------

Closing balance 744,508 773,653

Total unrealised gains for the period/year

included in:

* Profit or loss 16,982 119,070

* Other comprehensive income - -

-------- ----------

16,982 119,070

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSFMGFFMGLGKZM

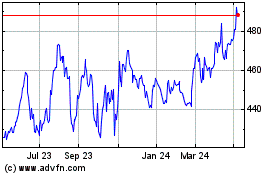

Vinacapital Vietnam Oppo... (LSE:VOF)

Historical Stock Chart

From Mar 2024 to Apr 2024

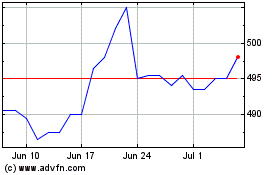

Vinacapital Vietnam Oppo... (LSE:VOF)

Historical Stock Chart

From Apr 2023 to Apr 2024