TIDMVOF

31 March 2016

VinaCapital Vietnam Opportunity Fund Limited

Interim results for the six months ended 31 December 2015

VinaCapital Vietnam Opportunity Fund Limited (the "Company" or "VOF"), an

investment company focused on Vietnam, today announces its interim results for

the six months ended 31 December 2015 ("the Period").

Financial highlights:

1 Net Asset Value ("NAV") of USD710.5 million (30 June 2015:

USD718.7 million)

2 NAV per share of USD3.31 (30 June 2015: USD3.27).

Operational highlights:

3 The Company held an Extraordinary General Meeting on 27 October

2015, where shareholders voted to allow VOF to migrate from the Cayman Islands

to Guernsey, a move that would ultimately allow the Company to change its

listing from the Alternative Investment Market to the Main

Market of the London Stock Exchange. The Company began trading on the Main

Market on 30 March 2016.

4 In December 2015 VOF announced the appointment of a new fund

administrator, Northern Trust Corporation. The Company is now administered from

Northern Trust's Guernsey office.

Enquiries:

Jeremy Greenberg

VinaCapital Investment Management Limited

Investor Relations

+84 8 3821 9930

jeremy.greenberg@vinacapital.com

Joel Weiden

VinaCapital Investment Management Limited

Communications

+84 8 3821 9930

joel.weiden@vinacapital.com

Franczeska Hanford / Martin Bourgaize

Northern Trust International Fund Administration Services (Guernsey) Limited

Company Secretary

+44 (0)1481 745918 / +44 (0)1481 745819

fk26@ntrs.com / meb16@ntrs.com

David Benda / Hugh Jonathan

Numis Securities Limited, Broker

+44 (0)20 7260 1000

funds@numis.com

Daniel Jason

Peregrine Communications, Public Relations (London)

+44 (0) 20 3040 0872

daniel.jason@peregrinecommunications.com

Chairman's Statement

It has been a busy six months for your Company, despite very little movement in

the Net Asset Value (NAV) per share. In this half year report, I will comment

on each sub section of the portfolio, update you on our migration process and

touch on governance.

During the first six months of the 2016 Fiscal Year, which covers the period

from 1st July 2015 to 31 December 2015, the NAV per share of VinaCapital

Vietnam Opportunity Fund (the "Company" or "VOF") increased by 1.2%, which

compares with a decline in the Vietnam Stock Index of 5.3% in USD terms.

Turning first to the portfolio:

Portfolio Review

Listed Stocks - 49.2% of assets, compared with 52.4% at 30th June 2015

This, the largest component of the portfolio, fell by 0.4% over the period,

significantly outperforming the market. As has been the case for a while, the

weakest sectors in the market have been oil and gas, and banking, in which the

portfolio is significantly underweight. By contrast, the largest position,

Vinamilk, which represents 15% of the overall portfolio and around 30% of the

listed assets, rose by 35% during the period and was by some margin the largest

contributor to return. The position was reduced somewhat at a premium of 17% to

the quoted price, partly because of the unusually large premium at that time,

but also for reasons of prudence given the scale of the holding. The Manager

remains of the view that Vinamilk is one of Vietnam's most attractive

businesses, with an ability to continue growing profits at a rate in the

mid-teens. It currently sells at approximately 16 times this year's earnings

forecast, as compared to an overall market multiple that is closer to 12 times.

During the half year, the portfolio became more concentrated, with the number

of holdings having been reduced from 22 to 19 stocks, a process which is

consistent with the Manager's approach of investing large stakes in attractive

companies and then engaging constructively to improve returns.

OTC Stocks - 6.1% of assets, compared with 4.9% at 30th June 2015

This category covers holdings which are going through the privatisation process

and which are en route to a stock market listing. The Manager would like to

deploy more capital in this area as it has been the source of some very

successful investments for the portfolio in the past, but their ability to do

so depends in large part on the rate at which companies are 'equitised', as the

process is known, the quality and prospects of those companies, as well as the

valuation at which these transactions occur. During the period, an investment

of USD10.5 million was made into the Airports Corporation of Vietnam,

effectively the monopoly airport operator. Other significant OTC holdings

include QNS, a food and drinks business and Vietnam's leading soy milk

producer, representing around 2% of net assets, and Vinatex, a leading textile

and garment producer, which makes up just over 1% of net assets. The pace of

equitisation continues to be slow, but several large transactions are expected

during 2016. Whether or not the Manager participates in any of these will

depend largely on valuation.

Private Equity - 11.2% of assets, compared with 11.3% at 30th June 2015

The largest position in this part of the portfolio is International Dairy

Products (IDP), a dairy business which is growing sales rapidly. The company is

in the second year of implementing a new marketing and product strategy, and

the Manager is optimistic that the current modest profits will follow sales

upwards.

During the half year, the Manager made a new investment in a convertible

preferred security in Novaland, one of the country's leading residential real

estate developers, which intends to list within the next couple of years. Since

the end of December, we have made progress with two new investments, one in a

large hospital south of Ho Chi Minh City, and the other in a leading

manufacturer and distributor of wood-based decorative panels. The hospital

investment was completed in March and we expect to complete the other by the

end of April.

The Manager has a pipeline of interesting new possibilities and hopes to invest

more capital in this part of the portfolio.

Direct Real Estate - 14.2% of assets, compared with 13.8% at 30th June 2015

As has been the case for the last three years, our strategy has been to reduce

the weighting of the portfolio in this area by selling assets. In this

endeavour, we have not been particularly successful. The reason for wishing to

reduce these direct property holdings is that we do not consider ourselves to

be property developers, but rather investors. It would be quite natural for a

fund such as VOF to have significant exposure to the real estate market in

Vietnam, but our approach is to reorient the portfolio away from direct

holdings towards listed equities and specific opportunities such as the

investment in Novaland.

Most of VOF's direct real estate assets are held in joint ventures with

VinaLand, another company managed by the Manager, and this company is in the

throes of a realisation process which should help us to achieve a significant

reduction in our property exposure by the end of 2016. Progress is slow,

however. Some assets are not in a shape or format to allow a quick sale and

where sales have been agreed, completing transactions in the Vietnamese real

estate market is bureaucratic and long-winded. At the time of writing, your

Board has been informed that it is likely that certain significant sales are

imminent, but no assurances can be given, despite a clear recovery in prices in

the property market. VOF will benefit from sales of any assets held through

joint ventures as well as through its holding in VinaLand. There were no

significant valuation changes in this part of the portfolio during the period

under review.

Operating Assets - 10.3% of assets, compared with 11.4% at 30th June 2015

The bulk of this part of the portfolio is represented by the 50% stake in the

Sofitel Metropole Hotel in Hanoi. This asset is operating slightly behind

budget, but more or less in line with last year. Increasing competition from 5

star hotels in the Hanoi market has had a marginally negative effect on

occupancy and room rates, but the asset remains solidly profitable. The Manager

expects a dividend of USD7.3 million during the current year which is in line

with prior year dividends received. As has been the case for a long time, the

Manager is happy to entertain offers for the hotel but, despite having received

several such expressions of interest, a sale on acceptable terms remains

elusive.

Migration & Listing

As you will no doubt be aware, VOF has shareholder approval to redomicile from

the Cayman Islands to Guernsey and more or less simultaneously shift its stock

market listing from AIM to the Premium section of the London Stock Exchange. We

had hoped to have this complete by the end of 2015, but ran into some problems

sourcing some of the information required by the Guernsey regulator. These

issues are now resolved and the process was completed on 30th March, just

before this report was issued. I would like to apologise to shareholders on

behalf of the Board for the delays, which were unforeseen. I remain optimistic

that the completion of this process will improve the breadth and depth of our

shareholder register, which, when combined with an active investor

communication plan to be implemented by the Manager, will help to reduce the

discount to NAV which remains stubbornly and annoyingly wide.

Governance

As I mentioned in the annual report, there was a difference of opinion between

the Manager and the Board on the methodology for the calculation of the

performance fee. The immediate issue was settled ahead of the release of the

2015 annual results, but in order to ensure that there is no recurrence, a

redraft of certain sections the Investment Management Agreement (IMA) is

needed. As yet, this is work in progress and we are taking advantage of the

process to review the IMA to align it with the standards expected of a premium

(MORE TO FOLLOW) Dow Jones Newswires

March 31, 2016 09:12 ET (13:12 GMT)

listed Company. These will be very much in shareholders' interests. We are

advised that no vote is required on the matter, but I will write a letter to

you to explain the changes which we are implementing as and when agreed.

As mentioned earlier, the discount remains a bone of contention both for the

Board and for shareholders. Share buybacks alone appear not to be able to fix

the problem. Our approach instead now combines several elements:

· Migration and relisting, which we expect to lead to inclusion in the

FTSE All Share Index and perhaps further improve liquidity

· A more extensive investor relations programme

· A reduction in the Direct Real Estate holdings

· A larger weighting to OTC and private equity opportunities

· Continuing share buybacks

The next six months will be important in determining whether this strategy can

deliver a narrower discount to NAV but, if it cannot, further measures will

have to be considered.

Outlook

The first couple of months of 2016 have laid bare investor nervousness about

the outlook for markets globally. Concern over commodity prices, the pace of

economic growth in China, and a potential slowdown in the developed world have

weighed heavily and volatility has spiked. In reality, nothing much has

changed: the developed world remains mired in sluggish growth with very low or

negative interest rates likely to persist, while China makes faltering steps to

reorient its huge economy to consumption activity. In this environment,

economic growth is scarce, and those investment opportunities which do not have

to stretch to achieve such growth should hold attractions for investors. In

Vietnam, that growth is visible. The country is not without its problems, most

obviously in the banking sector where non-performing loan issues are only

partly resolved and in the inherent uncertainty which surrounds the change of

political leadership. Nevertheless, with the passage of the Trans-Pacific

Partnership and other free trade agreements likely to facilitate trade, falling

inflation and attractive labour market dynamics, all of which should support

the continuing relocation of supply chains within Asia, Vietnam looks set to

grow faster than many of its neighbours and emerging markets in general.

Steven Bates

Chairman

VinaCapital Vietnam Opportunity Fund

31 March 2016

CONDENSED INTERIM BALANCE SHEET

31 December 2015 30 June 2015

Notes USD'000 USD'000

Unaudited Audited

ASSETS

Cash and cash equivalents 6 349 906

Short-term receivables from related 22 196 382

parties

Trade and other receivables 7 11,081 4,697

Financial assets at fair value through 9 699,016 712,567

profit or loss

Prepayments for acquisitions of investment 10 5,115 5,192

properties

------ ------

Total assets 715,757 723,744

------ ------

EQUITY AND LIABILITIES

EQUITY

Share capital 11 2,145 3,246

Additional paid-in capital 12 496,511 722,064

Treasury shares 13 - (213,283)

Retained earnings 211,869 206,637

------ ------

Total equity 710,525 718,664

------ ------

LIABILITIES

Payables to related parties 14 4,555 5,036

Accruals and other payables 677 44

------ ------

Total liabilities 5,232 5,080

------ ------

Total equity and liabilities 715,757 723,744

------ ------

Net asset value, USD per share 19(c) 3.31 3.27

----- -----

CONDENSED INTERIM STATEMENT OF CHANGES IN EQUITY

Treasury Retained Total

Share Additional shares earnings equity

capital paid-in

capital

USD'000 USD'000 USD'000 USD'000 USD'000

3,246 722,064 212,009

Balance at 1 July 2014 (165,939) 771,380

Profit for the six-month - - 1,462 1,462

period to -

31 December 2014

----- ------- ------- ------ ------

Total comprehensive - - - 1,462 1,462

income

Transactions with owners

Ordinary shares - - (30,592) - (30,592)

repurchased

----- ------- ------- ------- -------

3,246 722,064 (196,531) 213,471 742,250

Balance at 31 December ----- ------- ------- ------- -------

2014

Balance at 1 July 2015 3,246 722,064 (213,283) 206,637 718,664

Profit for the six-month - - 5,232 5,232

period to -

31 December 2015

Total comprehensive ----- ------- ------- ------ ------

income - - - 5,232 5,232

Transactions with owners

Ordinary shares - - (13,371) - (13,371)

repurchased

Ordinary shares cancelled (1,101) (225,553) 226,654 - -

----- ------- ------- ------- ------

Balance at 31 December 2,145 496,511 - 211,869 710,525

2015 ----- ------- ------- ------- ------

CONDENSED INTERIM STATEMENT OF COMPREHENSIVE INCOME

Six months ended

31 December 31

2015 December

2014

Notes USD'000 USD'000

Unaudited Unaudited

Dividend income (*) 15 25,733 46,242

Net losses on financial assets at fair value 16 (13,551) (29,146)

through profit or loss (**)

General and administration expenses 17 (7,069) (15,634)

Other income 196 -

Impairment losses (77) -

----- -----

Operating profit 5,232 1,462

----- -----

Profit before tax 18 5,232 1,462

Corporate income tax 18 - -

----- -----

Profit for the period 5,232 1,462

---- ----

Earnings per share 19(a),(b) 0.01

- basic and diluted (USD per share) 0.02 ----

----

----- -----

Total comprehensive income for the period 5,232 1,462

---- ----

Six months ended

31 December 31 December

2015 2014

USD'000 USD'000

(*) Dividend income includes:

- Dividend income from a subsidiary used to pay 13,371 30,592

for the Company's ordinary share repurchases

(MORE TO FOLLOW) Dow Jones Newswires

March 31, 2016 09:12 ET (13:12 GMT)

(Note 15)

- Dividend income from a subsidiary used to pay 12,362 15,650

for the Company's operating expenses (Note 15)

----- -----

25,733 46,242

----- -----

Six months ended

31 December 31 December

2015 2014

USD'000 USD'000

(**) Net losses on financial assets at fair

value through profit or loss include:

- Reduction in fair value of a subsidiary due to (13,371) (30,592)

payments for ordinary share repurchases on the

Company's behalf (Note 15)

- Reduction in fair value of a subsidiary due to (12,362) (15,650)

payment for the Company's operating expenses

(Note 15)

----- -----

(25,733) (46,242)

----- -----

CONDENSED INTERIM STATEMENT OF CASH FLOWS

Six months ended

31 31 December

December 2014

2015

USD'000 USD'000

Unaudited Unaudited

Notes

Operating activities

Profit before tax 5,232 1,462

Adjustments for:

Dividend income (25,733) (46,242)

Impairment losses 77 -

----- -----

(20,424) (44,780)

Change in financial assets at fair value through 13,551 29,146

profit or loss

Change in trade receivables and other assets (6,198) 234

Change in trade payables and other liabilities 152 (621)

Dividends received 12,362 15,650

Net cash inflows from operating activities ----- -----

19,867 44,409

----- -----

Net change in cash and cash equivalents for the (557) (371)

period

Cash and cash equivalents at the beginning of the 6 906 1,311

period

Cash and cash equivalents at the end of the ----- -----

period 6 349 940

----- -----

The condensed interim statement of cash flows does not include payments made

for ordinary share repurchases of USD13.4 million (period ended 31 December

2014: USD30.6 million) because these payments were made by a subsidiary of the

Company.

1 GENERAL INFORMATION

VinaCapital Vietnam Opportunity Fund Limited (the "Company") is a non-cellular

company with limited liability incorporated in Guernsey. The registered office

of the Company is PO Box 255, Trafalgar Court, Les Banques, St Peter Port,

Guernsey, GY1 3QL. The Company's principal activity is to achieve medium to

long-term returns through investment in assets either in Vietnam or in

companies with a substantial majority of their assets, operations, revenues or

income in, or derived from, Vietnam. The Company is quoted on the London Stock

Exchange's Main Market under the ticker symbol VOF.

The Company does not have a fixed life, but the Board considers it desirable

that shareholders should have the opportunity to review the future of the

Company at appropriate intervals. Accordingly, the Board intends that a special

resolution will be proposed every fifth year that the Company ceases to

continue as presently constituted. If the resolution is not passed, the Company

will continue to operate. If the resolution is passed, the Directors will be

required to formulate proposals to be put to shareholders to reorganise,

unitise or reconstruct the Company or for the Company to be wound up. The Board

tabled such special resolutions in 2008 and 2013, each of which was not passed.

This has allowed the Company to continue. The next special resolution on the

continuation of the Company will be held no later than 2018.

The condensed interim financial statements for the six-month period ended 31

December 2015 were approved for issue by the Board on 31 March 2016.

2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

2.1 Basis of preparation

These condensed interim financial statements for the six-month period ended 31

December 2015 have been prepared in accordance with International Accounting

Standard 34, "Interim Financial Reporting" as issued by the International

Accounting Standards Board ("IASB"). They do not include all of the information

required in the annual financial statements which are prepared in accordance

with International Financial Reporting Standards ("IFRS"). Accordingly, these

financial statements are to be read in conjunction with the annual financial

statements of the Company for the year ended 30 June 2015.

2.2 Accounting policies

These condensed interim financial statements (the "interim financial

statements") have been prepared in accordance with the accounting policies,

methods of computation and presentation adopted in the latest financial

statements for the year ended 30 June 2015.

2.3 Subsidiaries and associates

As a result of the adoption, in the year ended 30 June 2015, of the amendments

to IFRS 10, "Consolidated financial statements" ("IFRS 10") and the fair value

option under IAS 28, "Investments in associates and joint ventures" ("IAS 28"),

the Company accounts for its investments in subsidiaries and associates as

financial assets at fair value through profit and loss.

The fair values of a selection of investments in subsidiaries and associates

are assessed such that the fair values of all investments in subsidiaries and

associates are assessed at least once each financial year. The fair values of

the majority of these investments are estimated by a qualified independent

professional services firm, KPMG Limited ("KPMG"). The valuations are prepared

by KPMG using a number of approaches such as adjusted net asset valuations,

discounted cash flows, income-related multiples and price-to-book ratios. These

estimated fair values are used by the Company's Audit and Valuation Committee

("AVC") as the primary basis for estimating each subsidiary's or associate's

fair value.

For interim reporting purposes, the

Board, having taken independent advice, estimated the fair value of the

majority of the Company's subsidiaries and associates which invest in real

estate and private equity by considering the impact of any significant changes

in property valuations, investees' performance and the major assumptions used

in the most recent adopted valuations. The Board, again having taken

independent advice, also determined the valuations of those subsidiaries which

hold investments in listed and unlisted securities based on published closing

prices and broker quotes.

Any gains or losses arising from a change in the fair value of investments in

subsidiaries and associates are recognised in the condensed interim statement

of comprehensive income.

3 CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS

When preparing the condensed interim financial statements, the Company relies

on a number of judgements, estimates and assumptions about recognition and

measurement of assets, liabilities, income and expenses. Actual results may

differ from the judgements, estimates and assumptions.

Information about significant judgements, estimates and assumptions which have

the greatest effect on the recognition and measurement of assets, liabilities,

income and expenses were the same as those that applied to the last annual

financial statements for the year ended 30 June 2015.

3.1 Eligibility to qualify as an investment entity

The Board has determined that it continues to be an investment entity under the

definition in IFRS 10 as it meets the following criteria:

(a) the Company has obtained funds from investors for the purpose of providing

those investors with investment management services;

(b) the Company's business purpose is to invest funds solely for returns from

capital appreciation, investment income or both; and

(c) the performance of investments made by the Company are substantially

measured and evaluated on a fair value basis.

The Company also meets the typical characteristics of an investment entity:

· it holds more than one investment;

· it has more than one investor;

· it has investors that are not its related parties; and

(MORE TO FOLLOW) Dow Jones Newswires

March 31, 2016 09:12 ET (13:12 GMT)

· it has ownership interests in the form of equity or similar interests.

As a consequence, the Company does not consolidate its subsidiaries and

accounts for them at fair value through profit or loss.

3.2 Fair value of subsidiaries and associates and their underlying

investments

As at 31 December 2015, 100% (30 June 2015: 100%) of the financial assets at

fair value through profit and loss relate to the Company's investments in

subsidiaries and associates that have been fair valued in accordance with the

policies set out above. The Company has investments in a number of subsidiaries

and associates which were established to hold underlying investments. The

shares of the subsidiaries and associates are not publicly traded; return of

capital to the Company can only be made by divesting the subsidiaries and

associates or the underlying investments held by the subsidiaries and

associates. As a result, the carrying values of subsidiaries and associates may

not be indicative of the value ultimately realised on divestment.

The underlying investments include listed and unlisted securities, private

equity and real estate assets. Where an active market exists (for example, for

listed securities), the fair value of the subsidiary or associate reflects the

asset value of the underlying holdings. Where no active market exists,

valuation techniques are used.

As at 31 December 2015 and 30 June 2015, the Company classifies its investments

in subsidiaries and associates as Level 3 within the fair value hierarchy,

because they are held by subsidiaries and associates which are not publicly

traded, even when the underlying assets are readily realisable.

The fair value of the investments in subsidiaries and associates is primarily

based on their net asset values. The estimated fair values provided by KPMG and

/or the Investment Manager are used by the AVC as the primary basis for

estimating each investment's fair value for recommendation to the Board.

Information about the significant judgements, estimates and assumptions that

are used in the valuation of these investments is discussed below.

(a) Valuation of assets that are traded in an active market

The fair values of listed securities are based on quoted market prices at the

close of trading on the reporting date. For unlisted securities which are

traded in an active market, fair value is the average of the quoted prices at

the close of trading obtained from a minimum sample of three reputable

securities companies at the reporting date. Other relevant measurement bases

are used if broker quotes are not available or if better and more reliable

information is available.

(b) Valuation of assets that are not traded in an active market

The fair values of assets that are not traded in an active market (for example,

private equity and real estate where market prices are not readily available)

are determined by using valuation techniques. KPMG and/or the Investment

Manager uses its judgement to select a variety of methods and makes assumptions

that are mainly based on market conditions existing at each reporting date.

Independent valuations are also obtained from appropriately qualified

independent valuation firms. The valuations may vary from the actual prices

that would be achieved in an arm's length transaction at the reporting date.

Valuation of investments in private equity

The Company's private equity holdings are fair valued using the discounted cash

flow and market comparison methods. The projected future cash flows are driven

by management's business strategies and goals and its assumptions of growth in

gross domestic product ("GDP"), market demand, inflation, etc. KPMG and/or the

Investment Manager uses discount rates that reflect the uncertainty of the

amount and timing of the cash flows.

Depending on the development stage of a business and its associated risks, KPMG

uses discount rates ranging from 18% to 30% and terminal growth rates of 3% to

6% (30 June 2015: 25% to 30% and 5% to 6%, respectively). As at 31 December

2015 and 30 June 2015, if the discount rates had been higher/lower, the fair

value of the Company's private equity investments would have declined/risen. If

the terminal growth rates had been higher/lower, these investments' fair value

would have increased/decreased.

Valuation of real estate and hospitality investments

A number of the Company's real estate investments are co-invested with VinaLand

Limited ("VNL"), another fund managed by the Investment Manager. In most cases,

VNL holds a controlling stake in the joint venture companies and therefore

exerts control over the investments. There are no shareholder agreements in

place for these investments but as both funds are managed by the same

Investment Manager, the funds' investment objectives for each property are

similar. However, given that VNL has an investment objective of disposing of a

significant portion of its portfolio, the Company could potentially be put in a

position where sales may be triggered earlier than ideally desired. The Board

would expect the Company to fully participate in any sales of jointly held

investments and under normal circumstances is not prepared to assume the

development risk that would result from continuing to hold an investment which

VNL is selling.

The estimated values of underlying real estate properties are based

on valuations by qualified independent professional valuers including Coldwell

Banker Richard Ellis, Savills, Jones Lang LaSalle, Cushman & Wakefield and HVS.

These valuations are based on certain assumptions which are subject to

uncertainty and might materially differ from the actual results of a sale. The

estimated fair values provided by the independent professional real estate

appraisers are used by KPMG and/or the Investment Manager as the primary basis

for estimating fair value of the Company's subsidiaries and associates that

hold these properties in accordance with accounting policies set out in section

2.3 above.

In conjunction with making its judgement for the fair value of the Company's

underlying real estate and hospitality investments, KPMG and/or the Investment

Manager considers information from a variety of sources including:

a. current prices in an active market for properties of different nature,

condition or location (or subject to different lease or other contracts),

adjusted to reflect those differences;

b. recent prices of similar properties in less active markets, with

adjustments to reflect any changes in economic conditions since the date of the

transactions that occurred at those prices;

c. recent developments and changes in laws and regulations that might affect

zoning and/or the Company's ability to exercise its rights in respect to

properties and therefore fully realise the estimated values of such properties;

d. discounted cash flow projections based on estimates of future cash flows,

derived from the terms of external evidence such as current market rents,

occupancy and room rate, and sales prices for similar properties in the same

location and condition, and using discount rates that reflect current market

assessments of the uncertainty in the amount and timing of the cash flows; and

e. recent compensation prices made public by the local authority at the

province where the property is located.

As at 31 December 2015, the discount rates used ranged from 15% to 21.5% (30

June 2015: 15% to 21.5%). At the year end, if the discount rates had been

higher/lower, the fair value of the Company's underlying real estate and

hospitality investment would have been decreased/increased.

The average occupancy and room rate used in the discounted cash flow projection

for the Company's hospitality investment are 69% and USD235 (30 June 2015: 69%

and USD235, respectively). At 31 December 2015, if the average occupancy and

room rate had been higher/lower, the fair value of the Company's underlying

hospitality investment would have risen/declined.

4 SEGMENT ANALYSIS

In identifying its operating segments, the Investment Manager follows the

subsidiaries' sectors of investment which are based on internal management

reporting information. The operating segments by investment portfolio include

capital markets, real estate and hospitality, private equity and cash

(including cash and cash equivalents, bonds, and short-term deposits) sectors.

Each of the operating segments are managed and monitored individually by the

Investment Manager as each requires different resources and approaches. The

Investment Manager assesses segment profit or loss using a measure of operating

profit or loss from the underlying investment assets of the subsidiaries.

Expenses and liabilities which are common to all segments are allocated based

on each segment's share of total assets. There have been no changes from prior

periods in the measurement methods used to determine reported segment profit or

loss.

Segment information can be analysed as follows:

Statement of Comprehensive Income

Capital Real Private

markets estate and equity Total

hospitality

USD'000 USD'000 USD'000 USD'000

Six months ended 31 December 2015

Dividend income 25,733 - - 25,733

Net (losses)/gains on fair value of (17,518) 4,144 (177) (13,551)

financial assets at fair value

through profit or loss

General and administration expenses (4,974) (1,658) (437) (7,069)

Other income 196 - - 196

Impairment loss - (77) - (77)

----- ----- ---- -----

(MORE TO FOLLOW) Dow Jones Newswires

March 31, 2016 09:12 ET (13:12 GMT)

Profit before tax 3,437 2,409 (614) 5,232

----- ----- ---- -----

Six months ended 31 December 2014

Dividend income 46,242 - - 46,242

Net (losses)/gains on financial (34,839) (289) 5,982 (29,146)

assets at fair value through

profit or loss

General and administration (13,629) (1,580) (425) (15,634)

expenses

----- ----- ----- -----

Profit before tax (2,226) (1,869) 5,557 1,462

---- ---- ---- -----

Balance Sheet

Assets

Capital Real

markets estate and Private Cash Total

hospitality equity

USD'000 USD'000 USD'000 USD'000 USD'000

As at 31 December 2015

Cash and cash - - - 349 349

equivalents

Short-term receivables 196 - - - 196

from related parties

Trade and other 4,697 6,384 - - 11,081

receivables

Financial assets at 465,914 182,023 51,079 - 699,016

fair value through

profit or loss

Prepayments for 5,115 - 5,115

acquisitions of - -

investment properties

------ ------ ----- ----- ------

Total assets 470,807 193,522 51,079 349 715,757

------ ------ ----- ----- ------

Payables to related 4,254 238 63 - 4,555

parties

Accruals and other 472 162 43 - 677

payables

------ ------ ----- ----- ------

Total liabilities 4,726 400 106 - 5,232

------ ------ ----- ----- ------

Net asset value 466,081 193,122 50,973 349 710,525

------ ------ ----- ----- ------

As at 30 June 2015

Cash and cash - - - 906 906

equivalents

Short-term receivables 382 - - - 382

from related parties

Trade and other 4,697 - - - 4,697

receivables

Financial assets at 476,054 185,257 51,256 - 712,567

fair value through

profit or loss

Prepayments for - 5,192 - 5,192

acquisitions of -

investment properties

------ ------ ----- ----- ------

Total assets 481,133 190,449 51,256 906 723,744

------ ------ ----- ----- ------

Payables to related 4,580 456 - - 5,036

parties

Other payables 44 - - - 44

------ ------ ----- ----- ------

Total liabilities 4,624 456 - - 5,080

------ ------ ----- ----- ------

Net asset value 476,509 189,993 51,256 906 718,664

------ ------ ----- ----- ------

5 INTERESTS IN SUBSIDIARIES AND ASSOCIATES

5.1 Subsidiaries

The Company had the following significant subsidiaries as at 31 December 2015

and 30 June 2015:

As at

31.12.2015 30.6.2015

Country of % of % of Nature of the business

incorporation Company Company

Name interest interest

Vietnam Investment Property BVI 100 100

Holding Limited Holding company for listed,

unlisted securities and real

estate

Vietnam Investment Property BVI 100 100 Holding company for listed,

Limited and unlisted securities

Vietnam Ventures Limited BVI 100 100 Holding company for listed,

unlisted securities and real

estate

Vietnam Investments Limited BVI 100 100 Holding company for listed,

unlisted securities and real

estate

Asia Value Investment BVI 100 100 Holding company for listed,

Limited and unlisted securities

Vietnam Master Holding 2 BVI 100 100 Holding company for listed

Limited securities

VOF Investment Limited BVI 100 100 Holding company for listed,

unlisted securities and real

estate

VOF PE Holding 5 Limited BVI 100 100 Holding company for listed

securities

Visaka Holding Limited BVI 100 100 Holding company for treasury

shares

Portal Global Limited BVI 100 100 Holding company for listed

securities

Winstar Resources Limited BVI 100 100 Holding company for listed

securities

Indotel Limited Singapore 100 100 Holding company for hospitality

AllwealthWorldwide Limited Singapore 100 100 Holding company for private

equity

Fraser Investment Pte. Singapore 100 100 Holding company for listed

Limited securities

SE Asia Master Holding 7 Pte Singapore 100 100 Holding company for private

Limited equity

Alright Assets Limited Singapore 100 100 Holding company for real estate

VTC Espero Limited Singapore 100 100 Holding company for real estate

Howard Holdings Pte Limited Singapore 80.6 80.6 Holding company for private

equity

Indochina Ceramic Singapore Singapore 100 100 Holding company for private

Pte Limited equity

American Home Vietnam Co., Vietnam 100 100 Ceramic tiles

Limited

Yen Viet Joint Stock Company Vietnam 65 65 Birdnest products

International Dairy Products Vietnam 56 56 Dairy products

Joint Stock Company ("IDP")

---- ----

There is no legal restriction on the transfer of funds from the BVI or

Singapore subsidiaries to the Company. Cash held in Vietnamese subsidiaries is

subject to restrictions imposed by co-investors and the Vietnamese government

and therefore cannot be transferred out of Vietnam unless such restrictions are

satisfied.

5.2 Associates

As at

31.12.2015 30.6.2015

Name Country of % of % of Nature of the

incorporation Company Company business

interest interest

Pacific Alliance Land BVI 25 25 Holding company for

Limited

VinaSquare project

Sunbird Group Limited BVI 25 25 Holding company for

Pham Hung project

VinaCapital Danang Resorts BVI 25 25 Holding company for

Limited

Danang Resorts project

Vietnam Property Holdings BVI 25 25 Holding company for

Limited

Danang Golf project

Prosper Big Investment BVI 25 25 Holding company for

Limited

Century 21 project

VinaCapital Commercial Singapore 12.75 12.75 Holding company for

Center

Private Limited Capital Square phase 1

(MORE TO FOLLOW) Dow Jones Newswires

March 31, 2016 09:12 ET (13:12 GMT)

Mega Assets Pte. Limited Singapore 25 25 Holding company for

Capital Square phase 2

SIH Real Estate Pte. Singapore 25 25 Holding company for

Limited

Capital Square phase 3

VinaLand Eastern Limited Singapore 25 25 Holding company for

Phu Hoi City project

---- ----

The Company's real estate associates have commitments under investment

certificates which they have received for real estate projects jointly invested

with VNL (refer to Note 23).

5.3 Financial risks

The Company owns a number of subsidiaries for the purpose of holding

investments in listed and unlisted securities, debt instruments, private equity

and real estate. The Company, via these underlying investments, is subject to

financial risks which are further disclosed in Note 24. The Investment Manager

makes investment decisions after performing extensive due diligence on the

underlying investments, their strategies, financial structure and the overall

quality of management.

6 CASH AND CASH EQUIVALENTS

31 December 30 June

2015 2015

USD'000 USD'000

Cash in banks 349 906

----- -----

As at the balance sheet date, cash and cash equivalents are denominated in US

dollars ("USD"). Please refer to Note 9 for the balance of cash and cash

equivalents held at the Company's subsidiaries.

7 TRADE AND OTHER RECEIVABLES

31 December 30

2015 June 2015

USD'000 USD'000

Receivables from disposal of investments 11,081 4,697

----- -----

8 FINANCIAL INSTRUMENTS BY CATEGORY

Financial

assets at fair

Loans and value through

receivables profit or loss Total

USD'000 USD'000 USD'000

As at 31 December 2015

Cash and cash equivalents 349 - 349

Short-term receivables from 196 - 196

related parties

Trade and other receivables 11,081 - 11,081

Financial assets at fair value 699,016

through profit or loss - 699,016

------ ------- -------

Total 11,626 699,016 710,642

----- ------ ------

Financial assets denominated in:

- USD 11,626 699,016 710,642

----- ------ ------

As at 30 June 2015

Cash and cash equivalents 906 - 906

Short-term receivables from a 382 - 382

related party

Trade and other receivables 4,697 - 4,697

Financial assets at fair value - 712,567 712,567

through profit or loss

------ ------ -------

Total 5,985 712,567 718,552

------ ------ ------

Financial assets denominated in:

- USD 5,985 712,567 718,552

------ ------- -------

All financial liabilities are short term in nature and their carrying values

approximate their fair values. There are no financial liabilities that must be

accounted for at fair value through profit or loss (30 June 2015: nil).

9 FINANCIAL ASSETS AT FAIR VALUE

THROUGH PROFIT OR LOSS

Financial assets at fair value through profit and loss comprise the Company's

investments in subsidiaries and associates. The underlying assets and

liabilities of the subsidiaries and associates carried at fair value are

disclosed in the following table:

31 December 30 June

2015 2015

USD'000 USD'000

In Vietnam

Cash and cash equivalents 30,200 22,752

Ordinary shares - listed 349,926

376,453

Ordinary and preference shares - unlisted and 70,215

over-the- counter ("OTC") 63,810

Private equity 51,079 51,256

Real estate and hospitality companies 170,335 168,776

Other assets, net of liabilities 920 4,755

------- -------

672,675 687,802

In countries other than Vietnam

Ordinary shares - listed 26,341 24,765

------- -------

699,016 712,567

------ ------

The sectors of the major underlying investments held by the Company's

subsidiaries are as follows:

31 December 30 June

2015 2015

USD'000 USD'000

Consumer goods 193,524 175,391

Construction 75,921 94,341

Financial services 42,120 52,991

Agriculture 21,411 22,056

Energy, minerals and petroleum 32,804 58,153

Pharmaceuticals 18,745 21,356

Real estate and hospitality companies 266,743 257,491

Infrastructure 10,546 5,860

As at 31 December 2015, an underlying holding, Vietnam Dairy Products Joint

Stock Company, usually referred to as Vinamilk, within financial assets at fair

value through profit or loss amounted to 15% of the net asset value of the

Company (30 June 2015: 11%). There were no other holdings that had a value

exceeding 10% of the net asset value of Company as at

31 December 2015 or 30 June 2015.

10 PREPAYMENTS FOR

ACQUISITION OF INVESTMENT PROPERTIES

31 December 2015 30 June 2015

USD'000 USD'000

Historical cost 8,986 8,986

Less: cumulative allowance for impairment (3,871) (3,794)

loss

---- ----

5,115 5,192

---- ----

Movements in the allowance for impairment during the period/year are as below:

31 December 2015 30 June 2015

USD'000 USD'000

Opening balance (1 July 2015/1 July 2014) 3,794 2,736

Charge for the period/year 77 1,058

---- ----

Closing balance 3,871 3,794

---- ----

A prepayment was made by the Company to a property vendor in 2007 and 2008. The

final transfer of the property is pending the approval of the relevant

authorities and subject to the completion of certain performance conditions set

out in the relevant agreement. As at 31 December 2015, due to market

conditions, an impairment charge of USD0.1 million (year ended 30

June 2015: USD1.1 million) has been taken against this prepayment. The

recoverable amount is the fair value less costs to sell estimated by the Board

based on a 31 December 2015 valuation performed by a qualified independent

professional property valuer (refer to Note 3.2 (b)).

The valuation is prepared based on the expected future discounted cash flows of

the property using a yield that reflects the risks inherent therein. The

discount rate applied is 20% (30 June 2015: 20%). If a higher or lower discount

rate had been used the estimated recoverable amount would have decreased/

increased as a result. It is the Board's view that this prepayment should be

classified as Level 3 in the fair value hierarchy.

11 SHARE CAPITAL

(MORE TO FOLLOW) Dow Jones Newswires

March 31, 2016 09:12 ET (13:12 GMT)

31 December 2015 30 June 2015

Number of USD'000 Number of USD'000

ordinary ordinary

shares shares

Ordinary shares of

USD0.01 each:

Authorised 500,000,000 5,000 500,000,000 5,000

-------- ---- -------- ----

Issued and fully paid 214,521,612 2,145 324,610,259 3,246

-------- ---- -------- ----

12 ADDITIONAL PAID-IN CAPITAL

Additional paid-in capital represents the excess of consideration received over

the par value of ordinary shares issued.

31 December 2015 30 June 2015

USD'000 USD'000

Opening balance (1 July 2015/1 July 2014) 722,064 722,064

Ordinary shares cancelled (Note 13) (225,553) -

------- -------

Closing balance 496,511 722,064

------ ------

13 TREASURY SHARES

31 December 2015 30 June 2015

Number of USD'000 Number of USD'000

ordinary ordinary

shares shares

Opening balance (1 July

2015/

1 July 2014) 104,652,647 213,283 86,355,265 165,939

Ordinary shares 5,436,000 13,371 18,297,382 47,344

repurchased during the

period/year

Cancellation of treasury (110,088,647) (226,654) - -

shares

-------- ------ -------- ------

Closing balance - - 104,652,647 213,283

-------- ------ -------- ------

During the period, the Company purchased 5,436,000 of its ordinary shares (year

ended 30 June 2015: 18,297,382 ordinary shares) for total cash consideration of

USD13.4 million (year ended 30 June 2015: USD47.3 million). The consideration

was paid with cash from one of the Company's subsidiaries. All purchases had

been fully settled by the balance sheet dates.

In anticipation of the plan to move the Company's trading platform from the AIM

market to a premium listing on the Main Market of the London Stock Exchange,

all of the ordinary shares held in treasury were cancelled. Following the

cancellation, the total number of ordinary shares in issue and total voting

rights is 214,521,612.

The Company will continue with the ordinary share repurchase programme approved

by the Board on 25 October 2011. Any ordinary shares purchased as part of the

ordinary share repurchase activities may be held in treasury up to a limit of

10% of ordinary shares in issue.

14 PAYABLES TO RELATED PARTIES

31 December 30 June

2015 2015

USD'000 USD'000

Management fees payable to the Investment 883 938

Manager (Note 22)

Incentive fees payable to the Investment 3,672 3,672

Manager (Note 22)

Other payables to related parties - 426

----- -----

4,555 5,036

---- ----

All payables to related parties are short-term in nature. Therefore, their

carrying values are considered a reasonable approximation of their fair values.

15 DIVIDEND INCOME

31 December 31 December

2015 2014

USD'000 USD'000

Dividend income from a subsidiary used 13,371 30,592

to pay for the Company's ordinary

share repurchases (*)

Dividend income from a subsidiary used 12,362 15,650

to pay for the Company's operating

expenses

------ ------

25,733 46,242

----- -----

(*) This dividend income was settled by the subsidiary's payments on the

Company's behalf for its ordinary share repurchases.

As cash was transferred out of the subsidiary as settlement for the dividend

income, the subsidiary's fair value decreased, resulting in losses on financial

assets at fair value through profit or loss as described in Note 16.

16 NET LOSSES FROM FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR

LOSS

Six months ended

31 December 31 December

2015 2014

USD'000 USD'000

Financial assets at fair value through profit or

loss:

- Gains from the realisation of financial 2,053 114

assets, net

- Unrealised losses (15,604) (29,260)

------ ------

(13,551) (29,146)

----- -----

The above net losses of USD13.6 million (period ended 31 December

2014: USD29.2 million) on financial assets at fair value through profit or loss

include dividend and interest income of

USD11.0 million earned by the Company's subsidiaries during the period (period

ended 31 December 2014: USD17.1 million). The net losses also include total

payments of USD13.4 million which a subsidiary paid for ordinary share

repurchases made during the period (period ended 31 December 2014: USD30.5

million) as explained in Note 15. Also included in these losses were this

subsidiary's dividend payments of USD12.3 million to the Company to cover its

operating expenses (period ended 31 December 2014: USD15.7 million).

17 GENERAL AND ADMINISTRATION EXPENSES

Six months ended

31 December 31 December

2015 2014

USD'000 USD'000

Management fees (Note 22(a)) 5,233 6,007

Incentive fees (Note 22(b)) - 8,360

Directors' fees 173 205

Custodian, secretarial and other professional 721 769

fees

Listing expenses 898 -

Others 44 293

---- -----

7,069 15,634

---- ----

18 INCOME TAX EXPENSE

The Company is incorporated in Guernsey. Prior to 23 March 2016, the Company

was a company with limited liability in the Cayman Islands. Under the current

laws of Guernsey or the Cayman Islands, there are no income, state,

corporation, capital gains or other taxes payable by the Company in Guernsey

and the Cayman Islands.

A number of subsidiaries are established in Vietnam and Singapore and are

subject to corporate income tax in those countries. The income tax payable by

these subsidiaries is included in their fair values as disclosed in the line

item "Financial assets at fair value through profit or loss" on the balance

sheet.

The relationship between the estimated income tax expense based on the

applicable income tax rate of 0% and the tax expense actually recognised in the

condensed interim statement of income can be reconciled as follows:

Six months ended

31 December 31 December

2015 2014

USD'000 USD'000

Profit before tax 5,232 1,462

----- -----

Applicable tax rate 0% 0%

----- -----

Income tax - -

----- -----

There is no deferred income tax.

19 EARNINGS PER SHARE AND NET ASSET VALUE PER SHARE

(a) Basic

Basic earnings per share is calculated by dividing the profit from operations

of the Company by the weighted average number of ordinary shares in issue

during the six-month period excluding ordinary shares purchased by the Company

and held as treasury shares (Note 13).

Six months ended

(MORE TO FOLLOW) Dow Jones Newswires

March 31, 2016 09:12 ET (13:12 GMT)

31 December 31 December

2015 2014

USD'000 USD'000

Profit for the period (USD'000) 5,232 1,462

Weighted average number of ordinary shares 217,387,194 233,572,409

in issue

Basic earnings per share (USD per share) 0.02 0.01

-------- --------

(b) Diluted

Diluted earnings per share is calculated by adjusting the weighted average

number of ordinary shares outstanding to assume conversion of all dilutive

potential ordinary shares. The Company has no category of potentially dilutive

ordinary shares. Therefore, diluted earnings per share is equal to basic

earnings per share.

(c) Net asset value per share

Net Asset Value ("NAV") per share is calculated by dividing the NAV of the

Company by the number of outstanding ordinary shares in issue as at the

reporting date excluding ordinary shares purchased by the Company and held as

treasury shares (Note 13). NAV is determined as total assets less total

liabilities.

As at 31 December As at 30 June

2015 2015

Net asset value (USD'000) 710,525 718,664

Number of outstanding ordinary shares on 214,521,612

issue 219,957,612

Net asset value per share (USD/share) 3.31 3.27

--------- ---------

20 SEASONALITY

The Board believes that the impact of seasonality on the condensed interim

financial information is not material.

21 DIRECTORS' REMUNERATION

The aggregate directors' fees for the six-month period amounted to USD172,500

(six months ended 31 December 2014: USD204,944), of which there was no

outstanding amount payable at the reporting date (30 June 2015: nil).

The remuneration of each director is summarised below:

Six months ended

31 December 31 December

2015 2014

USD USD

Steven Bates 47,500 47,500

Martin Adams 40,000 40,000

Martin Glynn (*) - 32,444

Michael Gray 45,000 45,000

Bich Thuy Dam 40,000 40,000

------- -------

172,500 204,944

------- -------

(*) Martin Glynn retired on 27 November 2014.

22 RELATED PARTIES

(a) Management fees

Under an amended and restated investment management agreement dated 24 June

2013 which became effective as of 1 July 2013 (the "Amended Management

Agreement"), the Investment Manager receives a fee at an annual rate of 1.5% of

the NAV, payable monthly in arrears.

Total investment management fees for the six-month period amounted to USD5.2

million (31 December 2014: USD6 million), with USD0.8 million (31 December

2014: USD1 million) in outstanding accrued fees due to the Investment Manager

at the reporting date.

(b) Incentive fee

Under the Amended Management Agreement dated 24 June 2013 and the latest

amendment dated 15 October 2014, from 1 July 2013 the incentive fee was changed

to be 15% of the increase in NAV per share over a hurdle rate of 8% per annum.

A catch up is no longer applied. Furthermore, for the purposes of calculating

incentive fees, the Company's net assets are segregated into a Direct Real

Estate Portfolio and a Capital Markets Portfolio. Ordinary shares bought back

by the Company shall be treated as distributions, with the purchase amounts

allocated to each portfolio subtracted from the relevant portfolio as an

adjustment to the high water mark per share. A separate incentive fee is

calculated for each portfolio so that for any balance sheet date it will be

possible for an incentive fee to become payable in relation to one, both, or

neither, portfolio depending upon the performance of each portfolio. However,

the maximum incentive fee that can be paid in any given year in respect to a

portfolio is 1.5% of the NAV of that portfolio at the balance sheet date. Any

incentive fees earned in excess of the cap may be paid out in subsequent years

providing that certain performance targets are met.

There is a difference of interpretation between the Company and the Investment

Manager about certain provisions of the investment management agreement

relating to the incentive fee. The Board has taken independent legal advice on

the matter. In order to avoid the costs and financial uncertainty of recourse

to a legal solution, the Board and the Investment Manager agreed that the

incentive fee payable for the year ended 30 June 2015 is USD3.7 million, which

has been fully settled. The Investment Manager and the Board have agreed in

principle that the investment management agreement will be amended before 30

June 2016 to reduce the possibility of differences of interpretation in the

future. No incentive fee has been accrued on the Company's performance for the

six month period ended 31 December 2015 as the Board and the Investment Manager

do not expect that any incentive fee will have become payable during the period

under the contemplated revised terms of the Amended Management Agreement.

(c) Other balances with related parties

31 December 30 June

2015 2015

USD'000 USD'000

Receivable from the Investment Manager for investment 196 382

management fees rebated back to the Company (*)

--- ---

Payable to the Investment Manager for expenses paid on - 426

behalf of the Company

--- ---

Investments in other investment funds managed by the

Investment Manager, held by a subsidiary of the

Company:

- Vietnam Infrastructure Limited ("VNI") 3,969 5,860

- VNL 22,364 18,698

----- -----

26,333 24,558

----- -----

(*) This receivable pertains to investment management fees earned by the

Investment Manager on the Company's investments in VNL and VNI which are

rebated by the Investment Manager to the Company. These rebates are recognised

as other income in the statement of comprehensive income.

23 COMMITMENTS

The Company's real estate associates have a broad range of commitments under

investment certificates which have been received for real estate projects

jointly invested with VNL (Note 3.2 (b)). The Company's share of these

commitments is approximately USD8.5 million (30 June 2015: USD11.5 million).

Further investments in these arrangements are at the Company's discretion.

24 FINANCIAL RISK MANAGEMENT

(a) Financial risk factors

The Company's activities expose it to a variety of financial risks: market risk

(including currency risk, fair value interest rate risk, cash flow interest

rate risk and price risk), credit risk and liquidity risk.

The condensed interim financial statements do not include all financial risk

management information and disclosures required in the annual financial

statements; they should be read in conjunction with the Company's annual

financial statements as at 30 June 2015.

There have been no significant changes in the management of risk or in any risk

management policies since the last balance sheet date.

(b) Fair value estimation

The table below analyses financial instruments carried at fair value, by

valuation method. The different levels have been defined as follows:

· Level 1: Quoted prices (unadjusted) in active markets for identical

assets or liabilities;

· Level 2: Inputs other than quoted prices included within Level 1 that

are observable for the asset or liability, either directly (that is, as prices)

or indirectly (that is, derived from prices); and

· Level 3: Inputs for the asset or liability that are not based on

observable market data (that is, unobservable inputs).

There are no financial liabilities of the Company which were measured using the

fair valuation method as at 30 June 2015 and 31 December 2015.

The level into which financial assets are classified is determined based on the

lowest level of significant input to the fair value measurement.

Financial assets measured at fair value in the balance sheet are grouped into

the following fair value hierarchy:

Level 3 Total

(MORE TO FOLLOW) Dow Jones Newswires

March 31, 2016 09:12 ET (13:12 GMT)

USD'000 USD'000

As at 31 December 2015

Financial assets at fair value through 699,016 699,016

profit or loss

----- -----

As at 30 June 2015

Financial assets at fair value through 712,567 712,567

profit or loss

------ ------

All of the Company's financial assets at fair value through profit or loss are

classified as Level 3, because they represent the Company's interests in

private entities which hold the Company's underlying investments. If these

investments were held at the Company level, they would be presented as follows:

Level 1 Level 2 Level 3 Total

USD'000 USD'000 USD'000 USD'000

As at 31 December 2015

Cash and cash equivalents 30,200 - - 30,200

Ordinary shares - listed 376,267 - - 376,267

Ordinary and preference shares - - 41,684 28,531 70,215

unlisted

and OTC

Private equity - - 51,079 51,079

Real estate and hospitality - - 170,335 170,335

companies

Other assets, net of liabilities - - 920 920

------ ------ ------ ------

406,467 41,684 250,865

699,016

------ ------ ------ ------

Level 1 Level 2 Level 3 Total

USD'000 USD'000 USD'000 USD'000

As at 30 June 2015

Cash and cash equivalents 22,752 - - 22,752

Ordinary shares - listed 391,459 9,759 - 401,218

Ordinary and preference shares - - 30,438 33,372 63,810

unlisted and OTC

Private equity - - 51,256 51,256

Real estate companies and - - 168,776 168,776

hospitality

Other assets, net of liabilities - - 4,755 4,755

------ ------ ------- -------

414,211 40,197 258,159

712,567

------ ------ ------- -------

Investments whose values are based on quoted market prices in active markets,

and are therefore classified within Level 1, include actively traded equities,

government bonds and private equity investments which have committed prices at

the balance sheet date. The Company does not adjust the quoted price for these

instruments.

Financial instruments which trade in markets that are not considered to be

active but are valued based on quoted market prices and dealer quotations are

classified within Level 2. These include investments in unlisted equities and

over-the-counter ("OTC") equities. As Level 2 investments include positions

that are not traded in active markets, valuations may be adjusted to reflect

illiquidity and/or non-transferability, which are generally based on available

market information. There are no significant adjustments that may result in a

fair value measurement categorised within Level 3.

Private equity, real estate and hospitality investments, and other assets that

do not have an active market are classified within Level 3. The Company uses

valuation techniques to estimate the fair value of these assets based on

significant unobservable inputs such as discount rates, average occupancy and

room rates, etc., as described in Note 3.2.

There were no transfers between the Levels (year ended 30 June 2015: none).

Specific valuation techniques used to value financial instruments include:

* Quoted market prices or dealer quotes;

* Use of discounted cash flow technique to present value the estimated

future cash flows;

* Other techniques, such as latest market transaction price.

Changes in Level 3 financial assets at fair value through profit or loss

The fair value of the Company's investments and associates are estimated using

approaches as described in Note 3.2. As observable prices are not available for

these investments, the Company classifies them as Level 3 fair values.

31 December 30 June

2015 2015

USD'000 USD'000

Opening balance (1 July 2015/1 July 2014) 712,567 768,956

Realised gains 2,053 114

Unrealised losses (15,604) (56,503)

----- -----

Closing balance 699,016 712,567

----- -----

Total unrealised gains for the period/year

included in:

- Profit or loss (15,604) (56,503)

----- -----

(15,604) (56,503)

----- -----

25. SUBSEQUENT EVENTS

At the Extraordinary General Meeting on 27 October 2015 shareholders approved

proposals to migrate the Company from the Cayman Islands to Guernsey and to

move the trading venue for its ordinary shares from the Alternative Investment

Market to the Main Market of the London Stock Exchange. The Company's migration

to Guernsey occurred on 23 March 2016. The Company's ordinary shares were

admitted to trading on the Main Market of the London Stock Exchange on 30 March

2016.

END

(END) Dow Jones Newswires

March 31, 2016 09:12 ET (13:12 GMT)

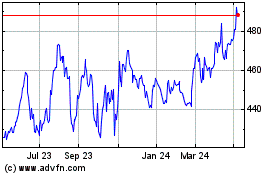

Vinacapital Vietnam Oppo... (LSE:VOF)

Historical Stock Chart

From Mar 2024 to Apr 2024

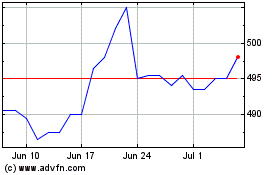

Vinacapital Vietnam Oppo... (LSE:VOF)

Historical Stock Chart

From Apr 2023 to Apr 2024