Company Delivers Improved Financial Performance

as Management Continues to Execute on Strategic Plan

Quarterly Revenues Rose 8%, with Continued

Gains in Filmed Entertainment and Media Networks

Year-to-Date Net Cash Provided by Operating

Activities Increased to $653 Million, Up $253 Million; Operating

Free Cash Flow Grew to $548 Million, Up $228 Million

Viacom Inc. (NASDAQ: VIAB, VIA) today reported financial results

for the third quarter of fiscal 2017 ended June 30, 2017.

Bob Bakish, President and Chief Executive Officer, said, "In the

third quarter, Viacom strengthened its top line, with growth in

advertising and affiliate revenues and gains across its Filmed

Entertainment segment, while continuing to execute on a strategic

plan to reinvigorate our brands, break down silos, deepen our

relationships with business partners and reposition Paramount for

the future.

"Among other recent successes, the Company entered into an

unprecedented distribution and data partnership with Altice USA,

secured a significant cross-platform talent agreement with

award-winning writer, director and actor Tyler Perry and recorded

quarterly year-over-year ratings growth across our Media Networks

portfolio, with strong momentum at our flagship networks, including

MTV. We also further delevered our balance sheet by redeeming over

$1 billion of outstanding debt and completing the sale of our

substantial interest in EPIX.

"Every day we are working hard to reinvent Viacom and revitalize

its brands for the future, and the early, tangible results are

encouraging. There remains much work to be done, but we will

continue to build on this progress for our shareholders, partners

and fans."

FISCAL YEAR 2017 RESULTS

(in millions, except per share amounts)

Quarter Ended June 30, B/(W)

Nine Months Ended June 30, B/(W)

2017 2016

2017 vs. 2016

2017 2016

2017 vs. 2016

GAAP

Revenues

$ 3,364 $ 3,107 8 %

$ 9,944 $

9,262 7 % Operating income

746 769 (3 )

1,784 2,194

(19 ) Net earnings from continuing operations attributable to

Viacom

680 432 57

1,197 1,184 1 Diluted EPS from

continuing operations

1.69 1.09 55

2.99 2.98 —

Non-GAAP*

Adjusted operating income

$ 805 $ 769 5 %

$

2,165 $ 2,194 (1 )% Adjusted net earnings from continuing

operations attributable to Viacom

471 419 12

1,201

1,192 1 Adjusted diluted EPS from continuing operations

1.17

1.05 11

3.00 3.00 —

* Non-GAAP measures referenced in this release are detailed in

the Supplemental Disclosures at the end of this release.

Revenues in the third fiscal quarter increased 8%, or

$257 million, to $3.36 billion, reflecting growth across Filmed

Entertainment and Media Networks segments. Operating income

declined 3% to $746 million, reflecting restructuring and

programming charges of $59 million, principally resulting from the

execution of strategic initiatives at Paramount. Adjusted

operating income rose 5% to $805 million in the quarter. Net

earnings from continuing operations attributable to Viacom grew

57%, or $248 million, to $680 million in the quarter, principally

due to the gain on the sale of the Company's investment in EPIX.

Adjusted net earnings from continuing operations

attributable to Viacom grew 12%, or $52 million, to $471 million,

driven by the increase in tax-effected adjusted operating income.

Diluted earnings per share for the quarter increased

$0.60 to $1.69, and adjusted diluted earnings per share

increased $0.12 to $1.17.

MEDIA NETWORKS

Media Networks revenues grew 2% to $2.56 billion in the

quarter, with affiliate revenues up 4% to $1.19 billion and

advertising revenues up 2% to $1.24 billion. Domestic

revenues were substantially flat at $2.04 billion, and

international revenues increased 8% to $522 million. Excluding

foreign exchange, which had a 5-percentage point unfavorable

impact, international revenues increased 13% in the quarter,

primarily driven by the acquisition of Telefe.

Domestic affiliate revenues increased 4% to $1.01 billion,

principally reflecting higher revenues from SVOD and other OTT

agreements, as well as rate increases, partially offset by a

decline in subscribers. International affiliate revenues increased

1% to $178 million.

Domestic advertising revenues declined 2% to $955 million,

reflecting higher pricing, more than offset by lower impressions.

International advertising revenues grew 14% to $280 million in the

quarter.

Ancillary revenues decreased 9% to $135 million in the

quarter. Domestic ancillary revenues fell 17% to $71 million, while

international ancillary revenues grew 2% to $64 million.

Adjusted operating income for Media Networks was

substantially flat at $870 million in the quarter, primarily

reflecting the increase in revenues offset by an increase in

operating and SG&A expenses.

Performance highlights:

- The Company secured a groundbreaking

partnership with Altice USA, which ensures continued distribution

of Viacom's premiere networks in the Cablevision system, returns

Viacom programming to Suddenlink customers, expands next-generation

branded content offerings for viewers and leverages our

industry-leading advertising products across multiple platforms and

screens.

- Viacom entered a multi-year talent

agreement with Tyler Perry that encompasses television, film,

short-form and digital video. The partnership will bring Perry's

signature brand of storytelling to Viacom's audiences.

- Sequential quarterly improvement in

domestic ad sales revenues and momentum from the U.S. upfront

indicate that the Company's flagship brand strategy and renewed

commitment to partnerships are resonating.

- Under six months of new leadership, MTV

recorded year-over-year ratings growth in June for the first time

since 2011, and claimed four of the top 30 cable series in the

quarter, including a rebooted Fear Factor - the network's highest

rated new series in the last two years.

- BET experienced its strongest June

year-over-year ratings growth in four years, and July was the

network's second consecutive month of year-over-year growth.

- Comedy Central's The Daily Show with

Trevor Noah continued its ratings climb as cable's number-one daily

late night talk show with millennials, recording its highest-rated

and most-watched quarter ever.

- Nickelodeon continued to dominate the

ratings in its major demographics, with 9 of the top 10 shows for

kids 2-11 and four of the top five shows for kids 2-5. It grew

year-over-year ratings by 5% and has remained the number-one kids

network for eight consecutive quarters.

- Revenue weighted share for VIMN’s

portfolio of flagship brands increased 6% internationally, while

Channel 5 outperformed the market and grew share for a sixth

straight quarter. The successful integration of Telefe continued as

the network maintained its strong market leadership in

Argentina.

FILMED ENTERTAINMENT

Filmed Entertainment revenues grew 36% to $847 million,

reflecting continued increases across all revenue streams. Domestic

revenues rose 19% to $388 million in the quarter, while

international revenues increased 56% to $459 million.

Theatrical revenues increased 189% to $263 million, with

revenues from current quarter releases up 199% compared to revenues

from releases in the third quarter of fiscal 2016. The growth in

theatrical revenues was primarily driven by the release of

Transformers: The Last Knight. Domestic theatrical revenues rose

85%, while international theatrical revenues increased 296%.

Licensing revenues rose 1% to $300 million in the

quarter. Domestic licensing revenues decreased 9% due to the mix of

titles available in the pay-TV window, while international

licensing revenues grew 7%, reflecting higher revenues from

arrangements with SVOD distributors.

Home entertainment revenues increased 14% to $218

million, primarily reflecting catalog distribution revenues, as

domestic and international revenues increased 6% and 33%,

respectively.

Ancillary revenues grew 61% to $66 million. Domestic

ancillary revenues increased 77% in the quarter, while

international ancillary revenues rose 10%.

Filmed Entertainment reported adjusted operating

income of $9 million in the quarter compared to an adjusted

operating loss of $26 million in the prior year quarter, an

improvement of $35 million. The improvement principally reflected

the various revenue increases, partially offset by higher operating

expenses.

Performance highlights:

- In June, Paramount announced the

establishment of Paramount Players, a new production division that

will develop, produce and market feature films in collaboration

with Viacom's flagship brands. AwesomenessTV founder Brian Robbins

will lead the division as President.

- The studio recently named accomplished

filmmaker and producer Mireille Soria as President of Paramount

Animation to oversee the group's operations and work with Viacom's

teams to guide the creative development and production of its

animated feature slate.

- Transformers: The Last Knight opened to

number one in the U.S. and in 53 markets internationally, including

China.

- Paramount TV continued to strengthen

its portfolio, with 16 shows ordered to production and over 50

projects in development. Remaining fiscal 2017 releases include new

seasons of Shooter, Berlin Station and Nickelodeon's School of

Rock, which was recently nominated for a Primetime Emmy for

Outstanding Children's Program.

BALANCE SHEET AND LIQUIDITY

In the quarter, the Company continued to implement its plan to

strengthen its balance sheet, reduce leverage and enhance

liquidity, redeeming over $1.0 billion of senior notes and

debentures, and executing on the sale of our stake in EPIX. At

June 30, 2017, total debt outstanding was $11.17 billion,

compared with $11.91 billion at September 30, 2016.

The Company’s cash balance was $425 million at June 30,

2017, an increase from $379 million at September 30, 2016. In

the nine months, net cash provided by operating activities

increased $253 million, or 63%, to $653 million, free cash flow

increased $195 million, or 61%, to $515 million and operating free

cash flow increased $228 million, or 71%, to $548 million.

About Viacom

Viacom is home to premier global media brands that create

compelling television programs, motion pictures, short-form

content, apps, games, consumer products, social media experiences,

and other entertainment content for audiences in more than 180

countries. Viacom's media networks, including Nickelodeon, Comedy

Central, MTV, VH1, Spike, BET, CMT, TV Land, Nick at Nite, Nick

Jr., Logo, Nicktoons, TeenNick, Channel 5 (UK), Telefe (Argentina)

and Paramount Channel, reach over 3.9 billion cumulative television

subscribers worldwide. Paramount Pictures is a major global

producer and distributor of filmed entertainment. Paramount

Television develops, finances and produces programming for

television and other platforms.

For more information about Viacom and its businesses, visit

www.viacom.com. Viacom may also use social media channels to

communicate with its investors and the public about the company,

its brands and other matters, and those communications could be

deemed to be material information. Investors and others are

encouraged to review posts on Viacom’s company blog

(blog.viacom.com), Twitter feed (twitter.com/viacom) and Facebook

page (facebook.com/viacom).

Cautionary Statement Concerning Forward-Looking

Statements

This news release contains both historical and forward-looking

statements. All statements that are not statements of historical

fact are, or may be deemed to be, forward-looking statements.

Forward-looking statements reflect our current expectations

concerning future results, objectives, plans and goals, and involve

known and unknown risks, uncertainties and other factors that are

difficult to predict and which may cause future results,

performance or achievements to differ. These risks, uncertainties

and other factors include, among others: the effect of recent

changes in management and our board of directors; the ability of

our recently-announced strategic initiatives to achieve their

operating objectives; the public acceptance of our brands,

programs, motion pictures and other entertainment content on the

various platforms on which they are distributed; the impact of

inadequate audience measurement on our program ratings and

advertising and affiliate revenues; technological developments and

their effect in our markets and on consumer behavior; competition

for content, audiences, advertising and distribution; the impact of

piracy; economic fluctuations in advertising and retail markets,

and economic conditions generally; fluctuations in our results due

to the timing, mix, number and availability of our motion pictures

and other programming; the potential for loss of carriage or other

reduction in the distribution of our content; changes in the

Federal communications or other laws and regulations; evolving

cybersecurity and similar risks; other domestic and global

economic, business, competitive and/or regulatory factors affecting

our businesses generally; and other factors described in our news

releases and filings with the Securities and Exchange Commission,

including but not limited to our 2016 Annual Report on Form 10-K

and reports on Form 10-Q and Form 8-K. The forward-looking

statements included in this document are made only as of the date

of this document, and we do not have any obligation to publicly

update any forward-looking statements to reflect subsequent events

or circumstances. If applicable, reconciliations for any non-GAAP

financial information contained in this news release are included

in this news release or available on our website at

http://www.viacom.com.

VIACOM INC.

CONSOLIDATED STATEMENTS OF

EARNINGS

(Unaudited)

Quarter Ended June 30,

Nine Months Ended June 30, (in millions, except per

share amounts)

2017 2016 2017

2016 Revenues

$ 3,364 $ 3,107

$

9,944 $ 9,262 Expenses: Operating

1,788 1,575

5,551 4,822 Selling, general and administrative

756

708

2,205 2,080 Depreciation and amortization

53 55

167 166 Restructuring

21 —

237

— Total expenses

2,618 2,338

8,160

7,068 Operating income

746 769

1,784 2,194 Interest

expense, net

(155 ) (156 )

(469 ) (466

) Equity in net earnings of investee companies

47 19

78 85 Gain on sale of EPIX

285 —

285 —

Gain/(loss) on extinguishment of debt

16 —

(20

) — Other items, net

(18 ) 3

(17

) (1 ) Earnings from continuing operations before provision

for income taxes

921 635

1,641 1,812 Provision for

income taxes

(233 ) (195 )

(417 ) (602

) Net earnings from continuing operations

688 440

1,224 1,210 Discontinued operations, net of tax

3

—

3 — Net earnings (Viacom and

noncontrolling interests)

691 440

1,227 1,210 Net

earnings attributable to noncontrolling interests

(8

) (8 )

(27 ) (26 ) Net earnings attributable

to Viacom

$ 683 $ 432

$

1,200 $ 1,184 Amounts attributable to Viacom:

Net earnings from continuing operations

$ 680 $ 432

$ 1,197 $ 1,184 Discontinued operations, net of tax

3 —

3 — Net earnings

attributable to Viacom

$ 683 $ 432

$ 1,200 $ 1,184 Basic earnings per

share attributable to Viacom: Continuing operations

$

1.69 $ 1.09

$ 3.00 $ 2.99 Discontinued

operations

0.01 —

0.01 —

Net earnings

$ 1.70 $ 1.09

$

3.01 $ 2.99 Diluted earnings per share

attributable to Viacom: Continuing operations

$ 1.69

$ 1.09

$ 2.99 $ 2.98 Discontinued operations

0.01 —

0.01 — Net

earnings

$ 1.70 $ 1.09

$

3.00 $ 2.98 Weighted average number of common

shares outstanding: Basic

402.0 396.5

399.1 396.4

Diluted

402.6 398.0

400.0 397.9 Dividends declared

per share of Class A and Class B common stock

$ 0.20

$ 0.40

$ 0.60 $ 1.20

VIACOM INC.

CONSOLIDATED BALANCE SHEETS

(Unaudited)

(in millions, except par value)

June

30, 2017 September 30, 2016

ASSETS Current assets: Cash and cash equivalents

$

425 $ 379 Receivables, net

3,302 2,712 Inventory, net

930 844 Prepaid and other assets

477 587

Total current assets

5,134 4,522 Property and

equipment, net

955 932 Inventory, net

4,074 4,032

Goodwill

11,648 11,400 Intangibles, net

325 315 Other

assets

990 1,307 Total assets

$

23,126 $ 22,508

LIABILITIES AND

EQUITY Current liabilities: Accounts payable

$

325 $ 453 Accrued expenses

878 773 Participants'

share and residuals

848 801 Program obligations

746

692 Deferred revenue

406 419 Current portion of debt

70 17 Other liabilities

523 517 Total

current liabilities

3,796 3,672 Noncurrent portion of debt

11,103 11,896 Participants' share and residuals

370

358 Program obligations

468 311 Deferred tax liabilities,

net

337 381 Other liabilities

1,381 1,349 Redeemable

noncontrolling interest

209 211 Commitments and

contingencies Viacom stockholders' equity: Class A common stock,

par value $0.001, 375.0 authorized; 49.4 and 49.4 outstanding,

respectively

— — Class B common stock, par value $0.001,

5,000.0 authorized; 353.0 and 347.6 outstanding, respectively

— — Additional paid-in capital

10,108 10,139 Treasury

stock, 393.8 and 399.4 common shares held in treasury, respectively

(20,591 ) (20,798 ) Retained earnings

16,589

15,628 Accumulated other comprehensive loss

(697 )

(692 ) Total Viacom stockholders' equity

5,409 4,277

Noncontrolling interests

53 53 Total equity

5,462 4,330 Total liabilities and equity

$ 23,126 $ 22,508

VIACOM INC.

CONSOLIDATED STATEMENTS OF CASH

FLOWS

(Unaudited)

Nine Months Ended June 30, (in

millions)

2017 2016 OPERATING ACTIVITIES Net

earnings (Viacom and noncontrolling interests)

$

1,227 $ 1,210 Discontinued operations, net of tax

(3

) — Net earnings from continuing operations

1,224 1,210 Reconciling items: Depreciation and amortization

167 166 Feature film and program amortization

3,475

3,253 Equity-based compensation

52 71 Equity in net earnings

and distributions from investee companies

(11 ) (81 )

Gain on sale of EPIX

(285 ) — Deferred income taxes

(118 ) 470 Operating assets and liabilities, net of

acquisitions: Receivables

(504 ) (137 ) Production

and programming

(3,252 ) (3,915 ) Accounts payable

and other current liabilities

(139 ) (482 ) Other,

net

44 (155 ) Net cash provided by operating

activities

653 400 INVESTING ACTIVITIES

Acquisitions and investments, net

(358 ) (59 )

Capital expenditures

(139 ) (80 ) Proceeds received

from sale of EPIX

593 — Proceeds received from grantor

trusts

52 — Sale of marketable securities

108

— Net cash provided by/(used in) investing activities

256 (139 ) FINANCING ACTIVITIES Borrowings

2,569 — Debt repayments

(3,300 ) (368 )

Commercial paper

— 453 Purchase of treasury stock

—

(100 ) Dividends paid

(239 ) (476 ) Excess tax

benefits on equity-based compensation awards

1 — Exercise of

stock options

172 10 Other, net

(64 ) (64 )

Net cash flow used in financing activities

(861 )

(545 ) Effect of exchange rate changes on cash and cash equivalents

(2 ) (30 ) Net change in cash and cash equivalents

46 (314 ) Cash and cash equivalents at beginning of period

379 506 Cash and cash equivalents at end of

period

$ 425 $ 192

SUPPLEMENTAL DISCLOSURES REGARDING NON-GAAP

FINANCIAL INFORMATION

The following tables reconcile our results for the quarter and

nine months ended June 30, 2017 and 2016 to adjusted results that

exclude the impact of certain items identified as affecting

comparability. We use consolidated adjusted operating income,

adjusted earnings from continuing operations before provision for

income taxes, adjusted provision for income taxes, adjusted net

earnings from continuing operations attributable to Viacom and

adjusted diluted earnings per share ("EPS") from continuing

operations, as applicable, among other measures, to evaluate our

actual operating performance and for planning and forecasting of

future periods. We believe that the adjusted results provide

relevant and useful information for investors because they clarify

our actual operating performance, make it easier to compare

Viacom’s results with those of other companies and allow investors

to review performance in the same way as our management. Since

these are not measures of performance calculated in accordance with

accounting principles generally accepted in the United States of

America, they should not be considered in isolation of, or as a

substitute for, operating income, earnings from continuing

operations before provision for income taxes, provision for income

taxes, net earnings from continuing operations attributable to

Viacom and diluted EPS from continuing operations as indicators of

operating performance, and they may not be comparable to similarly

titled measures employed by other companies.

(in millions, except per share amounts)

Quarter Ended June 30, 2017

Operating Income

Earnings from Continuing

Operations Before Provision for Income

Taxes

Provision for Income Taxes

(1)

Net Earningsfrom Continuing

Operations Attributable toViacom

Diluted EPS from Continuing

Operations

Reported results (GAAP)

$ 746 $ 921

$ 233 $ 680 $ 1.69

Factors Affecting Comparability: Restructuring and programming

charges (2)

59 59 21 38 0.09

Gain on extinguishment of debt (3)

— (16 )

(5 ) (11 ) (0.03 ) Gain

on sale of EPIX (4)

— (285 ) (96

) (189 ) (0.47 ) Investment

impairment (5)

— 10 4 6 0.01

Discrete tax benefit (6)

— — 53

(53 ) (0.12 ) Adjusted results

(Non-GAAP)

$ 805 $ 689

$ 210 $ 471 $

1.17

Nine Months Ended June 30, 2017

Operating Income

Earnings from Continuing

Operations Before Provision for Income

Taxes

Provision for Income Taxes

(1)

Net Earningsfrom Continuing

Operations Attributable to Viacom

Diluted EPS from Continuing

Operations

Reported results (GAAP)

$ 1,784 $ 1,641

$ 417 $ 1,197 $ 2.99

Factors Affecting Comparability: Restructuring and programming

charges (2)

381 381 135 246 0.62

Loss on extinguishment of debt (3)

— 20 7

13 0.03 Gain on sale of EPIX (4)

— (285

) (96 ) (189 ) (0.47

) Investment impairment (5)

— 10 4

6 0.02 Discrete tax benefit (6)

—

— 72 (72 ) (0.19

) Adjusted results (Non-GAAP)

$ 2,165

$ 1,767 $ 539 $

1,201 $ 3.00

Quarter

Ended June 30, 2016

Operating Income

Earnings from Continuing

Operations Before Provision for Income

Taxes

Provision for Income Taxes

(1)

Net Earningsfrom Continuing

Operations Attributable to Viacom

Diluted EPS from Continuing

Operations

Reported results (GAAP) $ 769 $ 635 $ 195 $ 432 $ 1.09 Factors

Affecting Comparability: Discrete tax benefit (6) — —

13 (13 ) (0.04 ) Adjusted results (Non-GAAP) $ 769 $

635 $ 208 $ 419 $ 1.05

Nine Months

Ended June 30, 2016

Operating Income

Earnings from Continuing

Operations Before Provision for Income

Taxes

Provision for Income Taxes

(1)

Net Earningsfrom Continuing

Operations Attributable to Viacom

Diluted EPS from Continuing

Operations

Reported results (GAAP) $ 2,194 $ 1,812 $ 602 $ 1,184 $ 2.98

Factors Affecting Comparability: Discrete tax expense (7) —

— (8 ) 8 0.02 Adjusted results (Non-GAAP) $

2,194 $ 1,812 $ 594 $ 1,192 $ 3.00

(1) The tax impact has

been calculated by applying the tax rates applicable to the

adjustments presented. (2) We recognized pre-tax

restructuring and programming charges of $59 million and $381

million in the quarter and nine months ended June 30, 2017,

respectively, resulting from the execution of our flagship brand

strategy and strategic initiatives at Paramount. The charges

include severance charges of $14 million and $212 million in the

quarter and nine months, respectively, a non-cash intangible asset

impairment charge of $18 million in the nine months resulting from

the decision to abandon an international trade name, programming

charges of $38 million and $144 million in the quarter and nine

months, respectively, associated with management’s decision to

cease use of certain original and acquired programming and $7

million of other exit activities in the quarter and nine months.

(3) We redeemed senior notes and debentures totaling $3.3

billion in the nine months ended June 30, 2017, of which $1.0

billion was redeemed in the quarter ended June 30, 2017. As a

result of these transactions, we recognized a pre-tax

extinguishment gain of $16 million in the quarter ended June 30,

2017 and a pre-tax extinguishment loss of $20 million in the nine

months ended June 30, 2017. (4) During the quarter ended

June 30, 2017, we completed the sale of our 49.76% interest in

EPIX, resulting in a gain of $285 million. (5) During the

quarter ended June 30, 2017, we recognized an impairment loss to

write-down a cost method investment. (6) The net discrete

tax benefit in the quarter ended June 30, 2017 was principally

related to the reversal of a valuation allowance on capital loss

carryforwards in connection with the sale of our investment in EPIX

and the release of tax reserves with respect to certain effectively

settled tax positions. In addition to the items in the quarter, the

net discrete tax benefit in the nine months ended June 30, 2017

included the reversal of valuation allowances on net operating

losses upon receipt of a favorable tax authority ruling. The net

discrete tax benefit in the quarter ended June 30, 2016 was

principally related to the release of tax reserves upon the

remeasurement of excess foreign tax credits associated with the

reorganization of certain non-U.S. subsidiaries in the fourth

quarter of 2015. (7) The net discrete tax expense in the

nine months ended June 30, 2016 was principally related to a

reduction in qualified production activity tax benefits as a result

of retroactively reenacted legislation, partially offset by reserve

releases.

The following table includes a reconciliation of net cash

provided by operating activities (GAAP) to free cash flow and

operating free cash flow (non-GAAP). We define free cash flow as

net cash provided by operating activities minus capital

expenditures, plus excess tax benefits from equity-based

compensation awards (actual tax deductions in excess of amounts

previously recognized, which is included within financing

activities in the statement of cash flows), as applicable. We

define operating free cash flow as free cash flow, excluding the

impact of the cash premium on the extinguishment of debt, as

applicable. Free cash flow and operating free cash flow are

non-GAAP measures. Management believes the use of these measures

provides investors with an important perspective on, in the case of

free cash flow, our liquidity, including our ability to service

debt and make investments in our businesses, and, in the case of

operating free cash flow, our liquidity from ongoing

activities.

Reconciliation of net cash provided by operating

activities

to free cash flow and operating free

cash flow

(in millions)

Quarter Ended June 30,

Better/

(Worse)

Nine Months Ended June 30,

Better/

(Worse)

2017 2016 $ 2017

2016 $ Net cash provided by operating activities

(GAAP)

$ 248 $ 116 $ 132

$ 653 $ 400 $

253 Capital expenditures

(44 ) (26 ) (18 )

(139 ) (80 ) (59 ) Excess tax benefits

1

— 1

1 — 1 Free

cash flow (Non-GAAP)

205 90 115

515 320 195 Debt

retirement premium

— — —

33

— 33 Operating free cash flow (Non-GAAP)

$ 205 $ 90 $ 115

$

548 $ 320 $ 228

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170803006434/en/

Press:Jeremy Zweig, (212)

846-7503Vice President, Corporate Communications andCorporate

Affairsjeremy.zweig@viacom.comorAlex Rindler, (212) 846-4337Senior

Manager, Corporate

Communicationsalex.rindler@viacom.comorInvestors:James Bombassei, (212)

258-6377Senior Vice President, Investor

Relationsjames.bombassei@viacom.comorKareem Chin, (212)

846-6305Vice President, Investor

Relationskareem.chin@viacom.com

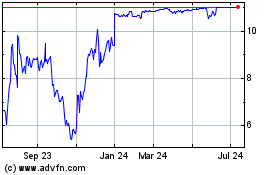

Via Renewables (NASDAQ:VIA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Via Renewables (NASDAQ:VIA)

Historical Stock Chart

From Apr 2023 to Apr 2024