Verizon Reviewing Terms of Yahoo Deal As Revenue Slides

October 20 2016 - 11:32AM

Dow Jones News

By Ryan Knutson and Anne Steele

Verizon Communications Inc. on Thursday reported declining

revenue and plunging subscriber growth, and said it is assessing

whether it will need to renegotiate its acquisition of Yahoo Inc.

after a major data breach.

Verizon's Chief Financial Officer Fran Shammo described the

recently announced breach of 500 million Yahoo accounts as

"extremely large."

He said the company is assuming that it will have a "material

impact" on Yahoo, suggesting that the carrier will look to

renegotiate the deal though he gave no indication Verizon intended

to walk away.

Mr. Shammo said Verizon lawyers had their first call with

Yahoo's lawyers this week and said evaluating the impact of the

breach is "going to be a long process."

The carrier, which has sought to develop new revenue streams via

acquisitions, in July said it would buy Yahoo's Web assets for

$4.83 billion in cash, the biggest of a recent string of digital

acquisitions. For New York-based Verizon, the deal is a key

component of a digital media and advertising empire the nation's

biggest wireless carrier is trying to build in hopes of taking on

Alphabet Inc.'s Google and Facebook Inc.

At the same time, Verizon's wireless business is sagging as

competitors gain strength. The carrier reported its second straight

quarterly revenue decline after six years of growth. It also posted

a 66% drop in net retail postpaid wireless subscribers from a year

ago, down to 442,000, which is also 28% lower than in the previous

quarter.

Shares, which were up 9% this year before the results, dropped

2.7% in early Thursday trading.

"We are executing in a very challenging competitive

environment," Mr. Shammo said on a call with analysts.

Verizon, which has been facing rising competition from smaller

rivals like Sprint Corp. and T-Mobile US Inc., has warned that

earnings may plateau in 2016 as it works through changes it has

made to keep its wireless plans in line with competitors. Sprint

this week reported strong subscriber growth for the quarter.

On its wireless business, the carrier had a net loss of 36,000

postpaid phone customers compared with gains of 430,000 a year ago,

a sign that a healthier Sprint and an aggressive T-Mobile are

inflicting pain on their larger competitor. Postpaid churn, or the

rate at which customers canceled service, rose 11 basis points to

1.04% from a year ago.

Mr. Shammo blamed some of the slowdown in subscriber growth on

the recall of Samsung Electronics Co.'s new Galaxy Note 7 over

issues with its batteries.

"We were off to a really good start with the Samsung Note 7,"

Mr. Shammo said. "And then unfortunately there was a total recall

of that phone which has definitely impacted our growth because

historically Verizon has always been the number one leader in

high-end Samsung phones."

For the September period, revenue slipped 6.7% to $30.94

billion, below estimates for $31.09 billion, according to Thomson

Reuters. Verizon posted a profit of $3.6 billion, down from $4

billion last year.

On Thursday, the company backed its forecast of earnings for

2016 -- excluding a 7-cent per-share dent from the work stoppage

during a union strike -- to remain flat with 2015.

Verizon has been shifting its wireless customers to noncontract

plans that have a cheaper monthly service rate but require

customers to pay full price for their device, usually in

installments. The percentage of phone activations on installment

plans rose to 70% from 67% in the second quarter. Verizon said it

expects that rate to remain consistent in the fourth quarter.

Write to Ryan Knutson at ryan.knutson@wsj.com and Anne Steele at

Anne.Steele@wsj.com

(END) Dow Jones Newswires

October 20, 2016 11:17 ET (15:17 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

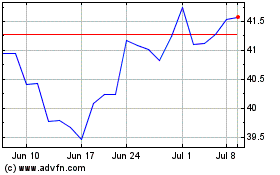

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

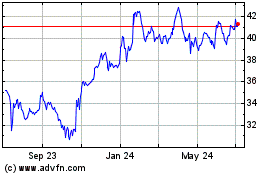

Verizon Communications (NYSE:VZ)

Historical Stock Chart

From Apr 2023 to Apr 2024