Veolia EPS Lags, Revs Rise - Analyst Blog

August 12 2011 - 12:07PM

Zacks

Veolia Environnement (VE) announced financial

results for the first half of 2011. The company reported an

operating loss per share of €1.05 in the first half of 2011 versus

operating earnings of €0.67 in the first half of 2010.

On a GAAP basis, operating loss during the first half of the

year was €0.14 versus earnings of €0.78 in the first half of 2010.

The difference between GAAP and operating loss was due to a

one-time gain of €0.91 from discontinued operations.

Total Revenue

In first half of 2011, the total revenue of the company was

€16.29 billion versus €14.10 billion in the similar period of 2010,

reflecting a growth of 15.5%.

The year-over-year growth in revenue was boosted by the positive

impact from the acquisition made by the company in the previous

year. The first time consolidation of the Veolia Transdev

joint venture also backed the improvement.

Segment Results

Water: Total revenue from this segment

was €6.12 billion versus €5.89 billionin first half of 2010, up

5.5%. The growth was primarily attributable to higher level of

activity in Europe, particularly the United Kingdom, Germany and

Central Europe as well as the ramp-up of activities in Asia.

Enviornmental Services: Total revenue

from this segment was €4.9 billion versus €4.5 billionin first half

of 2010, up 8.4%. This growth was mainly organic. The increase in

activity levels for industrial services, treatment of hazardous

waste and commercial waste collection in the main geographical

areas boosted results.

Energy Services: The segment generated

total revenue of €3.86 billion versus €3.70 billionin the first

half of 2010, up 4.3%. The growth in this segment was attributable

to the favorable impact of energy prices, offset partially by the

impact of adverse weather.

Veolia Transdev: Contribution from

this new segment in the reported period was €1.3 billion.

Operational Update

During the first half of 2011, the company experienced a 24%

growth in the cost of sales compared to the prior-year period. The

general and administrative expenses and selling costs also surged

by 10.4% and 1.4% from the first half of 2010.

Operating income of the company decreased to €0.25 billion from

€1.1 billion in the first six months of 2010 and was negatively

impacted by non-recurring write-downs amounting to €0.7 billion

mainly in Italy, Morocco and the United States.

Finance costs in the first half of 2011 were €435.6 million,

marginally lower than €439.3 million reported in the first half of

2010.

Financial Update

Cash and cash equivalents of the company as of June 30, 2011

were €5.6 billion versus €4.6 billion in June 30, 2010.

Net cash from operating activities in the first half of 2011 was

€0.86 billion versus €1.3 billion in the same period of 2010.

Restructuring and Convergence

During the first six months of the year, the company continued

to work on restructuring and convergence of its operations to make

it more profitable. To achieve its goal the company has decided to

lower its geographical exposure and concentrate on 40 countries by

2013 as against 77 countries at present.

The company will also work on rationalization of the

organization, processes and local headquarters and has made plans

for additional cost savings aiming to add a minimum of €150 million

in operating income by 2013 and gradually increasing the

level to a range of €250 million to €300 million annually by

2015.

Guidance

For 2011, Veolia Environnement expects a marginal decline in

adjusted operating income at constant exchange rates, compared to

its previous expectation, excluding Veolia Transdev.

The company will continue with its plans for strategic asset

divestments and divest €1.3 billion in 2011. At the same time, it

expects to save €250 million in 2011 through its cost savings

plan.

Our View

Veolia Environnement is bent on reducing costs in the

forthcoming years, which can potentially boost margins. The company

has entered into a few major contracts during the first half of

2011, which are likely to boost its topline. A €1.5 billion

contract from The Private Finance Initiative and €1.2 billion

contract awarded by Dalkia are worth mentioning.

Veolia Environnement retains a Zacks #3 Rank (short-term Hold

rating). Veolia competes with Connecticut Water Service

Inc. (CTWS) and York Water Co.

(YORW).

Based in France, Veolia Environnement is a provider of

environmental management services to its worldwide consumers. It

operates through four segments, which are Water, Environmental

Services, Energy Services and Veolia Transdev.

CONN WATER SVC (CTWS): Free Stock Analysis Report

VEOLIA ENVIRON (VE): Free Stock Analysis Report

YORK WATER CO (YORW): Free Stock Analysis Report

Zacks Investment Research

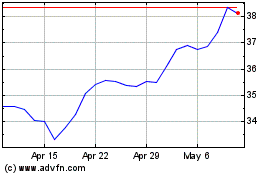

York Water (NASDAQ:YORW)

Historical Stock Chart

From Mar 2024 to Apr 2024

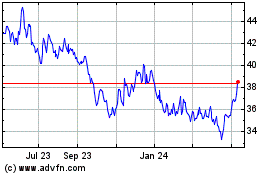

York Water (NASDAQ:YORW)

Historical Stock Chart

From Apr 2023 to Apr 2024